|

시장보고서

상품코드

1628728

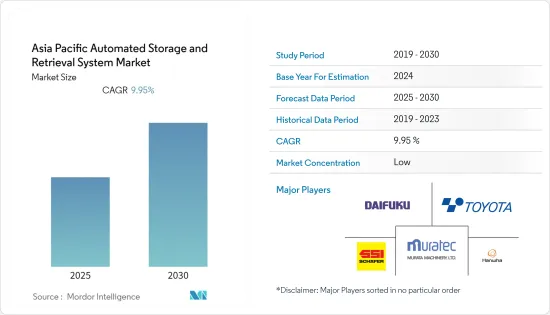

아시아태평양의 자동화 스토리지 및 검색 시스템 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)Asia Pacific Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

아시아태평양의 자동화 스토리지 및 검색 시스템(ASRS) 시장은 예측 기간 동안 9.95%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

주요 하이라이트

- Zebra가 실시한 Warehouse 2020 Asia Pacific Vision Study에 따르면, 아시아태평양의 73%가 2020년까지 창고 수를 늘릴 계획이며, 52%는 기존 창고의 공간 확장을 축소할 계획이라고 밝혔습니다.년까지 창고 수를 늘릴 계획이며, 이 중 52%는 2020년까지 기존 창고 공간 확장을 축소할 계획이라고 밝혔습니다.

- 또한, 많은 식음료 기업들이 ASRS 시스템이 제공하는 이점을 인식하고 시장 도입에 더욱 집중하고 있습니다.

- 예를 들어, 호주의 제과업체 Cadbury Schweppes는 멜버른의 전국 물류 센터를 성공적으로 업그레이드했습니다. 이 업그레이드를 통해 전체 배송 능력을 유지하면서 창고 자동 보관 및 검색 시스템의 생산성을 20% 향상 시켰습니다. 이번 업그레이드에는 ASRS 크레인 4대의 개조 및 업그레이드, 물류 센터의 컨베이어 및 분류 시스템 현대화 등이 포함됐습니다.

- 한국은 1990년대 이후 지속적으로 세계 최고 수준의 자동차 생산국이자 최대 자동차 수출국 중 하나입니다. 전기자동차, 하이브리드 전기자동차, 연료전지 전기자동차를 포함한 친환경 자동차는 예측 기간 동안 한국에서 가장 빠르게 성장하는 자동차 최종 사용자 부문이 될 것으로 예상됩니다. 이는 한국 자동차 산업에서 자동화에 큰 기회가 될 것입니다.

- 또한 일본은 린 제조, 적시 생산, 적시 생산 개념을 사내 물류에 도입했습니다. 긴밀한 구조로 인해 일본은 모든 수준에서 AS/RS 시스템을 채택할 수 있었고, 경제적이고 효율적이었습니다. 현재 세계는 4차 산업혁명에 대한 기대를 가지고 있으며, 일본은 중요한 역할을 하고 있습니다.

- 또한, 인도네시아는 적극적인 자동화 도입 국가로 분류됩니다. 이 나라는 산업 작업에서 로봇 사용 증가를 기록하고 있습니다. 일본은 공급국이자 소비국이기 때문에 인도네시아는 일본과의 무역에서 이익을 얻을 것으로 예상됩니다. 이 때문에 이 지역의 자동화 수요가 증가하고 있습니다.

아태지역 ASRS 시스템 시장 동향

소매업이 큰 시장 점유율을 차지할 것으로 예상

- 소매업은 다른 산업에 비해 이 지역에서 우편 및 소포에 이어 두 번째로 높은 ASRS 수요를 창출하고 있으며, ASRS는 다른 유형의 장비와 비교했을 때 이 지역의 소매 부문에서 높은 채택률을 보이고 있으며, 중국과 인도가 이에 크게 기여하고 있습니다.

- 또한 2011년 이후 중국 소매업의 수익은 지속적으로 증가하고 있으며, 이는 중국 소매업의 자동화를 크게 촉진하고 있습니다. 소매업 증가는 ASRS를 필요로 하는 상품의 효과적인 보관 및 창고 관리를 필요로 합니다. 중국 상무부(MOFCOM)에 따르면, 소매 기업의 혁신과 변화로 인해 중국의 소매 매출은 향후 몇년안에 미국을 능가할 것으로 예상됩니다.

- 또한 인도 시장의 성장은 다양한 기업이 다양한 솔루션을 제공하는 산업 자동화 시스템의 채택으로 보완되고 있으며, 이는 최근의 특징적인 추세입니다. 예를 들어, Delta Electronics는 창고 로봇 솔루션 등 다양한 자동화 제품과 솔루션을 제공합니다.

- Skill India 및 Digital India와 같은 플래그십 프로그램의 수렴은 이 목표를 달성하기 위한 핵심이며, 이를 통해 이 나라 시장 성장을 가속할 것입니다.

- 2020년 12월, 기술부와 타타는 인도 기술 연구소의 1기생을 출범시켰습니다. 이러한 프로그램은 인도에서 공장 자동화 및 검색 시스템 기술을 개발하고 일반 시민과 기업 조직 사이에서 더 높은 인지도를 창출하기 위해 인도에서 전개되고 있습니다.

- 또한 인도네시아에서는 인더스트리 4.0의 도래가 식음료 산업, 섬유 및 의류, 자동차, 화학, 전자제품 제조에 공장 자동화 시스템 도입에 초점을 맞춘 연구 시장을 주도하고 있습니다. 인도네시아와 독일 간의 정부 간 이니셔티브는 인도네시아의 스타트업 생태계를 강화하고 있습니다. 이와 더불어 2020년 6월 일본의 산업기계 및 건설기계 무역회사인 마루카(Maruka Corp.)는 인도네시아에 공장 자동화 및 보관 시스템 전문 자회사를 설립할 것이라고 발표했습니다. 동남아시아 국가에서 공장 자동화 시스템에 대한 수요가 증가함에 따라 로봇 시스템, 생산 라인, 청소 장비의 설계, 생산, 판매 및 수리를 담당할 예정입니다.

중국이 가장 큰 시장 점유율을 차지합니다.

- 중국은 아시아태평양의 ASRS 시장 성장에 크게 기여하고 있습니다. 제조업, 소매업, 자동차 산업, 전자상거래 등의 산업에서 ASRS 제품에 대한 수요가 증가하면서 시장 성장을 견인하고 있습니다.

- 또한, 독일에서 일부 영감을 받은 중국 정부의 야심찬 '메이드 인 차이나 2025' 이니셔티브는 인더스트리 4.0을 지향하며, 제조 부문에서 중국의 경쟁력을 강화하는 것을 목표로 하고 있습니다.

- 중국 전자상거래 업체인 JD.com Inc.는 최근 증가하는 소매 판매 수요에 대응하기 위해 효과적인 창고 관리를 위한 효율적인 ASRS를 구축했습니다. 또한, 삼성 홀딩스는 중국 가구 산업에 ASRS를 도입한 최초의 기업 중 하나로, 생산된 모든 제품을 자동으로 기계적으로 저장, 추적 및 검색할 수 있어 각 배송마다 다른 제품을 조립하는 데 필요한 준비 시간을 충분히 절약할 수 있습니다.

- 또한 중국 소매업체들은 무인 매장을 개발하고 있습니다. 예를 들어, 중국 온라인 쇼핑 플랫폼 인 Suning은 중국에서 5 개의 무인 매장을 개설하고 얼굴 인식 기술을 결제 서비스에 적용하여 쇼핑객에게 소비 습관에 기반한 지능형 쇼핑 경험을 제공합니다. 이는 이 지역에서 연구되고 있는 시장 성장에 크게 기여하고 있습니다.

- 2020년 10월, 텐센트(Tencent)가 지원하는 음식 배달 서비스 메이퇀뎬핑(美團店平)은 베이징 수강공원(首鋼公園)에 자사 최초의 스마트 AI 소매점인 'MAI Shop'을 오픈했습니다. 이 매장은 AI와 로봇 공학을 결합하여 중국의 슈퍼마켓과 편의점에서 정기적으로 볼 수 있는 '뉴 리테일' 형식을 채택하고 있으며, Meituan은 완전 자동화된 창고와 배송을 통합하여 테이크아웃 배송 능력을 극대화하고 있으며, 무인 배송의 소매 경험을 선사할 수 있는 기술을 결합했습니다.

아태지역 ASRS 시스템 산업 개요

아시아태평양의 자동화 보관 및 검색 시스템 시장은 세분화되어 있으며 경쟁이 치열합니다. 제품 출시, 높은 R&D 비용, 파트너십 및 인수합병 등이 이 지역 기업들이 치열한 경쟁을 유지하기 위해 채택하는 주요 성장 전략입니다. 최근 시장 개척 동향은 다음과 같습니다.

- 2020년 8월 - KION Group, 자동화 솔루션 확대를 위해 중국 제조업체와 판매 계약 및 공동 개발 계획에 관한 양해각서 체결 - Quicktron과의 협력을 통해 자동 창고 및 트럭 시장에서 Quicktron의 입지가 더욱 강화될 것으로 예상됩니다. 더욱 강화될 것으로 기대됩니다.

- 2020년 6월 - 코히시오 그룹(Cohesio Group)은 현재 코버 서플라이 체인(Korber Supply Chain)으로 알려진 새로운 분류 로봇 솔루션을 호주 및 뉴질랜드에 도입했습니다. Korber의 솔루션을 통해 물류 운영자는 유연하고 저렴하며 확장 가능한 자동화를 통해 운영 능력을 극대화할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업 매력 - Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 노동 안전 중시 증가

- 인건비에 대한 우려 증가

- 시장 성장 억제요인

- 숙련 노동력 필요성과 수작업 대체에 대한 우려

- 시장에 대한 COVID-19의 영향

제6장 시장 세분화

- 제품 유형별

- 고정 통로 방식

- 카르셀(수평 카르셀+수직 카르셀)

- 수직 리프트 모듈

- 최종사용자 산업별

- 공항

- 자동차

- 식품 및 음료

- 일반 제조업

- 우편·소포

- 소매업

- 기타

- 국가별

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

제7장 경쟁 구도

- 기업 개요

- DAIFUKU Co. Ltd.

- Murata Machinery Ltd.

- Schaefer Systems International Pvt Ltd

- Toyota Industries Corporation

- Hanwha Group

- GEEK+INC.

- Kardex Group

- Siasun Robot & Automation Co. Ltd.

- System Logistics S.p.A.

- Noblelift Intelligent Equipment Co. Ltd.

제8장 투자 분석

제9장 시장의 미래

LSH 25.01.21The Asia Pacific Automated Storage and Retrieval System Market is expected to register a CAGR of 9.95% during the forecast period.

Key Highlights

- The Asia-Pacific region is witnessing an increasing focus towards automation by the warehousing companies, which is anticipated to drive the market for Automated Storage and Retrieval Systems. According to Warehouse 2020 APAC Vision Study conducted by Zebra, 73% of the warehousing companies in the region plan to increase the number of warehouses by 2020, and 52% of them also plan to reduce space expansion in existing warehouses in 2020.

- Further, many of the food and beverage industry companies have recognized the advantages provided by the ASRS systems and have increased their focus towards market adoption.

- For instance, Australia's confectionery manufacturer, Cadbury Schweppes, successfully upgraded its national distribution center in Melbourne. The upgrade resulted in a 20% productivity improvement to its warehouse's automated storage and retrieval system while maintaining full distribution capability. It involved refurbishing and upgrading four ASRS cranes and modernizing the distribution center's conveyor and sortation system.

- South Korea has always been one of the world's top automotive manufacturing countries and one of the largest automotive exporters since the 1990s. Eco-friendly vehicles, including electric vehicles, hybrid electric vehicles, and fuel-cell electric vehicles, are expected to be the fastest-growing automotive end-user segment in South Korea during the forecast period. This provides a massive opportunity for automation in the automotive industry in the country.

- Moreover, Japan introduced lean manufacturing, a Just-In-Time concept in intralogistics. The close-knitted structure allowed the nation to adopt AS/RS systems at every level, economic and efficient. Currently, with the world looking forward to the fourth industrial revolution, Japan plays a significant part.

- Further, Indonesia is categorized as an aggressive automation-adopting nation. The country has recorded increased robotic usage for industrial work. Since Japan is both its supplier and consumer, Indonesia is expected to benefit from the trade with Japan. Thus increasing the demand for automation in the region.

Asia-Pacific ASRS Systems Market Trends

Retail Industry is Expected to Hold Significant Market Share

- The retail sector generated the second-highest demand for ASRS in the region, after post and parcel, compared to other industries. ASRS, when compared to different equipment types, has witnessed a higher adoption in the region's retail sector, and China and India have significantly contributed to this.

- Additionally, the Chinese retail revenue has been on a constant increase since 2011, significantly driving up the automation in the country's retail sector. A rise in retail requires effective storage and warehouse management of products suitably requiring ASRS. According to China's Ministry of Commerce (MOFCOM), China's retail sales are expected to surpass sales in the United States in upcoming years due to the innovation and transformation of retail enterprises.

- Moreover, the growth of the market in India is complemented by the adoption of industrial automation systems with various companies offering different solutions and is characterized by recent developments. For instance, Delta Electronics provides a wide range of automation products and solutions, including robot solutions for warehouses.

- The convergence of flagship programs, such as Skill India and Digital India, is the key to achieving this goal, thereby driving the country's market growth. In December 2020, Skill Ministry and Tata launched the first batch of the Indian Institute of Skills. Such programs are rolled out in India to develop Factory Automation and Retrieval System skills and create greater awareness amongst the general public and business organizations.

- Further, In Indonesia, the onset of Industry 4.0 is driving the studied market, focusing on implementing factory automation systems in the manufacturing of the food and beverage industry, textiles and clothing, automotive, chemical, and electronics. Cross government initiatives between Indonesia and Germany are strengthening the start-up ecosystem in the country. In addition to this, in June 2020, Maruka Corp., a Japanese industrial and construction machinery trader, announced to set up a wholly-owned subsidiary in Indonesia for a dedicated factory automation and storage system unit. It offers to design, produce, market, and repair robot systems, production lines, and washing equipment as demand for factory automated systems in the Southeast Asian country increases.

China Accounts For the Largest Market Share

- China has been a prominent contributor to the growth of the ASRS market in the Asia-Pacific region. The increasing demand for ASRS products across industries, such as manufacturing, retail, automotive, and e-commerce, boosts the market's growth.

- Further, the government's ambitious 'Made in China 2025' initiative, partially inspired by Germany, for Industry 4.0 aims to boost the country's competitiveness in the manufacturing sector.

- An e-commerce giant in China, JD.com Inc., recently built an efficient ASRS for effective warehouse management to cater to the demand for increasing retail sales. Additionally, Samson Holding was one of the first companies to implement ASRS in the Chinese furniture industry, enabling automatically and mechanically storing, tracking, and retrieving every product produced, thus saving ample preparation time required to assemble different products for each shipment.

- Furthermore, Chinese retailers are developing unmanned shops. For instance, Suning, the Chinese online shopping platform, launched five unmanned shops in China, which apply facial recognition technology to payment services and offer shoppers an intelligent shopping experience based on their consumption habits. This has significantly contributed to the growth of the market studied in the region.

- In October 2020, Tencent-backed food delivery service, Meituan-Dianping, introduced its first-ever smart AI retail store, MAI Shop, within Beijing's Shougang Park. The store is equipped with a combination of AI and robotics, which are regularly seen in "New Retail" formats across supermarkets, convenience stores, and more in China. The combined technology brings an unmanned delivery retail experience as Meituan integrates a fully automated warehouse and distribution to maximize its takeout delivery capacity.

Asia-Pacific ASRS Systems Industry Overview

The Asia-Pacific automated storage and retrieval system market is fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Some of the recent developments in the market are -

- August 2020 - KION Group has signed a distribution agreement and a memorandum of understanding on plans for joint development with the Chinese manufacturer to expand automation solutions. The collaboration with Quicktron is anticipated to strengthen further the former's position in the automated storage and trucks market.

- June 2020 - Cohesio Group, now known as Korber Supply Chain, introduced a new sorting robot solution in Australia and New Zealand. The Korber solution will allow logistics operators to maximize operational capabilities through flexible, affordable, and scalable automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industries

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and Beverage

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DAIFUKU Co. Ltd.

- 7.1.2 Murata Machinery Ltd.

- 7.1.3 Schaefer Systems International Pvt Ltd

- 7.1.4 Toyota Industries Corporation

- 7.1.5 Hanwha Group

- 7.1.6 GEEK+ INC.

- 7.1.7 Kardex Group

- 7.1.8 Siasun Robot & Automation Co. Ltd.

- 7.1.9 System Logistics S.p.A.

- 7.1.10 Noblelift Intelligent Equipment Co. Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

샘플 요청 목록