|

시장보고서

상품코드

1850981

기가비트 이더넷 시험 장비 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Gigabit Ethernet Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

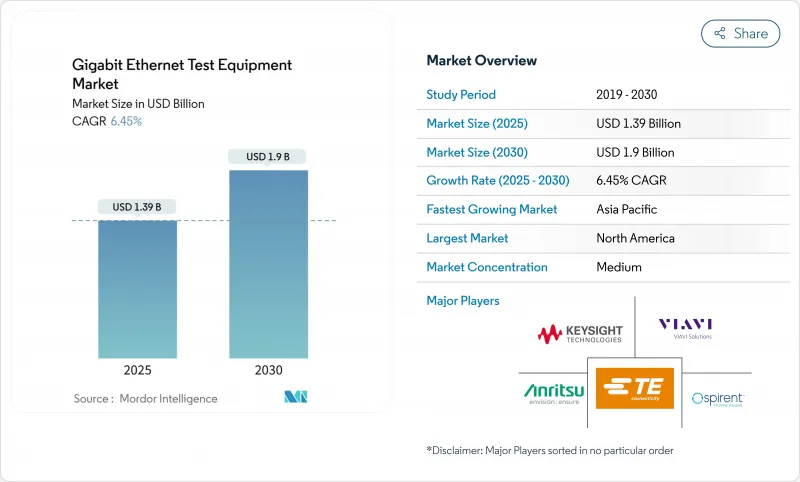

기가비트 이더넷 시험 장비 시장은 2025년에 13억 9,000만 달러에 이를 전망이며, 2030년에는 CAGR 6.45%로 성장해 19억 달러에 이를 것으로 예측됩니다.

인공지능 워크로드의 채용이 증가하고 대역폭에 대한 기대가 재정의되고 있기 때문에 검증팀은 400G를 넘어 새로운 800G 및 1.6T 표준을 채택할 필요가 있습니다. 데이터센터 운영자는 기존의 비트 오류율 도구에서 패킷 스프레이, 순방향 오류 수정 및 RoCEv2 대기 시간을 실제 혼잡 하에서 평가하는 고정밀 솔루션으로 예산을 재분배합니다. 하이퍼스케일러는 현재 개발 사이클을 줄이기 위해 트래픽 생성, 네트워크 에뮬레이션 및 머신러닝 중심의 분석을 결합한 완전 자동화 테스트 베드를 요구하고 있습니다. PAM4 옵틱스 공급 병목 현상과 224Gbps 채널 설계 전문가 부족으로 인해 납품 리드 타임은 장기화되고 가격 인상이 둔화되지만 1.6T 기능에 조기 액세스를 보장할 수 있는 공급업체는 프리미엄 계약을 획득하고 있습니다.

세계의 기가비트 이더넷 시험 장비 시장의 동향 및 인사이트

AI 클러스터 인프라가 800G 시험 수요를 견인

주요 하이라이트

- 인공지능 교육을 통해 대역폭 요구사항은 기존 400G를 넘어서고 사업자는 새로운 검증 전략이 필요한 800G 및 1.6T 링크를 채택해야 합니다. 현재 클러스터에는 xPU당 1Tbps가 필요하며 NRZ에서 PAM4 변조로 전환하는 SerDes 설계에 스트레스를 줍니다. 벤더는 현재 고속 오실로스코프에 자동 디임베딩 소프트웨어를 번들하고 있으며, 엔지니어는 10ps 이하의 단위 간격을 수일이 아닌 수분 만에 특성화할 수 있습니다. 울트라 이더넷 컨소시엄은 IEEE 802.3 이상의 v1.0 사양을 최종 결정하고 레거시 이더넷에서 볼 수 없었던 혼잡 관리 테스트를 추가했습니다. 1.6T의 능력을 제공하는 조기 진출기업은 AI 패브릭의 장래성 확보에 열심한 하이퍼스케일러와 다년간의 프레임워크 계약을 획득하고 있습니다. 이러한 프로젝트는 옵틱스, 트래픽 생성, 애널리틱스를 단일 오케스트레이션 계층에 연결할 수 있는 기업의 수익을 가속화합니다.

클라우드 서비스 확대로 멀티 스피드 테스트 가속

클라우드 제공업체는 100G, 400G, 800G의 토폴로지를 혼합하여 배포하고 다양한 워크로드에 대해 성능과 비용 간에 균형을 이루기 위해 여러 속도를 동시에 검증하는 시험 장비가 필요합니다. 이러한 속도에서는 순방향 오류 정정 중에서도 특히 RS-FEC가 필수적이므로 솔루션은 잠재적인 결함을 숨기지 않고 실시간 패리티 블록을 모니터링해야 합니다. 에뮬레이션 엔진은 현재 마이크로초 미만의 지연 지표를 유지하면서 마이크로 버스트의 혼잡을 재현하기 위해 수일 동안 트래픽 로그를 재생하고 있습니다. 운영자는 CI/CD 툴체인과 통합하는 프로그래머블 API를 요구하여 네트워크 업그레이드의 일일 회귀를 가능하게 합니다. 그 결과 하드웨어 설비 투자를 줄이면서도 결정적인 성능 기준선을 제공하는 가상화 테스트 랩에 대한 수요가 높아지고 있습니다.

기술 전문가 부족으로 시장 확대 억제

NRZ에서 PAM4로의 전환에는 디스큐잉, 심볼 에러 플롯, 224Gbps 채널 모델링에 익숙한 엔지니어가 필요하지만, 이러한 기술자는 세계적으로도 드뭅니다. 많은 서비스 제공업체는 눈 높이와 지터 허용도를 해석하기 위해 자동화된 알고리즘에 의존하지만 복잡한 장애에는 여전히 인간의 인사이트가 필요합니다. Inspect Before You Connect'와 같은 광섬유 검사 캠페인은 기술 부족이 설치 오류율을 높이는 현상을 보여줍니다. 트레이닝 파이프라인은 기술 로드맵에 뒤처져 있기 때문에 공급업체는 최소한의 사용자 입력을 기반으로 장비를 구성하는 AI 주도 위자드를 통합해야 합니다. 그럼에도 불구하고 PAM4의 크로스토크, 스큐, FEC 마진의 고급 문제 해결은 여전히 수작업으로 이루어지므로 프로젝트 일정은 인력 부족의 영향을 받기 쉽습니다.

부문 분석

10GbE 범주는 2024년 기가비트 이더넷 시험 장비 시장 점유율의 42%를 유지하였으며 기업의 스위칭 백본에서의 존재감을 보여줍니다. 그러나 800GbE 및 1.6TbE 장비는 2030년까지 21.5%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 보이며, 이는 어떤 속도 등급보다 빠른 성장 속도입니다. Keysight의 AresONE 플랫폼은 6.4Tbps의 테스트 트래픽을 스트리밍하고 있으며, Keysight에 따르면 초고속 기어 기가비트 이더넷 시험 장비 시장의 규모는 2030년까지 4억 9,000만 달러에 달할 전망입니다. 반면에 25/40/50GbE 및 100GbE는 특히 레거시 옵틱스 생태계가 전환 위험을 줄이는 경우 비용 효율적인 발판이 됩니다. Marvell과 같은 반도체 공급업체는 3nm PAM4 DSP의 모듈 전력 소비를 20% 절감하는 샘플링을 통해 고밀도 섀시의 냉각 엔벨로프를 확장하고 시프트를 가속화합니다.

구매자는 업그레이드 타이밍과 표준 성숙도를 비교 검토합니다. 400GbE는 성숙한 RS-FEC 프로파일을 제공하기 때문에 빠른 리턴을 요구하는 프로젝트에서는 여전히 선호되고 있습니다. 반대로, 1.6T를 평가하는 엔지니어링 랩에서는 당면한 요구에 대응하는 800G 블레이드와 미래의 1.6T 플러그 케이블에 대응하는 케이지를 조합한 믹스 스피드 섀시를 주문하고 있습니다. 이러한 유연성을 통해 자본계획을 안정시키는 동시에 조기 도입 기업을 진부화로부터 보호할 수 있습니다. 하이퍼스케일러가 패브릭 업그레이드를 6개월 단위로 배포하는 동안 현장 업그레이드 가능한 하드웨어와 영구 소프트웨어 라이선스를 제공하는 공급업체는 지속적인 수익원을 확보할 수 있습니다. 이 마이그레이션은 제품 수명주기를 단축시키고, 경쟁의 초점은 하드웨어 BOM에서 프로그래머블 기능의 속도로 마이그레이션합니다.

통신은 5G 백홀의 전개에 의해 2024년의 수익의 36.5%를 획득했지만, 데이터센터와 클라우드 프로바이더는 2030년까지 연평균 복합 성장률(CAGR) 18%로 확대되어 2027년에는 절대 지출액으로 통신을 추월할 전망입니다. AI의 워크로드 밀도를 통해 데이터센터는 무손실 패킷 스프레이, 서브마이크로세컨드 지터, RoCEv2 혼잡 제어를 동시에 검증하게 되며 이들은 전통적인 통신 사업자의 지표를 능가합니다. 자동차 및 운송 장비 OEM은 운전 지원 및 자율 주행 스택을 지원하기 위해 이더넷 컴플라이언스를 강화하여 10GBASE-T1 특성화가 가능한 견고한 오실로스코프 및 EMI 챔버에 대한 수요를 창출합니다.

한편, 제조업에서는 위험 구역 내에서의 이더넷 APL 파일럿을 가속화하고 있으며, 전원 루프 분석기를 겸하는 본질 안전 방폭 테스터가 필요합니다. A&D 통합기는 진동, 극단적인 온도 및 전자기 펄스를 견딜 수 있는 장비를 필요로 하며 공급업체는 군용 등급의 하우징을 채택해야 합니다. 유틸리티와 헬스케어는 결정론적인 페일 세이프 프로토콜을 지정하고 제로 손실 보호 스위칭과 사이버 하드화 펌웨어를 검증하는 테스트 계획을 추진하고 있습니다. 이처럼 여러 분야에 걸쳐 공급업체는 다양한 규제 프레임워크를 수용하면서 R&D 오버헤드를 줄이는 전략으로 각 산업별 컴플라이언스 패키지를 주문형으로 장착하는 모듈형 플랫폼을 제공해야 합니다.

기가비트 이더넷 시험 장비 시장 보고서는 유형(1GbE, 10GbE, 기타), 최종 사용자 산업(통신, 데이터센터, 클라우드 등), 용도(연구개발/연구, 제조/생산, 기타), 테스트 유형(기능/트래픽 생성, 성능/스트레스, 컴플라이언스/적합 등), 지역별로 분류됩니다.

지역 분석

북미는 반도체의 연구개발과 기록적인 속도로 800G의 인정을 의무화하는 적극적인 AI 클러스터의 전개가 집중되어 있기 때문에 매출의 33%를 차지하고 있습니다. 미국은 클라우드 공급자가 수주의 대부분을 차지하지만 캐나다는 광대역 활성화와 산업용 이더넷 업그레이드로 견인 역할을 하고 있습니다. 멕시코는 니어 쇼어링 동향을 활용하여 자동차 하네스 제조를 확대하여 T1 컴플라이언스 키트 수요를 높입니다. 일부 주에서는 에너지 비용이 낮아 데이터센터가 증가하고 있지만 800G 리그의 전력 소비가 높기 때문에 조달주기에 영향을 줄 수 있는 지속가능성 감사가 실시됩니다.

아시아태평양은 중국의 하이퍼스케일 확장과 현지화된 1.6T 광학 공급망을 배경으로 CAGR 10.25%로 성장을 이끌고 있습니다. 일본의 자동차산업은 엄격한 EMC 검증이 필요한 결정론적 이더넷 스택을 지지하고, 한국은 반도체 팹을 3nm 클래스로 밀어 올려 초고속 지터와 크로스토크 프로브를 필요로 합니다. ASEAN 국가들은 5G 백홀과 스마트 팩토리의 파일럿 사업을 전개하고, 멀티레이트 핸드헬드 애널라이저의 수주를 획득하고 있습니다. 인도의 정책적 인센티브는 통신 장비 제조 및 소프트웨어 정의 네트워크 실험실에 박차를 가합니다.

유럽에서는 독일 OEM 기업이 자동차 이더넷 테스트 계획을 공식화하고 산업 사업자가 프로세스 플랜트 내에서 이더넷-APL을 채택하는 등 꾸준한 성장을 보여줍니다. 영국에서는 파이버 백본 네트워크가 근대화되어 휴대용 OTDR과 BERT 수요가 높아집니다. 프랑스와 스페인은 신재생에너지 그리드 업그레이드에 투자하고 있으며 결정론적인 변전소 이더넷 테스트가 필요합니다. 중동에서는 석유 수입을 걸프의 그린필드 데이터센터로 옮기고, 아프리카 광산은 가혹한 환경에 대응하는 견고한 PoE 테스터를 주문하고 있습니다. 남미는 브라질 통신 사업자의 업그레이드와 아르헨티나의 자동차용 와이어 하네스 수출에 견인되어 완만하면서 안정을 유지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 모바일 백홀 성장

- 클라우드 서비스와 빅데이터 도입

- 제조업에 있어서의 이더넷의 이용 증가

- 레거시 케이블의 2.5/5GbE 업그레이드

- 800G/1.6T 테스트용 AI 클러스터 수요

- RoCEv2 구동의 초저지연 검증

- 시장 성장 억제요인

- 기술적인 전문지식의 부족

- 복잡한 측정 정밀도의 한계

- 800G 리그의 에너지와 열의 제약

- PAM-4 광학계 공급 체인의 병목

- 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 유형별

- 1GbE

- 10GbE

- 25/40/50GbE

- 100GbE

- 400GbE

- 800GbE 및 1.6 TbE

- 최종 사용자 업계별

- 통신

- 데이터센터와 클라우드

- 제조업

- 자동차 및 운송

- 항공우주 및 방위

- 기타(유틸리티, 헬스케어)

- 용도별

- 연구개발/실험실

- 제조/생산

- 필드 서비스와 설치

- 인증 및 컴플라이언스

- 테스트 유형별

- 기능/트래픽 생성

- 퍼포먼스/스트레스

- 컴플라이언스/적합

- 네트워크 에뮬레이션

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Keysight Technologies Inc.

- Anritsu Corp.

- VIAVI Solutions Inc.

- Spirent Communications plc

- EXFO Inc.

- Rohde and Schwarz GmbH and Co KG

- Teledyne LeCroy(Xena)

- Yokogawa Test and Measurement

- VeEX Inc.

- GL Communications Inc.

- Trend Networks

- GigaNet Systems

- Xinertel Technology

- Apposite Technologies

- NetScout Systems Inc.

- Te Connectivity Ltd.

- Aquantia(Marvell)

- GAO Tek Inc.

- IDEAL Industries Inc.

- Veryx Technologies

제7장 시장 기회와 미래 전망

CSM 25.11.20The Gigabit Ethernet test equipment market reached USD 1.39 billion in 2025 and is forecast to climb to USD 1.90 billion by 2030, advancing at a 6.45% CAGR.

Rising adoption of artificial intelligence workloads is redefining bandwidth expectations, forcing validation teams to move beyond 400G and embrace emerging 800G and 1.6T standards. Data center operators are reallocating budgets from legacy bit error rate tools to high-precision solutions that evaluate packet spray, forward error correction, and RoCEv2 latency under real-world congestion. Hyperscalers now request fully automated test beds that blend traffic generation, network emulation, and machine-learning-driven analytics to shorten development cycles. Supply bottlenecks for PAM4 optics and a shortage of 224 Gbps channel-design experts keep delivery lead times long and price points high, yet vendors that can guarantee early access to 1.6T capability are commanding premium contracts.

Global Gigabit Ethernet Test Equipment Market Trends and Insights

AI Cluster Infrastructure Drives 800G Testing Demand

Key Highlights

- Artificial intelligence training pushes bandwidth requirements beyond conventional 400G, compelling operators to adopt 800G and 1.6T links that demand fresh validation strategies. Current clusters need 1 Tbps per xPU, stressing SerDes designs that shift from NRZ to PAM4 modulation, which in turn mandates eye-opening precision for signal-to-noise ratio analysis. Vendors now bundle high-speed oscilloscopes with automated de-embedding software so engineers can characterize sub-10-ps unit intervals in minutes rather than days. The Ultra Ethernet Consortium is finalizing v1.0 specifications that extend beyond IEEE 802.3, adding congestion management tests never seen in legacy Ethernet. Early movers that deliver 1.6T capability are winning multi-year framework deals with hyperscalers eager to future-proof AI fabrics. These projects accelerate revenue for companies able to link optics, traffic generation, and analytics into a single orchestration layer.

Cloud Services Expansion Accelerates Multi-Speed Testing

Cloud providers deploy mixed 100G, 400G, and 800G topologies to balance performance and cost across variable workloads, creating a need for test rigs that validate several speeds concurrently. Forward error correction, particularly RS-FEC, is essential at those rates, so solutions must monitor real-time parity blocks without masking latent defects. Emulation engines now replay days of traffic logs to reproduce microburst congestion while maintaining sub-microsecond latency metrics. Operators request programmable APIs that integrate with CI/CD toolchains, enabling daily regression of network upgrades. The result is rising demand for virtualized test labs that cut hardware capex yet still provide deterministic performance baselines.

Technical Expertise Shortage Constrains Market Expansion

Moving from NRZ to PAM4 demands engineers competent in de-skewing, symbol error plotting, and 224 Gbps channel modeling, skills still rare across global labor pools. Many service providers rely on automated algorithms to interpret eye height and jitter budgets, yet complex failures still need human insight. Fiber inspection campaigns such as "Inspect Before You Connect" show how deficit skills inflate installation error rates. Training pipelines lag behind technology roadmaps, compelling vendors to embed AI-driven wizards that configure instruments based on minimal user input. Nevertheless, advanced troubleshooting of PAM4 crosstalk, skew, and FEC margin remains a manual discipline, keeping project timelines vulnerable to talent shortages.

Other drivers and restraints analyzed in the detailed report include:

- Manufacturing Ethernet Adoption Creates Industrial Testing Opportunities

- Legacy Infrastructure Upgrades Drive Multi-Gigabit Testing

- Measurement Accuracy Limitations Impede High-Speed Validation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 10 GbE category retained 42% of the Gigabit Ethernet test equipment market share in 2024, underscoring its entrenched presence in enterprise switching backbones. Yet 800 GbE and 1.6 TbE rigs are set to grow at 21.5% CAGR to 2030, the fastest pace of any speed grade, fueled by AI cluster architectures that need line-rate validation at 224 Gbps per lane. Keysight's AresONE platform streams 6.4 Tbps of test traffic, marking a leap that positions the Gigabit Ethernet test equipment market size for ultra-high-speed gear at USD 490 million by 2030, according to Keysight. Meanwhile 25/40/50 GbE and 100 GbE serve as cost-efficient stepping-stones, especially where legacy optics ecosystems lower migration risk. Semiconductor vendors such as Marvell accelerate the shift by sampling 3 nm PAM4 DSPs that drop module power by 20%, extending cooling envelopes inside dense chassis.

Buyers weigh upgrade timing against standards maturity. 400 GbE enjoys mature RS-FEC profiles, so projects chasing rapid returns still favor it. Conversely, engineering labs evaluating 1.6 T are ordering mixed-speed chassis that combine 800 G blades for immediate needs and empty cages ready for future 1.6 T pluggables. This flexibility stabilizes capital planning while protecting early adopters from obsolescence. As hyperscalers roll out fabric upgrades in six-month sprints, vendors that ship field-upgradeable hardware and perpetual software licenses gain recurring revenue streams. The transition compresses product lifecycles, shifting competitive focus from hardware bill-of-materials to programmable feature velocity.

Telecommunications captured 36.5% of 2024 revenue due to 5G backhaul rollouts, yet data centers and cloud providers are expanding at an 18% CAGR to 2030, overtaking telcos in absolute spending by 2027. AI workload density drives data centers to validate lossless packet spraying, sub-microsecond jitter, and RoCEv2 congestion control concurrently, all of which exceed traditional telco metrics. Automotive and transport OEMs ramp Ethernet compliance to support driver assistance and autonomous stacks, creating demand for rugged oscilloscopes and EMI chambers capable of 10GBASE-T1 characterization.

Meanwhile, manufacturing outfits accelerate Ethernet-APL pilots within hazardous zones, requiring intrinsically safe testers that double as power loop analyzers. A&D integrators need equipment that withstands vibration, temperature extremes, and electromagnetic pulse, compelling suppliers to adapt military-grade enclosures. Utilities and healthcare specify deterministic fail-safe protocols, pushing test plans to verify zero-loss protection switching and cyber-hardened firmware. These cross-sector nuances pressure vendors to offer modular platforms that slot vertical-specific compliance packages on demand, a strategy that tempers R&D overhead while addressing divergent regulatory frameworks.

The Gigabit Ethernet Test Equipment Market Report is Segmented by Type (1 GbE, 10 GbE, and More), End-User Industry (Telecommunications, Data Centers and Cloud, and More), Application (R&D/Lab, Manufacturing/Production, and More), Test Type (Functional / Traffic Generation, Performance / Stress, Compliance / Conformance, and More), and Geography.

Geography Analysis

North America holds 33% revenue thanks to concentrated semiconductor R&D and aggressive AI cluster deployments that mandate 800G qualification in record time. United States cloud providers anchor most orders, but Canada gains traction through broadband revitalization and industrial Ethernet upgrades. Mexico leverages nearshoring trends to expand automotive harness manufacturing, raising demand for T1 compliance kits. Low energy costs in some states attract additional data center builds, yet the high power draw of 800G rigs prompts sustainability audits that may influence procurement cycles.

Asia Pacific leads growth at 10.25% CAGR on the back of China's hyperscale expansion and localized 1.6 T optics supply chains. Japan's auto sector champions deterministic Ethernet stacks that require stringent EMC validation, while Korea pushes semiconductor fabs into 3 nm class, needing ultra-fast jitter and crosstalk probes. ASEAN states deploy 5G backhaul and smart factory pilots, generating orders for multi-rate handheld analyzers. India's policy incentives spur telco equipment manufacturing and software defined network labs, though patchy infrastructure and a talent shortfall temper near-term adoption.

Europe charts steady gains with German OEMs formalizing in-vehicle Ethernet test plans and industrial operators embracing Ethernet-APL inside process plants. The United Kingdom modernizes fiber backbone networks, fueling demand for portable OTDRs and BERTs. France and Spain invest in renewable energy grid upgrades that require deterministic sub-station Ethernet testing. The Middle East channels oil revenues into greenfield data centers in the Gulf, while African miners commission ruggedized PoE testers for harsh environments. South America remains modest but stable, driven by Brazilian telco upgrades and Argentine automotive wire harness exports.

- Keysight Technologies Inc.

- Anritsu Corp.

- VIAVI Solutions Inc.

- Spirent Communications plc

- EXFO Inc.

- Rohde and Schwarz GmbH and Co KG

- Teledyne LeCroy (Xena)

- Yokogawa Test and Measurement

- VeEX Inc.

- GL Communications Inc.

- Trend Networks

- GigaNet Systems

- Xinertel Technology

- Apposite Technologies

- NetScout Systems Inc.

- Te Connectivity Ltd.

- Aquantia (Marvell)

- GAO Tek Inc.

- IDEAL Industries Inc.

- Veryx Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in mobile backhaul

- 4.2.2 Adoption of cloud services and big data

- 4.2.3 Increased Ethernet use in manufacturing

- 4.2.4 2.5 / 5 GbE upgrades on legacy cabling

- 4.2.5 AI cluster demand for 800G/1.6T testing

- 4.2.6 RoCEv2-driven ultra-low-latency validation

- 4.3 Market Restraints

- 4.3.1 Lack of technical expertise

- 4.3.2 Complex measurement accuracy limits

- 4.3.3 Energy and thermal constraints in 800G rigs

- 4.3.4 Supply-chain bottlenecks for PAM-4 optics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 1 GbE

- 5.1.2 10 GbE

- 5.1.3 25/40/50 GbE

- 5.1.4 100 GbE

- 5.1.5 400 GbE

- 5.1.6 800 GbE and 1.6 TbE

- 5.2 By End-user Industry

- 5.2.1 Telecommunications

- 5.2.2 Data Centers and Cloud

- 5.2.3 Manufacturing

- 5.2.4 Automotive and Transport

- 5.2.5 Aerospace and Defense

- 5.2.6 Others (Utilities, Healthcare)

- 5.3 By Application

- 5.3.1 RandD/Lab

- 5.3.2 Manufacturing/Production

- 5.3.3 Field Service and Installation

- 5.3.4 Certification and Compliance

- 5.4 By Test Type

- 5.4.1 Functional / Traffic Generation

- 5.4.2 Performance / Stress

- 5.4.3 Compliance / Conformance

- 5.4.4 Network Emulation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Keysight Technologies Inc.

- 6.4.2 Anritsu Corp.

- 6.4.3 VIAVI Solutions Inc.

- 6.4.4 Spirent Communications plc

- 6.4.5 EXFO Inc.

- 6.4.6 Rohde and Schwarz GmbH and Co KG

- 6.4.7 Teledyne LeCroy (Xena)

- 6.4.8 Yokogawa Test and Measurement

- 6.4.9 VeEX Inc.

- 6.4.10 GL Communications Inc.

- 6.4.11 Trend Networks

- 6.4.12 GigaNet Systems

- 6.4.13 Xinertel Technology

- 6.4.14 Apposite Technologies

- 6.4.15 NetScout Systems Inc.

- 6.4.16 Te Connectivity Ltd.

- 6.4.17 Aquantia (Marvell)

- 6.4.18 GAO Tek Inc.

- 6.4.19 IDEAL Industries Inc.

- 6.4.20 Veryx Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment