|

시장보고서

상품코드

1628762

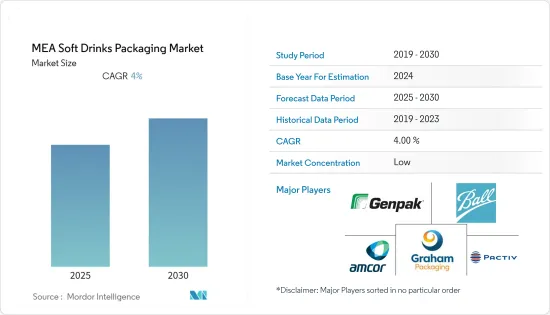

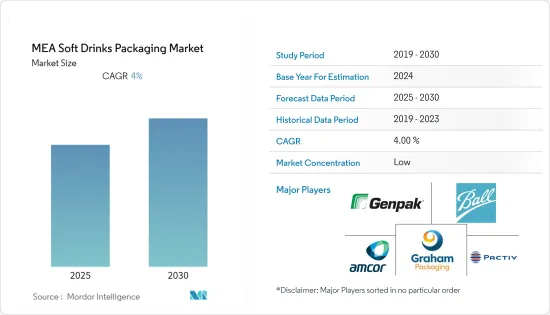

중동 및 아프리카의 청량음료 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)MEA Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

중동 및 아프리카의 청량음료 포장 시장은 예측 기간 동안 CAGR 4%를 기록할 것으로 예상됩니다.

주요 하이라이트

- Tetra Pack의 조사에 따르면 2018년 GCC의 유제품 소비량은 373억 3,300만 리터, 주스, 넥타, 스틸 음료 26억 4,600만 리터, 커피 및 차 69억 9,000만 리터, 포장된 물 11억 3,310만 리터, 탄산음료 29억 8,100만 리터로 총 278억 5,700만 리터였습니다.

- 음료 산업은 이 지역에서 중요한 역할을 하고 있습니다. 제8회 아랍 음료 회의에 따르면, 음료 산업은 이 지역의 약 3억 명의 소비자를 대상으로 연간 약 100억 리터의 생산량을 생산하고 있습니다. 음료 산업은 지역 경제 형성에 중요한 역할을 계속하고 있습니다.

- 지역 각국의 보건부가 주도하는 캠페인의 영향을 받아 건강음료에 대한 수요가 증가할 것으로 예상됩니다. 이 지역의 많은 국가에서 알코올을 금지하고 있기 때문에 에너지 음료나 건강 음료와 같은 청량음료가 그 대안으로 여겨지고 있습니다. 캐나다 농업식품부에 따르면, 2020년 아랍에미레이트의 영양 강화 및 기능성 에너지 음료 소매 매출은 3억 4,480만 달러에 달할 것으로 예상됩니다.

- 이 지역에서는 생수에 대한 수요가 크게 증가하고 있습니다. 또한, 소비자들은 건강한 식생활에 대한 필요성을 인식하고 있습니다. 생수 수요의 증가는 중동 및 아프리카의 생수 포장 시장의 성장을 증가시킬 것으로 예상됩니다.

- 또한 물과 기타 청량음료 포장용 PET 병에 대한 수요도 큽니다. 예를 들어, 알마라이(Almarai)는 전략적 투자를 통해 사업을 발전시켰습니다. 중동에서 가장 큰 청량음료 제조 및 판매 회사입니다. 주스 시장의 선두주자인 Almarai는 Al Kharj 중앙 가공 공장(CPP)에 시간당 54,000병을 처리할 수 있는 두 개의 Sidel PET 완제품 라인을 신설했습니다.

- 최근 COVID-19 사태로 인해 많은 청량음료 포장 및 솔루션 제조업체의 생산량이 감소했습니다(해당 지역의 봉쇄 상황과 공급망 혼란으로 인해). 이 요인은 여러 기업의 포장 제품 생산에 영향을 미쳤습니다. 예를 들어, 2020년 3월 27일 UAE 정부는 신선식품 시장을 2주간 폐쇄했습니다. 사우디아라비아와 카타르 등 이 지역의 다른 국가들도 비슷한 조치를 취했습니다. 아시르 지방정부는 전염병 상황을 고려하여 식료품의 안전하고 확실한 포장을 명령했습니다.

- 아프리카 지역은 COVID-19로 인한 GDP 감소에 직면해 있습니다. 원자재 및 상품 수입에 크게 의존하고 있기 때문에 공급망에 영향을 미칠 것으로 예상됩니다. 이는 결국 이 지역의 포장 제품 생산에도 영향을 미칠 것으로 예상됩니다.

중동 및 아프리카의 청량음료 포장 시장 동향

사우디아라비아가 가장 큰 시장을 차지

- 사우디아라비아는 중동 지역에서 가장 큰 청량음료 포장 산업 중 하나입니다. 사우디는 방대한 소비자 기반을 보유하고 있으며, 매년 청량음료 포장에 대한 수요가 급증하고 있습니다.

- 높은 가처분 소득, 접근성, 생활 수준 향상, 다양성, 관광객 증가, 국내 존재감, 국제적인 플레이어의 시장 진출 등의 요인이 음료 산업의 성장을 촉진하고 있습니다.

- 또한 사우디는 GCC 지역에서 가장 큰 플라스틱 제품 소비국 중 하나이며, GPCA의 최근 추정에 따르면 사우디의 1인당 플라스틱 소비량은 약 95kg으로 GCC 지역 전체에서 가장 큰 플라스틱 제품 소비국 중 하나입니다.

- 높은 수요와 소비량에도 불구하고 플라스틱 포장에는 상당한 단점이 있습니다. 중국으로부터 폴리머 및 기타 플라스틱 원료를 조달하는 현지 제조업체는 종종 원유 가격 변동과 치안 사건으로 인한 불확실성에 노출되어 폴리머 및 수지 비용에 영향을 미칩니다.

- 현재 사우디에서는 PET(폴리에틸렌 테레프탈레이트) 병의 약 10%가 재활용되고 있습니다. 정부가 재활용에 더 많은 노력을 기울이면서 재활용률이 높아질 것으로 예상됩니다. 이에 따라 사우디의 PET 수요가 증가할 것으로 예상됩니다.

- 기업들은 PET를 음료 용기와 같은 식품 용기로 재활용하는 것이 시급하다는 점에 점점 더 많은 관심을 기울이고 있습니다. 예를 들어, 코카콜라는 2030년까지 용기의 50%를 재활용 PET로 만들 계획입니다.

- 사우디아라비아에 본사를 둔 SABIC은 사출 성형으로 경질 패키지를 생산할 수 있도록 새로운 Flowpact PP 충격 공중 합체를 개발했으며, Flowpact PP는 부피가 200ml에서 10L에 이르는 경질 패키지를 생산하도록 설계되었습니다. 새로운 Flowpact PP는 강화된 적층 능력을 가진 경질 포장을 제공하여 운송 및 보관을 보다 경제적으로 만듭니다.

- 국내에서는 플라스틱 사용에 대한 엄격한 규제가 시행되고 있습니다. 이로 인해 제조업체들은 산화 분해성 플라스틱과 같은 새로운 대체 포장재를 선택해야만 합니다. 사우디아라비아에 위치한 스위스 비즈니스 허브 중동의 라비 엘-아타리(Larbi El-Attari)에 따르면, 이러한 규제는 사우디에서 생산되는 플라스틱뿐만 아니라 수입되는 플라스틱에도 동일하게 적용된다고 합니다. 이 개발의 결과로, 비준수 제품은 더 이상 수입 경로를 통해 반입할 수 없게 되었습니다.

이집트 유리병은 큰 성장이 예상

- 유리병은 장기 보관이 가능하고 오염을 피할 수 있기 때문에 청량음료의 포장재로 가장 선호되고 있습니다. 음료의 향과 맛을 유지하는 유리병의 능력이 수요를 주도하고 있습니다.

- 따라서 대부분의 레스토랑은 매력적이고 세척이 용이하며 재사용이 가능한 메이슨 글라스 항아리를 사용하고 있습니다. 고객의 환경 인식이 높아짐에 따라 제조업체는 포장재에 대한 재검토를 요구하고 있습니다.

- 시장의 많은 공급업체들은 품질에 민감한 고객의 요구에 부응하기 위해 첨단 도구와 생산 인프라로 전환하여 제조 공장을 현대화하고 있습니다.

- 예를 들어, 아랍 제약 유리 회사는 전자 제어 유리 용해로, 6 개의 자동 생산 라인, 전자 제어식 첨단 성형기, 검사기로 전환하여 제조 공장을 업그레이드하여 Gsk, Aventis Pharma, MEPACO, Novartis Pharmaceuticals 등의 제약회사에 유리병을 공급하고 있습니다.

중동 및 아프리카의 청량음료 포장 산업 개요

중동 및 아프리카의 청량음료 포장 시장은 국내외 공급업체의 종합적인 포트폴리오를 보유하고 있습니다. 이러한 요인으로 인해 공급업체 간의 경쟁이 치열합니다. 대부분의 경우 여러 유통 채널이 없기 때문에 공급업체는 최종사용자와 직접 상호 작용하여 제품을 판매합니다. 이 시나리오는 최종사용자와의 장기적인 거래로 이어집니다. 따라서 공급업체는 경쟁력 있는 가격 전략으로 고객을 유지하거나 신규 고객을 확보하는 경우가 많습니다.

또한 포장재 대부분이 수입품에서 조달되기 때문에 한정된 시장에서 제한된 기업을 확보하기 위해 공급업체 간의 경쟁이 치열합니다. 이 요인은 국내외 제조업체 간의 경쟁 기업 간의 적대적 관계를 심화시키고 있습니다. 최근 몇 가지 동향을 소개합니다.

- 2020년 7월 - 후타마키는 오늘 고품질의 합리적인 가격의 재사용 가능한 재사용 가능한 안면 마스크 시리즈를 출시했으며, Huhta의 마스크는 일상적인 사용에 적합하며 주변으로 비말이 퍼지는 것을 방지할 수 있습니다. 이 편안한 마스크는 통기성이 뛰어나고 세탁이 가능하며 항균 및 발수 기능이 있는 고품질 원단으로 만들어졌습니다.

- 2020년 6월 - 테트라팩은 음료 가공을 새로운 효율 수준으로 끌어올리기 위해 세계 최초로 주스, 넥타, 스틸 음료(JNSD)를 위한 새로운 저에너지 가공 라인을 발표했습니다. 이 라인은 저온 살균, 여과 및 자외선 기술을 결합하여 두 개의 개별 흐름으로 음료를 처리하고 최종 음료에 무균적으로 혼합합니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 청량음료 소비 증가

- 소비자 간편 포장에 대한 수요 증가

- 시장 성장 억제요인

- 플라스틱 사용에 관한 환경 문제

- 엄격한 정부 규제

- 중동 및 아프리카의 청량음료 포장 시장 현재 기회

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 산업 정책

제5장 기술 현황

제6장 시장 세분화

- 주요 재료별

- 플라스틱

- 종이·판지

- 유리

- 금속

- 기타

- 유형별

- 보틀수

- 주스

- RTD 음료

- 스포츠 음료

- 기타

- 지역별

- 아랍에미리트

- 사우디아라비아

- 남아프리카공화국

- 이집트

- 기타

제7장 경쟁 구도

- 기업 개요

- Pactiv, LLC

- Amcor, Ltd.

- Genpak

- Graham Packaging Company

- Ball Corporation

- SIG Combibloc Company Ltd.

- Tetra Pak International

- Placon

- Toyo Seikan Group Holdings Ltd.

- Rock Tenn Company

- Nuconic Packaging

- The Scoular Company

- Owens-Illinois Inc

- Crown Holdings Incorporated

- Rexam inc

- Alcoa Inc

제8장 투자 분석

- 최근의 M&A

- 투자가 전망

제9장 중동 및 아프리카 청량음료 포장 시장 전망

ksm 25.01.17The MEA Soft Drinks Packaging Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- According to a study by Tetra Pack, the GCC consumed 3,733 million liters of dairy, 2,646 million liters of juice, nectars, and still drinks, 6,909 million liters of coffee and tea, 11,310 million liters of packaged water, and 2,981 million liters of carbonated soft drinks in 2018 for a total of 27,857 million liters.

- The beverage industry plays an essential role in the region. According to the Eighth Arab Beverages Conference, the beverage industry caters to about 300 million consumers in the region, with a production volume of about 10 billion liters per year. The beverage industry continues to play a significant role in shaping the region's economy.

- The demand for health drinks is expected to increase, influenced by the campaigns led by the ministries of health in various countries in the region. Due to the ban on alcohol in many countries in the region, soft drinks, such as energy and health drinks, are considered substitutes. According to Agriculture and Agri-Food Canada, the retail sales of fortified and functional energy drinks in the United Arab Emirates are expected to account for USD 344.8 million in 2020.

- The demand for bottled water increased significantly in the region. In addition, consumers are more conscious of the need for healthier diets. The increased demand for bottled water, in turn, is expected to augment the growth of the bottled water packaging market in the MEA region.

- Moreover, there is a significant demand for PET bottles for water and other soft drinks packaging. For instance, Almarai developed its business through strategic investments. It is the largest producer and distributor of soft drinks in the Middle East. As the leader in the juice market, Almarai installed two new Sidel PET complete lines, each one handling 54,000 bottles/hr, in its Al Kharj central processing plant (CPP).

- With the recent outbreak of COVID -19, the production of many manufacturers of soft drink packaging solutions decreased (due to lockdown situations in the region and the disruption in the supply chain). This factor impacted the manufacturing of packaging products among various companies. For example, on March 27, 2020, the UAE government closed the fresh food market for two weeks. The other countries in the region, such as Saudi Arabia and Qatar, also implemented the same. The Asir municipality ordered safe and secure packaging for food and beverage light of the pandemic situation.

- The African region is facing a decline in GDP due to the pandemic. This is expected to impact its supply chain, as it is heavily dependent on importing raw materials and goods. This, in turn, is expected to affect the manufacturing of packaging products in the region.

Middle East and Africa Soft Drinks Packaging Market Trends

Saudi Arabia to hold the highest market

- Saudi Arabia is one of the most extensive soft drinks packaging industries in the Middle Eastern region. The country has a vast consumer base, adding to the rapid growth in the demand for soft drinks packaging from the country every year.

- The factors, such as high disposable income, ease of availability, improvement in living standards wide variety, increasing tourism, presence of domestic, and the presence of the international players in the market, are fueling the growth of the beverages industry in the country.

- In addition, Saudi Arabia is one of the largest consumers of plastic products in the GCC region. According to the recent estimates of the GPCA, the country has about 95 kg per capita consumption of plastics, making it the largest consumer of plastic products in the entire GCC region.

- Despite the high demand and consumption, plastic packaging also has considerable drawbacks. The local manufacturers who source polymer or other plastic raw material from the country are often exposed to uncertainty caused by fluctuating crude oil prices and security incidents, affecting the cost of polymers and resins.

- Currently, Saudi Arabia recycles about 10% of its PET (polyethylene terephthalate) bottles. The recycling rate is expected to increase, with the increasing focus of the government on recycling. This, in turn, is expected to drive the demand for PET in the country.

- Companies are increasingly focusing on the urgency of recycling PET into food-grade products, such as beverage containers. For instance, The Coca-Cola Company intends to use 50% recycled PET in its containers by 2030.

- The Saudi Arabian-based SABIC developed new Flowpact PP impact copolymers to assist in manufacturing injection-molded rigid packaging. Flowpact PP was designed to produce rigid packaging, with volumes ranging between 200 ml and around 10 L. It can be used to manufacture closures and caps used for packaging soft drinks. The new Flowpact PP offers rigid packaging with enhanced stacking capabilities and makes transport and storage more economical.

- Stringent regulations for the use of plastic are imposed in the country. This is forcing the manufacturers to opt for new packaging alternatives, such as oxo-degradable plastics. According to the Larbi El-Attari of the Swiss Business Hub Middle East in Saudi Arabia, these regulations are equally applicable to the plastic produced in Saudi Arabia or imported to the country. As a result of this development, non-compliant products can no longer be brought through import channels.

Glass Jars in Egypt are expected to Register a Significant Growth

- Glass Jar is among the most preferred packaging material for soft drinks as it preserves for the long term and avoids contamination. The ability of glass jars to preserve the aroma and flavor of the drink is driving the demand.

- Therefore, most restaurants use mason glass jars to serve as they are attractive, easy to wash, and reusable. The rise in environmental awareness among customers is also forcing manufactures to reconsider their packaging.

- Many vendors in the market are modernizing their manufacturing plants by switching to advanced tools and production infrastructure to meet the needs of their quality-conscious customers.

- For instance, Arab Pharmaceutical Glass Co. has upgraded its manufacturing plants by switching to electronically controlled glass melting furnaces, six automated production lines, electronically controlled state-of-the-art forming machines, and inspection machines. It offers glass jars to pharmaceutical companies such as Gsk, Aventis Pharma, MEPACO, Novartis Pharmaceuticals, etc.

Middle East and Africa Soft Drinks Packaging Industry Overview

The Middle East and Africa packaging market have a comprehensive portfolio of suppliers from the local and international markets. This factor leads to high competition among the vendors. In many cases, due to the absence of multiple distribution channels, the vendors directly interact with the end-users to sell their products. This scenario leads to long-term deals with end-users. Hence, the vendors often choose to retain their clients or make new clients by competitive pricing strategies.

Additionally, as most of the packaging material is sourced from imports, there is high competition among the suppliers to capture a limited number of players in the market. This factor intensifies the competitive rivalry among the local and foreign manufacturers. Some of the recent developments are:

- Jul 2020 - Huhtamaki launched a range of high-quality affordable and reusable face masks today. The Huhta Masks are suitable for everyday use and help reduce the spread of droplets into the environment. The comfortable masks are designed to be breathable and washable and are made of high-quality fabric with anti-microbial and fluid repellent properties.

- June 2020 - Tetra Pak launched a new, first-of-its-kind low-energy processing line for juice, nectar, and still drinks (JNSD) to take beverage processing to a new efficiency level. It uses a combination of Pasteurization, Filtration, and UV Light technology to treat beverages in two separate streams, aseptically blended into the final beverage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Soft Drink Consumption

- 4.2.2 Increased demand for convenience packaging from consumers

- 4.3 Market Restraints

- 4.3.1 Environmental concerns regarding usage of plastic

- 4.3.2 Stringent Government Regulations

- 4.4 Current Opportunities in the Middle East and Africa Soft Drinks Packaging Market

- 4.5 Industry Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of substitute products and services

- 4.6.5 Competitive Rivalry within the Industry

- 4.7 Industry Policies

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Primary Material Used

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.1.5 Others

- 6.2 By Type

- 6.2.1 Bottles Water

- 6.2.2 Juices

- 6.2.3 RTD Beverages

- 6.2.4 Sport Drinks

- 6.2.5 Others

- 6.3 By Region

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 South Africa

- 6.3.4 Egypt

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv, LLC

- 7.1.2 Amcor, Ltd.

- 7.1.3 Genpak

- 7.1.4 Graham Packaging Company

- 7.1.5 Ball Corporation

- 7.1.6 SIG Combibloc Company Ltd.

- 7.1.7 Tetra Pak International

- 7.1.8 Placon

- 7.1.9 Toyo Seikan Group Holdings Ltd.

- 7.1.10 Rock Tenn Company

- 7.1.11 Nuconic Packaging

- 7.1.12 The Scoular Company

- 7.1.13 Owens-Illinois Inc

- 7.1.14 Crown Holdings Incorporated

- 7.1.15 Rexam inc

- 7.1.16 Alcoa Inc

8 INVESTMENT ANALYSIS

- 8.1 Recent Mergers and Acquisitions

- 8.2 Investor Outlook