|

시장보고서

상품코드

1851597

금속 코팅 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Metal Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

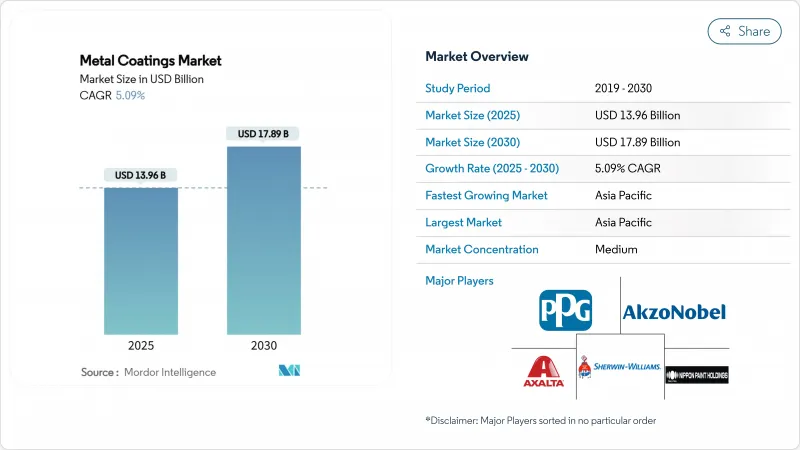

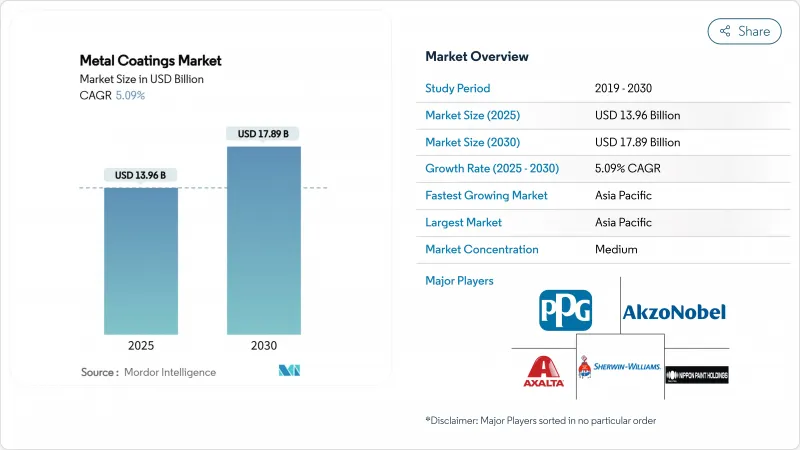

금속 코팅 시장 규모는 2025년에 139억 6,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 5.09%로, 2030년에는 178억 9,000만 달러에 달할 것으로 예상됩니다.

이 궤도는 대기질 규제 강화, 불안정한 원료 가격, 고객 요구의 변화에도 불구하고 이 분야의 탄력성을 돋보이게 합니다. 북미, 유럽, 아시아태평양의 규제기관은 휘발성 유기화합물(VOC)의 역치를 낮추고 급속한 재제조를 촉구하고 있지만, 수계 및 에너지 경화형 시스템에도 기회를 주고 있습니다. 선진국 경제의 인프라 갱신, 수송 차량의 전기화, 해상 풍력 발전 설비의 급증과 연동해 수요가 확대됩니다. 기술 공급업체는 하이브리드 경화 케미스트리, 자가 복구 바인더 및 디지털 공정 제어를 통해 이러한 요구를 충족시켜 성능과 지속가능성을 모두 향상시킬 것을 약속합니다.

세계의 금속 코팅 시장 동향과 인사이트

엄격한 휘발성 유기 화합물(VOC) 규제가 수계 기술을 뒷받침

새로운 대기질 기준으로 용제형에서 수성형으로의 구조 전환이 가속화되고 있습니다. 미국 환경보호청은 2025년 1월에 에어로졸 페인트의 휘발성 유기화합물(VOC) 배출 기준을 개정하고 보다 엄격한 규제치를 유지하면서 2027년 1월까지 준수를 연장했습니다. 캘리포니아주 사우스코스트 대기질 관리지구는 2025년 5월에 자동차 재도장에 관한 규칙 1151의 규제치를 강화하고, 업계 관계자는 유사한 규제치가 인접한 부문에 연쇄적으로 적용될 것으로 예상하고 있습니다. 캐나다에서는 2025년 1월에 130개 제품 카테고리에서 휘발성 유기 화합물(VOC) 농도 규제가 시행되어 이 동향의 확산을 보여주고 있습니다. 이러한 규정은 성숙한 수성 플랫폼과 확장 가능한 생산 자산을 보유한 공급업체에게 보상됩니다. 수계 시스템은 현재, 실내나 경산업 용도의 대부분으로 용제계에 필적하는 성능을 발휘하고 있지만, 그래도 도포시에는 면밀한 표면 처리와 보다 엄격한 습도 관리가 필요합니다.

선진국의 인프라 갱신 증가

북미와 유럽에서는 교량, 항만 및 에너지 인프라의 대규모 리노베이션이 고성능 보호 페인트 수요를 지원합니다. 미국의 해상풍력발전개발 파이프라인은 2025년 초에 52GW를 넘어, 주정책은 2030년까지 112GW를 목표로 하고 있으며, 25-30년 방청 도장 시스템의 보급을 촉진하고 있습니다. 건조막 두께 660µm의 에폭시·폴리우레탄 3코트 방식은 15년 이상의 필드 서비스를 제공해, 강제 모노파일이나 트랜지션 피스의 디팩트 사양이 되고 있습니다. 인프라 소유자는 점점 더 예보 유지 보수 도구를 선호하고 있으며 열화를 알릴 수있는 스마트 코팅이 시험적으로 도입되고 있습니다.

불안정한 원료 가격

알루미늄, 구리 및 아연의 가격이 녹색 에너지 수요와 지정 긴장으로 인해 멈추기 때문에 금속 코팅 제조업체는 마진 압축에 직면하고 있습니다. 세계은행은 베이스메탈의 평균 가격이 2025년까지 2019-2021년 수준을 초과할 것으로 예측했습니다. 많은 제형에서 가장 큰 비용 항목인 이산화티타늄은 중국의 생산 능력이 2025년에 700만 톤으로 상승하고 안료 마진에 압력을 가하는 동시에 구매자에게 품질 일관성에 대한 우려를 가져옵니다. 유럽의 에너지 집약형 제련소는 2024년 생산량을 억제해 공급 리스크를 높여 컨버터에 재고 정책의 조정을 다가섰습니다.

부문 분석

에폭시 수지는 해양 및 중산업 용도에서 비교할 수 없는 접착성과 내약품성을 강점으로 2024년 매출에서 39.17%의 최대 점유율을 차지했습니다. 이 부문은 장벽 특성을 향상시키는 나노 스케일 충전재 및 자외선 안정성을 향상시키는 양자점 광중합 개시제와 같은 기술 혁신의 혜택을 계속 받고 있습니다. 동시에 아크릴, 불소수지, 실록산 하이브리드로 구성된 특수한 “기타 수지”는 건축업자, 자동차 제조업체, 재생에너지 사업자가 셀프 클리닝성, 소빙성, 방열성 등의 특주 기능을 요구하고 있기 때문에 CAGR 6.85%로 가장 급성장하고 있는 카테고리입니다. 또한, 식물성 기름과 조류 바이오매스 유래의 바이오 베이스 수지 화학물질도, 건축용 탑 코트나 가전제품의 마무리에 파일럿 규모로 채용되고 있습니다. 이러한 추세는 에폭시 수지의 핵심 역할을 강화하는 동시에 지속가능성을 희생하지 않고 목표로 하는 성능을 요구하는 최종 사용자의 선택을 확대하고 있습니다.

폴리우레탄 수지가 자동차용 플라스틱 분야를 개척하고 폴리에스테르가 건축용 외관에서 비용 리더십을 유지함에 따라 수지 경쟁 구도이 다양해지고 있습니다. 고급 경화제 공급업체는 근적외선으로 활성화되는 티올루 에폭시 네트워크를 추진하고 2.5cm보다 두꺼운 필름으로 90% 이상의 전화율을 달성하여 중장비의 리파인에 문을 열고 있습니다. 이와 병행하여, 폴리아스파르트산계는 교량과 주차장 구조물의 재이용을 촉진합니다. 이러한 시장 개척은 수지 카테고리가 전통적인 벌크 볼륨과 프리미엄 틈새 솔루션을 통해 부가가치를 획득할 수 있게 해주며, 금속 코팅 시장 전체의 균형 잡힌 성장 전망을 지원합니다.

금속 코팅 시장 보고서는 수지 유형(에폭시, 폴리에스테르, 폴리우레탄, 기타 수지 유형), 기술(수성, 용제성, 분말 등), 용도(건축, 자동차, 해양, 보호, 일반 산업, 기타 용도), 지역(아시아태평양, 북미, 유럽, 남미, 중동, 아프리카)으로 분류하고 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

아시아태평양은 2024년에 46.92%의 매출에서 선두를 유지했고 2030년까지 6.36%의 연평균 복합 성장률(CAGR)로 전진할 것으로 예측됩니다. 중국은 2023년 철강 수출을 36.2% 증가시키기로 결정하고 국내 수요 수준이 변동하더라도 화성 처리 및 코일 코팅의 국내 소비를 유지했습니다. 2047년까지 제철 능력을 3배의 5억 톤으로 끌어올리는 인도의 로드맵은 다운스트림에서 큰 비즈니스 기회의 지지가 됩니다. 이 나라는 이미 탄소 집약도를 조강 1톤당 2.25톤 CO2까지 삭감하는 것을 목표로 하고 있으며, 고고형분과 수용성 처방의 채용에 인센티브를 주고 있습니다. 지역의 이산화티탄 생산 능력은 700만 톤에 육박해 중국과 일본 제조업체의 수직 통합을 지원하지만 동시에 품질 경쟁도 격화하고 있습니다. 인도네시아에서는 법률에 따른 납의 단계적 사용 금지와 VOC 규제의 실시로 2030년까지 페인트 가격이 42억 4,000만 달러에 달할 것으로 예상되고 있습니다.

북미는 인프라와 운송 분야에서 견조한 수요 기반을 유지하고 있습니다. 미국은 2030년까지 112GW의 해상풍력발전의 설치를 목표로 하고 있으며, 스플래시가 걸리는 환경하에서 25년의 수명을 보증하는 유리플레이크 에폭시나 선진 프라이머의 조달을 촉진하고 있습니다. EV의 국내 생산에 대한 연방 및 주 정부의 우대 조치는 수십억 달러 규모의 자본 계획을 실현하여 저 베이크형 음극 전해 페인트와 절연 배터리 팩 코팅의 수주로 이어지고 있습니다. 멕시코의 니어쇼어링 허브로서의 대두는 악조노벨에 누에보 레온의 코일 라인을 2024년에 35% 확장하는 것을 촉구해 자동차 생산 대수의 지속적인 증가에 대한 기대를 나타냈습니다.

유럽은 높은 에너지 비용과 엄격한 지속가능성 의무와 균형을 이룹니다. BASF가 현재 진행중인 68억 달러의 코팅 부문의 전략적 검토는 에너지 변동이 포트폴리오 결정에 어떻게 영향을 미치는지를 보여줍니다. 한편, 헨펠의 2024년 매출은 21억 8,500만 유로이며, 프리미엄 해양·보호 기술에 의한 회복력을 뒷받침했습니다. 북해의 해상 풍력 발전은 3 코트의 에폭시 폴리 우레탄 사양이 골드 표준이되어 초 내구성 시스템의 유력한 공급원이되고 있습니다. 항공우주산업의 프라임과 탑코트는 유럽항공안전청의 요구를 충족시키기 위해 크롬이 없는 대체품으로 전환하고 있습니다. 서큘러 이코노미(순환형 경제) 정책에 의해 바이오 유래 수지나 리사이클 가능한 패키징의 연구 개발이 추진되어, 향후 코팅 과학의 중심지로서의 유럽의 역할이 강화되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 엄격한 휘발성 유기 화합물(VOC) 규제가 수성 기술을 뒷받침

- 선진국의 인프라 갱신 증가

- 확대하는 자동차 생산 대수

- 전자 차량용 배터리 인클로저용 코일 코팅 알루미늄의 급증

- 고성능 방청 시스템이 요구되는 해상 풍력 발전 설비

- 시장 성장 억제요인

- 불안정한 원료 가격

- 신흥국에서의 용매계 휘발성 유기 화합물(VOC) 규제 준수 비용

- 엄격한 운용 환경에 따른 과제

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 수지 유형별

- 에폭시

- 폴리에스테르

- 폴리우레탄

- 기타 수지 유형(아크릴, 불소 수지 등)

- 기술별

- 수성

- 용제계

- 분체

- 자외선(UV) 경화형

- LED 경화형

- 용도별

- 건축

- 자동차

- 선박

- 보호

- 일반 산업

- 기타 용도(재생에너지 등)

- 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 태국

- 말레이시아

- 필리핀

- 베트남

- 싱가포르

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 튀르키예

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 이집트

- 카타르

- 나이지리아

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/랭킹 분석

- 기업 프로파일

- AkzoNobel NV

- Axalta Coating Systems LLC

- BASF

- Beckers Group

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- Shalimar Paints Ltd

- Socomore

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

제7장 시장 기회와 향후 전망

KTH 25.11.24The Metal Coatings Market size is estimated at USD 13.96 billion in 2025, and is expected to reach USD 17.89 billion by 2030, at a CAGR of 5.09% during the forecast period (2025-2030).

This trajectory highlights the sector's resilience despite tighter air-quality rules, volatile feedstock prices, and shifting customer requirements. Regulatory bodies in North America, Europe, and Asia-Pacific are enforcing lower volatile-organic-compound (VOC) thresholds, prompting rapid reformulation but also opening opportunities for water-borne and energy-curable systems. Demand expands in tandem with infrastructure renewal in developed economies, electrification of transport fleets, and a surge in offshore wind power installations. Technology suppliers are meeting these needs with hybrid curing chemistries, self-healing binders, and digital process controls that promise both performance and sustainability gains.

Global Metal Coatings Market Trends and Insights

Stringent Volatile Organic Compound (VOC) Regulations Boosting Water-Borne Technologies

New air-quality standards are accelerating a structural shift from solvent-borne to water-borne formulations. The United States Environmental Protection Agency amended National Volatile Organic Compound (VOC) Emission Standards for aerosol coatings in January 2025 and retained stricter limits while extending compliance to January 2027, giving producers a finite window to transition . California's South Coast Air Quality Management District tightened Rule 1151 limits for automotive refinishes in May 2025, and industry observers expect similar caps to cascade into adjacent segments. Canada enforced Volatile Organic Compound (VOC) concentration limits across 130 product categories in January 2025, illustrating the breadth of the trend. These mandates reward suppliers that possess mature water-borne platforms and scalable production assets. Although water-borne systems now rival solvent-borne performance in many indoor and light-industrial uses, they still require meticulous surface preparation and more stringent humidity control during application.

Rising Infrastructure Renewal in Developed Economies

Large-scale refurbishment of bridges, ports, and energy infrastructure sustains demand for high-performance protective coatings across North America and Europe. The United States offshore-wind development pipeline surpassed 52 GW in early 2025, and state policies target 112 GW by 2030, driving uptake of 25-30 year anti-corrosion paint systems. Three-coat epoxy-polyurethane schemes with 660 µm dry-film thickness have delivered 15+ year field service, becoming de-facto specifications for steel monopiles and transition pieces. Infrastructure owners increasingly favor predictive-maintenance tools, and smart coatings able to signal degradation are entering pilot deployment.

Volatile Feedstock Prices

Metal-coating producers face margin compression as aluminum, copper, and zinc prices remain elevated due to green-energy demand and geopolitical tensions. The World Bank projects base-metal average prices to stay above the 2019-2021 levels through 2025 . Titanium dioxide, the largest single cost item in many formulations, saw Chinese capacity climb toward 7 million tons in 2025, exerting downward pressure on pigment margins while introducing quality-consistency concerns for buyers. Energy-intensive smelters in Europe curtailed output during 2024, adding supply risk and forcing converters to adjust inventory policies.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Automotive Production Volume

- Offshore Wind Installations Demanding High-Performance Anti-Corrosion Systems

- Compliance Cost of Solvent-Borne Volatile Organic Compound (VOC) Limits in Emerging Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy resins generated the largest share of 2024 revenue at 39.17% on the strength of unmatched adhesion and chemical resistance in marine and heavy-industrial service. The segment continues to benefit from innovations such as nanoscale fillers that improve barrier properties, while quantum-dot photoinitiators extend ultraviolet stability. At the same time, specialty "other resins" comprising acrylic, fluoropolymer, and siloxane hybrids are the fastest-growing category at 6.85% CAGR as builders, automakers, and renewable-energy operators demand tailored features such as self-cleaning, ice-phobic, and heat-dissipation attributes. Bio-based resin chemistries derived from plant oils and algal biomass are also gaining pilot-scale adoption in architectural topcoats and appliance finishes. Combined, these trends reinforce epoxy's central role while widening the choice set for end users seeking targeted performance without sacrificing sustainability.

The competitive landscape for resins is diversifying as polyurethane chemistries carve out space in automotive plastics and polyester maintains cost leadership in building facades. Suppliers of advanced curing agents promote thiol-epoxy networks activated by near-infrared light, achieving over 90% conversion in films thicker than 2.5 cm and opening doors for heavy-equipment refinish. In parallel, polyaspartic systems allow accelerated return-to-service for bridges and parking structures. These developments position the resin category to capture incremental value through both traditional bulk volumes and premium niche solutions, underpinning a balanced growth outlook for the overall metal coatings market.

The Metal Coatings Market Report is Segmented Into by Resin Type (Epoxy, Polyester, Polyurethane, Other Resin Types), Technology (Water-Borne, Solvent-Borne, Powder, and More), Application (Architectural, Automotive, Marine, Protective, General Industrial, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 46.92% revenue in 2024 and is projected to advance at 6.36% CAGR through 2030. China's decision to raise steel exports by 36.2% during 2023 sustains local consumption of conversion and coil coatings even as domestic demand levels fluctuate. India's roadmap to triple steel-making capacity to 500 million tons by 2047 underpins vast downstream opportunities; the country already targets a reduction of carbon-intensity to 2.25 tons CO2 per ton of crude steel, incentivizing adoption of high-solid and water-borne formulations. Regional titanium-dioxide capacity nears 7 million tons, supporting vertical integration for Chinese and Japanese producers but also sharpening quality competition. Indonesia illustrates the broader arc: its coatings value is set to reach USD 4.24 billion by 2030 as legislation phases out lead and institutes VOC fees.

North America maintains a solid demand base across infrastructure and transportation. The United States aims for 112 GW of installed offshore wind by 2030, driving procurement of glass-flake epoxies and advanced primers that guarantee 25-year lifetimes in splash-zone environments. Federal and state incentives for domestic EV production have unlocked multi-billion-dollar capital programs, translating to orders for low-bake cathodic electrocoats and insulating battery-pack coatings. Mexico's emergence as a near-shoring hub spurred AkzoNobel to expand coil lines in Nuevo Leon by 35% capacity in 2024, signaling expectations of sustained automotive output growth.

Europe balances high energy costs with stringent sustainability mandates. BASF's ongoing strategic review of its USD 6.8 billion coatings division shows how energy volatility influences portfolio decisions. Meanwhile, Hempel's EUR 2,185 million revenues in 2024 underscore the resilience afforded by premium marine and protective technologies. Offshore wind in the North Sea remains a powerhouse for ultra-durable systems, with three-coat epoxy-polyurethane specifications serving as the gold standard. Aerospace primes and topcoats migrate to chrome-free alternatives to satisfy European Aviation Safety Agency requirements. Circular-economy policies drive R&D on bio-derived resins and recyclable packaging, reinforcing Europe's role as a crucible for future coating science.

- AkzoNobel N.V.

- Axalta Coating Systems LLC

- BASF

- Beckers Group

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- Shalimar Paints Ltd

- Socomore

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Volatile Organic Compound (VOC) Regulations Boosting Water-Borne Technologies

- 4.2.2 Rising Infrastructure Renewal in Developed Economies

- 4.2.3 Expanding Automotive Production Volume

- 4.2.4 Surge in Coil-Coated Aluminium for Electronic Vehicle Battery Enclosures

- 4.2.5 Offshore Wind Installations Demanding High-Performance Anti-Corrosion Systems

- 4.3 Market Restraints

- 4.3.1 Volatile Feedstock Prices

- 4.3.2 Compliance Cost of Solvent-Borne Volatile Organic Compound (VOC) Limits in Emerging Nations

- 4.3.3 Challenges Associated with Harsh Operational Environment

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Polyurethane

- 5.1.4 Other Resin Types (Acrylic, Fluoropolymer, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder

- 5.2.4 Ultraviolet (UV)-Cured

- 5.2.5 Light Emitting Diode (LED) Curing

- 5.3 By Application

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Protective

- 5.3.5 General Industrial

- 5.3.6 Other Applications (Renewable Energy, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Philippines

- 5.4.1.8 Vietnam

- 5.4.1.9 Singapore

- 5.4.1.10 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Turkey

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Axalta Coating Systems LLC

- 6.4.3 BASF

- 6.4.4 Beckers Group

- 6.4.5 Chugoku Marine Paints, Ltd.

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co.,Ltd.

- 6.4.9 Nippon Paint Holdings Co. Ltd

- 6.4.10 PPG Industries Inc.

- 6.4.11 Shalimar Paints Ltd

- 6.4.12 Socomore

- 6.4.13 Teknos Group

- 6.4.14 The Sherwin-Williams Company

- 6.4.15 TIGER Coatings GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Biodegradable Metal Coatings