|

시장보고서

상품코드

1628815

라틴아메리카의 AMH 및 스토리지 시스템 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)LA AMH and Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

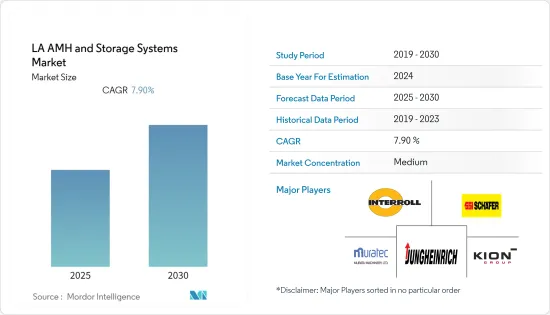

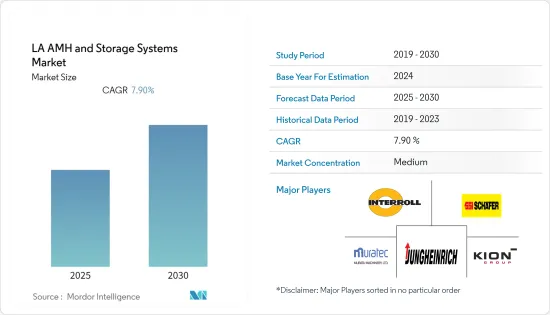

라틴아메리카의 AMH 및 스토리지 시스템 시장은 예측 기간 동안 7.9%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 재고 관리 단위(SKU)의 급속한 증가로 인해 도매업체와 유통업체는 업무에 대한 정보에 입각한 의사결정을 내리는 데 어려움을 겪고 있습니다. 이러한 요인으로 인해 인력, 장비 및 기술을 보다 스마트하게 활용해야 할 필요성이 증가하고 있습니다. 자동 자재 취급 시스템의 필요성을 높이는 주요 요인은 비용 절감, 노동 효율성 및 공간 제약입니다.

- 현재 시장 상황에서는 사용 가능한 제품 수가 증가하고 더 빈번하고 작은 단위의 배송에 대한 수요가 증가하고 있습니다. 또한 자동운반차(AGV) 및 창고관리 시스템(WMS)과 같은 첨단 기술은 식음료 창고 및 생산 업무에서 지속적으로 증가하여 제조업체에 여러 가지 이점을 가져다주고 있습니다.

- 시설 내 자동화 시스템 간의 연계를 지원하는 인더스트리 4.0에 영감을 받아 라틴아메리카의 창고 관리자들은 현재 전사적 자동화 도입에 관심을 보이고 있습니다. AGV를 전사적으로 도입하면 창고 직원들이 매일 사용할 수 있고, 자동 보관 및 검색 시스템(AS/RS) 및 창고 관리 시스템과 통신하여 다른 기술 시스템과의 통합을 촉진할 수 있습니다.

- 라틴아메리카 지역 부문의 성장의 주요 원동력은 도시화의 발전, E-Commerce 매출 증가, 기술 제공업체들의 큰 존재감입니다. 이 기업들은 치열한 시장 경쟁에서 살아남기 위해 혁신적인 솔루션을 제공하는 R&D 활동에 투자하고 있습니다.

라틴아메리카의 AMH 및 스토리지 시스템 시장 동향

자동유도차가 큰 시장 점유율을 차지할 것으로 예상

- 견인/트랙터/예인형 AGV는 인트라로지스틱스 업무의 중요한 요소입니다. 창고에서의 반자동 집하, 생산 라인으로의 원자재 운송, 최종 제품 운송(하역) 등 다양한 작업에 세부적인 커스터마이징을 통해 활용할 수 있습니다. 그러나 Asociacion Nacional de Productores de Autobuses, Camiones y Tractocamiones Mexico에 따르면, 트랙터를 포함한 대형 생산 차량의 생산량은 6만 5,080대로 크게 감소했습니다.

- 또한 투자가 라틴아메리카 지역의 시장 성장을 주도하고 있습니다. 예를 들어, 아마존은 2020년 10월 멕시코에 1억 달러의 물류 투자를 발표했는데, 이는 인구가 많은 대도시를 제외한 최초의 물류 센터를 포함하여 보다 빠른 배송을 제공하기 위해 멕시코에 새로운 물류 창고를 개설하는 것입니다. 새로운 거점에는 북부 도시 몬테레이 인근과 중부 도시 과달라하라 인근의 두 개의 주문 처리 센터가 포함됩니다. 또한, 최근 브라질에 10만 평방미터 규모의 5번째이자 최대 규모의 풀필먼트 센터를 오픈하는 등 브라질 진출에도 박차를 가하고 있습니다. 이러한 모든 투자는 창고에서 AGV의 사용을 촉진할 것으로 예상됩니다.

- 대형 제조업체에 비해 작은 화물을 처리해야 하는 중규모 산업 및 연구소의 자동화 붐은 단위 적재형 AGV에 대한 수요를 촉진하는 주요 요인입니다.

- 또한, 지속적으로 증가하는 R&D 비용과 이 지역의 생산 시설 수가 증가함에 따라 전 세계 중견 산업, 특히 헬스케어 및 제약 부문의 자동화 수요가 증가하고 있습니다.

- 또한 이 지역의 소비자들은 배송 시간 단축을 요구하고 있으며, 창고 및 물류 센터에서 AGV의 적용이 증가하고 있습니다. 또한 기술 발전으로 AGV가 더 좋고 더 작아지고 비용 절감과 일부 지역의 노동력 부족으로 인해 조사 대상 시장의 성장에 박차를 가하고 있습니다.

브라질은 시장 규모가 크게 성장할 것으로 예상됨

라틴아메리카의 AMH 및 스토리지 시스템 산업 개요

라틴아메리카의 AMH 및 스토리지 시스템 시장은 상당한 수의 지역 및 세계 기업이 존재하며, 경쟁이 치열합니다. 시장 점유율이 높은 주요 업체들은 기술 혁신, 인수합병(M&A), 파트너십, 해외 고객 기반 확대에 주력하고 있습니다. 각 업체들은 수익성을 높이기 위해 전략적 협력 이니셔티브를 활용하고 있습니다.

- 2021년 7월 - S&H Systems는 창고 운영에 다용도성을 제공하는 혁신적인 Interroll 크로스 벨트 분류기 및 컨베이어 제품을 통해 자동화 제품 라인을 확장했습니다. 모듈화된 제품을 제공함으로써 고객 중심의 환경에서 선택권을 제공할 수 있게 되었습니다.

- 2020년 8월 무라타기계 주식회사가 알펜사와 첫 3D 로봇 창고 시스템 alphabot 구축 계약을 체결했습니다. 또한, 알펜 그룹의 주요 물류센터인 알펜 코마키 물류센터에 alphabot을 도입하여 보관 능력을 보완하고, 피킹, 분류, 포장 작업을 약 60% 절감할 예정입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 산업 생태계에 대한 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장을 지지하는 기술 진보 증가

- 창고 자동화로 이어지는 E-Commerce의 급성장

- 인더스트리 4.0에 대한 투자가 AMH 및 스토리지 시스템 수요를 촉진

- 시장 과제

- 숙련 노동자의 부족

- 높은 자본 요건

제6장 시장 세분화

- 제품 유형별

- 소프트웨어

- 하드웨어

- 서비스

- 통합

- 기기 유형별

- 이동 로봇

- 무인운반차(AGV)

- 자동 지게차

- 자동 견인/트랙터/예인

- 유닛 로드

- 조립 라인

- 자율 이동 로봇(AMR)

- 자동 창고 시스템(ASRS)

- 고정형 미사일

- 캐러셀

- 수직 리프트 모듈

- 자동 컨베이어

- 벨트

- 롤러

- 팔레트

- 오버헤드

- 팔레타이저

- 기존

- 로봇

- 분류 시스템

- 이동 로봇

- 최종사용자별

- 공항

- 자동차

- 식품 및 음료

- 소매/창고/배송센터/물류센터

- 일반 제조업

- 의약품

- 우편·소포

- 전자·반도체 제조

- 기타 최종사용자

- 국가별

- 브라질

- 아르헨티나

- 멕시코

- 콜롬비아

- 페루

- 칠레

제7장 경쟁 구도

- 기업 개요

- JBT Corporation

- KION Group AG

- SSI SCHEFER AG

- Daifuku Co. Limited

- Kardex Group

- Beumer Group GMBH & Co. KG

- Jungheinrich AG

- Murata Machinery Limited

- Interroll Group

- System Logistics

제8장 투자 분석

제9장 시장 전망

ksm 25.01.20The LA AMH and Storage Systems Market is expected to register a CAGR of 7.9% during the forecast period.

Key Highlights

- With the rapid growth in stock-keeping units (SKUs), wholesalers and distributors are finding it difficult to make informed decisions about the operations. This factor is driving the need for smarter usage of labor, equipment, and technology. The major factors driving the need for automated material-handling systems are cost savings, labor efficiency, and space constraints.

- In the current market landscape, there is an increase in the number of available products and demand for more frequent and smaller deliveries. Also, advanced technologies, like automatic guided vehicles (AGVs) and warehouse management systems (WMS), continued to increase in the food and beverage warehouses and production operations, providing several benefits to the manufacturers.

- Inspired by Industry 4.0, which supports collaboration between automated systems within facilities, warehouse managers in Latin America are now interested in incorporating enterprise-wide automation. The company-wide deployment will increase AGVs' accessibility to warehouse employees daily and encourage integration among other technological systems, as AGVs communicate with automated storage and retrieval systems (AS/RS) and warehouse management systems.

- The primary driving forces for the growth of the Latin America regional segment are the rising urbanization, rising e-commerce sales, and the significant presence of technology providers. These players are investing in research and development activities to offer innovative solutions to stay in the competitive market landscape.

Latin America AMH & Storage Systems Market Trends

Automated Guided Vehicle Expected to Witness Significant Market Share

- The tow/tractor/tug type of AGV is a key element in intralogistics operations. It can be used for multiple tasks with minor customizations, such as a semi-automatic pickup in warehouses, transporting raw materials to the production line, or dispatching end-products for transportation (loading and unloading). However, According to Asociacion Nacional de Productores de Autobuses, Camiones y Tractocamiones Mexico witnessed a significant decrease by 65.08 thousand production units in heavy production vehicles, including tractors.

- Further, the investments are driving the market growth in the Latin American region. For instance, In October 2020, Amazon announced a USD 100 million logistics investment in opening new warehouses in Mexico, including its first shipping centers outside the populous capital area, to offer faster deliveries. The new sites include two fulfillment centers, one near the northern city of Monterrey and another near the central city of Guadalajara. Additionally, the company is also striving to make inroads in Brazil, where it recently opened its fifth and biggest fulfillment center in the country, with 100,000 square meters. All these investments are expected to drive the utilization of AGV in the warehouse.

- The boom of automation in the medium-sized industries and laboratories that need to handle smaller loads, compared to the large-scale manufacturers, is the primary factor driving the demand for Unit load type of AGVs.

- Further, the continuously increasing R&D expenditure and the rising number of production establishments in the region are driving the demand for automation in the mid-range industries worldwide, especially in the healthcare and pharmaceutical sectors.

- Moreover, the consumers in the region seek shorter delivery times, increasing the application of AGV in warehouses and distribution centers. In, addition advancements in technology have made AGV's better and smaller; lower costs and shortage of labor in some places have fueled the growth of the market studied.

Brazil Expected to Witness Significant Growth in the Market

- Due to the outbreak of COVID-19, the need for autonomous material handling has been becoming more significant in Brazil as more demanding tasks in industrial automation increase. At the same time, companies are facing labor shortages and challenges in implementing new social distancing requirements, thereby driving the market players to invest in product innovation.

- The country is witnessing various expansions. For instance, in January 2020, Material Handling Clark Brazil relocated its corporate headquarters to the Campinas Technology Centre. The strategic step aims to future growth in the Brazilian market and builds capacity for establishing a production facility in Brazil. Campinas, about 100 kilometers north of So Paulo, is a significant industrial and commercial center with various economic activities. Also, the company is expected to meet the country's increasing demand for Clark materials handling vehicles.

- Moreover, due to the high initial cost, vendors in the market studied have been providing more flexible carousels to cater to client-specific requirements. Such innovations in terms of products are expected to boost the adoption of carousels in the region.

- The market vendors catering to carousels are driving demand. For instance, SSI Schaefer offers carousels that can perform 1,000 picks per hour and 50% higher storage density. The SSI Carousel is a suitable solution for handling small parts along with medium to slow-moving products. These include pharmaceutical products, cosmetics, electronics components, media, and food, along with standard-sized and small parts.

- The launch of automated material handling equipment and vehicles, which increases the ease of handling pallets, is also expected to positively impact the adaptability of pallets by various warehouses in the region. However, In 2020, according to Associacao Nacional dos Fabricantes de Veiculos Automotores, approximately 95 thousand trucks were produced in Brazil, a decrease of 19% compared to 2019, which could restrain the market for a considerable period.

Latin America AMH & Storage Systems Industry Overview

The Latin America Automated Material Handling and Storage Systems Market is moderately competitive, with a considerable number of regional and global players. The major vendors with a prominent share in the market are focusing on innovations, mergers and acquisitions, partnerships, and expanding customer base across foreign countries. The companies are leveraging on strategic collaborative initiatives to increase their profitability.

- July 2021 - S&H Systems expanded their automation product line with innovative Interroll crossbelt sorter and conveyor products that provide versatility for warehouse operations. The partnership with Interroll enables S&H to offer more flexible and modular products to clients, providing them with options in a customer-driven environment.

- August 2020 - Murata Machinery Ltd signed a contract with Alpen Co. Ltd to construct the first 3D robot warehousing system, alphabot. Further, alphabot will be introduced at the Alpen Komaki Distribution Center, one of Alpen Group's main distribution centers, to complement its storage capacity and reduce picking, sorting, and packaging operations by approximately 60%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancements Aiding Market Growth

- 5.1.2 Rapid Growth in E-commerce Leading to Warehouse Automation

- 5.1.3 Industry 4.0 Investments Driving the Demand for Automated Material Handling and Storage Systems

- 5.2 Market Challenges

- 5.2.1 Unavailability for Skilled Workforce

- 5.2.2 High Capital Requirements

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Software

- 6.1.2 Hardware

- 6.1.3 Services

- 6.1.4 Integration

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle(AGV)

- 6.2.1.1.1 Automated Forklift

- 6.2.1.1.2 Automated Tow/Tractor/Tug

- 6.2.1.1.3 Unit Load

- 6.2.1.1.4 Assembly Line

- 6.2.1.2 Autonomous Mobile Robots(AMR)

- 6.2.2 Automated Storage and Retrieval System(ASRS)

- 6.2.2.1 Fixed Asile

- 6.2.2.2 Carousel

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End-User

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Electronics and Semiconductor Manufacturing

- 6.3.9 Other End-Users

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Mexico

- 6.4.4 Colombia

- 6.4.5 Peru

- 6.4.6 Chile

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JBT Corporation

- 7.1.2 KION Group AG

- 7.1.3 SSI SCHEFER AG

- 7.1.4 Daifuku Co. Limited

- 7.1.5 Kardex Group

- 7.1.6 Beumer Group GMBH & Co. KG

- 7.1.7 Jungheinrich AG

- 7.1.8 Murata Machinery Limited

- 7.1.9 Interroll Group

- 7.1.10 System Logistics