|

시장보고서

상품코드

1629780

주류 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Alcoholic Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

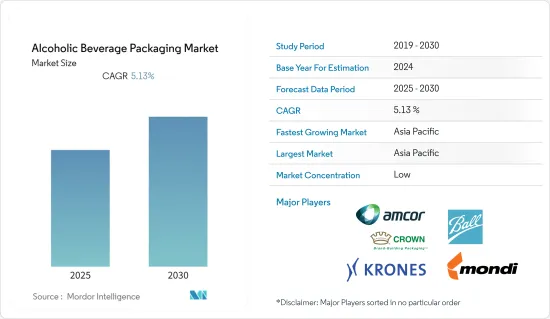

주류 포장 시장은 예측 기간 동안 CAGR 5.13%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 최근 수십 년 동안 전 세계 주류 소비량이 크게 증가한 것으로 확인되었으며, Lancet이 실시한 조사에 따르면 국민 1 인당 알코올 소비량은 1990 년 59 리터에서 2017년에는 전 세계적으로 65 리터로 증가했습니다. 또한 이후 13 년 동안 1 인당 알코올 소비량은 17% 증가하여 2030년에는 76 리터에 도달할 것으로 예상됩니다. 주류 소비 증가는 시장 성장을 촉진하는 주요 요인 중 하나입니다.

- 또한, 포장 폐기물을 최소화하기 위해 100% 재활용 가능한 제품 사용에 대한 인식이 높아지면서 포장재 재활용에 대한 관심이 높아지고 있습니다. 이는 지속가능한 포장 제품에 대한 수요를 증가시켜 주류 포장 시장의 성장을 뒷받침하고 있습니다.

- 그러나 위험물 및 비생분해성 제품 사용에 대한 정부의 엄격한 규제로 인해 제조업체는 일부 포장재에 국한되어 있습니다. 또한, 생산 비용의 증가는 조사 대상 시장의 성장을 제한하고 있습니다.

주류 포장 시장 동향

유리 포장이 큰 비중을 차지

- 유리는 품질과 견고함을 잃지 않고 100% 재활용이 가능합니다. 사용 된 유리 병의 대부분은 새로운 유리 병 생산에 사용됩니다. 와인 포장에 대한 중요성이 높아지고 시장의 견고한 수요로 인해 유리 용기에 대한 수요는 확대될 수 있습니다.

- 전 세계적으로 소비되는 알코올의 50% 이상이 와인 형태로 소비되고 있으며, OIV는 전 세계적으로 와인 생산량이 17% 증가할 것으로 예상하고 있습니다. 고객들은 가방에 담긴 상자(BiB)와 같은 대체 포장의 와인을 받아들이기 시작했지만, 대량 구매에 국한되어 있습니다.

- 2019년 4월에 발표된 Wine Institute of America의 보고서에 따르면 2017년 미국에서 생산된 와인은 약 10억 갤런에 달합니다. 미국은 와인 소비량이 가장 많으며 세계 점유율은 15 %입니다. 따라서 유리 포장 부문은 와인 포장 응용 분야를 지배하고 있습니다.

- 또한 맥주 산업은 지난 몇 년 동안 꾸준한 성장세를 보이고 있습니다. 성장하는 맥주 산업은 아마도 유리 포장 부문에서 큰 발전을 보일 수 있습니다. 예를 들어, 유럽에서 유리는 2017년 전체 재활용 재료 중 종이 다음으로 22%의 점유율을 차지했습니다.

아시아태평양이 시장을 독점할 것으로 예상

- 이 지역에서는 맥주와 주류 소비가 증가하고 있으며, 이는 시장 성장의 주요 요인으로 작용하고 있으며, WHO는 인도 알코올 소비자의 92%가 맥주나 와인보다 증류주를 선호한다고 발표했습니다. 각 기업들이 지속가능한 포장 제품을 지향하는 가운데, 이 지역에서는 주류용 유리 포장의 채택이 확대되고 있습니다.

- 중국과 인도와 같은 인구가 많은 국가의 존재, 가처분 소득의 증가, 신흥국에서 알코올 소비에 대한 수용성 증가로 강화된 이 지역의 거대한 소비자 기반은 조사 대상 시장의 성장을 촉진하는 주요 요인입니다.

- Lancet의 조사에 따르면, 동남아시아 및 서태평양 지역의 1인당 알코올 소비량은 1990년부터 2017년까지 각각 104%와 54% 증가하였습니다. 아시아 인구의 평균 연령은 30.7세로 주류 시장에 엄청난 잠재적 기회를 가져와 주류 포장에 대한 수요를 증가시키고 있습니다.

주류 포장 산업 개요

주류 포장 솔루션을 제공하는 여러 기업이 존재함에 따라 시장 경쟁이 치열해지고 있습니다. 따라서 시장은 적당히 세분화되어 있으며, 많은 기업들이 확장 전략을 펼치고 있습니다.

- 2019년 4월 - Diageo PLC는 플라스틱 폐기물 최소화에 초점을 맞추고 자사의 맥주 브랜드 Guinness에 대해 전 세계적으로 플라스틱 포장을 사용하지 않겠다고 발표했습니다. 이 회사는 이러한 움직임과 플라스틱을 대체할 100% 재활용 가능하고 생분해성 골판지 채택을 위해 1,600만 유로를 투자할 계획입니다.

- 2019년 3월 - Amcor Limited는 경쟁사인 Bemis Company Inc.를 인수했습니다. Amcor는 두 시장 리더를 결합하여 주주, 고객, 직원 및 환경에 더 강력한 가치 제안을 제공하는 것을 목표로 하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 주류 소비 증가

- 재활용에 대한 주목 상승

- 제품 장기 보존에 대한 수요 증가

- 시장 성장 억제요인

- 포장 재료에 관한 엄격한 규제 실시

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 재료별

- 유리

- 금속

- 플라스틱

- 기타

- 제품별

- 캔

- 보틀

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 기타

- 라틴아메리카

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 기업 개요

- Amcor PLC

- Ball Corporation

- Krones AG

- Mondi PLC

- Crown Holdings Inc.

- Sidel SA

- Oi SA

- Ardagh Group SA

- Berry Global Inc.

- Nampak Limited

- Stora Enso Oyj

- Gerresheimer AG

제7장 투자 분석

제8장 시장 기회와 향후 동향

ksm 25.01.23The Alcoholic Beverage Packaging Market is expected to register a CAGR of 5.13% during the forecast period.

Key Highlights

- It was observed that the global consumption of alcoholic beverages has been increasing significantly, over the decades. According to the study conducted by Lancet, alcohol per-capita consumption increased from 59 liters in 1990 to 65 liters in 2017, globally. Furthermore, in the following 13 years, alcohol per-capita consumption is expected to grow by 17%, reaching 76 liters in 2030. The rising alcoholic beverage consumption is one of the key factors driving market growth.

- Additionally, owing to the awareness regarding the usage of 100% recyclable products, in order to minimize packaging waste, the focus on recycling packagings is growing. This is, thus, fuelling the demand for sustainable packaging products and supporting the growth of the alcoholic beverage packaging market.

- However, stringent government regulations on the use of hazardous and non-biodegradable products have limited the manufacturers to a few packaging materials. Furthermore, the increasing cost of production is also restricting the growth of the market studied.

Alcoholic Beverage Packaging Market Trends

Glass Packaging Segment to Account for a Crucial Share

- Glass is 100% recyclable without the loss of quality and sturdiness. The majority of utilized glass bottles are used for the production of new glass bottles. The demand for glass containers may likely expand, owing to its increasing importance in wine packaging and robust demand in the market.

- More than 50% of the alcohol consumed globally is in the form of wine, and OIV has projected a 17% growth in the production of wine, globally.Though the customers have started accepting wine in alternative packagings, like Bags in a Box (BiB), it is limited to bulk purchasing.

- According to the report by the Wine Institute of America, released in April 2019, almost 1 billiongallons of wine wereproduced in the United States in 2017. The United States isthe highest consumerof wine,with a 15% global share. Thus, the glass packaging segment dominates the wine packaging application.

- Additionally, the beer industry has shown steady growth over the past years. Thegrowing beer industry may possibly show significant development in the glass packaging segment. For instance,in Europe, out of the overall recycling materials, glass captured 22% share in 2017, after paper.

Asia-Pacific Region is Expected to Dominate the Market

- The increasing consumption of beer and spirit drinks in the region has been a significant factor for the growth of the market. WHO has stated that 92% of the alcohol consumers in India prefer spirits over beer and wine. As the players are moving toward sustainable packaging products, the adoption of glass packaging for alcoholic beverages is growing in the region.

- The huge consumer base in the region, reinforced by the presence of highly populated countries, like China and India, increasing disposable incomes, and the growing acceptance of alcohol consumption in developing nations are the major factors driving the growth of the market studied.

- The study by Lancet has stated that per capita alcohol consumption in Southeast Asia and West Pacific increased by 104% and 54%, respectively, from 1990 to 2017. The Asian population represents the median age of 30.7 years, which presents huge potential opportunities for the alcoholic beverages market, thus augmenting the demand for alcoholic beverage packaging.

Alcoholic Beverage Packaging Industry Overview

The availability of several players providingpackagingsolutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies.

- Apr 2019 -Diageo PLCannounced that it will not be using plastic packaging, globally, for its beer brand, Guinness, with a focus on minimizing plastic waste. The company is planning to invest EUR 16 million for this move and for the introduction of 100% recyclable and biodegradable cardboard to replace plastic.

- Mar 2019 - Amcor Limited acquired its rival Bemis CompanyInc. By combining these two market leaders, Amcor aims tocreate a stronger value proposition for shareholders, customers, employees, and the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumption of Alcoholic Beverages

- 4.2.2 Increased Focus on Recycling

- 4.2.3 Rising Demand for Long Shelf Life of the Product

- 4.3 Market Restraints

- 4.3.1 Implementation of Stringent Regulations on Packaging Materials

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Other Materials

- 5.2 By Product

- 5.2.1 Cans

- 5.2.2 Bottles

- 5.2.3 Other Products

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 Unites States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Ball Corporation

- 6.1.3 Krones AG

- 6.1.4 Mondi PLC

- 6.1.5 Crown Holdings Inc.

- 6.1.6 Sidel SA

- 6.1.7 Oi SA

- 6.1.8 Ardagh Group SA

- 6.1.9 Berry Global Inc.

- 6.1.10 Nampak Limited

- 6.1.11 Stora Enso Oyj

- 6.1.12 Gerresheimer AG

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록