|

시장보고서

상품코드

1627216

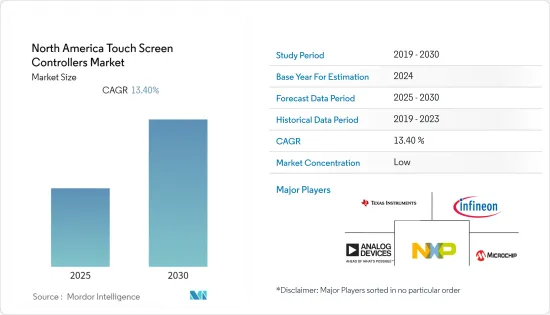

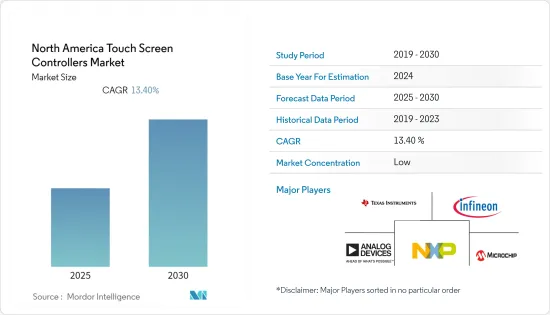

북미의 터치스크린 컨트롤러 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)North America Touch Screen Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

북미의 터치스크린 컨트롤러 시장은 예측 기간 중 CAGR 13.4%를 기록할 전망

주요 하이라이트

- 태블릿, 도어락 시스템, 스마트 가전, 자동차 인포테인먼트 시스템 등 전자제품의 터치스크린에 대한 수요가 증가하면서 이 시장에서 터치스크린 컨트롤러의 성장이 촉진되고 있습니다.

- 또한 BFSI 산업의 급속한 디지털화로 인해 은행에서는 ATM기, KYC용 생체인식 장비, 온라인 결제용 POS기, 통장 인쇄용 인쇄기 등이 통합되어 시장 성장을 크게 촉진하고 있습니다.

- 터치스크린 디스플레이는 전 세계에서 큰 수요가 있습니다. 공급업체들이 자체 버전의 스마트 기기를 출시함에 따라 터치스크린에 대한 수요가 급격히 증가하고 있습니다. 이러한 성장은 터치스크린 컨트롤러 시장을 주도하고 있으며, 산업 전반에 걸쳐 터치스크린의 적용이 확대되고 있습니다. 그러나 기술적 복잡성과 전력 소비 증가는 시장 성장을 압박하고 있습니다.

- COVID-19 기간 중 직원들이 선호하던 직장 폐쇄가 시행되면서 스마트폰, 태블릿, 킨들 등과 같은 터치 지원 기기에 대한 수요가 증가하여 터치스크린 컨트롤러 시장에 긍정적인 영향을 미치고 있습니다. 또한 팬데믹 발생으로 인한 공급망 혼란도 전 세계 생산 활동에 영향을 미쳤습니다.

북미 터치스크린 컨트롤러 시장 동향

정전식 터치스크린이 큰 시장 점유율을 차지

- 정전용량식 터치스크린 컨트롤러는 터치 명령을 처리하는 장비로, 특히 정전용량식 터치스크린에 사용됩니다. 정전식 터치스크린 컨트롤러에는 여러 가지 유형이 있는데, 그 중 금속-산화막-반도체 칩이 가장 많이 사용됩니다.

- 이 유형의 컨트롤러는 사람의 터치를 입력으로 사용하며 신뢰성, 정확성, 터치 감도, 멀티 터치 지원 등 여러 가지 이점을 제공합니다. 이러한 장점으로 인해 정전식 컨트롤러는 소비자 용도에서 큰 추진력을 보이고 있습니다.

- 또한 에너지 모니터링 장비, 도어 액세스 컨트롤러, 의료기기 등의 용도에서 정전식 터치스크린의 통합이 진행되고 있으며, 향후 수년간 수요를 증가시킬 것으로 예상됩니다.

- 이 시장공급업체는 제품 혁신에 적극적으로 초점을 맞추고 있으며, 많은 고객을 수용하기 위해 새로운 제품을 시장에 출시하고 있습니다. 예를 들어 IDEC Corporation은 2022년 5월 신제품 HG2J 시리즈 7인치 터치스크린 HMI를 출시하여 HMI 제품군을 확장했습니다. 이 HMI는 하드웨어 및 소프트웨어의 발전으로 모든 유형의 산업 용도에 쉽게 통합하고 사용할 수 있습니다.

소비자용 전자기기 부문은 급격한 성장이 예상

- 가정용 전자제품은 최종사용자의 주요 부문 중 하나입니다. 이 지역에서는 새롭고 혁신적인 기술 제품에 대한 수요가 증가함에 따라 다양한 기기에 터치스크린이 장착되어 터치스크린 컨트롤러에 대한 수요가 증가하고 있습니다.

- 가정용 전자제품의 기술 발전은 소비자들이 최신 기능을 갖춘 신제품에 대한 지출을 유도하고 있습니다. 따라서 사람들은 터치 스크린 기반 제품으로 전환하여 시장 성장을 더욱 증가시키고 있습니다.

- 도시바 일렉트로닉 디바이스 앤 스토리지(Toshiba Electronic Devices & Storage Co., Ltd.)의 유럽 판매 및 마케팅 자회사인 도시바 일렉트로닉스 유럽(Toshiba Electronics Europe GmbH)이 유럽에서는 퍼넬(Farnell), 북미에서는 뉴어크(Newark), 아시아태평양에서는 엘리먼트 14(Element 14)로 알려진 전자 부품, 제품 및 솔루션의 세계 유통업체와 관계를 확대했다고 발표했습니다.의 세계 유통업체인 퍼넬(Farnell)과의 관계를 확대했다고 발표했습니다.

- 터치스크린 컨트롤러가 내장된 가전제품으로는 스마트 웨어러블과 노트북을 들 수 있습니다. 또한 냉장고, 세탁기 및 기타 제품은 스마트 기술을 채택하여 더 나은 사용자 경험을 제공하고 수요를 창출하기 위해 터치 지원 기능을 탑재하고 있습니다.

북미 터치스크린 컨트롤러 산업 개요

북미 터치스크린 컨트롤러 시장은 경쟁이 치열하고 여러 기업이 진출해 있습니다. 각 기업은 혁신을 통해 다른 기업과의 경쟁 우위를 확보하기 위해 신기술에 집중하고 있으며, 다양한 용도에 맞는 차별화된 제품을 개발하고 있습니다.

- 2021년 11월 - Microchip Technology Inc.는 방수, 고속, 고정밀 멀티터치 감지와 함께 1:1에서 5:1에 이르는 다양한 디스플레이 종횡비를 충족하는 광범위한 유연성을 제공하는 자동차용 maXTouch MXT1296M1T 터치스크린 컨트롤러를 발표했습니다.

기타 혜택 :

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 업계 밸류체인 분석

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 스마트 전자기기의 수요 증가

- 다양한 업계별 터치 디바이스의 보급

- 시장이 해결해야 할 과제/억제요인

- 기술적 복잡성과 소비전력

제6장 시장 세분화

- 유형별

- 저항막방식

- 용량성

- 최종사용자별

- 산업용

- 헬스케어

- 가전

- 소매

- 자동차

- BFSI

- 기타 최종사용자

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 개요

- Texas Instruments Incorporated

- Infineon Technologies

- Analog Devices, Inc.

- NXP Semiconductors

- Microchip Technology Incorporated

- Silicon Laboratories

- Integrated Device Technology, Inc.

- Broadcom Inc.

- Semtech Corporation

제8장 투자 분석

제9장 시장의 미래

KSA 25.01.22The North America Touch Screen Controllers Market is expected to register a CAGR of 13.4% during the forecast period.

Key Highlights

- The growing demand for touch screens in the electronics products such as tablets, door lock systems, smart home appliances, and automobile infotainment systems is propelling the growth of touch screen controllers in the market.

- In addition, the rapid digitalization in the BFSI industry has resulted in the integration of ATM machines, biometric devices for KYC, POS machines for online payments, and printing machines for passbook printing at banks, which is significantly boosting market growth.

- Touch screen displays are in huge demand across the world. The need for touchscreen has been rising exponentially as the vendors launch their own versions of smart devices. This growth is driving the touch screen controller market, with the increasing application of touch screens across industries. However, the technical complexity and more power consumption are straining the market growth.

- The imposition of lockdown during COVID-19, the employees were preferably working from, has positively impacted the touchscreen controller market as the demand increased for touch-enabled devices like smartphones, tablets, kindles, etc. Moreover, the supply chain disruptions caused due to the pandemic outbreak also impacted production activities across the globe.

North America Touch Screen Controllers Market Trends

Capacitive Touch Screens to Account for a Significant Market Share

- A capacitive touch screen controller is a device that processes touch commands and is used specifically in capacitive touch screens. These controllers are available in several types, among which the metal-oxide-semiconductor chip is most used.

- This type of controller uses human touch as input and offers several benefits, such as reliability, accuracy, touch sensitivity, and multi-touch support. Owing to such benefits, capacitive controllers are gaining significant momentum in consumer applications.

- Moreover, the growing integration of capacitive touch screens in applications such as energy monitoring devices, door access controllers, and medical devices will push the demand in the coming years.

- The vendors in the market are also actively focusing on product innovations and are launching new products in the market to cater to a large number of customers. For instance, in May 2022, IDEC Corporation expanded its HMI product line by introducing the new HG2J Series 7" touchscreen HMI. This HMI's hardware and software advancements make it easier to integrate and use for any type of industrial application.

Consumer Electronic Segment is Expected to Grow Rapidly

- Consumer electronics is one of the key segments of the end-user. The rising demand for new and innovative technology products in the region has pushed the demand for touch screens in various devices, thereby driving the demand for touch screen controllers.

- The technological advancement in consumer electronics products attracts consumers to spend on new products with the latest features; hence, people are switching to touchscreen-based products, further augmenting the growth of the market studied.

- In June 2022, Toshiba Electronic Devices & Storage Corporation announced that its European sales and marketing subsidiary, Toshiba Electronics Europe GmbH, has extended its relationship with Farnell, a global distributor of electronic components, products, and solutions known as Farnell in Europe, Newark in North America, and element14 throughout the Asia Pacific.

- Smart wearables and laptops are examples of consumer electronics items with integrated touch screen controllers. In addition, fridges, washing machines, and other products are adopting smart technologies and have come with touch-enabled features to deliver a better user experience and create demand.

North America Touch Screen Controllers Industry Overview

The North American touch screen controller market is highly competitive and consists of several players. The companies are focusing on new technologies to gain a competitive advantage over other players through innovation and are developing differentiated products for various applications.

- November 2021 - Microchip Technology Inc. announced its new maXTouch MXT1296M1T touchscreen controllers that will offer extensive flexibility to satisfy unique display aspect ratios from 1:1 to 5:1 for cars, along with waterproof, fast, and accurate multi-touch detection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand of Smart Electronic Devices

- 5.1.2 Penetration of Touch Devices Across Different Industry Verticals

- 5.2 Market Challenges/Restraints

- 5.2.1 Technical Complications and Power Consumption

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Resistive

- 6.1.2 Capacitive

- 6.2 By End-user

- 6.2.1 Industrial

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Retail

- 6.2.5 Automotive

- 6.2.6 BFSI

- 6.2.7 Other End-users

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 Infineon Technologies

- 7.1.3 Analog Devices, Inc.

- 7.1.4 NXP Semiconductors

- 7.1.5 Microchip Technology Incorporated

- 7.1.6 Silicon Laboratories

- 7.1.7 Integrated Device Technology, Inc.

- 7.1.8 Broadcom Inc.

- 7.1.9 Semtech Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

샘플 요청 목록