|

시장보고서

상품코드

1851716

컨텐츠 전송 네트워크(CDN) 보안 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Content Delivery Network (CDN) Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

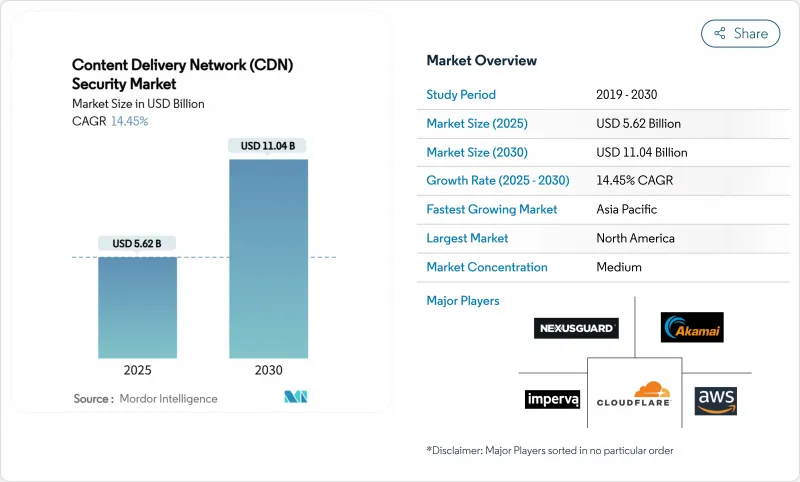

컨텐츠 전송 네트워크(CDN) 보안 시장은 2025년에 56억 2,000만 달러로 추정되고, 2030년에는 110억 4,000만 달러에 이를 전망이며, CAGR 14.45%로 성장할 전망입니다.

공격량 증가, 엄격한 규제 기한, 멀티클라우드 및 엣지 환경으로의 워크로드 전환이 이 시장 확대의 주요 요인이 되고 있습니다. Cloudflare가 2025년 1분기에 세계 DDoS 이벤트가 358% 급증하고 2,050만 건의 공격이 차단된 것을 기록한 후 기업은 현재 상시 가동의 비헤이비어 기반 미티게이션을 주장하고 있습니다. EU의 디지털 운영 탄력성 법(DORA) 및 PCI DSS v4.0과 같은 의무화로 컴플라이언스 위험이 증가하는 반면, OTT 트래픽이 증가함에 따라 컨텐츠 소유자는 전송 파이프라인에 보다 깊은 보안을 통합해야 합니다. 클라우드 전개로의 병렬 이동이 신속한 전개를 가능하게 한다는 것은 클라우드 전개 점유율이 이미 65.7%에 도달했기 때문에 분명합니다. 기존 기업이 통합을 진행(Akamai에 의한 Noname의 4억 5,000만 달러 인수), Cloudflare 등 전문 기업이 진화하는 봇이나 스크레이퍼에 대항하기 위해 AI를 활용한 검출 기능을 확장함에 따라 경쟁이 격화되고 있습니다.

세계의 컨텐츠 전송 네트워크(CDN) 보안 시장 동향 및 인사이트

DDoS/L-7 공격의 빈도 상승 및 고도화

Cloudflare의 원격 측정에 따르면 네트워크 계층 공격은 2025년 1분기에 전년 동기 대비 509% 증가하여 테라비트 규모의 플러드가 일상화되고 있습니다. 멀티 벡터 캠페인은 SYN 플러드와 Mirai 봇넷을 조합한 것으로, CLDAP나 ESP 등의 리플렉션 기법은 각각 3,488%와 2,301% 급증했습니다. 2024년에 관측된 모든 공격의 82.78%를 차지한 융단 폭격의 수법에 의해 조직은 트래픽을 우회시키는 어프로치 대신에 상시 접속형의 방어를 채용하지 않을 수 없게 되었습니다. 지정학적 긴장이 하쿠티비즘에 박차를 가하는 가운데 금융 서비스는 여전히 주요 목표가 되고 있습니다. Akamai는 2023년에 이 섹터에 초점을 맞춘 이벤트가 154% 증가한 것을 기록했습니다. CDN 보안 공급업체는 현재 엣지 PoP에 ML 주도의 비정상적인 스코어링을 통합하여 합법적인 마이크로 버스트와 악성 플러드를 구별하고 있습니다.

OTT 비디오 및 실시간 스트리밍 트래픽 급증

가입자 해지는 스트림 버퍼링과 직접 상관되기 때문에 플랫폼은 다중 CDN 설정과 DRM 워터마크의 도입을 촉구합니다. ContentArmor와 Limelight는 저작권 침해를 억제하기 위해 법의학 워터마크를 업그레이드하고 전개 레이어에 직접 통합했습니다. Qwilt의 엣지 네이티브 인프라는 퍼스트 프레임 대기 시간을 줄이지만 시청자에게 가깝기 때문에 자격 증명 및 토큰 도난 가능성이 있습니다. 따라서 보안 스택은 라이브 스포츠에 중요한 대기 시간 예산을 확장하지 않고 세션별 엔트로피 검사 및 토큰 바인딩을 통합합니다.

숙련된 사이버 보안 전문가의 세계 부족

보고된 침해의 46%는 1,000명 미만의 직원을 보유한 기업을 공격하고, 랜섬웨어 인시던트의 82%는 동일한 집단을 표적으로 하고 있습니다. 또한 ransomware 사고의 82%가 이 계층을 대상으로 합니다. 대학은 평균적으로 1,580개의 공개 도메인을 갖고 있지만, 이를 강화하는 보안 팀이 부족한 경우가 많습니다. 공급업체는 현재 포인트 앤 클릭 구성 사전 설정과 AI 트리어지를 제공하고 있지만 인재 격차가 근본적이기 때문에 리소스 제한이 있는 구매자들 사이에서 CDN 보안 시장의 보급이 늦어지고 있습니다.

부문 분석

대기업은 DDoS, WAF, 봇, 제로 트러스트 레이어에 걸친 복잡한 인프라와 깊은 보안 예산을 배경으로 2024년 매출의 75.4%를 차지했습니다. NEC는 인터넷 및 비공개 앱에 대한 액세스를 중앙 집중화하기 위해 120,000명의 세계 직원을 위해 Zscaler를 전개했습니다. 반대로 중소기업은 매니지드 클라우드 모델이 과거 포춘 500사에만 제공되었던 툴을 민주화함으로써 CAGR 14.7%로 가장 높은 성장세를 보이고 있습니다. 클라우드 플레어는 라쿠텐 모바일과 제휴하여 일본 중소기업을 위한 제로 트러스트 서비스를 제공합니다. 인력 부족 및 비용 의식은 뿌리 깊지만, 간소화된 대시 보드와 이용 기반의 가격 설정이 채용을 뒷받침합니다.

웹 애플리케이션 방화벽은 PCI DSS v4.0의 스크립트 감시 의무화로 2024년에는 47.2%의 점유율을 획득했습니다. 포티넷의 FortiAppSec Cloud는 WAF와 성능 분석을 결합하여 전개를 간소화합니다. 봇 미티게이션은 CAGR 15.3%로 확대되어 AI에 의한 스크래핑이나 자격증의 부정 이용에 대응합니다. Cloudflare의 AI Labyrinth는 미끼 페이지를 생성하여 악성 크롤러를 포착하고, HUMAN Security는 지능형 핑거프린팅으로 99.9%의 검출 정밀도를 주장하고 있습니다. 공격자가 머신러닝을 무기로 하는 동안 WAF, 봇, API 방어를 통합한 레이어 방어가 CDN 보안 시장의 궤적을 형성할 것으로 보입니다.

컨텐츠 전송 네트워크(CDN) 보안 시장은 조직 규모별(중소기업, 대기업), 보안 유형별(DDoS 방어, 웹 애플리케이션 방화벽(WAF) 등), 최종 사용자 산업별(미디어 엔터테인먼트, BFSI 등), 전개 모드별(클라우드, On-Premise), 지역별로 분류됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

북미는 2024년 세계 매출의 32.9%를 창출했습니다. 성숙한 컴플라이언스 체제와 1인당 높은 사이버 지출액이 채용을 뒷받침했습니다. 오클라호마는 Zscaler를 도입하여 암호화된 3만 4,000건의 위협과 1,760만개의 정책 위반을 차단했습니다.

아시아태평양은 CAGR 15.1%로 확대되고 있습니다. Akamai는 2024년 아시아태평양 사이트에 대한 510억 건의 웹 애플리케이션 공격을 기록했으며, 이는 73%의 급증으로 호주, 인도, 싱가포르가 가장 큰 피해를 입고 있습니다. 라쿠텐 모바일은 클라우드 플레어와의 제휴에 의해 현지의 중소기업용으로 매니지드 제로 트러스트를 상품화하고 있습니다.

유럽에서는 DORA와 GDPR(EU 개인정보보호규정)이 운영 및 데이터 보호 요구 사항을 강화하는 동안 꾸준한 성장을 이루고 있습니다. 은행은 탄력성 테스트를 위해 API와 WAF 제어를 개조하고 에스토니아 정보 시스템국은 주권 디지털 서비스를 보호하기 위해 Cloudflare를 사용합니다. 라틴아메리카와 아프리카는 여전히 개발 도상입니다. CDNetworks는 현재 라틴아메리카 20개국에서 PoP를 운영하고 6억 명의 가입자에게 도달하고 있으며 미래의 CDN 보안 시장 확대를 위한 기반을 구축하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- DDoS/L-7 공격의 빈도 상승 및 고도화

- OTT 비디오 및 실시간 스트리밍 트래픽 급증

- 멀티클라우드 및 엣지 아키텍처로의 기업 이동

- 규제 업타임 및 데이터 보호 의무(예 : DORA, PCI DSS v4)

- 내장형 제로 트러스트 제어를 가능하게 하는 엣지 PoP 통합

- 보안 통합 CDN을 견인하는 알고리즘에 의한 네트워크 비용 조향

- 시장 성장 억제요인

- 숙련된 사이버 보안 전문가의 세계적 부족

- 중소기업에서 상시 접속 완화가 높은 TCO

- 레거시 필터링 기기의 갭을 노출하는 IPv6 트래픽

- 엣지 PoP에서 에너지 비용 상승이 풋 프린트의 확대 지연 초래

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 시장의 거시경제 요인 평가

제5장 시장 규모 및 성장 예측

- 조직 규모별

- 중소기업(SMBs)

- 대기업

- 보안 유형별

- DDoS 보호

- 웹 애플리케이션 방화벽(WAF)

- 봇 마이그레이션와 스크린 스크래핑 대책

- 데이터 보안 및 컨텐츠 무결성

- 기타

- 최종 사용자 업계별

- 미디어 및 엔터테인먼트

- 소매 및 전자상거래

- BFSI

- IT 및 통신

- 헬스케어 및 생명과학

- 정부 및 공공 부문

- 교육

- 기타

- 전개 모드별

- 클라우드

- 온프레미스

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Akamai Technologies Inc.

- Amazon Web Services Inc.(CloudFront)

- Cloudflare Inc.

- Google LLC(Cloud CDN)

- Microsoft Corp.(Azure Front Door)

- Imperva Inc.

- Fastly Inc.

- Edgio Inc.(Limelight Networks)

- Verizon Media Platform

- Radware Ltd.

- F5 Inc.

- StackPath LLC

- G-Core Labs SA

- Alibaba Cloud(Alibaba Group)

- Corero Network Security plc

- Nexusguard Ltd.

- CDNetworks Inc.

- Neustar Security Services

- Akamai(Prolexic)

- NETSCOUT Systems(Arbor)

제7장 시장 기회 및 향후 전망

AJY 25.11.24The CDN Security market generated USD 5.62 billion in 2025 and is on track to reach USD 11.04 billion by 2030, advancing at a 14.45% CAGR.

Escalating attack volumes, aggressive regulatory deadlines, and the migration of workloads to multi-cloud and edge environments are the primary forces behind this expansion. Enterprises now insist on always-on, behavioral-based mitigation after Cloudflare documented a 358% jump in global DDoS events during Q1 2025, equal to 20.5 million blocked attacks. Mandates such as the EU's Digital Operational Resilience Act (DORA) and PCI DSS v4.0 elevate compliance risk, while OTT traffic growth pushes content owners to embed security deeper into delivery pipelines. A parallel shift toward cloud delivery enables rapid deployment, illustrated by the 65.7% share that cloud implementations already hold. Competitive intensity is rising as incumbents consolidate (Akamai's USD 450 million acquisition of Noname) while specialists such as Cloudflare expand AI-powered detection to counter evolving bots and scrapers.

Global Content Delivery Network (CDN) Security Market Trends and Insights

Rising Frequency and Sophistication of DDoS / L-7 Attacks

Cloudflare's telemetry shows network-layer assaults ballooned 509% year-over-year in Q1 2025, while terabit-scale floods are now routine. Multi-vector campaigns combine SYN floods with Mirai botnets, and reflection methods such as CLDAP and ESP have spiked 3,488% and 2,301% respectively.Carpet-bombing tactics, 82.78% of all observed attacks in 2024, force organizations to adopt always-on defenses instead of traffic-divert approaches. Financial services remain the primary target as geopolitical tensions spur hacktivism; Akamai logged a 154% rise in sector-focused events in 2023. CDN security vendors now embed ML-driven anomaly scoring at edge PoPs to distinguish legitimate microbursts from malicious floods.

Rapid Growth in OTT Video and Real-Time Streaming Traffic

Subscriber churn correlates directly with stream buffering, prompting platforms to deploy multi-CDN setups plus DRM watermarking. ContentArmor and Limelight upgraded forensic watermarking to curb piracy, integrating directly into delivery layers. Edge-native infrastructure from Qwilt reduces first-frame latency, but its proximity to viewers exposes surface area to credential-stuffing and token theft. Security stacks therefore integrate per-session entropy checks and token binding without inflating latency budgets crucial for live sports.

Global Shortage of Skilled Cyber-Security Practitioners

Forty-six percent of reported breaches hit firms with under 1,000 staff, and 82% of ransomware incidents target the same cohort. Universities average up to 1,580 public-facing domains yet often lack security teams to harden them. Providers now ship point-and-click configuration presets and AI triage, but a persistent talent gap slows CDN Security market adoption among resource-constrained buyers.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Shift to Multi-Cloud and Edge Architectures

- Regulatory Uptime and Data-Protection Mandates

- High TCO of Always-On Mitigation for SMEs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises controlled 75.4% of 2024 revenue thanks to complex infrastructures and deep security budgets that span DDoS, WAF, bot and zero-trust layers. NEC rolled out Zscaler for 120,000 global employees to centralize internet and private-app access. Conversely, SMEs show the strongest 14.7% CAGR as managed cloud models democratize tools once reserved for Fortune 500. Cloudflare's partnership with Rakuten Mobile offers packaged zero-trust services aimed at Japan's small-business segment. Talent shortages and cost sensitivities persist, yet simplified dashboards and usage-based pricing unlock adoption.

Web Application Firewalls held 47.2% share in 2024, bolstered by PCI DSS v4.0 script-monitoring mandates. Fortinet's FortiAppSec Cloud combines WAF with performance analytics to streamline deployment. Bot mitigation, expanding 15.3% CAGR, addresses AI-driven scraping and credential abuse. Cloudflare's AI Labyrinth generates decoy pages to trap illegal crawlers, while HUMAN Security claims 99.9% detection accuracy via intelligent fingerprinting. As attackers weaponize machine learning, layered defenses that join WAF, bot and API protection will shape the CDN Security market trajectory.

Content Delivery Network (CDN) Security Market is Segmented by Organization Size (SMBs, Large Enterprises), Security Type (DDoS Protection, Web Application Firewall (WAF), and More), End-User Industry (Media and Entertainment, BFSI, and More), Deployment Mode (Cloud, On-Premises), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.9% of global revenue in 2024. Mature compliance regimes and high per-capita cyber spend underpin adoption. Oklahoma's statewide Zscaler roll-out blocked 34,000 encrypted threats and 17.6 million policy violations, proving zero-trust viability at scale.

Asia-Pacific is expanding at a 15.1% CAGR. Akamai logged 51 billion web-app attacks against APAC sites in 2024, a 73% jump, with Australia, India and Singapore worst hit. Rakuten Mobile's partnership with Cloudflare commercializes managed zero-trust for local SMEs, while Japan's cyber insurance market is growing nearly 50% a year.

Europe sees steady growth as DORA and GDPR tighten operational and data-protection requirements. Banks retrofit API and WAF controls for resilience testing, and Estonia's Information System Authority relies on Cloudflare to safeguard sovereign digital services. Latin America and Africa remain nascent; CDNetworks now operates PoPs in 20 LATAM countries to reach 600 million subscribers, laying groundwork for future CDN Security market uptake.

- Akamai Technologies Inc.

- Amazon Web Services Inc. (CloudFront)

- Cloudflare Inc.

- Google LLC (Cloud CDN)

- Microsoft Corp. (Azure Front Door)

- Imperva Inc.

- Fastly Inc.

- Edgio Inc. (Limelight Networks)

- Verizon Media Platform

- Radware Ltd.

- F5 Inc.

- StackPath LLC

- G-Core Labs S.A.

- Alibaba Cloud (Alibaba Group)

- Corero Network Security plc

- Nexusguard Ltd.

- CDNetworks Inc.

- Neustar Security Services

- Akamai (Prolexic)

- NETSCOUT Systems (Arbor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising frequency and sophistication of DDoS / L-7 attacks

- 4.2.2 Rapid growth in OTT video and real-time streaming traffic

- 4.2.3 Enterprise shift to multi-cloud and edge architectures

- 4.2.4 Regulatory uptime and data-protection mandates (e.g., DORA, PCI DSS v4)

- 4.2.5 Edge PoP consolidation enabling embedded zero-trust controls

- 4.2.6 Algorithmic network-cost steering driving security-integrated CDNs

- 4.3 Market Restraints

- 4.3.1 Global shortage of skilled cyber-security practitioners

- 4.3.2 High TCO of always-on mitigation for SMEs

- 4.3.3 IPv6 traffic exposing gaps in legacy filtering appliances

- 4.3.4 Rising energy costs at edge PoPs slowing footprint expansion

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization Size

- 5.1.1 Small and Medium-Sized Businesses (SMBs)

- 5.1.2 Large Enterprises

- 5.2 By Security Type

- 5.2.1 DDoS Protection

- 5.2.2 Web Application Firewall (WAF)

- 5.2.3 Bot Mitigation and Screen-Scraping Protection

- 5.2.4 Data Security and Content Integrity

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail and E-commerce

- 5.3.3 BFSI

- 5.3.4 IT and Telecom

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Government and Public Sector

- 5.3.7 Education

- 5.3.8 Others

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-Premise

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akamai Technologies Inc.

- 6.4.2 Amazon Web Services Inc. (CloudFront)

- 6.4.3 Cloudflare Inc.

- 6.4.4 Google LLC (Cloud CDN)

- 6.4.5 Microsoft Corp. (Azure Front Door)

- 6.4.6 Imperva Inc.

- 6.4.7 Fastly Inc.

- 6.4.8 Edgio Inc. (Limelight Networks)

- 6.4.9 Verizon Media Platform

- 6.4.10 Radware Ltd.

- 6.4.11 F5 Inc.

- 6.4.12 StackPath LLC

- 6.4.13 G-Core Labs S.A.

- 6.4.14 Alibaba Cloud (Alibaba Group)

- 6.4.15 Corero Network Security plc

- 6.4.16 Nexusguard Ltd.

- 6.4.17 CDNetworks Inc.

- 6.4.18 Neustar Security Services

- 6.4.19 Akamai (Prolexic)

- 6.4.20 NETSCOUT Systems (Arbor)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment