|

시장보고서

상품코드

1628845

북미의 오프쇼어 헬리콥터 서비스 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)North America Offshore Helicopter Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

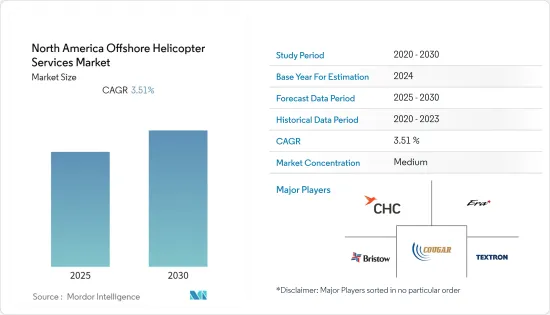

북미의 오프쇼어 헬리콥터 서비스 시장은 예측 기간 동안 CAGR 3.51%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 중기적으로는 심해 해양 개발 활동의 활성화와 해양 석유 및 가스 프로젝트의 실행 가능성 향상 등이 시장의 주요 촉진요인이 될 것으로 예상됩니다.

- 한편, 저렴한 승무원 수송선과의 경쟁으로 인해 시장 성장이 둔화되었습니다.

- 새로운 북미 해상풍력 시장의 폭발적인 성장은 예측 기간 종료 후 시장 성장에 큰 기회를 제공할 것으로 보입니다.

- 미국은 해양 석유 및 가스 탐사 및 생산 증가로 인해 시장을 독점할 것으로 예상됩니다.

북미의 오프쇼어 헬리콥터 서비스 시장 동향

해상풍력 발전이 가장 빠르게 성장하는 분야

- 북미에서는 해상 풍력 발전 부문이 빠르게 성장하기 시작했으며, 예측 기간 동안 이 부문이 크게 성장할 것으로 예상됩니다. 이 지역에는 여러 대규모 풍력발전소가 건설되고 있으며, 향후 몇 년동안 해상 헬리콥터 서비스에 대한 수요가 크게 증가할 것으로 예상됩니다. 미국의 해상 풍력 발전 설비용량은 2015년 29MW에서 2022년 말 41MW로 증가할 것으로 예상됩니다.

- 미국 에너지 부에 따르면 2022년 5 월까지 미국의 해상 풍력 발전 프로젝트 개발 및 운영 파이프라인은 4 만 83MW의 잠재적 발전 용량으로 성장할 것으로 예상되며, 2021년이후 미국에서 계획된 40,083MW의 해상 풍력 발전은 13.5% 증가했습니다. 발전량은 13.5% 증가했습니다.

- 미국 해상풍력에너지 시장은 해상풍력에너지 구매와 관련하여 각 주의 활동과 조치에 따라 여전히 영향을 받고 있습니다. 8개 주의 해상풍력에너지 관련 정책은 2040년까지 최소 3만 9,322MW의 해상풍력에너지 용량을 건설할 것을 요구하고 있습니다.

- 2021년 10월, BOEM은 "Offshore Wind Leasing Path Forward 2021-2025"를 발표하며 2025년까지 뉴욕만, 캐롤라이나 롱베이, 중부 대서양, 메인만, 캘리포니아, 오레곤, 멕시코만 등 최대 7개의의 새로운 해양 WEA 임대 경매를 개최할 계획을 발표했다(미국 내무부, 2021). 새로운 임대 지역은 미국에서 실행 가능한 해상 풍력에너지 부지의 수에 큰 변화를 가져올 것으로 보입니다. 또한, 북대서양과 중부 대서양 외에도 해상 풍력에너지를 이용할 수 있는 지역이 확대될 것입니다. 부유식 해상풍력 프로젝트의 첫 번째 상업적 임대 기회는 사용 가능한 기술 유형을 확대할 수 있는 기회이기도 합니다.

- 이러한 변화로 인해 이 지역의 해상 풍력 발전 시장은 빠르게 성장할 것으로 예상되며, 예측 기간 동안 이 부문에서 해상 헬리콥터 서비스에 대한 수요가 증가할 것으로 예상됩니다.

시장을 독점하고 있는 미국

- 미국은 2022년 이 지역의 오프쇼어 헬리콥터 시장을 장악할 것으로 예상되며, 예측 기간 동안에도 우위를 유지할 것으로 보입니다. 미국은 최근 몇 년동안 해양 탐사에 매우 적극적이며, 정부는 석유 및 가스 회사가 해양 전망을 개발할 수 있도록 다양한 유리한 조치를 마련했습니다.

- 2022년, 연방 멕시코만의 해상 석유 및 천연가스 생산량은 미국 전체 원유 생산량의 약 14.66%, 미국 전체 건식 천연가스 생산량의 약 2%를 차지합니다.

- 해양 생산을 유지하기 위해 탐사 및 개발 활동은 석유 및 가스 매장량이 아직 개발되지 않은 심해로 향하고 있습니다. 이러한 추세는 중대형 헬리콥터에 대한 수요를 증가시킬 것으로 예상되는 반면, 석유 및 가스 산업을 위한 소형 헬리콥터에 대한 수요는 예측 기간 동안 감소할 것으로 예상됩니다.

- 또한, 해상 풍력 부문의 성장도 예측 기간 동안 시장을 견인하는 요인으로, 2022년 5월 31일 현재 미국에는 해상 풍력에너지 조달을 위한 24건의 전력 구매 계약1이 체결되어 있으며, 해상 풍력에너지 계약은 17,597MW에 달할 전망입니다.

- 따라서, 중국의 해양 석유 및 가스 개발 증가와 해상 풍력 발전소 증가는 중국의 오프쇼어 헬리콥터 시장 성장에 기여할 것으로 예상됩니다.

북미의 오프쇼어 헬리콥터 서비스 산업 개요

북미의 오프쇼어 헬리콥터 서비스 시장은 비교적 통합된 시장입니다. 주요 기업(순서는 무관)으로는 Bristow Group Inc., Era Group Inc.(ERA), Cougar Helicopters Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서론

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 유형

- 소형 헬리콥터

- 중대형 헬리콥터

- 최종사용자 산업

- 석유 및 가스 산업

- 해상(Offshore) 풍력 산업

- 기타

- 용도

- 굴착

- 이전 및 폐지 조치

- 생산

- 기타

- 지역

- 미국

- 캐나다

- 기타 북미

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 주요 기업의 전략

- 기업 개요

- Service Providers

- Bristow Group Inc.

- Era Group Inc.(ERA)

- CHC Group Ltd

- Cougar Helicopters Inc.

- Helicopter Manufacturers

- Airbus SE

- Leonardo SpA

- Textron Inc.

- Lockheed Martin Corporation

- Service Providers

제7장 시장 기회와 향후 동향

LSH 25.01.22The North America Offshore Helicopter Services Market is expected to register a CAGR of 3.51% during the forecast period.

Key Highlights

- Over the medium term, factors such as rising deep-water offshore development activity and the improved viability of offshore oil and gas projects are expected to be major drivers of the market.

- On the other hand, the growth of the market was slowed by competition from crew transfer ships that were less expensive.

- Nevertheless, the explosive growth of the new North American offshore wind market is likely to give the market a big chance to grow after the forecast period is over.

- The United States is expected to dominate the market due to rising offshore oil and gas exploration and production.

North America Offshore Helicopter Services Market Trends

Offshore wind to be the fastest-growing segment

- The offshore wind sector is beginning to take off in North America, and the segment is expected to grow massively during the forecast period. Several big wind farms are being built in the area, which is expected to increase the need for offshore helicopter services by a lot over the next few years. In the United States, the total offshore wind installed capacity increased from 29 MW in 2015 to 41 MW at the end of 2022.

- According to the United States Department of Energy, by May 2022, the United States offshore wind energy project development and operational pipeline were projected to grow to a potential generating capacity of 40,083 megawatts (MW). Since 2021, the 40,083 MW of offshore wind energy planned for the U.S. has grown by 13.5%.

- The U.S. offshore wind energy market is still driven by the activities and policies of the states when it comes to buying offshore wind energy. Policies in eight states about offshore wind energy call for at least 39,322 MW of offshore wind energy capacity to be built by 2040.

- In October 2021, BOEM announced its "Offshore Wind Leasing Path Forward 2021-2025," calling for plans to hold up to seven new offshore WEA lease auctions by 2025, including the New York Bight, Carolina Long Bay, the Central Atlantic, the Gulf of Maine, California, Oregon, and the Gulf of Mexico (U.S. Department of the Interior 2021). The new lease areas will make a big difference in the number of viable offshore wind energy sites in the United States. They will also expand the number of regions where offshore wind energy can be used beyond the North Atlantic and mid-Atlantic. The first commercial lease opportunities for floating offshore wind projects will also make it possible to expand the types of technologies that can be used.

- The offshore wind market in the region is expected to grow quickly because of these changes, which will increase the need for offshore helicopter services in this sector during the forecast period.

The United States to Dominate the Market

- The United States dominated the offshore helicopter market in 2022 in the region and is expected to continue its dominance during the forecast period. The country has been very active in offshore exploration in recent years, and the government developed various favorable policies to help oil and gas companies develop offshore prospects.

- In 2022, offshore oil and natural gas production in the Federal Gulf of Mexico accounted for about 14.66% of total U.S. crude oil production and about 2% of total U.S. dry natural gas production.

- In order to maintain offshore production, the exploration and development activity is moving toward deeper waters, where oil and gas reserves have not been exploited. This trend is expected to drive the demand for medium and heavy helicopters, while the demand for small helicopters for the oil and gas industry is expected to decline during the forecast period.

- Additionally, the growth of the offshore wind sector is another factor driving the market during the forecast period. As of May 31, 2022, 24 power purchase agreements1 for offshore wind energy procurement were signed in the United States, adding up to 17,597 MW in offshore wind energy contracts.

- Therefore, the rising offshore oil and gas development and an increasing number of offshore wind farms in the country are expected to help grow the offshore helicopter market in the country.

North America Offshore Helicopter Services Industry Overview

The North American offshore helicopter services market is moderately consolidated. Some of the major companies (in no particular order) include Bristow Group Inc., Era Group Inc. (ERA), Cougar Helicopters Inc., CHC Group Ltd, and Textron Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, until 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Deep-Water Offshore Development Activity

- 4.5.1.2 Improved Viability of Offshore Oil and Gas Projects

- 4.5.2 Restraints

- 4.5.2.1 Competition from Crew Transfer Ships

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Light Helicopters

- 5.1.2 Medium and Heavy Helicopters

- 5.2 End-user Industry

- 5.2.1 Oil and Gas Industry

- 5.2.2 Offshore Wind Industry

- 5.2.3 Other End-user Industries

- 5.3 Application

- 5.3.1 Drilling

- 5.3.2 Relocation and Decommissioning

- 5.3.3 Production

- 5.3.4 OtherApplications

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Service Providers

- 6.3.1.1 Bristow Group Inc.

- 6.3.1.2 Era Group Inc. (ERA)

- 6.3.1.3 CHC Group Ltd

- 6.3.1.4 Cougar Helicopters Inc.

- 6.3.2 Helicopter Manufacturers

- 6.3.2.1 Airbus SE

- 6.3.2.2 Leonardo SpA

- 6.3.2.3 Textron Inc.

- 6.3.2.4 Lockheed Martin Corporation

- 6.3.1 Service Providers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Explosive Growth of the New North American Offshore Wind Market

샘플 요청 목록