|

시장보고서

상품코드

1627174

동남아시아의 접착제 및 실란트 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)Southeast Asia Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

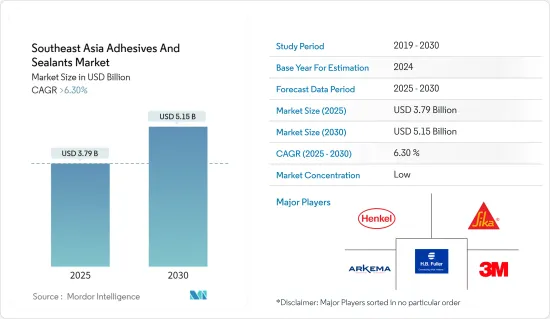

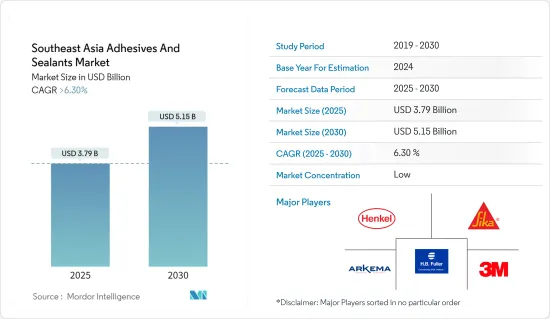

동남아시아의 접착제 및 실란트 시장 규모는 2025년 37억 9,000만 달러, 2030년에는 51억 5,000만 달러에 달할 것으로 예상되며, 예측 기간(2025-2030년) 동안 6.3% 이상의 CAGR을 나타낼 것으로 예상됩니다.

동남아시아의 접착제 및 실란트 시장은 코로나19로 인해 후퇴에 직면했습니다. 전 세계 봉쇄와 엄격한 정부 규제로 인해 생산 기지가 광범위하게 폐쇄되었습니다. 그러나 시장은 2021년에 회복되고 향후 몇 년동안 큰 성장을 보일 것으로 예상됩니다.

주요 하이라이트

- 단기적으로는 건설 부문 수요 증가와 포장 산업에서의 채용 확대가 조사 대상 시장 수요를 견인하는 주요 요인입니다.

- 그러나 접착제 및 실란트에 대한 엄격한 VOC 배출 규제가 시장 성장에 걸림돌이 될 것으로 예상됩니다.

- 바이오 접착제의 기술 혁신과 개발, 복합재료용 접착제 접합으로의 전환은 조사 대상 시장에서 새로운 기회를 창출할 것으로 예상됩니다.

- 예측 기간 동안 인도네시아가 시장을 장악하고 가장 높은 성장을 이룰 것으로 예상됩니다.

동남아시아의 접착제 및 실란트 시장 동향

건축 및 건설 부문이 급성장

- 접착제 및 실란트는 독특한 특성과 물리적 특성으로 인해 건축 및 건설 산업에서 매우 중요한 역할을 수행하며 시장의 주요 최종 사용자 부문으로 자리 매김했습니다.

- 접착제 및 실란트의 주요 특성은 높은 응집력과 유연성과 함께 강력한 응집력, 접착력 및 탄성을 포함합니다. 또한 높은 탄성 계수를 나타내며 열팽창을 견디고 자외선, 부식, 해수, 비 및 기타 풍화 조건과 같은 환경 문제를 견딜 수 있습니다.

- 일반적인 용도는 HVAC 시스템, 콘크리트 공사, 접합 시멘트, 탄성 바닥재, 지붕재, 고정 창틀 등 다양합니다.

- 동남아시아에서는 인도네시아, 필리핀, 말레이시아, 베트남, 태국 등에서 건설 활동이 활발해지면서 접착제 및 실란트 수요가 증가하고 있습니다.

- 말레이시아의 건설 부문은 정부의 실질적 지원에 힘입어 빠르게 현대화 및 확장되고 있습니다. 말레이시아 산업개발금융공사(MIDF)에 따르면 이 부문은 6기 연속 성장세를 보이고 있습니다.

- 2023년 마지막 분기에 말레이시아 셀랑고르 주 사이버자야에 17,000평방미터 규모의 7층짜리 데이터센터 '사이버자야 데이터센터' 건설이 시작됐습니다. 사이버자야 데이터센터는 1,830개의 캐비닛으로 구성되며 12MW의 용량을 가지고 있습니다. 건설은 2025년 2분기까지 완공될 예정으로, 조사 대상 시장 수요가 증가할 것으로 예상됩니다.

- 예산관리부에 따르면, 필리핀 정부는 2023년 인프라 및 자본 지출에 1조 2,046억 필리핀 페소(약 220억 달러)를 투자할 계획이며, 이는 전년 대비 19% 증가한 수치입니다.

- 건축건설청(Building and Construction Authority)의 자료에 따르면, 싱가포르의 건설 계약은 2023년 2700억 싱가포르 달러(약 206억 싱가포르 달러)에서 3200억 싱가포르 달러(약 244억 싱가포르 달러)에 달할 것으로 예상됩니다. 주택개발청(HDB)의 공공 주택 건설 파이프라인이 풍부하기 때문에 공공 부문 프로젝트가 이 수요의 약 60%를 차지할 것으로 예상됩니다. 또한, 수처리 플랜트, 교육 시설 등의 프로젝트가 급증함에 따라 싱가포르의 접착제 및 실란트 수요는 증가할 것으로 예상됩니다.

- 정부의 이니셔티브와 현재 진행 중이거나 계획 중인 수많은 인프라 프로젝트는 예측 기간 동안 동남아시아의 접착제 및 실란트 수요에 영향을 미칠 것입니다. 예를 들어, 태국 푸켓에서는 카투 파통 고속도로 프로젝트의 일부인 카투 파통 터널 프로젝트가 1.85km 길이의 터널을 건설할 예정입니다. 총 공사비는 146억 7,000만 바트(약 4억 3,000만 달러)이며, 2027년 완공을 목표로 하고 있습니다.

- 관광의 중심지인 태국은 쇼핑몰, 고급 호텔 등에 많은 투자가 이루어지고 있으며, 900개 이상의 객실을 갖춘 파타야 메리어트 마르퀴스 호텔은 2024년 개장을 목표로 하고 있는 주목할 만한 프로젝트입니다. 두 개의 건물로 구성된 이 개발에는 398실 규모의 JW 메리어트 및 파타야 비치 리조트 & 스파도 포함되어 있으며, 2027년까지 메리어트 그룹은 방콕과 파타야에 3개의 브랜드로 4개의 새로운 호텔을 도입할 계획이며, 이는 태국에 있는 기존 45개의 호텔 및 리조트 포트폴리오에 추가될 예정입니다.

- 베트남 통계청 자료에 따르면, 2023년 베트남의 건설 부문은 GDP에 640조 7,200억 동(약 300억 달러) 이상을 기여하여 국가 총 GDP의 6.27%인 약 1조 2,000억 동(약 4억 달러)을 차지할 것으로 예상했습니다.

- 이러한 동향을 감안할 때, 앞서 언급한 요인들은 향후 몇 년동안 접착제 및 실란트 수요 궤도를 형성할 것으로 보입니다.

시장 독식하는 인도네시아

- 인도네시아는 접착제 및 실란트 소비에서 동남아시아를 선도하고 있습니다. 이러한 성장의 주요 원동력은 건설 활동 증가, 전자 제품 생산의 호황, 신발, 가죽 및 의료 부문 수요 증가를 들 수 있습니다.

- 신발 및 가죽 산업에서 접착제 및 실란트는 재료의 접착, 내구성을 보장하고 제품 성능을 향상시키는 데 필수적입니다. 인도네시아의 신발 및 가죽 산업이 확대됨에 따라 접착제 및 실란트에 대한 수요도 증가하고 있습니다.

- 인도네시아 통계청 자료에 따르면 2023년 가죽 및 신발 제조업의 GDP는 약 49조 2,400억 루피아(약 30억 달러)에 달하고, 전년 대비 2% 증가했습니다. 이러한 성장은 인도네시아가 세계 제조업 강국으로 부상하고 있음을 뒷받침합니다.

- 의료 분야에서 접착제 및 실란트는 재료의 접착, 내구성을 보장하고 의료기기의 기능을 강화하는 데 필수적입니다. 의료 부문의 성장에 따라 접착제 및 실란트에 대한 수요는 향후 몇 년동안 증가할 것으로 예상됩니다.

- 지난 1년간 인도네시아는 국내외 대규모 투자를 통해 의료 부문을 강화해왔으며, 2023년 보건법(Law No.17 of 2023 on Health)은 의무적 의료 지출을 폐지하고 목표 지출을 촉진하기 위해 성과주의 예산제도(PBBS)를 도입했습니다. 도입되었습니다. 또한, 이 법은 6가지의 의료 혁신 개요를 제시하며, 인도네시아의 의료 서비스 강화에 대한 정부의 의지를 강조하고 있습니다.

- 인도네시아 보건부에 따르면, 2023년 인도네시아의 의료기기 수출액은 전년 대비 22% 증가한 약 33억 4,000만 달러에 달하고, 의료 부문의 성장을 더욱 촉진하고 조사 대상 시장의 성장을 뒷받침할 것으로 예상됩니다.

- 동남아시아 최대 건설 시장인 인도네시아는 주택 및 상업시설에 대한 수요 급증에 대응하기 위해 인프라 구축 및 도시화에 대한 정부 지출을 강화하고 있으며, 이에 따라 접착제 및 실란트에 대한 수요도 증가하고 있습니다.

- 건설 부문은 인도네시아의 GDP에 필수적입니다. 재무부는 2024년 예산에서 유틸리티주택부에 35조 루피아(약 20억 달러)의 기금을 배정하여 인프라 및 공무원 주택을 확충하기 위해 2023년 4분기에 서자바주 보고르에 95헥타르 규모의 세쿼이아 힐스 센투르(Sequoia Hills Sentur) 주택 개발 프로젝트가 착공될 예정입니다. 2027년 완공을 목표로 하고 있습니다.

- 인도네시아는 2024년 예산안에서 신수도 개발을 위해 40조 6,000억 루피아(미화 27억 달러)를 책정했습니다. 정부 관계자의 보고에 따르면 대통령궁과 일부 주택 건물은 2024년 완공을 목표로 빠르게 진행되고 있습니다. 이러한 건설 투자 급증은 접착제 및 실란트에 대한 수요를 증가시킬 것으로 보입니다.

- 자동차 부문에서 접착제 및 실란트는 재료의 접착, 내구성 확보, 차량 성능 향상에 필수적인 역할을 합니다. 자동차 생산 및 판매 확대에 따라 접착제 및 실란트의 성장은 예측 기간 동안 상승할 것으로 예상됩니다.

- OICA(Organisation Internationale des Constructeurs d' Automobiles)의 데이터에 따르면 2023년 인도네시아의 자동차 생산량은 139만 대를 기록해 2022년 147만 대보다 감소했습니다. 그러나 자동차 판매는 13% 증가하여 2023년 101만 대에 달했습니다.

- 강력한 회복세를 보인 인도네시아 자동차 시장은 2023년까지 회복세를 보였을 뿐만 아니라, 팬데믹 이전 수치를 넘어섰습니다. 그러나 2024년 1월에 후퇴가 발생하여 GAIKINDO에 따르면 전체 자동차 판매량은 2023년 9만 4,087대에서 6만 9,619대로 26% 감소했습니다. 승용차는 20% 감소한 5만 6,007대, 상용차는 43% 감소한 1만 3,612대였습니다. 이러한 상황에도 불구하고 GAIKINDO는 2024년 자동차 판매량이 약 110만 대에 달할 것으로 전망하고 있습니다.

- 전자 부문에서 접착제 및 실란트는 재료의 접착, 내구성 보장 및 장치 성능 향상에 필수적인 역할을 합니다. 전자 부문이 성장함에 따라 이러한 접착제 및 실란트에 대한 수요도 증가하고 있습니다.

- 인도네시아 전자제품 생산자협회(Gabel)의 데이터에 따르면, 전자제품의 국내 판매는 일반적으로 연간 약 11%의 성장률을 보이고 있으며, Gabel은 또한 2024년까지 전자산업이 5%에서 10%까지 상승할 것으로 예상하고 있습니다.

- 이러한 다양한 산업 분야의 추세를 고려할 때, 인도네시아의 접착제 및 실란트 수요는 향후 몇 년동안 증가할 것으로 예상됩니다.

동남아시아의 접착제 및 실란트 산업 개요

동남아시아의 접착제 및 실란트 시장은 세분화되어 있습니다. 주요 진출 기업으로는 3M, Arkema, Sika AG, H.B. Fuller, Henkel AG & Co. KGaA 등이 있습니다(순서에 관계없이).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 산업 밸류체인 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화(금액 기준 시장 규모)

- 접착 기술

- 수성

- 아크릴계

- 에틸렌초산비닐(EVA) 에멀전

- 폴리우레탄 분산액과 CR(클로로프렌 고무) 라텍스

- 폴리초산비닐(PVA) 에멀전

- 기타 수성 접착제

- 용제계

- 스티렌부타디엔고무(SBR)

- 스티렌부타디엔고무(SBR)

- 폴리 아크릴레이트(PA)

- 기타 용제형 접착제

- 반응성

- 에폭시

- 변성 아크릴

- 실리콘

- 폴리우레탄

- 혐기성

- 시아노아크릴레이트

- 기타 반응성 접착제

- 핫멜트

- 에틸렌 초산비닐

- 스티렌계 블록 공중합체

- 열가소성 폴리우레탄

- 기타 핫멜트 접착제

- 기타

- 수성

- 실란트 제품 유형

- 실리콘

- 폴리우레탄

- 아크릴

- 폴리비닐 아세테이트

- 기타

- 최종사용자 산업

- 건축 및 건설

- 종이 및 판지 포장

- 운송

- 목공 및 창호

- 신발 및 피혁

- 의료

- 전기 및 전자

- 기타

- 지역

- 인도네시아

- 말레이시아

- 필리핀

- 싱가포르

- 태국

- 베트남

- 기타 동남아시아 지역

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- 3M

- ADB Sealant Co., Ltd

- Arkema Group

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- DuPont

- Dymax Corporation

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Jowat AG

- Mapei Inc.

- MUNZING Corporation

- Pidilite Industries Ltd.

- Sika AG

- Tesa SE(A Beiersdorf Company)

- Wacker Chemie AG

제7장 시장 기회와 향후 동향

LSH 25.01.21The Southeast Asia Adhesives And Sealants Market size is estimated at USD 3.79 billion in 2025, and is expected to reach USD 5.15 billion by 2030, at a CAGR of greater than 6.3% during the forecast period (2025-2030).

The Southeast Asia adhesives and sealants market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, growing demand from the construction sector and increasing adoption in the packaging industry are the major factors driving the demand for the market studied.

- However, stringent VOC emissions regulations related to adhesives and sealants are expected to hinder the market's growth.

- Nevertheless, the innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials is expected to create new opportunities for the market studied.

- Indonesia is expected to dominate the market and witness the highest growth during the forecast period.

Southeast Asia Adhesives and Sealants Market Trends

Building and Construction Segment to Witness Fastest Growth

- Adhesives and sealants, due to their unique characteristics and physical properties, play a pivotal role in the building and construction industry, establishing it as the leading end-user segment in the market.

- Key properties of adhesives and sealants encompass strong cohesion, adhesion, and elasticity, coupled with high cohesive strength and flexibility. They also exhibit a high elastic modulus, resist thermal expansion, and withstand environmental challenges such as UV light, corrosion, saltwater, rain, and other weathering conditions.

- Common applications span across HVAC systems, concrete work, joint cementing, resilient flooring, roofing, and fixed window frames.

- In Southeast Asia, rising construction activities in nations like Indonesia, the Philippines, Malaysia, Vietnam, and Thailand are propelling the demand for adhesives and sealants.

- Malaysia's construction sector, buoyed by substantial government backing, is rapidly modernizing and expanding. As per Malaysian Industrial Development Finance Berhad (MIDF), the sector has seen six consecutive growth periods.

- In the last quarter of 2023, construction commenced on a 17,000 m2, seven-story data center called the Cyberjaya Data Centre in Cyberjaya, Selangor, Malaysia. The Cyberjaya Data Centre comprises 1,830 cabinets with a capacity of 12 MW. Construction is projected to be completed by the second quarter of 2025, thus increasing the demand for the market studied.

- According to the Department of Budget and Management, the Philippines government spent PHP 1204.6 billion (~USD 22 billion) on infrastructure and capital outlays in 2023, marking a 19% rise from the prior year, thus increasing the demand for the market studied.

- As per the data from the Building and Construction Authority, Singapore's construction contracts are projected to be valued between SGD 27 billion (~USD 20.6 billion) and SGD 32 billion (~USD 24.4 billion) in 2023. Public sector projects are anticipated to make up about 60% of this demand, driven by a robust pipeline of public housing initiatives from the Housing Development Board (HDB). Additionally, with a surge in projects like water treatment plants and educational facilities, the demand for adhesives and sealants in Singapore is set to rise.

- Government initiatives and numerous ongoing and planned infrastructure projects are set to influence the demand for adhesives and sealants in Southeast Asia during the forecast period. For instance, In Phuket, Thailand, the Kathu-Patong Tunnel Project, part of the Kathu-Patong Expressway Project, is set to construct a 1.85-kilometer tunnel. With an estimated cost of THB 14.67 billion (~USD 0.43 billion), completion is anticipated by 2027.

- Thailand, a major tourist hub, is seeing significant investments in malls, luxury hotels, and more. The Pattaya Marriott Marquis Hotel, boasting over 900 guest rooms, is the standout project, aiming for a 2024 launch. This dual-property development also features a 398-room JW Marriott and the Pattaya Beach Resort & Spa. By 2027, Marriott plans to introduce four new hotels across its three brands in Bangkok and Pattaya, adding to its existing portfolio of 45 hotels and resorts in Thailand, nine of which are in collaboration with Asset World Corporation.

- As per the data from General Statistics Office of Vietnam, in 2023, Vietnam's construction sector contributed over VND 640.72 trillion (~USD 0.03 trillion) to the GDP, representing 6.27% of the nation's total GDP, which was approximately VND 10.2 thousand trillion (~USD 0.0004 trillion).

- Given these dynamics, the aforementioned factors are poised to shape the demand trajectory for adhesives and sealants in the coming years.

Indonesia to Dominate the Market

- Indonesia leads Southeast Asia in the consumption of adhesives and sealants. Key drivers for this growth include rising construction activities, booming electronics production, and heightened demand in the footwear, leather, and healthcare sectors.

- In the footwear and leather industry, adhesives and sealants are essential for bonding materials, ensuring durability, and enhancing product performance. As Indonesia's footwear and leather sector expands, so does the demand for these adhesives and sealants.

- Data from Statistics Indonesia reveals that in 2023, the GDP from leather and footwear manufacturing reached approximately IDR 49.24 trillion (~USD 0.0030 trillion), marking a 2% increase from the previous year. This growth underscores Indonesia's emergence as a global manufacturing powerhouse.

- In the healthcare sector, adhesives and sealants are vital for bonding materials, ensuring durability, and enhancing the functionality of medical devices. With the healthcare sector's growth, the demand for adhesives and sealants is set to rise in the coming years.

- Over the past year, Indonesia has bolstered its healthcare sector through significant investments, both domestic and foreign. The 2023 Health Law (Law No.17 of 2023 on Health) eliminated mandatory health spending, introducing a performance-based budgeting system (PBBS) to promote targeted spending. This law also outlines a six-pillar healthcare transformation, highlighting the government's commitment to enhancing Indonesia's healthcare services.

- According to the Ministry of Health (Indonesia), in 2023, Indonesia's medical equipment exports reached approximately USD 3.34 billion, a 22% increase from the previous year, further fueling the healthcare sector's growth, therby supporting the growth of the market studied.

- As Southeast Asia's largest construction market, Indonesia is ramping up government spending on infrastructure and urbanization to meet the bosltering demand for residential and commercial properties, subsequently increasing the need for adhesives and sealants.

- The construction sector is vital to Indonesia's GDP. The Ministry of Finance has allocated an IDR 35 trillion (~USD 0.002 trillion) fund from the 2024 budget to the Public Works and Housing Ministry, aiming to boost infrastructure and housing for civil servants. In Q4 2023, construction began on the Sequoia Hills Sentul Residential Development project, a 95-hectare endeavor in Bogor, West Java, set for completion in 2027, aiming to elevate regional living standards.

- In its 2024 budget, Indonesia has set aside IDR 40.6 trillion (USD 2.7 billion) for its new capital city development. Government officials report rapid advancements, with the presidential office and several residential blocks on track for a 2024 completion. This surge in construction investment is poised to elevate the demand for adhesives and sealants.

- In the automotive sector, adhesives and sealants are crucial for bonding materials, ensuring durability, and enhancing vehicle performance. With the country's expanding vehicle production and sales, growth for adhesives and sealants is anticipated to rise during the forecast period.

- Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) indicates that Indonesia produced 1.39 million automobiles in 2023, down from 1.47 million in 2022. However, vehicle sales saw a 13% uptick, reaching 1.01 million units in 2023.

- After a strong recovery, Indonesia's vehicle market not only bounced back by 2023 but also exceeded pre-pandemic figures. Yet, January 2024 brought a setback, with GAIKINDO noting a 26% decline in overall vehicle sales, dropping to 69,619 units from 94,087 in 2023. Passenger vehicle sales dipped 20% to 56,007 units, while commercial vehicles saw a sharper 43% drop to 13,612 units. Despite this, GAIKINDO anticipates car sales will reach around 1.1 million units in 2024.

- In the electronics sector, adhesives and sealants are vital for bonding materials, ensuring durability, and enhancing device performance. As the electronics sector grows, so does the demand for these adhesives and sealants.

- Data from the Indonesian Electronics Producers Association (Gabel) indicates that domestic sales of electronic products typically see an annual increase of about 11%. Gabel also projects significant growth for the electronics industry, estimating a rise between 5% and 10% in 2024.

- Given these trends across various industries, the demand for adhesives and sealants in Indonesia is poised for growth in the coming years.

Southeast Asia Adhesives and Sealants Industry Overview

The Southeast Asia's adhesives and sealants market is fragmented in nature. The major players (not in any particular order) include 3M, Arkema, Sika AG, H.B. Fuller, and Henkel AG & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Construction Sector

- 4.1.2 Increasing Adoption in Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesive Technology

- 5.1.1 Water Borne

- 5.1.1.1 Acrylic

- 5.1.1.2 Ethylene Vinyl Acetate (EVA) Emulsion

- 5.1.1.3 Polyurethane Dispersion and CR (Chloroprene Rubber) Latex

- 5.1.1.4 Polyvinyl Acetate (PVA) Emulsion

- 5.1.1.5 Other Water-borne Adhesives

- 5.1.2 Solvent-borne

- 5.1.2.1 Styrene-Butadiene Rubber (SBR)

- 5.1.2.2 Styrene-Butadiene Rubber (SBR)

- 5.1.2.3 Poly Acrylate (PA)

- 5.1.2.4 Other Solvent-borne Adhesives

- 5.1.3 Reactive

- 5.1.3.1 Epoxy

- 5.1.3.2 Modified Acrylic

- 5.1.3.3 Silicone

- 5.1.3.4 Polyurethane

- 5.1.3.5 Anaerobic

- 5.1.3.6 Cyanoacrylate

- 5.1.3.7 Other Reactive Adhesives

- 5.1.4 Hot Melt

- 5.1.4.1 Ethylene Vinyl Acetate

- 5.1.4.2 Styrenic Block Copolymers

- 5.1.4.3 Thermoplastic Polyurethane

- 5.1.4.4 Other Hot Melt Adhesives

- 5.1.5 Other Technologies

- 5.1.1 Water Borne

- 5.2 Sealant Product Type

- 5.2.1 Silicone

- 5.2.2 Polyurethane

- 5.2.3 Acrylic

- 5.2.4 Polyvinyl Acetate

- 5.2.5 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Paper, Board, and Packaging

- 5.3.3 Transportation

- 5.3.4 Woodworking and Joinery

- 5.3.5 Footwear and Leather

- 5.3.6 Healthcare

- 5.3.7 Electrical and Electronics

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Philippines

- 5.4.4 Singapore

- 5.4.5 Thailand

- 5.4.6 Vietnam

- 5.4.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ADB Sealant Co., Ltd

- 6.4.3 Arkema Group

- 6.4.4 Ashland

- 6.4.5 Avery Dennison Corporation

- 6.4.6 Beardow Adams

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 Dymax Corporation

- 6.4.10 Franklin International

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Huntsman International LLC

- 6.4.14 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.15 Jowat AG

- 6.4.16 Mapei Inc.

- 6.4.17 MUNZING Corporation

- 6.4.18 Pidilite Industries Ltd.

- 6.4.19 Sika AG

- 6.4.20 Tesa SE (A Beiersdorf Company)

- 6.4.21 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials

- 7.3 Other Opportunities