|

시장보고서

상품코드

1628837

북미의 계면활성제: 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

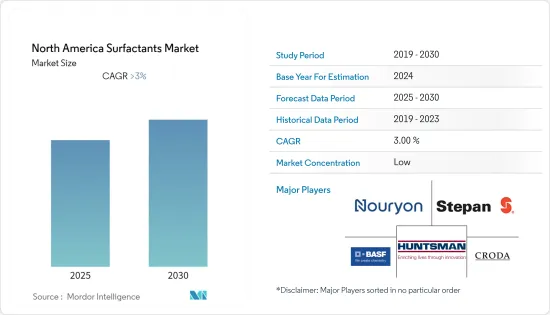

북미의 계면활성제 시장은 예측 기간 동안 3% 이상의 CAGR을 나타낼 것으로 예상됩니다.

주요 하이라이트

- 예측 기간 동안 가정용 계면활성제 및 바이오 계면활성제에 대한 수요가 증가함에 따라 시장이 성장할 것으로 예상됩니다.

- 한편, 합성 계면활성제에 대한 환경문제 증가는 시장 성장에 걸림돌이 될 것으로 예상됩니다.

- 향후 신생아 호흡곤란(NRD) 증후군을 앓고 있는 아기에게 폐 계면활성제로 사용할 수 있는 기회가 있을 것으로 보입니다.

- 개인 관리, 식품 가공 및 기타 산업이 성장하고 있기 때문에 미국은 이 지역에서 시장을 독점하고 있습니다.

북미의 계면활성제 시장 동향

가정용 비누 및 세제 수요 증가

- 세제는 일반적으로 주로 세척 목적으로 사용되는 계면 활성제의 혼합물로 다양한 희석으로 제공됩니다. 알킬 벤젠 설포 네이트는 세제를 구성합니다. 알킬 벤젠 설포 네이트는 화학적으로 비누와 유사하지만 경수에 잘 용해됩니다.

- 세제는 음이온성, 양이온성, 비이온성 등 이온성 측면에서 분류됩니다. 세분화에서 언급 된 비누는 주로 세탁 및 세탁 용도를 다루고 있습니다.

- 세제나 비누에 함유된 계면활성제는 물과 섞여 옷이나 기타 세척 표면의 얼룩에 달라붙는다. 이를 통해 표면 장력을 낮추고 얼룩을 제거 할 수 있습니다.

- 세제의 주요 용도는 가정용 세제와 연료 첨가제입니다.

- 2021년 미국에서 액체 바디워시는 비누 제품 중 가장 많은 판매량을 기록했으며, 2021년 액체 바디워시 부문은 미국에서 약 6억 2,400만 개의 멀티 아울렛 판매량을 기록했습니다.

- 또한 액체 손 비누와 손 소독제가 그 뒤를 이어 2021년에는 각각 약 4억 2천만 개와 2억 5,400만 개가 판매될 것으로 예상됩니다. 이는 예측 기간 동안 시장이 크게 성장하는 데 도움이 될 것으로 예상됩니다.

- 즉, 위의 요인으로 인해 가정용 비누 및 세제에 대한 수요 증가가 향후 몇 년동안 시장 성장을 견인할 것으로 예상됩니다.

시장을 독점하고 있는 미국

- 미국은 이 지역에서 계면활성제의 가장 큰 소비국입니다. 퍼스널케어 산업의 확대로 인해 계면활성제 사용량은 지난 몇 년동안 증가했으며, 예측 기간 동안 더욱 증가할 것으로 예상됩니다.

- 미국에서는 식품 가공 산업이 확대되고 있으며, 계면활성제 사용량이 증가할 것으로 예상됩니다. 미국은 북미 식품 제조 및 가공 공장의 거점입니다.

- 계면활성제는 윤활유와 연료 첨가제에 사용됩니다. 이러한 요인으로 인해 자동차 산업에서 계면활성제 사용량이 증가하고 있습니다. 자동차 판매량이 증가함에 따라 윤활유에 대한 수요가 증가하고 있으며, 이는 예측 기간 동안 계면활성제 시장의 성장을 뒷받침하고 있습니다.

- 미국 경제분석국(BEA)에 따르면 2021년 미국 자동차 부문은 1,490만 대 이상의 경차를 판매했습니다. 총 1,490만 대 중 약 330만 대의 자동차와 1,160만 대의 경트럭이 소매 판매되었습니다. 따라서 예측 기간 동안 시장 성장은 지속될 것으로 보입니다.

- 또한 미국에서는 비누 및 세제에 대한 소비 지출이 크게 증가하고 있습니다. 미국 노동 통계국에 따르면 2021년 비누 및 세제에 대한 연간 평균 지출은 소비자 1인당 80.5달러로 2020년 대비 약 6.5% 증가했습니다.

- 이상의 이유로 예측 기간 동안 미국이 시장을 주도할 것으로 예상됩니다.

북미의 계면활성제 산업 개요

북미의 계면활성제 시장은 원래 세분화되어 있습니다. 이 시장의 주요 기업으로는 Stepan Company, Nouryon, BASF SE, Croda International Plc, Huntsman International LLC 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 산업 밸류체인 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화(시장 규모(판매량))

- 유형

- 음이온 계면활성제

- 양이온 계면활성제

- 비이온 계면활성제

- 양성 계면활성제

- 실리콘계 계면활성제

- 기타

- 유래

- 합성 계면활성제

- 바이오계 계면활성제

- 용도

- 가정용 비누 및 세제

- 퍼스널케어

- 윤활유 및 연료 첨가제

- 산업 및 시설용 세정

- 식품 가공

- 유전용 화학제품

- 농업용 화학제품

- 섬유 가공

- 에멀전 중합

- 기타

- 지역

- 미국

- 캐나다

- 멕시코

- 기타 북미

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- 3M

- Ashland

- BASF SE

- CLARIANT

- Croda International Plc

- Dow

- Evonik Industries AG

- GALAXY

- Godrej Industries Limited

- Henkel Corporation

- Huntsman International LLC

- Innospec

- Kao Corporation

- MITSUI CHEMICALS AMERICA, INC.

- Nouryon

- Procter & Gamble

- Sasol

- Solvay

- Stepan Company

제7장 시장 기회와 향후 동향

LSH 25.01.22The North America Surfactants Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- During the forecast period, the market is likely to grow because there will be more demand for household surfaces and bio-surfactants.

- On the other hand, rising environmental concerns related to synthetic surfactants are expected to hamper market growth.

- In the future, there may be a chance to use it as a lung surfactant for babies with Neonatal Respiratory Distress (NRD) syndrome.

- Due to the growth of industries like personal care, food processing, and so on, the United States dominated the market in the area.

North America Surfactants Market Trends

Increasing Demand for Household Soaps and Detergents

- Detergent is usually a mixture of surfactants used mainly for the purpose of cleaning and is available in varying dilutions. Alkylbenzene sulfonates make up detergents. They are chemically similar to soap, but they dissolve better in hard water.

- Detergents are classified in terms of their ionic properties, namely anionic, cationic, and non-ionic. The soap mentioned in the segmentation deals mainly with washing and laundry applications.

- The surfactants incorporated in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce surface tension and remove dirt from the concerned surface.

- The major applications of detergents are reflected in household cleaning and fuel additives.

- In 2021, liquid body wash had the greatest unit sales among soap products in the United States. In 2021, the liquid body wash category generated around 624 million units in multi-outlet sales in the United States.

- Also, it was followed by liquid hand soap and hand sanitizer, which sold about 402 million units and 254 million units, respectively, in 2021. This is expected to help the market grow a lot during the time period covered by the forecast.

- So, because of the above factors, the growing demand for soaps and detergents for the home is expected to drive market growth over the next few years.

United States to Dominate the Market

- The United States is the largest consumer of surfactants in the region. Due to the expansion of the personal care industry, the usage of surfactants has increased over the past few years and is expected to increase further over the forecast period.

- The food processing industry in the country is expanding, which is expected to augment the use of surfactants. The United States is the hub of North America's food manufacturing and processing plants.

- Surfactants are used in lubricants and fuel additives. This factor has been driving the increased usage of surfactants in the automotive industry. With the increasing sales of motor vehicles, the demand for lubricants increases, which in turn supports the growth of the surfactants market during the forecast period.

- According to the Bureau of Economic Analysis (BEA), the United States auto sector sold over 14.9 million light vehicle units in 2021. Out of a total of 14.9 million, approximately 3.3 million vehicles and 11.6 million light truck units were sold at retail.As a result, market growth will be supported during the forecast period.

- Moreover, consumer spending on soaps and detergents has climbed significantly in the United States. According to the United States Bureau of Labor Statistics, the average yearly expenditures for soaps and detergents in 2021 were USD 80.5 per consumer unit, representing an increase of around 6.5 percent compared to 2020. thus benefiting the market's growth significantly.

- Due to the above reasons, it is expected that the United States will lead the market during the forecast period.

North America Surfactants Industry Overview

The North American surfactant market is fragmented by nature. Some of the major players in the market include Stepan Company, Nouryon, BASF SE, Croda International Plc, and Huntsman International LLC, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Bio-surfactants

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Concerns Related to Synthetic Surfactants

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Type

- 5.1.1 Anionic Surfactant

- 5.1.2 Cationic Surfactant

- 5.1.3 Non-ionic Surfactant

- 5.1.4 Amphoteric Surfactant

- 5.1.5 Silicone Surfactant

- 5.1.6 Other Types

- 5.2 Origin

- 5.2.1 Synthetic Surfactant

- 5.2.2 Bio-based Surfactant

- 5.3 Application

- 5.3.1 Household Soap and Detergent

- 5.3.2 Personal Care

- 5.3.3 Lubricants and Fuel Additives

- 5.3.4 Industry & Institutional Cleaning

- 5.3.5 Food Processing

- 5.3.6 Oilfield Chemicals

- 5.3.7 Agricultural Chemicals

- 5.3.8 Textile Processing

- 5.3.9 Emulsion Polymerization

- 5.3.10 Other Applications

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ashland

- 6.4.3 BASF SE

- 6.4.4 CLARIANT

- 6.4.5 Croda International Plc

- 6.4.6 Dow

- 6.4.7 Evonik Industries AG

- 6.4.8 GALAXY

- 6.4.9 Godrej Industries Limited

- 6.4.10 Henkel Corporation

- 6.4.11 Huntsman International LLC

- 6.4.12 Innospec

- 6.4.13 Kao Corporation

- 6.4.14 MITSUI CHEMICALS AMERICA, INC.

- 6.4.15 Nouryon

- 6.4.16 Procter & Gamble

- 6.4.17 Sasol

- 6.4.18 Solvay

- 6.4.19 Stepan Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage as Lung Surfactant in Neonatal Respiratory Distress (NRD) Syndrome

샘플 요청 목록