|

시장보고서

상품코드

1628828

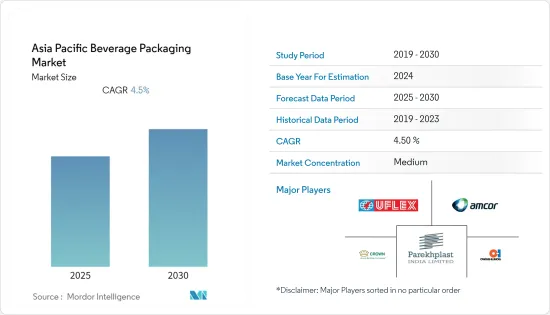

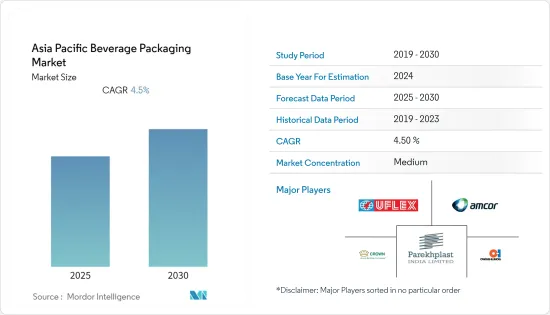

아시아태평양의 음료 포장: 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030)Asia Pacific Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

아시아태평양의 음료 포장 시장은 예측 기간 동안 4.5%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

주요 하이라이트

- 이 지역의 음료 시장에서는 소스 및 케첩 병과 함께 과일 육류, 주스 및 기타 농축액에 대한 수요가 증가하고 있습니다. 또한 각종 건강음료, 유제품, 맥주, 주류가 주로 이 지역의 음료 수요 증가에 기여하며 시장 성장을 주도하고 있습니다.

- 또한 인도의 주요 음료 제조업체들은 매년 차, 커피 등 다양한 제품을 해외 시장에 수출하고 있습니다. 인도 통계 및 프로그램 시행부(MOSPI)의 조사에 따르면 2019년 인도의 음료 제조 수입은 109억 4,000만 달러였으며, 2023년에는 116억 9,000만 달러에 달할 것으로 예상됩니다. 예를 들어, 인도에서 가장 중요한 다국적 연포장재 및 솔루션 기업인 UFlex Limited는 음료 부문을 위한 'Asepto Eye'라는 포장 솔루션을 출시했으며, Asepto의 최신 제품은 우수한 포장으로 무균 포장의 현대적 부활을 가져왔습니다. 무균 포장에 현대적인 부활을 가져와 Asepto 브랜드가 공언하는 혁신의 길을 걷고 있습니다.

- 최근 일회용 플라스틱 금지에 대한 규제는 플라스틱 포장의 성장을 증가시킬 것으로 예상되며, 모든 이해 관계자와의 논의가 마무리되면 향후 시행될 예정입니다. 이러한 규제는 플라스틱 병, 빨대 및 용기 형태로 플라스틱이 널리 사용되는 음료 최종 사용자 산업에서 플라스틱 사용에 큰 영향을 미칠 것으로 예상됩니다.

- 알코올 음료 및 비알코올 음료 시장의 성장에 따라 금속 캔 포장에 대한 수요는 지역 전체에서 크게 증가할 것으로 예상됩니다. 또한 음료 포장 증가는 이 지역의 금속 뚜껑 및 마개 시장을 주도하고 있습니다. 이 지역에는 음료 산업에 ROPP 및 알루미늄 캡과 클로저를 공급하는 많은 기업들이 진출해 있습니다. 예를 들어, Oricon Enterprises Ltd는 연간 92억 1,600만 개의 알루미늄 크라운 캡과 18억 개의 ROPP 캡을 공급하고 있습니다.

- 또한 2020년 2월 코카콜라 재팬은 도쿄, 가나가와, 지바, 사이타마에서 350ml와 700ml의 두 가지 음료용 PET 포장을 출시했습니다.

아시아태평양의 음료 포장 시장 동향

맥주가 큰 시장 점유율을 차지할 것으로 예상

- 맥주 소비량은 최근 몇 년동안 급격히 증가하고 있습니다. 인도는 여전히 가장 큰 맥주 시장 중 하나이며, 매년 2,000만 명 이상이 음주 연령에 도달하고 있습니다. 또한 유명한 Kingfisher 브랜드를 생산하는 인도에서 가장 유명한 맥주 제조업체인 United Breweries는 최신 Kingfisher Instant Beer를 출시했습니다. 이 제품은 2봉지 상자에 담겨 판매됩니다.

- 이 지역에서 맥주에 사용되는 전통적인 포장재는 크라운으로 밀봉된 유리병입니다. 이 지역에서 유리는 알코올 포장에 널리 사용되기 때문에 예측 기간 동안 수요가 증가할 것으로 예상됩니다. 또한, 유리의 가격은 원유 가격 동향에 따라 변동하는 알코올 기업의 마진 프로파일에 큰 영향을 미칩니다.

- 마진이 불투명하기 때문에 제조업체들은 점차 다른 포장재를 생산 라인에 도입하고 있습니다. 최근 추세는 알코올 맥주와 무알콜 맥주의 포장에 PET 병을 사용하는 것입니다. 사용되는 PET 병에는 비 터널형 저온 살균 병, 단방향 터널형 저온 살균 병, 리턴/리필 병이 있습니다.

- 맥주는 탄산음료(CSD)에 사용되는 PET에 비해 높은 CO2 및 O2 차단 성능이 필요합니다. 필요한 수준은 맥주 유형, 용기 크기, 유통 채널, 환경 조건(보관 시간, 온도, 습도 수준)에 따라 달라집니다.

- 또한 이 지역의 소비자들은 글루텐 프리 맥주로 전환하고 있습니다. 또한 중국, 인도, 베트남의 맥주 소비량은 연간 6% 이상 성장하고 있습니다. 따라서 맛과 배합에 대한 기술 혁신 증가는 맥주 수요를 견인하고 캔맥주의 성장을 증가시킬 가능성이 높습니다. 예를 들어, 암스테르담에 본사를 둔 하이네켄(Heineken)은 방갈로르에 본사를 둔 인도 최대 맥주 제조업체인 유나이티드 브루어리(United Breweries)에 대한 지분율을 높였습니다.

- 또한 일본 기업들은 동남아시아의 성장을 포착하기 위해 동남아시아에서 제품 혁신을 통해 사업을 확장하고 있습니다. 예를 들어, 2021년 3월 일본 Toyo Ink Group의 폴리머 및 페인트 자회사인 Toyochem은 금속 맥주병 및 캔용 비스페놀 A 무함유(BPA-NI) 내부 코팅제를 출시했습니다. 새로운 BPA-NI 내부 스프레이 및 스테이온튜브(SOT) 엔드용 코일 코팅은 아크릴 에멀젼과 폴리에스테르 수지를 기반으로 요구되는 성능을 달성하기 위해 배합되었습니다. 또한, 규제 당국과 소비자의 BPA 관련 건강 및 식품 안전 우려에 대응하고 있습니다. 또한, Toyochem은 BPA-NI 솔루션을 Lionova라는 새로운 브랜드명으로 판매하여 해외 시장에서의 입지를 확대하고자 합니다.

큰 폭의 보급이 예상되는 인도

- 인도 음료 포장의 경우 유리와 경질 플라스틱이 큰 비중을 차지하고 있으며, PET는 물 포장에 사용되는 재료로 인도 포장 물 부문의 약 55%를 차지합니다.

- 인도 포장 시장의 성장은 주로 식음료 산업이 주도하고 있으며, IBEF에 따르면 인도 식품 및 식료품 시장은 세계 6위이며, 소매업이 매출의 70%를 차지합니다.

- 중산층의 소비 능력 향상, 조직 소매의 급속한 확대, 수출이 시장 성장을 더욱 촉진하고 있습니다. 따라서 보존성을 높이고 생산 속도를 유지하면서 동시에 품질을 보장할 수 있는 표준화된 포장이 요구되고 있습니다.

- 따라서 품질을 보장하기 위해 고급 포장 방법을 채택하는 것은 인도 식음료 산업에 매우 중요해졌으며, 2020년 1월 인도 산업 연맹이 개최한 전국 포장 회의에 따르면 식음료 산업과 전자상거래가 포장 산업의 50%를 차지한다고 합니다.

- 또한 2020년 7월, Fabonest Food는 인도의 지속 가능한 개발 목표를 유지하기 위해 지속 가능하고 무한히 재활용할 수 있는 알루미늄 캔에 담긴 샘물 음료를 인도에서 출시했습니다.

- 인도 포장 협회(IIP)에 따르면 인도의 포장 소비량은 지난 10년동안 200% 증가하여 1인당 연간 4.3kg에서 8.6kg으로 증가했습니다. 그러나 이러한 성장에도 불구하고 인도의 1인당 소비량은 세계 경제 대국 중 가장 낮은 수준입니다. 이는 시장의 미래 성장 잠재력을 더욱 강조하고 있습니다.

- 또한 2021년 6월, FieldFresh Foods의 고급 포장 식품 브랜드인 Del Monte는 뛰어난 건강 및 미각 효과로 유명한 포장된 킹 코코넛 워터의 출시를 발표했습니다. 인도 최초의 브랜드입니다. 소비자들이 건강한 라이프스타일을 추구하는 경향이 높아짐에 따라 급성장하고 있는 코코넛워터 포장 시장에 새로운 바람을 불러일으킬 것으로 기대됩니다.

아태지역 음료 포장 산업 개요

아시아태평양의 음료 포장 시장은 그 특성상 세분화되어 있습니다. 시장 점유율이 높은 주요 기업들은 다양한 지역에서 고객 기반을 확장하고 있습니다. 또한 많은 기업들이 시장 점유율과 수익성을 높이기 위해 여러 기업과 전략적 및 협력적 이니셔티브를 체결하고 있습니다. 최근 시장 동향은 다음과 같습니다.

- 2020년 11월 - 일본 음료 제조업체인 Sangaria는 9년 이상 사이델을 중요한 파트너로 삼고 있습니다. 이 회사는 탄산음료와 페트병 음료를 무균적으로 처리하기 위해 'Versatile Sidel Aseptic Combi Predis'를 도입하여 생산 유연성을 높이기 위해 신뢰할 수 있는 공급업체에 다시 한 번 의존했습니다. 이 투자는 Sangaria가 향후 제품 포트폴리오를 확장하는 데 도움이 될 것입니다.

- 2020년 5월-Piramal Glass Limited는 Microsoft와 협력하여 제조 공정에 디지털 기술을 도입하여 업무 절차를 혁신합니다. 유리 사업을 혁신하기 위해 신기술 및 새로운 시대의 기술을 활용합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 세분화

- 재료별

- 플라스틱

- 판지

- 금속

- 유리

- 제품 유형별

- 보틀

- 캔

- 파우치 및 카톤

- 뚜껑 및 마개

- 기타

- 용도별

- 탄산음료 및 과일음료

- 맥주

- 와인 및 증류주

- 생수

- 우유

- 에너지 및 스포츠 드링크

- 기타

- 생산국

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

제6장 경쟁 구도

- 기업 개요

- Parekhplast India Limited

- Crown Holdings, Inc.

- Uflex Ltd

- Haldyn Glass Limited

- Rexam plc

- Owens-Illinois Inc

- Piramal Glass Private Limited

- HSIL Group

- Hindustan Tin Works Ltd

- Amcor plc

- Hindustan National Glass & Industries Ltd(HNGIL)

제7장 투자 분석

제8장 시장의 미래

LSH 25.01.22The Asia Pacific Beverage Packaging Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- The demand for fruit pulp, juices, and other concentrates, along with sauces or bottles of ketchup, is increasing in the beverage market in the region. In addition, various health beverages, milk products, beer, and liquors have mainly contributed to the increasing demand for drinks in the area, thus driving the market growth.

- Moreover, the leading beverage manufacturers in India export various products, such as tea and coffee, to foreign markets each year. According to the Ministry of Statistics and Program Implementation (MOSPI) survey, the revenue from manufacturing beverages in India in FY 2019 was USD 10.94 billion. It is expected to reach USD 11.69 billion by 2023. For instance, UFlex Limited, India's most significant multinational flexible packaging materials & solution company, has launched a packaging solution called 'Asepto Eye' for the beverages segment. The newest offering from Asepto gives a modern revival to aseptic packaging due to its packaging excellence, taking forward the innovative trail that the brand Asepto professes.

- The recent regulation on the ban of single-use plastics is expected to grow plastic packaging growth, which is scheduled to be enforced in the future once the discussion with all the stakeholders gets concluded. These regulations are expected to significantly affect the use of plastics in the beverage end-user industry, where plastics are extensively used in the form of bottles, straws, and containers.

- With the growth of the alcoholic and non-alcoholic beverage market, the demand for metal can package is expected to increase significantly across the region. Also, the increase in beverage packaging is driving the metal caps and closure market in the area. The region holds many players that supply ROPP and aluminum caps and closures to the beverage industries. For instance, Oricon Enterprises Ltd has 9,216 million units per annum of aluminum crown caps and 1,800 million units per annum of ROPP caps.

- Further, in February 2020, Coca-Cola Japan has launched two new PET packaging sizes for beverages that include 350ml and 700ml for its drink in Tokyo, Kanagawa, Chiba, and Saitama.

Asia Pacific Beverage Packaging Market Trends

Beer is Expected to Account For Significant Market Share

- The consumption of beer has been increasing exponentially in the recent past. India remains one of the largest beer markets, with more than 20 million people entering the legal age for drinking every year. In addition, United Breweries, India's most prominent beer producer that also makes the famous Kingfisher brand, has announced their latest Kingfisher Instant Beer. The product is sold in a box that contains two sachets.

- The traditional packaging material used for beer in the region is the glass bottle sealed with a crown closure. As glass is extensively used for alcohol packaging in the area, the demand is expected to increase during the forecast period. Also, glass prices have a significant impact on the margin profile of the alcohol companies, which fluctuates based on the crude oil price movement.

- Owing to the uncertain margins, manufacturers are gradually incorporating other packaging materials in their production lines. A recent development is the use of PET bottles for the packaging of both alcoholic and non-alcoholic beer. The PET beer bottles used are non-tunnel pasteurized, one-way tunnel pasteurized and returnable/refillable bottles.

- Beer needs high CO2 and O2 barrier performance compared to PET used in carbonated soft drinks (CSD). The level required depends on the type of beer, container size, distribution channels, and environmental conditions (storage time, temperature, and humidity levels).

- Moreover, in this region, consumers are increasingly shifting toward gluten-free beers. Also, beer consumption grows at over 6 percent per annum in China, India, and Vietnam. Hence, the growing innovation in flavors and preparations is likely to drive the demand for beer, increasing beer cans' growth. For instance, Heineken, an Amsterdam-based company, increased its stake in Bangalore-based United Breweries, India's largest beer manufacturer, thereby offering high growth potential for the beer packaging industry in the country, which will raise the usage of beer cans.

- Further, Japanese companies are striding up their business by product innovation in Southeast Asia to cash in on the region's growth. For instance, in March 2021, Toyochem Co., Ltd., the polymers and coatings subsidiary of Japan's Toyo Ink Group, launched a new Bisphenol A non-intent (BPA-NI) internal coatings for metal beer bottles and cans. The new BPA-NI interior sprays and coil coatings for stay-on tab (SOT) ends are formulated to achieve the required performance based on acrylic emulsion and polyester resins. It is also addressing BPA-related health and food safety concerns from regulators and consumers alike. In addition, Toyochem will be marketing its BPA-NI solutions under the new brand name Lionova, as the company also seeks to expand its position in markets overseas.

India to Expected to Witness Significant Rate of Adoption

- In terms of India's beverage packaging, glass and rigid plastic hold a prominent share of the market. PET is the material that is used for packaging water, which accounts for around 55% of India's packaged water sector.

- The growth of the packaging market in India is primarily driven by the food and beverage industries. According to IBEF, the Indian food and grocery market is the world's sixth-largest, with retail contributing to 70% of the sales.

- The increase in the spending capacity of the middle-income group, the rapid expansion of organized retail and exports further facilitate the growth of the market. This has led to the need for standardized packaging, which can improve shelf-life, maintain production speed, and simultaneously ensure quality.

- Thus, adopting advanced packaging methods to ensure quality has become critical for India's food and beverage industry. According to the National Packaging Conference held by the Confederation of Indian Industries in January 2020, the food and beverage industries and e-commerce accounted for 50% of the packaging industry.

- Further, in July 2020, Fabonest Food and Beverages has launched spring water beverages in sustainable and endlessly recyclable aluminum cans in India to keep up India's sustainable development goals.

- According to the Indian Institute of Packaging (IIP), packaging consumption in India increased by 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa. However, despite this growth, the per capita consumption of India is the lowest among the large economies of the world. This further emphasizes the future growth potential of the market.

- Further, in June 2021, Del Monte, the premium packaged foods brand from FieldFresh Foods, has announced its packaged King Coconut Water launch, renowned for its superior health and taste benefits. Del Monte is the first brand in India to offer King Coconut Water. It raises the bar in the fast-growing packaged coconut water segment as consumers increasingly adopt healthier lifestyles.

Asia Pacific Beverage Packaging Industry Overview

The Asia Pacific beverage packaging market is fragmented in nature. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- November 2020 - The Japanese beverage company Sangaria has been counting on Sidel as a vital partner for more than nine years. The company once again turned to its reliable supplier to increase its production flexibility by acquiring the Versatile Sidel Aseptic Combi Predis to handle aseptically carbonated and still drinks in PET bottles. This investment will also support Sangaria to widen its product portfolio in the future.

- May 2020 - Piramal Glass Limited partnered with Microsoft to transform its operational procedures to include digital technology in the manufacturing process. It will leverage some of the emerging or new-age technologies to transform its glass business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Acceleration in Packaging Machinery Imports, leading to proliferation of Beverage Packaging Industry

- 4.4.2 Increased demand for convenience packaging from consumers

- 4.5 Market Restraints

- 4.5.1 Lack of Exposure to Best Management and Manufacturing Practices

- 4.6 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Type of Product

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Pouches and Cartons

- 5.2.4 Caps and Closures

- 5.2.5 Other Types of Product

- 5.3 By Application

- 5.3.1 Carbonated Soft Drinks and Fruit Beverages

- 5.3.2 Beer

- 5.3.3 Wine and Distilled Spirits

- 5.3.4 Bottled Water

- 5.3.5 Milk

- 5.3.6 Energy and Sports Drinks

- 5.3.7 Other Applications

- 5.4 Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Parekhplast India Limited

- 6.1.2 Crown Holdings, Inc.

- 6.1.3 Uflex Ltd

- 6.1.4 Haldyn Glass Limited

- 6.1.5 Rexam plc

- 6.1.6 Owens-Illinois Inc

- 6.1.7 Piramal Glass Private Limited

- 6.1.8 HSIL Group

- 6.1.9 Hindustan Tin Works Ltd

- 6.1.10 Amcor plc

- 6.1.11 Hindustan National Glass & Industries Ltd (HNGIL)

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

샘플 요청 목록