|

시장보고서

상품코드

1630183

경질 벌크 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Rigid Bulk Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

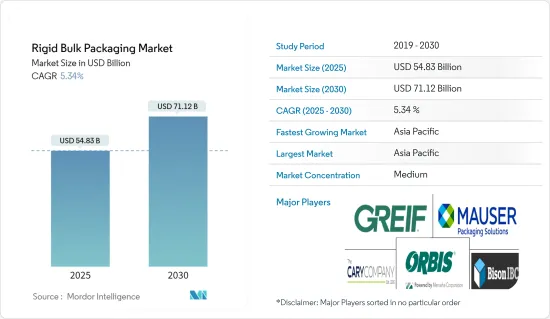

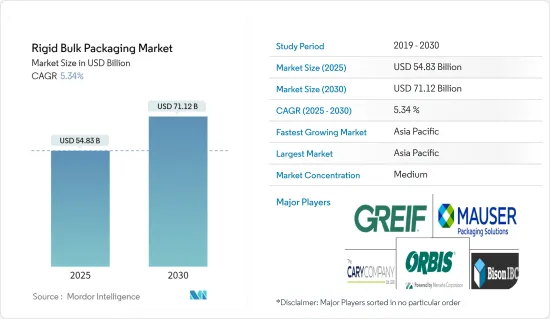

경질 벌크 포장 시장 규모는 2025년 548억 3,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 5.34%의 CAGR로 2030년에는 711억 2,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 지역 간 운송되는 자원과 제품의 양이 지속적으로 증가함에 따라 벌크 포장의 중요성이 가장 크게 증가하고 있습니다. 경질 벌크 포장 시장은 벌크 액체 및 입상 물질을 저장하고 운송하는 솔루션으로 구성됩니다. 여기에는 식품 원료, 용제, 화학제품, 의약품, 대량으로 취급되는 산업 장비 등이 포함됩니다.

- 경질 벌크 포장 시장은 세계 수출입 활동과 밀접한 관련이 있습니다. 중공업은 드럼통과 페트병과 같은 제품에 대한 강한 수요를 보이고 있습니다. 반면 물류 및 단거리 운송은 자재 취급 컨테이너 및 중간 벌크 컨테이너(IBC)에 크게 의존하고 있습니다.

- 다양한 최종사용자 산업에서 화학 및 석유 윤활유에 대한 수요가 증가하고 공급망 역량 강화가 두드러지게 강조되면서 산업용 스틸 드럼에 대한 수요가 급증할 것으로 예상되며, InfralineEnergy의 보고서에 따르면 인도는 이 지역에서 두 번째로 큰 윤활유 소비국이며 세계 미국과 중국에 이어 세계 3위입니다.

- 윤활유는 가공 산업에서 중요한 역할을 하며, 자동차 부품, 특히 브레이크와 엔진의 원활한 작동을 보장하는 자동차 부품에 필수적인 역할을 합니다. 이 시장은 피스톤 엔진용 윤활유 수출입 증가와 자동차 성능에 대한 소비자의 관심 증가로 인해 성장세를 보이고 있습니다. 화학, 광업, 비재래식 에너지와 같은 산업이 산업용 윤활유의 최대 소비자가 될 것으로 예상됩니다. 이러한 추세는 산업용 윤활유에 대한 수요를 강화하고 시장에서 경질 포장의 사용 증가를 시사합니다.

- 플라스틱 오염은 환경 악화에 크게 기여하고 있으며, 많은 연구가 그 해로운 영향을 강조하고 있습니다. 이에 따라 유럽은 다른 여러 국가들과 함께 전 세계적으로 플라스틱 사용량을 줄이기 위한 규제를 제정했습니다. 이러한 세계 입법 조치로 인해 기업들은 산업 포장 분야에서 지속가능하고 재사용 가능한 제품에 초점을 맞춘 기술 혁신을 강요당하고 있습니다.

경질 벌크 포장 시장 동향

산업용 컨테이너 드럼 부문이 큰 비중을 차지할 전망

- 산업용 드럼통은 위험물 및 비위험물 운송 및 보관에 자주 사용됩니다. 화학, 비료, 석유 및 석유 산업에서 가장 일반적으로 사용됩니다. 산업용 드럼통 시장의 성장을 뒷받침하는 요인 중 하나는 지난 10년 동안 이러한 부문의 지속적인 확장과 국제 무역 활동의 활성화입니다.

- 전통적인 파란색 플라스틱 드럼은 저장 시설, 슈퍼마켓, 창고 등에서 친숙합니다. 많은 산업 제품은 파란색 플라스틱 드럼에 적합합니다. 식품용 플라스틱 드럼은 식품을 안전하게 보관하고 운송하는 데 이상적입니다. 또한 식품 사업에 사용되는 플라스틱 드럼은 장기간 소모품을 운송 및 보관하기 전에 적절하게 오염을 제거하고 안전하다는 것이 입증되어야합니다.

- 또한, 이 나라의 농업이 확대되고 있으며, 특히 화학, 식품 곡물 및 비료 분야에서 철강 드럼에 대한 수요가 상당히 증가할 것으로 예상되며, 2024년 4월에 발표된 국제곡물협회(IGC) 보고서에 따르면 세계 곡물 생산량은 2020/2021 회계연도 22억 2700만 톤에서 2023/2024 회계연도 23억 100만 톤으로에서 2023/2024 회계연도에는 23억1천만 톤으로 꾸준히 증가하고 있습니다. 이러한 수요 증가 추세는 예측 기간 동안 지속될 것으로 예상되며, 이는 경질 벌크 포장 용기 및 드럼통에 대한 수요 증가로 이어질 것으로 보입니다.

- 산업용 저장의 가장 일반적인 유형 중 하나는 플라스틱 드럼입니다. 대량의 산업 제품의 장기 보관 및 운송은 여러 가지 기능을 수행하며 많은 이점을 나열합니다. 대부분의 플라스틱 드럼은 파란색이며 HDPE(고밀도 폴리에틸렌)로 만들어집니다. 플라스틱 드럼은 30리터에서 220리터까지 다양한 크기로 제공되며, 대부분 30리터에서 220리터까지 다양합니다.

- 또한 섬유 드럼은 생산성을 높이고 비용을 절감할 수 있기 때문에 화학 및 비료 산업에서 두드러지고 있습니다. 여러 국가 간의 비료 및 화학제품 운송이 확대되면서 다양한 산업용 드럼의 성장이 가속화 될 것으로 예상됩니다.

- 또한 다양한 최종사용자 산업의 화학 및 석유 윤활유에 대한 수요 증가와 공급망 역량 강화에 대한 중요한 초점은 산업용 스틸 드럼의 수요를 촉진할 것으로 예상되며, InfralineEnergy에 따르면 인도는 이 지역에서 두 번째, 전 세계에서 미국과 중국에 이어 세계 3위의 윤활유 소비국입니다.

아시아태평양이 가장 큰 시장 점유율을 차지

- 아시아태평양의 산업 및 제조업이 빠르게 발전하고 있으며 중국, 인도, 인도네시아 등 신흥 경제권으로 제조 기지를 계속 확장하고 있어 경질 벌크 포장의 사용량이 증가할 것으로 예상됩니다. 중국은 섬유 드럼 생산에서 낙관적인 성장세를 보이고 있습니다. 금액 기준으로는 말레이시아, 싱가포르 등 다른 국가를 압도하고 있습니다.

- 현지 기업과 유명 기업의 정교한 제품 포장 솔루션에 대한 관심이 높아짐에 따라 더 높은 품질의 섬유 드럼이 생산되고 있습니다. 소매 산업의 성장과 재활용 가능한 섬유 드럼과 같은 경량 벌크 용기에 대한 선호도가 높아지는 것은 섬유 드럼 시장에 영향을 미치는 주요 요인입니다. 섬유 드럼의 주요 장점은 재활용이 가능하기 때문에 아시아태평양의 경질 벌크 시장 전망은 밝습니다.

- 중국 경제는 높은 성장률을 유지하고 있으며, 이는 20년 이상 소비자 소비와 설비 투자, 산업 생산, 수출입의 지속적인 증가에 의해 자극을 받고 있습니다. 중국의 산업용 포장에 대한 수요는 지난 수십 년 동안 비슷한 추세를 보였습니다. 또한 향후 10년간 생산과 수요 모두 지속적으로 증가할 것으로 예상되며, 이는 중국의 산업용 포장 시장의 성장을 뒷받침할 것으로 예상됩니다.

- Indian Brand Equity Federation에 따르면 인도는 세계 최고의 제네릭 의약품 공급국입니다. 인도 제약 산업은 전 세계 백신 수요의 절반 이상, 미국 제네릭 수요의 40 %, 영국 전체 의약품의 25%를 공급하고 있습니다. 전 세계적으로 인도의 의약품 생산량은 세계 3위, 금액 기준으로는 14위를 차지하고 있습니다. 의약품 산업의 성장과 함께 인도의 의약품 포장 사업도 성장하여 이 지역의 경질 벌크 포장 시장을 주도할 것으로 보입니다.

- 또한 아시아 국가들의 화학 및 관련 산업 수출 증가는 드럼, 컨테이너, 드럼통, 통조림, 페일 캔과 같은 경질 벌크 포장 제품에 대한 수요를 견인하고 있습니다. 인도 중앙은행과 상업정보국(Directorate General of Commercial Intelligence)의 데이터에 따르면, 인도는 2023 회계연도에 2조 4,353억 6,360만 인도 루피(290억 2,000만 달러) 이상의 유기 및 무기 화학제품을 수출했습니다. 이는 지난 회계연도의 2조 1,890억 7,000만 인도 루피(260억 8,000만 달러)에서 증가한 수치입니다. 결과적으로 이러한 화학제품 수출의 급격한 증가는 예측 기간 동안 시장 강화로 이어질 것으로 보입니다.

경질 벌크 포장 산업 개요

경질 벌크 포장 시장은 세분화되어 있으며 Greif Inc., FDL Packaging Group, Mondi PLC, BWAY Corporation과 같은 많은 대기업이 시장에 진입했습니다. 또한 포장 시장의 다른 주요 기업들은 시장에 진입하고 제품을 성장시키기 위해 인수 및 파트너십 전략을 채택하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- 시장 역학

- 시장 성장 촉진요인

- 지속가능하고 재활용 가능한 포장 재료의 출현

- 화학·제약 산업 생산량 증가

- 시장 성장 억제요인

- 환경 규제가 시장 성장 과제

- 시장 성장 촉진요인

제5장 시장 세분화

- 재료별

- 플라스틱

- 금속

- 목재

- 기타

- 제품별

- 산업용 벌크 용기

- 드럼

- 페일

- 박스

- 기타 벌크 용기

- 최종 이용 산업별

- 식품

- 음료

- 산업용

- 제약·화학

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 아시아

- 인도

- 중국

- 일본

- 호주·뉴질랜드

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트

- 남아프리카공화국

- 사우디아라비아

- 북미

제6장 경쟁 구도

- 기업 개요

- ORBIS Corporation

- FDL Packaging Group Ltd

- Bison IBC Ltd

- Wadpack Pvt Ltd

- Greif Inc.

- The Cary Company

- Hoover Container Solutions

- ITP Packaging

- Mauser Packaging Solutions

- Mondi PLC

제7장 투자 분석

제8장 시장 기회와 향후 동향

ksm 25.01.23The Rigid Bulk Packaging Market size is estimated at USD 54.83 billion in 2025, and is expected to reach USD 71.12 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

Key Highlights

- As the volume of resources and products transported across regions continues to rise, the significance of bulk packaging has become paramount. The rigid bulk packaging market comprises solutions for storing and transporting bulk liquids and granulated substances. These include food ingredients, solvents, chemicals, pharmaceuticals, and even industrial equipment, all handled in large quantities.

- The rigid bulk packaging market is closely tied to global import and export activities. Heavy manufacturing industries show a strong demand for products like drums and pails. In contrast, logistics and short-distance transportation of goods heavily rely on materials handling containers and intermediate bulk containers (IBCs).

- With a growing demand for chemicals and petroleum lubricants across diverse end-user industries and a pronounced emphasis on bolstering supply chain capabilities, the need for industrial steel drums is set to surge. As reported by InfralineEnergy, India ranks as the second-largest lubricant consumer in its region and holds the third position globally, trailing only the United States and China.

- Lubricants play a crucial role in processing industries and are vital for automobile parts, especially brakes and engines, ensuring their smooth operation. The market is witnessing growth, fueled by rising imports and exports of piston engine lubricants and an increasing consumer emphasis on vehicle performance. Industries such as chemicals, mining, and unconventional energy are anticipated to be the largest consumers of industrial lubricants. This trend bolsters the demand for industrial lubricants and hints at a heightened use of rigid packaging in the market.

- Plastic pollution has significantly contributed to environmental degradation, with numerous studies highlighting its detrimental effects. In response, European regions, alongside several other nations, have enacted regulations to curb plastic usage globally. These worldwide legislative measures have forced companies to innovate, focusing on sustainable and reusable products in industrial packaging.

Rigid Bulk Packaging Market Trends

The Industrial Containers and Drums Segment is Expected to Hold a Significant Share

- Industrial drums are frequently used for transporting and storing hazardous and non-hazardous commodities. They are most commonly used in the chemical, fertilizer, oil, and petroleum industries. One factor supporting the growth of the industrial drum market is the continued expansion of these segments and rising international trade activities over the past 10 years.

- Traditional blue plastic drums are familiar in storage facilities, supermarkets, and warehouses. Many industrial objects fit in blue plastic drums. Food-grade plastic drums are ideal for securely storing and transporting food. Additionally, plastic drums used in the food business should be properly decontaminated and certified as safe before transporting and storing consumables over an extended period.

- Further, the expanding agricultural industry in the country is anticipated to generate considerable demand for steel drums, particularly in chemicals, food grains, and fertilizer applications within the region. According to the International Grains Council (IGC) report published in April 2024, global grain production has consistently increased from 2,227 million metric tons in FY 2020/2021 to 2,301 million metric tons in FY 2023/2024. This rising demand trend is expected to continue during the forecast period, leading to an increased demand for rigid bulk packaging containers and drums.

- One of the most common types of industrial storage is plastic drums. The long-term storage and transportation of large quantities of industrial commodities serve multiple functions and offer numerous advantages. Most plastic drums are blue and made of HDPE (high-density polyethylene), a robust type of plastic that can be molded easily and lasts for many years. Plastic drums come in a variety of sizes, often ranging from 30 to 220 liters.

- Moreover, fiber drums are becoming more prominent in the chemical and fertilizers industry because they improve productivity and reduce expenses. The expansion of fertilizer and chemical traffic between various countries is predicted to accelerate the growth of different industrial drums.

- Further, the rise in the demand for chemicals and petroleum lubricants from various end-user industries and a significant focus on strengthening the supply chain capability is expected to drive the need for industrial steel drums. According to InfralineEnergy, India is the second-largest lubricant consumer in the region and the third-largest globally, after the United States and China.

Asia-Pacific to Hold the Largest Market Share

- The rapidly evolving industrial and manufacturing industry in Asia-Pacific is expected to increase the usage of rigid bulk packaging as manufacturers continue expanding their manufacturing bases to emerging economies like China, India, and Indonesia. China has shown optimistic growth in the production of fiber drums. In terms of value, it has a strong hold over other countries such as Malaysia and Singapore.

- The rising concerns for sophisticated product packaging solutions by local and renowned players have translated into better quality fiber drums. The growing retail industry and the increasing preference for lightweight bulk containers such as recyclable fiber drums are key factors affecting the fiber drums market. The primary benefit of utilizing fiber drums is their recyclability, leading to a positive outlook for the rigid bulk market in Asia-Pacific.

- The Chinese economy maintains a high speed of growth, which has been stimulated by consecutive increases in consumer consumption and capital investment, industrial output, and import and export for over two decades. The demand for industrial packaging in China has followed a similar trend in the past few decades. Also, both production and demand are expected to continue to grow in the next decade, which is expected to support the growth of the industrial packaging market in the country.

- India is the world's top supplier of generic pharmaceuticals, according to the Indian Brand Equity Federation. The Indian pharmaceutical industry supplies more than half of the global demand for vaccines, 40% of the generic demand in the United States, and 25% of all pharmaceuticals in the United Kingdom. Globally, India ranks third in terms of pharmaceutical production by volume and 14th by value. The country's pharmaceutical packaging business will grow as the pharmaceutical industry grows, driving the rigid bulk packaging market in the region.

- Also, the growth of chemical and allied industry exports from Asian countries is driving the demand for rigid bulk packaging products like drums, containers, drums, and pails. Data from the Reserve Bank of India and the Directorate General of Commercial Intelligence reveal that in fiscal year 2023, India exported organic and inorganic chemicals worth over INR 2435.36 billion (USD 29.02 billion). This marked an uptick from the prior fiscal year's valuation of INR 2189.07 billion (USD 26.08 billion). As a result, this surge in chemical exports is poised to strengthen the market during the forecast period.

Rigid Bulk Packaging Industry Overview

The rigid bulk packaging market is fragmented, with many major players like Greif Inc., FDL Packaging Group, Mondi PLC, and BWAY Corporation. Additionally, the other major players in the packaging market are adopting acquisition and partnership strategies to enter the market and grow offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Dynamics

- 4.4.1 Market Drivers

- 4.4.1.1 Emergence of Sustainable and Recyclable Packaging Materials

- 4.4.1.2 Growing Production Volume of Chemical and Pharmaceutical Industries

- 4.4.2 Market Restraint

- 4.4.2.1 Environmental Legislations Challenge the Market Growth

- 4.4.1 Market Drivers

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Pastic

- 5.1.2 Metal

- 5.1.3 Wood

- 5.1.4 Other Materials

- 5.2 By Product

- 5.2.1 Industrial Bulk Containers

- 5.2.2 Drums

- 5.2.3 Pails

- 5.2.4 Boxes

- 5.2.5 Other Bulk Containers

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Industrial

- 5.3.4 Pharmaceutical and Chemical

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.3 Asia

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ORBIS Corporation

- 6.1.2 FDL Packaging Group Ltd

- 6.1.3 Bison IBC Ltd

- 6.1.4 Wadpack Pvt Ltd

- 6.1.5 Greif Inc.

- 6.1.6 The Cary Company

- 6.1.7 Hoover Container Solutions

- 6.1.8 ITP Packaging

- 6.1.9 Mauser Packaging Solutions

- 6.1.10 Mondi PLC