|

시장보고서

상품코드

1627143

북미의 스마트 팩토리 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)North America Smart Factory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

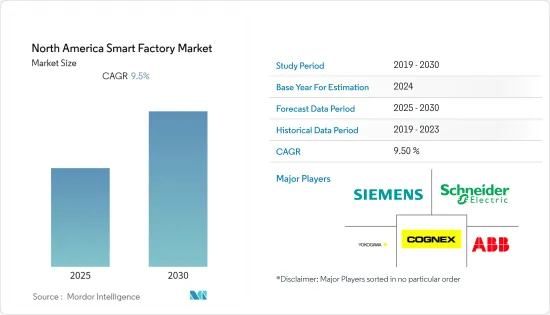

북미의 스마트 팩토리 시장은 예측 기간 동안 CAGR 9.5%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 메리빌 대학의 예측에 따르면, 2025년까지 전 세계적으로 매년 180조 기가바이트 이상의 데이터가 생성될 것이라고 합니다. 그 중 대부분은 IIoT 지원 산업에서 생성될 것입니다. 산업용 사물인터넷(IIoT) 선도기업인 마이크로소프트의 조사에 따르면, 85%의 기업이 하나 이상의 IIoT 이용 사례 프로젝트를 가지고 있습니다. 응답자의 94%가 2021년까지 IIoT 전략을 도입할 것이라고 응답한 것으로 보아 이 수치는 증가할 것으로 보입니다.

- IoT 기술은 특히 미국과 같은 선진국의 제조업에서 노동력 부족을 극복하고 있습니다. 이 때문에 미국에서는 연방정부와 민간기업이 인더스트리 4.0의 IoT 기술에 투자하여 중국 및 기타 인건비가 저렴한 국가에 빼앗긴 미국의 산업 기반을 확대하려고 노력하고 있습니다. 따라서 IoT 기술은 주로 전 세계적으로 스마트 팩토리 솔루션의 채택을 촉진할 수 있습니다.

- 또한 최근 관세 인상으로 인해 미국 제조업체들은 자동화를 통해 더 낮은 비용으로 제품을 생산해야할 것으로 보입니다. 관세 인상 전에 자동화에 투자한 자동차 회사들은 이미 앞서 나가고 있으며, 다른 회사들의 비용 절감을 위한 청사진이 되고 있습니다. 산업용 로봇과 자동화 제품을 생산하는 기업들은 자동화에 필요한 로봇과 장비의 최대 생산자이기 때문에 혜택을 볼 수 있습니다.

- 협동 로봇과 같은 자동화 기술은 인간의 개입과 상호 작용을 필요로 합니다. 또한, 산업용 제어 시스템(ICS)에는 보안 위험이 도사리고 있습니다. 따라서 시스템에 대한 보안 위협을 방지하기 위해 ICS 보안 솔루션을 도입해야 하며, 이는 ICS의 유지보수 비용을 증가시킵니다. 사이버 보안 솔루션의 발전으로 ICS와 관련된 보안 문제에 대한 불안감이 줄어들고 있습니다.

북미의 스마트 팩토리 시장 동향

반도체 산업이 큰 폭으로 성장

- 이 지역의 전자 산업은 안정적인 속도로 성장하고 있으며, 설계 및 팹리스 분야에서 사업을 운영하는 많은 기업이 큰 비중을 차지하고 있습니다. 미국 인구 조사국에 따르면, 반도체 및 기타 전자 부품 부문의 매출은 2023년까지 1,051억 6,000만 달러에 달할 것으로 예상됩니다.

- 또한, 이 지역은 스마트폰과 가전제품에 대한 수요가 높으며, 이는 연구 시장 수요를 주도하고 있습니다. 에릭슨에 따르면, 2025년까지 스마트폰 계약 건수는 3억 6,000만 건에 달할 것으로 예상되며, 5G 수요로 인해 더욱 강화될 것으로 예상됩니다.

- 또한, 스마트 웨어러블에 대한 수요 증가는 이 지역의 반도체 수요를 주도하고 있으며, Cisco Systems에 따르면 2022년까지 북미의 커넥티드 웨어러블 기기 수는 4억 3,900만 달러에 달할 것으로 예상됩니다. 이러한 발전은 이 지역 시장 수요를 증가시키고 있습니다.

- 반도체산업협회(SIA)에 따르면, 반도체 산업은 미국에서 약 25만 명의 근로자를 직접 고용하고 있습니다. 미국은 또한 전기자동차 및 고성능 IC가 필요한 자동차의 자동 운전 가능성에 투자하는 세계 주요 자동차 제조업체의 본거지이기도 합니다. 이는 반도체 실리콘 웨이퍼 시장 수요를 촉진하는 주요 요인 중 하나입니다. 예를 들어, 2020년 12월, 리튬이온용 실리콘-탄소 복합소재의 세계 공급업체인 Group14 Technologies는 SK머티리얼즈가 주도하는 시리즈 B 펀딩을 통해 1,700만 달러의 투자를 유치했습니다.

- 대유행은 미국의 많은 사람들과 산업계에 잔인할 정도로 나쁜 일이었지만, 반도체 산업은 유일하게 밝은 부분 중 하나였습니다. 이는 모든 유형의 칩에 대한 추가 수요로 이어져 이미 전력 질주하고 있던 공급망에 대한 압력을 증가시켰습니다. 이에 따라 시장 관계자들은 제품 개발에 투자하기 시작했습니다.

통신은 시장을 주도하는 분야 중 하나입니다.

- 유선 통신은 특정 송신처에서 수신처로 정보를 전달할 때 상대적으로 왜곡이 적은 경향이 있습니다. 예를 들어, 유선 아날로그-디지털 컨버터에서 디지털 인코딩된 데이터를 8k 비트/초의 고정된 속도로 하나의 디지털 컨트롤러로 전송하는 경우, 데이터 유출이나 왜곡이 거의 발생하지 않습니다. 또한 PROFIBUS-DP 및 ControlNet과 같은 일부 유선 네트워크 프로토콜은 토큰을 사용하여 네트워크에 대한 액세스를 제어함으로써 비교적 일정한 지연 프로파일을 목표로 하는 유선 네트워크 프로토콜도 있습니다.

- 예를 들어, FieldComm Group, PI(Profibus &Profinet International), ODAVA는 산업용 이더넷 개발을 촉진하기 위해 협력하고 있습니다. 이는 EtherNet/IP, HART-IP, PROFINET의 사용을 공정 산업의 위험한 장소로 확대하는 것을 목표로 하고 있으며, 현재 IEEE 802.3.cg에서 진행 중인 작업을 활용하고 있습니다.

- 무선 네트워크는 산업 자동화에 많은 가능성을 가져다주는 방식으로 발전하고 있습니다. 무선 산업 자동화라는 아이디어는 오랫동안 많은 조직에서 달성할 수 없는 목표였지만, 5G는 이 목표를 현실화하기 시작했습니다. 비상장 기업들은 이미 공장에 5G 네트워크를 도입하기 시작했으며, 성능, 저지연, 결정성 및 신뢰성이 향상되는 것을 목격하고 있습니다.

- 예를 들어, 코닝과 버라이즌은 미국 히코리에 위치한 코닝의 광섬유 케이블 제조 시설에 5G 초광대역 서비스를 도입했습니다. 코닝은 버라이즌의 5G 기술을 사용하여 세계에서 가장 큰 규모의 광섬유 케이블 제조 시설 중 하나에서 공장 자동화 및 품질 보증과 같은 기능 향상에 5G를 적용하는 테스트를 수행합니다.

- 무선 통신을 통합한 개별 장비는 일반적으로 유선 네트워크보다 비용이 더 많이 듭니다. 그러나 이러한 초기 비용 증가는 여러 가지 방법으로 상쇄될 수 있습니다. 무선 장치는 생산 구역 내 배선 비용을 절감할 수 있는 등 장기적으로 가장 비용 효율적인 선택이 될 수 있습니다.

북미의 스마트 팩토리 산업 개요

북미의 스마트 팩토리 시장은 몇몇 대기업이 존재하며, 어느 정도 통합되어 있습니다. 각 업체들은 시장 점유율을 확대하기 위해 전략적 제휴와 제품 개발에 지속적으로 투자하고 있습니다. 최근 시장 개척 동향을 몇 가지 소개하고자 합니다.

- 2021년 4월-Mitsubishi Electric Corporation은 HVIGBT 2종, HVDIODE 5종을 포함한 X 시리즈 신제품 7종을 개발하여 총 24종의 X 시리즈 파워 반도체 모듈을 개발했습니다. 이들 모듈은 트랙션 모터, 직류 송전 장치, 산업용 대용량 기기 등 대용량화, 소형화가 진행되고 있는 고전압, 고전류 기기용 인버터용으로 개발되었으며, 7월부터 순차적으로 출시될 예정입니다.

- 2020년 9월 - 지멘스와 그룬트포스는 상하수도, 산업 자동화, 빌딩 기술의 세 가지 주요 부문에서 양사가 제공하는 상호 보완적인 제품 및 솔루션에 초점을 맞춘 전략적 협력을 위한 디지털 파트너십 프레임워크에 서명했습니다. 체결하였습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

- COVID-19가 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 제품별

- 머신 비전 시스템

- 카메라

- 프로세서

- 소프트웨어

- 인클루저

- 프레임 그래버

- 통합 서비스

- 조명

- 산업용 로봇

- 다관절 로봇

- 직교 로봇

- 원통형 로봇

- 스카라 로봇

- 병렬 로봇

- 협동 작업 로봇

- 제어 기기

- 릴레이 및 스위치

- 써보 모터 및 드라이브

- 센서

- 통신 기술

- 유선

- 무선

- 기타

- 머신 비전 시스템

- 기술별

- Product Lifecycle Management (PLM)

- Human Machine Interface (HMI)

- Enterprise Resource and Planning (ERP)

- Manufacturing Execution System (MES)

- Distributed Control System (DCS)

- Supervisory Controller and Data Acquisition (SCADA

- Programmable Logic Controller (PLC)

- 기타

- 최종사용자 산업별

- 자동차

- 반도체

- 석유 및 가스

- 화학제품 및 석유화학제품

- 제약

- 항공우주 및 방위

- 식품 및 음료

- 광업

- 기타

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 개요

- ABB Ltd.

- Cognex Corporation

- Siemens AG

- Schneider Electric SE

- Yokogawa Electric Corporation

- Kuka AG

- Rockwell Automation Inc.

- Honeywell International Inc.

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Fanuc Corporation

- Emerson Electric Company

- FLIR Systems Inc.

제8장 투자 분석

제9장 시장 전망

LSH 25.01.21The North America Smart Factory Market is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- The Maryville University estimates that by 2025, over 180 trillion gigabytes of data will be created worldwide every year. A large portion of this will be generated by IIoT-enabled industries. A survey by the Industrial IoT (IIoT) giant, Microsoft, found that 85% of companies have at least one IIoT use case project. This number will increase, as 94% of the respondents said they will implement IIoT strategies by 2021.

- IoT technologies are overcoming the labor shortage in the manufacturing sector, especially in the developed countries, like the United States. Due to this, the Federal Government and the private sector in the United States are investing in Industry 4.0 IoT technologies, to increase the American industrial base, which was taken over by China and other low labor cost countries. Therefore, IoT technologies may mainly drive the adoption of smart factory solutions, across the world.

- Also, the recent increase in tariffs is likely to force manufacturers of the United States to produce goods at a lower cost, which is to be achieved through automation. Auto companies that invested in automation pre-tariffs are ahead of the game, and they are the cost-saving blueprint for other companies. Companies that produce industrial robots and automation products are set to benefit, as they are the largest producers of the robots and equipment needed for automation.

- Automation technologies, such as collaborative robots, require human intervention/ interaction. Furthermore, industrial control systems (ICS) are laced with security risks. Hence, ICS security solutions must be installed to prevent security threats to the systems, which increases the cost of maintaining ICS. Nevertheless, advancements in cybersecurity solutions are reducing the fear of security issues associated with ICS.

North America Smart Factory Market Trends

Semiconductor Industry is Observing a Significant Growth

- The electronics industry in the region is growing at a steady pace and holds a prominent share in a number of enterprises operating in the design and fabless space. According to the US Census Bureau, the revenue of the semiconductors and other electronic components sector is expected to reach USD 105.16 billion by 2023.

- Moreover, the region commands significant demand for smartphones and consumer electronics, which is driving demand for the studied market. According to Ericsson, smartphone subscription is expected to reach 360 million by 2025, augmented by the demand from 5G.

- Additionally, the increasing demand for smart wearables in the region is spearheading the demand for semiconductors in the region. By 2022, the number of connected wearable devices in North America is expected to reach USD 439 million, according to Cisco Systems. Such developments are augmenting demand for the market in the region.

- According to the Semiconductor Industry Association (SIA), the semiconductor industry directly employs nearly a quarter of a million workers in the United States. The United States is also home to some of the world's major automotive players, who are investing in electric vehicles and in the self-driving potential of cars, which demand high-performance ICs. This is one of the major factors to drive demand for the semiconductors silicon wafers market. For instance, in December 2020, Group14 Technologies, a global provider of silicon-carbon composite materials for lithium-ion applications, secured USD 17 million in Series B funding led by SK Materials.

- The pandemic has been brutally bad for many people and industries in the United States, but the semiconductor industry has been one of the only bright spots. That translates to additional demand for chips of all sorts, which increased the pressure on a supply chain that was already running as fast as it could. Thus, driving market players to invest in product development.

Communication is One of the Segment Driving the Market

- Wired communication tends to have a relatively low degree of distortion when delivering information from a particular source to a destination. For instance, receiving digitally encoded data from a wired analog to digital converter, sent to a single digital controller at a fixed rate of 8 kbit/second, occurs with little data loss and distortion, i.e., only the least significant bits tend to have errors. In addition, there are wired networking protocols that aim to achieve a relatively constant delay profile by using a token to control access to the network, such as PROFIBUS-DP and ControlNet.

- For instance, FieldComm Group, PI (Profibus & Profinet International), and ODAVA are working together to promote developments for Industrial Ethernet. It is aimed to expand the use of EtherNet/IP, HART-IP, and PROFINET into hazardous locations in the process industry, leveraging the work currently underway in the IEEE 802.3.cg.

- Wireless networks are advancing in ways that are driving many possibilities for industrial automation. The idea of wireless industrial automation has long been an unachievable goal for many organizations, but 5G is starting to make this goal a reality. Companies are already beginning to deploy private 5G networks within plants and are seeing an increase in performance, low latency, determinism, and reliability.

- For instance, Corning and Verizon have installed a 5G Ultra-Wideband service in Corning's fiber optic cable manufacturing facility in Hickory, United States. Corning will use Verizon's 5G technology to test the application of 5G to enhance functions, such as factory automation and quality assurance, in one of the most extensive fiber optic cable manufacturing facilities in the world.

- Individual devices incorporating wireless communication are generally costlier than wired networks. However, this increased upfront cost offset in multiple ways. Wireless devices often prove to be the most cost-effective option over the long run, owing to factors such as saving the cost of running cabling through a production area.

North America Smart Factory Industry Overview

The North American Smart Factory Market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- April 2021- Mitsubishi Electric Corporation developed seven new X-Series products, including two HVIGBTs and five HVDIODEs, bringing the total number of X-Series power semiconductor modules to 24. These modules are designed for increasingly big-capacity, small-sized inverters used in traction motors, DC-power transmitters, substantial industrial machines, and other high-voltage, large-current equipment. Beginning in July, the models will be released in order.

- September 2020 - Siemens and Grundfos signed a digital partnership framework for strategic cooperation between the two companies to focus on complementary products and solutions provided by both parties in three main areas: water and wastewater applications, industrial automation and building technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain

- 5.1.2 Rising Demand for Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Huge Capital Investments for Transformations

- 5.2.2 Vulnerable to Cyber Attacks

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Machine Vision Systems

- 6.1.1.1 Cameras

- 6.1.1.2 Processors

- 6.1.1.3 Software

- 6.1.1.4 Enclosures

- 6.1.1.5 Frame Grabbers

- 6.1.1.6 Integration Services

- 6.1.1.7 Lighting

- 6.1.2 Industrial Robotics

- 6.1.2.1 Articulated Robots

- 6.1.2.2 Cartesian Robots

- 6.1.2.3 Cylindrical Robots

- 6.1.2.4 SCARA Robots

- 6.1.2.5 Parallel Robots

- 6.1.2.6 Collaborative Industry Robots

- 6.1.3 Control Devices

- 6.1.3.1 Relays and Switches

- 6.1.3.2 Servo Motors and Drives

- 6.1.4 Sensors

- 6.1.5 Communication Technologies

- 6.1.5.1 Wired

- 6.1.5.2 Wireless

- 6.1.6 Other Products

- 6.1.1 Machine Vision Systems

- 6.2 By Technology

- 6.2.1 Product Lifecycle Management (PLM)

- 6.2.2 Human Machine Interface (HMI)

- 6.2.3 Enterprise Resource and Planning (ERP)

- 6.2.4 Manufacturing Execution System (MES)

- 6.2.5 Distributed Control System (DCS)

- 6.2.6 Supervisory Controller and Data Acquisition (SCADA

- 6.2.7 Programmable Logic Controller (PLC)

- 6.2.8 Other Technologies

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Semiconductors

- 6.3.3 Oil and Gas

- 6.3.4 Chemical and Petrochemical

- 6.3.5 Pharmaceutical

- 6.3.6 Aerospace and Defense

- 6.3.7 Food and Beverage

- 6.3.8 Mining

- 6.3.9 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Cognex Corporation

- 7.1.3 Siemens AG

- 7.1.4 Schneider Electric SE

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 Kuka AG

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 Honeywell International Inc.

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Mitsubishi Electric Corporation

- 7.1.11 Fanuc Corporation

- 7.1.12 Emerson Electric Company

- 7.1.13 FLIR Systems Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

샘플 요청 목록