|

시장보고서

상품코드

1628783

아시아태평양의 차세대 스토리지 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)APAC Next Generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

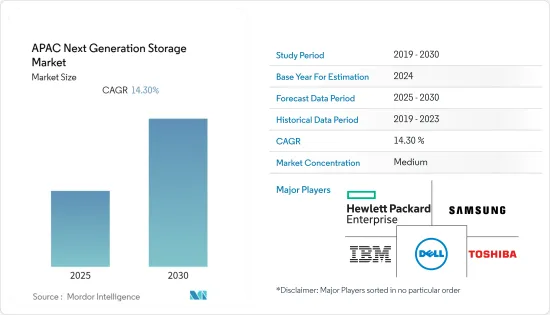

아시아태평양의 차세대 스토리지 시장은 예측 기간 동안 CAGR 14.3%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 기술의 급속한 발전과 다양한 업종과 산업에서 비정형 데이터의 증가로 인해 아시아태평양에서는 안전하고 신뢰할 수 있으며 비용 효율적인 스토리지 인프라에 대한 요구가 증가하고 있습니다. 현재 기업들은 증가하는 데이터 양, 속도, 다양성으로 인한 도전에 직면하고 있으며, 이는 효율적인 스토리지 솔루션에 대한 수요 증가로 이어지고 있습니다.

- 차세대 스토리지 솔루션은 데이터 파일과 오브젝트를 빠르고 효율적으로 저장, 이식, 추출하는 데 사용되는 컴퓨팅 장치입니다. 또한, 기업들은 일상 업무에 클라우드 기술을 활용하는 추세가 더욱 강화되고 있습니다. 클라우드 플랫폼을 통해 향후 참조에 필요한 방대한 양의 데이터가 생성됩니다. 따라서 기업들은 견고하고 효율적인 스토리지 솔루션에 대한 수요가 증가하고 있으며, 이는 예측 기간 동안 시장 성장을 촉진할 것으로 예상됩니다.

- E-Commerce는 전 세계적으로 성장하고 있으며, 아시아태평양도 예외는 아닙니다. 아시아태평양 전체에서 E-Commerce 활동의 성장은 아시아태평양 시장 성장의 중요한 요인 중 하나입니다. 중국, 인도, 일본, 한국 등의 국가들이 이 지역의 E-Commerce 산업 성장에 크게 기여하고 있습니다. 세계경제포럼에 따르면 중국 E-Commerce는 전 세계 소매 E-Commerce 매출의 50% 이상을 차지하고 있습니다. 또한 동아시아 포럼에 따르면 2020년 중국의 E-Commerce 매출은 2조 3,000억 달러에 달할 것으로 예상됩니다. 소비자의 인터넷 사용 증가로 인해 대량의 중요한 데이터가 생성됨에 따라 차세대 데이터 스토리지 솔루션의 채택이 증가하고 있습니다.

- 아시아태평양은 차세대 스토리지 솔루션 공급업체에게 큰 비즈니스 기회로, COVID-19 팬데믹으로 인해 원격 작업과 온라인 작업의 추세가 더욱 가속화되고 있습니다. 개인뿐만 아니라 민간 조직과 공공 기관에서도 인터넷 사용이 증가하면서 스마트 스토리지 솔루션에 대한 수요가 증가하고 있습니다. 인터넷을 통해 생성되는 데이터의 중요성을 고려할 때, 기업들은 차세대 스토리지 솔루션에 투자하는 경향이 강해졌고, 이는 시장 성장의 원동력이 되고 있습니다.

- 아시아태평양의 차세대 스토리지 시장 개척은 주로 디지털화를 발전시키고 촉진하기 위한 정부 이니셔티브에 의해 주도되고 있습니다. 예를 들어, 일본 정부는 2021년 5월에 5개 정도의 지방 도시에 데이터센터를 설립하기 위해 기업 및 지방 자치 단체에 재정 지원을 발표했습니다.

- 또한, 중소기업(SME)의 데이터 스토리지 수요 증가와 아시아태평양 내 스마트폰, 노트북, 태블릿PC의 보급 확대 등의 요인으로 차세대 스토리지 솔루션에 대한 수요가 증가하고 있습니다.

아시아태평양의 차세대 스토리지 시장 동향

소매 최종 이용 산업이 큰 성장을 이룰 것으로 예상

- 소매업계는 클라우드 컴퓨팅을 광범위하게 채택하고 있으며, 클라우드 기술에 대한 투자가 빠르게 증가하고 있습니다. 은행 및 제조 업계와 마찬가지로 소매 업계도 디지털 사회의 발전에 따른 클라우드 컴퓨팅의 변혁적 역할을 인식하고 있습니다.

- 소매업계의 디지털화도 시장 성장에 기여하고 있습니다. 또한, IoT, AI, ML과 같은 기술은 다양한 소매업체에서 비즈니스 운영을 혁신하고 고객에게 향상된 서비스를 제공하기 위해 채택되고 있습니다.

- 아시아태평양의 스마트폰 사용자가 증가함에 따라 소매업계는 경쟁이 치열해지고 있습니다. 스마트폰의 보급으로 인한 E-Commerce의 성장은 기본적으로 온라인 소매 판매의 성공에 기여하고 있습니다. 이러한 모바일을 통한 소매 판매의 증가는 E-Commerce 시장을 대규모로 견인하고 있습니다. NASSCOM에 따르면 인도 E-Commerce 시장은 5%의 성장률을 기록할 것으로 예상되며, 2021년 매출은 560억 달러가 넘을 것으로 예상됩니다. 또한 2021년 1분기 인도 스마트폰 출하량은 전년 동기 대비 약 23% 증가한 3,800만 대에 달했습니다. 이러한 성장은 주로 업체들의 신제품 출시와 2020년에 비해 지연된 수요에 기인한 것으로 분석됩니다.

- 소매 거래는 많은 양의 데이터를 생성합니다. 조직 및 기타 제3자는 이 데이터를 활용하여 다양한 비즈니스 의사결정을 내리기 위해 데이터를 활용합니다. 따라서 기업들은 이러한 데이터를 활용하기 위해 정형 또는 비정형 데이터웨어하우스에 데이터를 저장하고 있습니다. 아시아태평양의 전체 소매업의 성장도 이 지역 전체에서 차세대 스토리지 솔루션의 성장에 기여하고 있습니다.

중국이 큰 점유율을 차지할 것으로 예상

- 2020년 중국은 이 시장에서 가장 큰 점유율을 차지하고 있으며, 예측 기간 동안에도 그 우위가 지속될 것으로 예상됩니다. 중국에는 비즈니스 요구에 따라 스토리지 솔루션을 필요로 하는 많은 중소규모의 조직이 존재하고 있습니다.

- 중국에서는 E-Commerce의 보급이 활발히 진행되고 있습니다. 또한 헬스케어, 교육 등 다양한 분야에서 서비스의 디지털화가 가속화되고 있습니다. 따라서 이들 산업은 시장 기업들에게 고객 기반을 확대할 수 있는 다양한 성장 기회를 제공할 것으로 기대됩니다. 예를 들어, 2021년 10월 중국 직장 앱 중 하나인 딩톡(DingTalk)은 사용자 수가 2021년 1월 4억 명에서 2021년 8월에는 5억 명으로 증가했다고 보고했습니다.

- COVID-19로 인해 지능형 온라인 뱅킹 서비스에 대한 수요가 증가하면서 전통적인 뱅킹 비즈니스는 큰 도전에 직면했습니다. 모바일 뱅킹이 소매업의 주요 채널로 떠오르면서 여러 은행들이 고객 확보를 위한 디지털 뱅킹 모델을 구축하기 시작했습니다. 중국 인터넷 네트워크 정보 센터에 따르면, 온라인 결제 사용자 비율은 중국 인구의 86.3%를 차지합니다. 따라서 은행 업계의 디지털화에 대한 관심 증가와 도입 확대는 중국 내 차세대 스토리지 솔루션의 성장에도 영향을 미치고 있습니다.

- 또한 중국은 아시아태평양에서 가장 많은 데이터센터를 보유하고 있으며, CBRE에 따르면 중국에는 약 47,000 개의 데이터센터가 있으며 향후 몇 년 동안 그 수가 더 늘어날 것으로 예상됩니다. 이는 중국의 방대한 인구와 기술에 대한 포화 상태 때문입니다.

아시아태평양의 차세대 스토리지 산업 개요

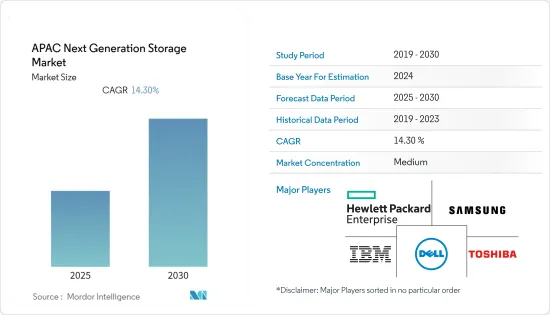

아시아태평양의 차세대 스토리지 시장은 경쟁이 치열하고, 지역 내 여러 주요 기업들이 존재하며, 어느 정도 통합되어 있습니다. 주요 기업으로는 Hewlett Packard Enterprise Development LP, Dell Inc., SAMSUNG, IBM Corporation, TOSHIBA CORPORATION 등이 있습니다. 시장 개척 기업들은 제품 개발, 인수합병(M&A), 제휴 및 협업 등 다양한 전략을 구사하고 있습니다.

- 2021년 2월 - 도시바는 18TB HDD 신제품 MG09 시리즈 출시를 발표했습니다. 새로운 HDD는 에너지 보조 자기 기록 방식을 채택했습니다. 또한이 HDD는 많은 응용 프로그램과 OS를 지원합니다. 또한, 도시바는 데이터 증가에 따른 시장 수요에 대응하여 스토리지 솔루션 설계자와 클라우드 스케일 서비스 제공업체가 클라우드, 하이브리드 클라우드 및 온프레미스 랙 스케일 스토리지에서 더 높은 스토리지 밀도를 달성할 수 있도록 지원하는 것을 목표로 하고 있습니다.

- 2021년 10월 - 데이터다이렉트 네트웍스(DDN)는 인도에서 데이터 스토리지 솔루션을 현지에서 생산할 것이라고 발표했습니다. 이 이니셔티브는 인도의 아트마니르바르 바랏 아비얀(Atmanirbhar Bharat Abhiyaan) 정부에 따른 것으로, 이에 따라 '인도산' 스토리지 제품을 고객에게 제공하게 될 것입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 은행 업계의 디지털화 진전

- E-Commerce 산업의 성장

- 시장 성장 억제요인

- 데이터 보안에 대한 우려

- 밸류체인/공급망 분석

- Porters 5 Force 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 스토리지 시스템별

- 직접 연결 스토리지(DAS)

- 네트워크 결합 스토리지(NAS)

- 스토리지 에어리어 네트워크(SAN)

- 스토리지 아키텍처별

- 파일 및 개체 기반 스토리지(FOBS)

- 블록 스토리지

- 최종 이용 업계별

- BFSI

- 소매

- IT 및 통신

- 헬스케어

- 미디어·엔터테인먼트

- 기타 최종 이용 산업

- 국가별

- 아시아태평양

- 인도

- 중국

- 일본

- 기타 아시아태평양

- 아시아태평양

제6장 경쟁 구도

- 기업 개요

- Dell Inc.

- HP

- IBM

- NetApp, Inc.

- SanDisk Corporation

- Samsung Electronics

- Toshiba Corporation

- Netgear, Inc.

- Pure storage Inc.

- Hitachi, Ltd

제7장 투자 분석

제8장 시장 전망

ksm 25.01.20The APAC Next Generation Storage Market is expected to register a CAGR of 14.3% during the forecast period.

Key Highlights

- Rapid technological advancements and the increasing volume of unstructured data across different verticals/industries have created the need for secure, reliable, and cost-efficient storage infrastructure in the Asia-Pacific region. In the current scenario, enterprises face challenges posed by the escalating data volumes, velocity, and variety, leading to increased demand for efficient storage solutions.

- Next-generation storage solutions are computing devices used to store, port, and extract data files and objects quickly and efficiently. Moreover, companies are increasingly moving towards using cloud technology for their day-to-day business operations. Humongous amounts of data are generated through the cloud platform that may be required for future reference. Therefore, robust and efficient storage solutions are required by the companies that are anticipated to drive the market growth over the forecast period.

- E-commerce is gaining traction worldwide, and the Asia Pacific region is no expectation to it. The growth in e-commerce activity across the region is also one of the critical factors for the regional market growth. Countries such as China, India, Japan, and South Korea, among others, are the key contributors to the growth of the e-commerce industry across the region. According to the World Economic Forum, e-commerce in China represents more than 50% of the global retail e-commerce sales. Moreover, according to the East Asia Forum, e-commerce sales in China stood at USD 2.3 trillion in 2020. Increasing internet usage for consumer purchases generates large amounts of crucial data, resulting in the increasing adoption of next-generation data storage solutions.

- The Asia-Pacific region presents a significant opportunity for next-generation storage solution vendors. The outbreak of the COVID-19 pandemic has escalated the trend of remote operations and online working. Increased usage of the internet in private and public organizations, as well as by individuals, is creating demand for smart storage solutions. Given the criticality of data generated through the internet, companies are highly inclined to invest in next-generation storage solutions, which is also driving market growth.

- Growth in the Asia-Pacific next-generation storage market is primarily driven by government initiatives to develop and promote digitalization. For instance, in May 2021, the Japanese government announced financial support to companies and municipalities to establish data centers in around five regional cities.

- Further, factors such as the growing demand for data storage in small to medium enterprises (SMEs) and the increasing proliferation of smartphones, laptops, and tablets in the Asia-Pacific region have augmented the demand for a next-generation storage solution.

APAC Next Generation Storage Market Trends

Retail end-use industry is expected to register significant growth

- The retail industry is widely adopting cloud computing, with its investment in cloud technologies increasing rapidly. Like the banking and manufacturing industries, retailers recognize the transformative role of cloud computing in the prevailing digital world.

- Increasing digitalization in the retail industry is also contributing to the growth of the market. Moreover, technologies such as IoT, AI, and ML, are also increasingly adopted by various retailers to transform their business operations and provide enhanced services to their customers.

- The retail industry is witnessing increased competition, with the increased smartphone users prevailing in the Asia Pacific region. The growth of e-commerce due to the rising popularity of smartphones is essentially contributing to online retail sales success. This increase in retail sales via mobiles is driving the e-commerce market on a large scale. As such, the retailers are finding themselves competing in a marketplace that is increasingly dominated by online marketplaces. According to NASSCOM, the e-commerce market in India is expected to register a growth of 5%, with a sales value of more than USD 56 billion in 2021. Moreover, smartphone shipments in India reached 38 million units in Q1 2021, increasing approximately 23% YoY. This growth is primarily driven by new product launches by the companies and delayed demand from 2020.

- A large amount of data is generated from retail transactions. Organizations and other third parties utilize this data to make various informed business decisions. Therefore, to make this data available, companies store the data in the structured or unstructured format in data warehouses. The growth of the overall retail industry in the Asia Pacific region is also contributing to the growth of next-generation storage solutions across the region.

China is expected to hold the major share

- China held the largest share in the market in 2020 and is expected to continue its dominance over the forecast period. The country has a large number of small and medium-sized organizations that require storage solutions for their business needs.

- China has a widespread e-commerce adoption. Also, the digitization of services is accelerating across a variety of sectors that include healthcare and education. Therefore, these industries are also expected to offer various growth opportunities for the market players to expand their customer base. For instance, in October 2021, DingTalk, one of the workplace apps in China, reported that its number of users has increased to 500 million in August 2021 from 400 million in January 2021.

- The COVID-19 pandemic increased demand for intelligent online banking services, and the traditional banking business witnessed significant challenges. With mobile baking being the primary channel for retail businesses, various banks began building digital banking models for customer acquisition. According to the China Internet Network Information Center, the percentage of online payment users accounted for 86.3% of the country's population. Therefore, the increased focus on digitalization in the banking industry and its growing adoption is also supporting the growth of next-generation storage solutions in the country.

- Furthermore, China also houses the most significant number of data centers in the Asia Pacific region. According to CBRE, there are around 47,000 data centers in China, and the number is expected to grow further over the coming years. This is because of the country's massive population and its saturation towards technology.

APAC Next Generation Storage Industry Overview

The Asia Pacific Next Generation Storage market, is competitive and moderately consolidated with several key players across the region. Some of the prominent players in the market include Hewlett Packard Enterprise Development LP, Dell Inc., SAMSUNG, IBM Corporation, and TOSHIBA CORPORATION. The market players are undertaking various strategies such as product development, merger and acquisition, and partnership and collaboration, among others.

- February 2021 - Toshiba Corporation announced the launch of a new MG09 Series of 18TB HDD. The new HDD is equipped with energy-assisted magnetic recording. Moreover, these HDDs are compatible with a large number of applications and operating systems. The company also aims to suffice the market demand due to increased data volumes, thereby helping storage solution designers and cloud-scale service providers achieve higher storage densities for cloud, hybrid-cloud, and on-premises rack-scale storage.

- October 2021 - DataDirect Networks (DDN) announced that the company would be locally manufacturing its data storage solutions in India. This initiative is in line with the nation's Atmanirbhar Bharat Abhiyaan; following which, the company will be delivering "Make in India" storage products to the customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing digitalization across the banking industry

- 4.2.2 Rising e-commerce industry

- 4.3 Market Restraints

- 4.3.1 Data security concerns

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Storage System

- 5.1.1 Direct Attached Storage (DAS)

- 5.1.2 Network Attached Storage (NAS)

- 5.1.3 Storage Area Network (SAN)

- 5.2 Storage Architecture

- 5.2.1 File and Object-based Storage (FOBS)

- 5.2.2 Block Storage

- 5.3 End-User Industry

- 5.3.1 BFSI

- 5.3.2 Retail

- 5.3.3 IT and Telecom

- 5.3.4 Healthcare

- 5.3.5 Media and Entertainment

- 5.3.6 Other End-User Industries

- 5.4 Country

- 5.4.1 Asia Pacific

- 5.4.1.1 India

- 5.4.1.2 China

- 5.4.1.3 Japan

- 5.4.1.4 Rest of Asia Pacific

- 5.4.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dell Inc.

- 6.1.2 HP

- 6.1.3 IBM

- 6.1.4 NetApp, Inc.

- 6.1.5 SanDisk Corporation

- 6.1.6 Samsung Electronics

- 6.1.7 Toshiba Corporation

- 6.1.8 Netgear, Inc.

- 6.1.9 Pure storage Inc.

- 6.1.10 Hitachi, Ltd