|

시장보고서

상품코드

1850287

스파크 플라즈마 소결 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Spark Plasma Sintering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

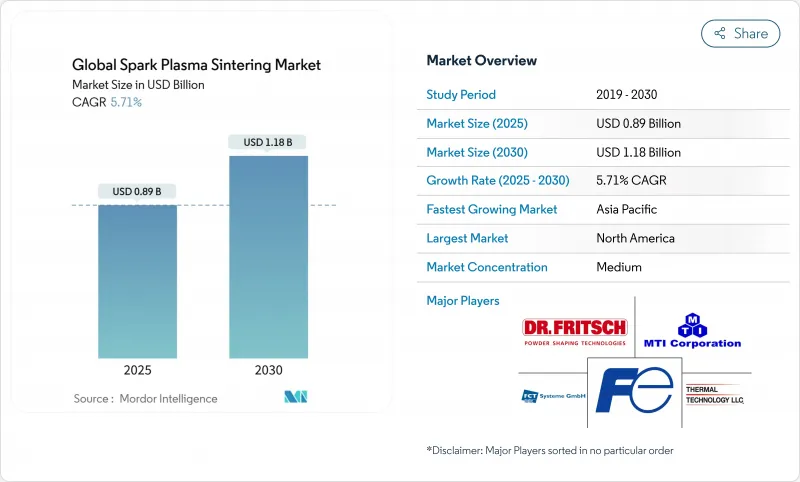

스파크 플라즈마 소결 시장 규모는 2025년 8억 9,000만 달러로 추정되고, 2030년에는 11억 8,000만 달러에 이를 것으로 예측되며, CAGR 5.71%로 성장할 전망입니다.

급속 가열 소결 물리학과 엣지 대응 센서, 온보드 AI 칩, 프로세스 파라미터를 지속적으로 개량하는 컨텍스트 스튜어얼 애널리틱스를 조합한 제조업체가 수요를 촉진하고 있습니다. 반도체의 백엔드 패키징, 정밀 가전, 전동화 차량 부품의 채용이 확대되고 있는 것은 이 기술이 얼마나 엄격한 공차, 스크랩의 저감, 생산 사이클의 단축을 서포트하고 있는지를 뒷받침하고 있습니다. 디바이스 벤더는 현재 예측 알고리즘을 로컬로 실행하는 신경 처리 유닛을 통합하고 있으며 5G 링크는 흩어져 있는 라인을 통합 제어 허브에 연결합니다. 동시에 노동력 부족이 공장 자동화를 추진하는 가운데 국산 칩 제조와 클린 테크놀로지 소재에 대한 정부의 우대조치에 의해 신규 설비로의 자본 유입이 계속되고 있습니다.

세계의 스파크 플라즈마 소결 시장 동향 및 인사이트

통합형 IoT 제품의 상승

제조업체는 현재 다이셋 내부에 소형 열전대, 압력 셀 및 고밀도 센서를 직접 통합하여 가열 램프와 홀드 시간을 분석하는 에지 게이트웨이에 밀리초 단위의 데이터를 공급하고 있습니다. 이 폐쇄 루프 피드백을 통해 사람의 손 없이 에너지 사용을 줄이고 부품 밀도를 높일 수 있습니다. 센서의 이력을 기반으로 구축된 예지 보전 모델은 고장 몇 시간 전에 전극의 이상 마모와 같은 이상을 감지하여 예정되지 않은 다운타임을 방지합니다. 센서 모듈에 칩 레벨 암호화를 널리 도입함으로써 생산 네트워크를 외부 분석 엔진에 개방하는 것에 대한 IT 우려가 완화됩니다. Manufacturing Institute에 따르면 대부분의 경영진은 IoT를 경쟁력의 핵심 기둥으로 간주하고 있으며, 엣지 컴퓨팅은 현재 이러한 장치가 로컬로 데이터를 분석하고 실시간 제어 대기 시간을 줄일 수 있습니다.

모바일 앱 및 엣지 앱에서 AI 통합

경량 비전 모델을 실행하는 태블릿 대시보드는 광학 비교기에서 벗어난 마이크로 균열을 위해 소결 부품을 스캔하고 음성 구동 어시스턴트는 라이브 고밀도 곡선을 기반으로 온도 오프셋을 제안합니다. 컨트롤러의 AI 에이전트는 저항이 급증하자마자 펄스 폭과 압력을 자율적으로 미세 조정하여 균일한 결정립 성장을 유지합니다. 추론은 NPU에서 이루어지기 때문에 클라우드 링크가 낮아지더라도 원격 위치의 플랜트는 완벽한 기능을 유지합니다. LTIMindtree는 제조업체가 문서화와 디자인 반복을 모두 관리하는 에이전트 AI로 축발을 옮겨 엔지니어가 새로운 재료 레시피를 몇 주가 아닌 몇 시간 내에 반복할 수 있도록 한다는 것을 관찰합니다.

계산의 복잡성

임베디드 GPU에서 실행되는 실시간 유한 요소 솔버와 적응형 컨트롤러는 기존 PLC를 훨씬 초과하는 처리 부담을 초래합니다. 중견 기업의 대부분은 튜닝 알고리즘을 실행하는 컨테이너화된 마이크로서비스를 오케스트레이션하는 IT 인력이 부족하여 관리 엣지 프로바이더에 아웃소싱할 수밖에 없습니다. NetSuite는 이 기술 격차를 가장 중요한 과제로 삼고 있으며, 기업은 처음부터 코딩하지 않고 머신 데이터를 활용하기 위해 ERP 스택을 현대화하고 있습니다. 턴키 플랫폼이 성숙할 때까지 복잡성은 채택 속도를 억제합니다.

부문 분석

컨텍스츄얼 분석 엔진이 다변량 센서 스트림을 해석하고 에너지 효율이 우수한 레시피를 처방했기 때문에, 2024년 매출의 46%를 소프트웨어가 획득했습니다. 스파크 플라즈마 소결 시장은 플래그쉽 퍼니스를 MES 및 ERP 스위트와 연결하고 로트 추적을 동기화하는 미들웨어에 의존합니다. AI 칩/NPU는 피드백 루프를 50밀리초 이하로 억제하는 엣지 추론 수요를 반영하여 CAGR 23.4%로 성장할 전망입니다. 하드웨어 센서는 새로운 퍼니스가 고밀도 계측 풋 프린트를 탑재하여 출하되기 때문에 계속 확대되고 있습니다. 관리 서비스 팀이 구독 기반 모니터링을 제공함으로써 소규모 공장은 전문가를 고용하지 않고 데이터 사이언스의 혜택을 누릴 수 있습니다. 생성형 AI 모듈은 프로세스 조정을 문서화하고 품질 보고서를 자동으로 입력하여 소프트웨어의 가치 제안을 더욱 확대합니다.

둘째, 서비스는 통합, 교육 및 수명주기 지원을 통해 기여합니다. 제품 유형은 합금 유형을 기반으로 하는 챔버 열역학을 반영하는 디지털 트윈 템플릿을 번들하여 제품을 시작할 때 시험 사이클을 단축합니다. 엔지니어가 공유 라이브러리에서 모범 사례 소결 곡선을 가져오면 한 번 걸린 프로젝트가 이제 몇 주 만에 끝납니다. 이러한 집합적인 학습은 소프트웨어의 채용에 기세를 주고 정기적인 업그레이드에 의해 이상 세분화 및 음성 대시보드 등의 기능이 추가됩니다.

장비 제조업체는 내장 분석 기능을 미리 탑재한 턴키 인쇄기를 출하하여 2024년 37.2%의 점유율을 획득했습니다. 펄스 발생 및 전극 마모 패턴에 대한 전문 지식을 통해 기계 설계 및 컴퓨팅 모듈의 융합이 가능합니다. 스파크 플라즈마 소결 시장에서는 현재 이러한 OEM이 센서 제조업체 및 클라우드 벤더와 제휴하여 시운전 시간을 단축하는 엔드 투 엔드 스택을 구축하고 있습니다. 한편, 온라인 및 웹 벤더는 레시피 리포지토리를 호스팅하고 유휴로의 능력을 중개함으로써 연간 21.1%의 성장을 이루고 있습니다.

모바일 네트워크 사업자는 컨소시엄에 참여하여 분산된 캠퍼스 간의 가열파 동기화에 필요한 10ms 이하의 대기 시간 서비스 수준 계약을 보장합니다. 벤더는 오픈 API를 공개함으로써 타사 앱이 실시간 데이터 스트림을 호출할 수 있도록 하고, 전극 수명 예측이나 진공 씰 진단 등 틈새 작업을 위한 마이크로서비스 마켓플레이스에 박차를 가하고 있습니다.

스파크 플라즈마 소결 시장은 컴포넌트별(하드웨어, 소프트웨어, 서비스), 벤더별(디바이스 제조업체, 모바일 네트워크 오퍼레이터 등), 컨텍스트별(컴퓨팅 컨텍스트, 사용자 컨텍스트), 네트워크별(무선 셀룰러, WLAN/Wi-Fi, PAN/BLE), 최종 사용자 산업별(은행, 금융서비스 및 보험(BFSI), 소비자 일렉트로닉스 등), 지역별로 분류됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

북미는 성숙한 반도체 생태계, 강력한 산학 연계, CHIPS법의 390억 달러의 기금과 같은 연방 정부의 인센티브로 2024년 매출의 34%를 차지했습니다. 애리조나, 텍사스, 뉴욕의 공장이 후공정의 패키징 라인을 확장하고 금속과 세라믹의 인터포저를 접합할 수 있는 펄스 전류 프레스 수요가 지속되고 있습니다. 캐나다의 저탄소 산업에 대한 노력은 소결의 사이클 타임 단축과 에너지 실적의 감소와 밀접한 관련이 있습니다. 멕시코의 전자 장비 조립 부문은 소결 피드 스루와 히트 스프레더를 국내에서 조달하고 OEM 공급망을 단축하고 있습니다.

아시아태평양은 중국의 제조 자동화 추진, 일본 분말 야금의 전통, 한국의 메모리 칩 생산 능력 경쟁에 견인되어 CAGR 18.5%로 성장할 기세입니다. 국가가 지원하는 펀드는 차세대 소결을 번들하는 스마트 공장 개보수에 수십억 달러를 투입하고 있습니다. 인도의 일렉트로닉스용 생산 연동 인센티브 제도는 파워 디바이스용 고속 사이클 소결을 포함한 그린필드 공장에 박차를 가합니다. 대만의 OSAT 기업이 첨단 기판을 생산하기 위한 새로운 프레스를 도입하여 지역 리더십을 강화합니다.

유럽은 지속가능성과 노동자의 안전성을 강조하고, 오프가스를 회수하여 미립자 물질의 배출을 최소화하는 폐쇄 루프로를 장려하고 있습니다. 독일 인더스트리 4.0 프레임워크는 오픈 OPC-UA 인터페이스를 갖춘 커넥티드 프레스 기계의 채택을 가속화하고 있습니다. 프랑스에서는 경량 항공우주 브라켓에, 이탈리아에서는 초합금 터빈 디스크에 이 기술이 이용되고 있습니다. 중동 및 아프리카에서 사우디아라비아와 아랍에미리트(UAE)의 신흥 공업 단지는 적층 조형 공구에 소결을 채택하고 남아프리카는 광업 마모 부품의 현지 생산을 모색하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 통합 IoT 제품의 주류화

- 모바일 및 엣지 앱에 AI의 주류 통합

- 5G 대응 스마트 디바이스의 보급

- 소매 미디어에서 눈에 띄지 않는 컨텍스트 광고 ROI가 급상승

- 차재 감정 센싱에 대한 OEM의 잠재적 수요

- Industry 4.0 라인의 OT와 사이버의 숨겨진 융합

- 시장 성장 억제요인

- 주류의 계산 복잡성

- 주류 데이터 프라이버시 규제 강화

- 눈에 띄지 않는 엣지 AI 실리콘 공급의 병목

- 눈에 띄지 않는 컨텍스트 드리프트가 ML 모델의 정밀도 저하

- 밸류체인 및 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력 및 소비자

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 컴포넌트별

- 하드웨어

- 센서와 MCU

- AI칩 및 NPU

- 소프트웨어

- SDK 및 미들웨어

- 컨텍스트 분석 플랫폼

- 서비스

- 매니지드 엣지 서비스

- 전문 서비스

- 하드웨어

- 벤더 유형별

- 디바이스 제조업체

- 모바일 네트워크 사업자

- 온라인, 웹, 소셜 네트워킹 벤더

- 네트워크 유형별

- 무선 셀룰러

- 무선 LAN/Wi-Fi

- PAN/BLE

- 최종 사용자 업계별

- BFSI

- 가전

- 미디어 및 엔터테인먼트

- 자동차

- 헬스케어

- 통신

- 물류 및 수송

- 기타 산업

- 컨텍스트 유형별

- 컴퓨팅 컨텍스트

- 사용자 컨텍스트

- 물리적 컨텍스트

- 시간적 컨텍스트

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd

- Intel Corporation

- Apple Inc.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Huawei Technologies Co. Ltd

- Baidu Inc.

- Infosys Ltd.

- Ericsson AB

- Telefonica, SA

- Bosch Sensortec GmbH

- STMicroelectronics NV

- Arm Ltd.

제7장 시장 기회 및 향후 전망

AJY 25.11.07The spark plasma sintering market size is estimated at USD 0.89 billion in 2025 and is projected to reach USD 1.18 billion by 2030, registering a 5.71% CAGR.

Demand is fuelled by manufacturers combining rapid-heating sintering physics with edge-ready sensors, on-board AI chips, and contextual analytics that continually refine process parameters. Wider adoption in semiconductor back-end packaging, precision consumer electronics, and electrified vehicle components underscores how the technology supports tighter tolerances, lower scrap, and shorter production cycles. Equipment vendors now embed neural processing units that run predictive algorithms locally, while 5G links tie scattered lines into unified control hubs. At the same time, government incentives for domestic chip fabrication and clean-tech materials keep capital flowing into new installations, even as labour shortages push factories toward deeper automation.

Global Spark Plasma Sintering Market Trends and Insights

Rise in Integrated IoT Offerings

Manufacturers now embed miniature thermocouples, pressure cells, and densification sensors directly inside die sets, feeding millisecond data into edge gateways that analyse heating ramps and hold times. This closed-loop feedback lowers energy use and improves part density without human intervention. Predictive maintenance models built on sensor history flag anomalies, such as abnormal electrode wear hours before failure, avoid unplanned downtime. Wider deployment of chip-level encryption within sensor modules eases IT concerns about opening production networks to external analytics engines. The Manufacturing Institute reports that most executives see IoT as a core pillar of competitiveness, and edge computing now lets those devices crunch data locally, cutting latency for real-time control.

Integration of AI in Mobile and Edge Apps

Tablet dashboards running lightweight vision models scan sintered parts for micro-cracks that escape optical comparators, while voice-driven assistants suggest temperature offsets based on live densification curves. AI agents inside controllers autonomously fine-tune pulse width and pressure as soon as resistance spikes, maintaining uniform grain growth. Because inference happens on-board NPUs, remote plants keep full functionality even if cloud links drop. LTIMindtree observes manufacturers pivoting toward agentic AI that governs both documentation and design iterations, letting engineers iterate new material recipes in hours rather than weeks.

Computational Complexities

Real-time finite-element solvers and adaptive controllers running on embedded GPUs elevate the processing burden well beyond classic PLCs. Many midsized job shops lack the IT talent to orchestrate containerized microservices that run tuning algorithms, forcing them to outsource to managed edge providers. NetSuite identifies this skills gap as a top challenge, with firms modernizing ERP stacks to harness machine data without coding from scratch. Until turnkey platforms mature, complexity tempers adoption speed.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of 5G-Enabled Smart Devices

- Contextual-Ads ROI Surge in Retail Media

- OEM Demand for In-Vehicle Emotion Sensing

- OT-Cyber Convergence in Industry 4.0 Lines

- Data-Privacy Regulations Tightening

- Edge-AI Silicon Supply Bottlenecks

- Context Drift Undermining ML Model Accuracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software captured 46% of 2024 revenue because contextual analytics engines interpret multivariate sensor streams and prescribe energy-efficient recipes. The spark plasma sintering market relies on middleware to connect flagship furnaces with MES and ERP suites, allowing synchronized lot tracking. AI chips/NPUs are slated to grow at a 23.4% CAGR, reflecting demand for edge inference that keeps feedback loops under 50 milliseconds. Hardware sensors continue to expand because each new furnace ships with denser instrumentation footprints. Managed services teams offer subscription-based monitoring so smaller plants can benefit from data science without hiring specialists. Generative AI modules document process adjustments and auto-populate quality reports, further widening the software's value proposition.

Secondarily, services contribute through integration, training, and lifecycle support. Providers bundle digital twin templates that mirror chamber thermodynamics based on alloy type, reducing trial cycles during product launch. Projects that once ran for months now close in weeks as engineers import best-practice sintering curves from shared libraries. This collective learning adds momentum to software adoption, ensuring recurring upgrades add features such as anomaly segmentation and voice-activated dashboards.

Device manufacturers held 37.2% share in 2024 by shipping turnkey presses pre-loaded with embedded analytics. Their expertise in pulse generation and electrode wear patterns positions them to fuse mechanical design with compute modules. The spark plasma sintering market now sees these OEMs partnering with sensor fabricators and cloud vendors, creating end-to-end stacks that shorten commissioning time. Meanwhile, online/web vendors grow 21.1% annually by hosting recipe repositories and brokering idle furnace capacity-effectively creating "manufacturing clouds" that match demand and supply.

Mobile network operators join consortia to guarantee service-level agreements for sub-10 millisecond latency needed in synchronous heating waves across distributed campuses. The ecosystem approach means competitive dynamics revolve around interoperability; vendors publish open APIs so third-party apps can call real-time data streams, spurring a marketplace of micro-services for niche tasks such as electrode life prediction or vacuum seal diagnostics.

Spark Plasma Sintering Market is Segmented by Component (Hardware, Software and Services), Vendor Type (Device Manufacturers, Mobile Network Operators and More), Context Type (Computing Context, User Context), Network Type (Wireless Cellular, WLAN /Wi-Fi and PAN /BLE), End-User Industry (BFSI, Consumer Electronics and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America owns 34% of 2024 revenue thanks to a mature semiconductor ecosystem, strong university-industry collaboration, and federal incentives such as the CHIPS Act's USD 39 billion fund. Plants in Arizona, Texas, and New York expand back-end packaging lines, generating sustained demand for pulse-current presses capable of joining metal-ceramic interposers. Canada's push toward a low-carbon industry dovetails with sintering's shorter cycle times and lower energy footprint. Mexico's rising electronics assembly sector sources sintered feedthroughs and heat spreaders domestically, shortening supply chains for near-shoring OEMs.

Asia-Pacific is on track for an 18.5% CAGR, driven by China's manufacturing automation push, Japan's heritage in powder metallurgy, and South Korea's memory-chip capacity race. State-backed funds channel billions into smart-factory retrofits that bundle next-gen sintering. India's Production Linked Incentive scheme for electronics spurs greenfield fabs incorporating fast cycle sintering for power devices. Taiwan's OSAT players install new presses to produce advanced substrates, reinforcing regional leadership.

Europe stresses sustainability and worker safety, encouraging closed-loop furnaces that reclaim off-gas and minimize particulate emissions. Germany's Industry 4.0 framework speeds adoption of connected presses with open OPC-UA interfaces. France exploits the technology for lightweight aerospace brackets, and Italy for super-alloy turbine disks. In the Middle East and Africa, budding industrial parks in Saudi Arabia and the UAE adopt sintering for additive-manufactured tooling, while South Africa explores localized production of mining wear parts.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd

- Intel Corporation

- Apple Inc.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Huawei Technologies Co. Ltd

- Baidu Inc.

- Infosys Ltd.

- Ericsson AB

- Telefonica, S.A.

- Bosch Sensortec GmbH

- STMicroelectronics N.V.

- Arm Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Rise in integrated IoT offerings

- 4.2.2 Mainstream Integration of AI in mobile and edge apps

- 4.2.3 Mainstream Proliferation of 5G-enabled smart devices

- 4.2.4 Under-the-Radar Contextual-ads ROI surge in retail media

- 4.2.5 Under-the-Radar OEM demand for in-vehicle emotion sensing

- 4.2.6 Under-the-Radar OT-cyber convergence in Industry 4.0 lines

- 4.3 Market Restraints

- 4.3.1 Mainstream Computational complexities

- 4.3.2 Mainstream Data-privacy regulations tightening

- 4.3.3 Under-the-Radar Edge-AI silicon supply bottlenecks

- 4.3.4 Under-the-Radar Context drift undermining ML model accuracy

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Sensors and MCUs

- 5.1.1.2 AI Chips/NPUs

- 5.1.2 Software

- 5.1.2.1 SDKs and Middleware

- 5.1.2.2 Contextual Analytics Platforms

- 5.1.3 Services

- 5.1.3.1 Managed Edge Services

- 5.1.3.2 Professional Services

- 5.1.1 Hardware

- 5.2 By Vendor Type

- 5.2.1 Device Manufacturers

- 5.2.2 Mobile Network Operators

- 5.2.3 Online, Web and Social Networking Vendors

- 5.3 By Network Type

- 5.3.1 Wireless Cellular

- 5.3.2 WLAN /Wi-Fi

- 5.3.3 PAN /BLE

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Consumer Electronics

- 5.4.3 Media and Entertainment

- 5.4.4 Automotive

- 5.4.5 Healthcare

- 5.4.6 Telecommunications

- 5.4.7 Logistics and Transportation

- 5.4.8 Other Industries

- 5.5 By Context Type

- 5.5.1 Computing Context

- 5.5.2 User Context

- 5.5.3 Physical Context

- 5.5.4 Time Context

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 United Arab Emirates

- 5.6.5.1.4 Turkey

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Google LLC

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Samsung Electronics Co. Ltd

- 6.4.9 Intel Corporation

- 6.4.10 Apple Inc.

- 6.4.11 NVIDIA Corporation

- 6.4.12 Qualcomm Technologies Inc.

- 6.4.13 ATandT Inc.

- 6.4.14 Huawei Technologies Co. Ltd

- 6.4.15 Baidu Inc.

- 6.4.16 Infosys Ltd.

- 6.4.17 Ericsson AB

- 6.4.18 Telefonica, S.A.

- 6.4.19 Bosch Sensortec GmbH

- 6.4.20 STMicroelectronics N.V.

- 6.4.21 Arm Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment