|

시장보고서

상품코드

1630251

독일의 포장 산업 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Germany Packaging Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

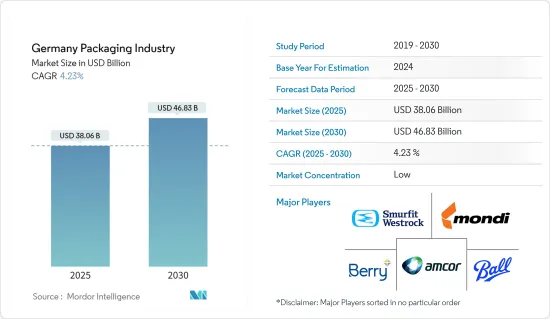

독일의 포장 산업은 예측 기간(2025-2030년) 동안 4.23%의 CAGR로 2025년 380억 6,000만 달러에서 2030년 468억 3,000만 달러로 성장할 것으로 예상됩니다.

주요 하이라이트

- 독일에서는 E-Commerce의 급격한 증가로 포장재에 대한 수요가 증가하고 있습니다. 이에 대응하기 위해 지역 포장 업체들은 온라인 소매를 위해 특별히 고안된 비용 효율적이고 안전하며 가벼운 솔루션을 제공하기 위해 노력하고 있습니다.

- 이 제품들은 운송 중 제품을 보호하면서 재료 사용량을 최적화하는 혁신적인 디자인을 특징으로 합니다. 온라인 주문 증가에 대응하기 위해 이들 기업은 로봇 시스템, AI 기반 분류 도구 등 최첨단 자동 포장 기술에 투자하고 있습니다. 이러한 자동화는 작업을 간소화할 뿐만 아니라 포장 품질의 균일성을 보장합니다.

- 독일의 포장 식품 및 퍼스널케어 부문은 향후 몇 년 동안 더욱 가속화될 것으로 예상되는 추세로 더 작은 포장 크기에 대한 수요 증가를 목격하고 있습니다. 이러한 변화는 1인 가구의 증가, 밀봉이 가능하고 휴대가 간편한 포장에 대한 선호, 유통기한에 대한 관심 등의 요인에 기인합니다.

- 이러한 움직임은 소스 및 드레싱에서 과자 및 가공 과일에 이르기까지 포장재에 대한 필요성을 증폭시키고 있습니다. 이에 대응하기 위해 제조업체들은 제품의 신선도를 우선시하고, 폐기물을 최소화하며, 포션 컨트롤을 강화하는 혁신적인 포장 솔루션을 고안해내고 있습니다.

- 연질 플라스틱 포장에 대한 수요는 경량성과 적응성으로 인해 증가하는 추세입니다. 이러한 추세는 컴팩트하고 사용하기 쉬운 포장에 대한 선호와 디자인의 발전으로 인해 더욱 가속화되고 있습니다. 연질 플라스틱은 유통기한을 연장하고 운송 비용을 절감할 뿐만 아니라 제품 보호도 강화합니다. 환경 보호 차원에서 제조업체들은 재활용 및 생분해가 가능한 연질 플라스틱 개발에 우선순위를 두고 있습니다.

- 환경 친화적인 포장재에 대한 소비자의 전환이 두드러집니다. 알루미늄과 유리는 환경적 이점과 재활용 가능성으로 인해 이 지역에서 인기를 얻고 있습니다. 이러한 추세는 전통적인 플라스틱에서 벗어나려는 보다 광범위한 움직임을 뒷받침하고 있습니다.

- 또한, 유럽 이사회는 일회용 플라스틱을 대상으로 야심찬 재활용 목표를 설정하는 새로운 EU 전역의 규정을 마련했습니다. 이러한 규제는 시장 상황에 영향을 미칠 것으로 예상됩니다.

독일의 포장 시장 동향

강화된 규제 속에서도 성장세를 이어가는 독일 플라스틱 포장 분야

- 독일에서는 솔루션 공급업체와 최종사용자의 선도적인 노력으로 플라스틱 포장 솔루션의 도입이 진행되고 있습니다. '메이드 인 독일'의 명성은 이 지역의 플라스틱 포장 기업들에게 유리한 환경을 조성해 왔습니다. 그러나 독일 정부는 플라스틱 포장 산업에 엄격한 규제를 가하고 있습니다. 독일 포장법은 포장재를 재활용할 수 있도록 설계하고, 재활용성을 중시하며, 재활용 및 재생 가능한 재료를 사용하도록 규정하고 있습니다.

- 제조업체들은 다양한 부문에서 수요가 증가함에 따라 플라스틱 병의 사용이 확대되는 것을 목격하고 있습니다. 예를 들어, 2023년 6월 코카콜라 유로퍼시픽 파트너스 독일(Coca-Cola Europacific Partners Germany)은 바트노이에나르(Bad Neuenahr)의 시설에서 미사용 PET 리턴 가능 PET 라인을 가동했습니다. 이 라인은 코카콜라, 환타, 스프라이트 등 인기 탄산음료를 병에 담아 무설탕 음료를 재도입할 예정입니다.

- 청량음료, 특히 탄산음료는 주로 플라스틱 병, 특히 폴리에틸렌 테레프탈레이트(PET) 병으로 포장되어 있습니다. 소비량이 증가함에 따라 이러한 플라스틱 병에 대한 수요도 증가하여 플라스틱 포장 부문의 성장에 박차를 가하고 있습니다. 비알콜 음료 경제 협회(wafg)의 데이터에 따르면 2023년 독일인의 평균 청량 음료 소비량은 약 124.5 리터로 2020년의 114.7 리터에서 증가할 것으로 예상됩니다.

- 이러한 소비 트렌드는 재활용 소재나 생분해성 플라스틱과 같은 지속가능한 플라스틱 포장 솔루션으로 옮겨갈 가능성이 있습니다. 기업들은 환경적 책임에 대한 소비자 및 규제 당국의 요구에 부응하기 위해 이러한 혁신에 투자할 것으로 보입니다.

- 플라스틱 병과 용기는 비용 효율성, 취급 용이성, 깨지지 않는 특성으로 인해 샴푸, 컨디셔너, 로션과 같은 퍼스널케어 제품에 선호되고 있습니다. 또한 재활용 및 생분해성 옵션과 같은 친환경 플라스틱 소재의 발전으로 인해 지속가능성에 대한 우려가 완화되어 환경 친화적인 소비자에게 더욱 매력적으로 다가오고 있습니다. 예를 들어, 2024년 8월 Alpla Werke Alwin Lehner GmbH &Co KG와 zerooo initiator SEA ME GmbH는 화장품 및 퍼스널케어 제품에 적합한 재사용 및 완전 재활용이 가능한 PET 병을 출시하였습니다.

독일의 포장 산업은 식품 트렌드와 환경 문제에 의해 주도되고 있다

- 재택근무의 강력한 추세에 힘입어 식품 부문이 주로 독일의 포장 산업을 주도하고 있습니다. 가볍고 비용 효율적이며 디자인이 유연한 플라스틱은 식품 포장의 주류를 차지하고 있으며, 제품을 쉽게 보관하고 사용하기에 이상적입니다.

- 경질 플라스틱 포장은 대량 생산에 유리한 비용 우위를 자랑하지만, 종이와 골판지 포장의 인기도 높아지고 있는데, 그 이유로 휴대성과 편리함을 꼽을 수 있습니다. 이러한 재료는 냉장 보관 없이 유통기한을 연장할 뿐만 아니라 환경 친화적이라는 장점도 있습니다.

- 경제가 번영함에 따라 슈퍼마켓에서 편의점에 이르기까지 현대 소매점은 특히 냉동 식품을 제공하는 데 있어 시야를 넓히고 있습니다. 이러한 소매업의 진화는 수축 필름, 연질 백, 뚜껑 필름, 하이 배리어 소재, 열성형 필름, 스킨 필름 등 신흥 시장에서 다양한 포장 기술의 채택을 가속화하고 있습니다.

- 환경에 대한 관심이 높아짐에 따라 독일의 주요 FMCG 기업들은 식품 포장에 플라스틱 사용을 기꺼이 줄이고 환경 친화적인 재료로 전환하고 있으며, 종이 기반 포장이 눈에 띄게 급증하고 있습니다.

- 식품 포장은 식품을 소비자에게 안전하게 전달하기 위해 매우 중요한 역할을 합니다. 기능적이고 아름다운 포장에 대한 수요가 증가함에 따라 식품 포장 분야의 기업들은 이러한 기대에 부응할 준비를 하고 있습니다.

- 트레이부터 파우치, 박스까지 다양한 포장 수요를 가진 조리식품은 포장 시장의 기술 혁신을 주도하고 있습니다. 제조업체들은 이러한 수요를 충족시키기 위해 다양한 솔루션을 적극적으로 개발하고 있습니다.

- Statistisches Bundesamt의 데이터에 따르면 독일 간편식 판매량이 눈에 띄게 증가하여 2021년 439만 달러에서 2023년 635만 달러로 급증할 것으로 예상됩니다. 이러한 판매량 증가를 나타내는 이러한 매출 급증은 각 준비된 음식은 자체 포장이 필요하기 때문에 포장재에 대한 수요 증가와 직접적으로 관련이 있습니다.

독일의 포장 산업 개요

세분화되어 있는 독일 포장 시장에는 다양한 세계 기업들이 진출해 있습니다. Amcor plc, Berry Global Inc., Mondi plc, O-I Germany GmbH &Co.KG(Owens-Illinois Inc. 자회사), Smurfit WestRock plc, Ball Corporation 등이 있습니다. 독일의 포장 산업에서는 전략적 성장을 위한 제품 출시, 인수, 기업 간 또는 기업 간 제휴 등의 추세가 지속적으로 나타나고 있습니다.

- 2024년 11월, Mondi plc는 독일에 혁신 허브를 개설하여 연질 포장 솔루션의 미래를 공동 창조하는 것을 목표로 하고 있습니다. 이 체험형 스튜디오는 Mondi의 고객이 혁신 과정에 직접 참여할 수 있도록 설계되었습니다. 고객은 이러한 체험형 스튜디오를 통해 몬디의 풍부한 전문 지식, 첨단 기술, 연포장 분야에서 지속가능한 변화를 주도하는 몬디의 노력을 활용할 수 있게 됩니다. 몬디는 파일럿 라인, 테스트 역량, 협업 공간을 통합함으로써 새로운 포장 및 종이 솔루션의 시장 출시를 가속화할 수 있는 역량을 갖추고 있습니다.

- 2024년 10월, Ardagh Group S.A.의 한 부서인 Ardagh Glass Packaging-Europe(AGP-Europe)는 새로운 경량 표준 와인 병 시리즈를 발표했습니다. 독일에서 생산된 이 병은 특히 유럽 시장을 겨냥한 제품입니다. 주목할 만한 점은 병의 무게가 410g에서 360g으로 줄었다는 점입니다. 이러한 경량화는 재활용 유리 카렛을 최대 80%까지 사용함으로써 가능했으며, 그 결과 병당 이산화탄소 배출량을 12%까지 줄일 수 있었습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 기술 현황

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 각국의 첨단 기술 도입에 의한 혁신적 및 맞춤형 포장 솔루션에 대한 수요

- 친환경적이고 편리한 포장 솔루션에 대한 수요 상승

- 시장 성장 억제요인

- 정부 규제와 환경 문제

제6장 시장 세분화

- 재료별

- 종이와 판지

- 유리

- 플라스틱

- 금속

- 기타

- 포장 유형별

- 경질

- 연질

- 산업별

- 식품

- 음료

- 의약품

- 가정용품·퍼스널케어

- 기타 최종 이용 산업별

제7장 경쟁 구도

- 기업 개요

- Amcor plc

- Berry Global Inc.

- Mondi plc

- Ball Corporation

- Ardagh Group S.A.

- Crown Holdings, Inc.

- O-I Germany GmbH & Co. KG(Owens-Illinois Inc.)

- Smurfit WestRock plc

- Stora Enso Oyj

- Constantia Flexibles GmbH

제8장 투자 분석

제9장 시장 기회와 향후 동향

ksm 25.01.23The Germany Packaging Industry is expected to grow from USD 38.06 billion in 2025 to USD 46.83 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

Key Highlights

- In Germany, the surge of e-commerce has led to a heightened demand for packaging materials. In response, regional packaging companies are pivoting, providing cost-effective, secure, and lightweight solutions specifically designed for online retail.

- These offerings feature innovative designs that safeguard products during transit while optimizing material usage. To handle the uptick in online orders, these firms are channeling investments into cutting-edge automated packing technologies, including robotic systems and AI-driven sorting tools. Such automation not only streamlines operations but also guarantees uniformity in packaging quality.

- Germany's packaged food and personal care sectors are witnessing an escalating demand for smaller pack sizes, a trend poised to gain momentum in the coming years. This shift is attributed to factors like the rise of single-person households, a preference for resealable, on-the-go packaging, and best-before-date considerations.

- These dynamics amplify the need for packaging materials in items ranging from sauces and dressings to confectionery and processed fruits. In response, manufacturers are crafting innovative packaging solutions that prioritize product freshness, minimize waste, and enhance portion control.

- The need for flexible plastic packaging is on the rise, driven by its lightweight nature and adaptability. This trend is bolstered by the preference for compact, user-friendly packaging and design advancements. Flexible plastics not only extend shelf life and cut transportation costs but also bolster product protection. In light of environmental concerns, manufacturers are prioritizing the development of recyclable and biodegradable flexible plastic variants.

- There's a noticeable consumer shift towards eco-friendly packaging materials. Aluminum and glass are gaining traction in the region, celebrated for their environmental benefits and recyclability. This trend underscores a broader movement away from traditional plastics.

- Additionally, the European Council has rolled out new EU-wide regulations targeting single-use plastics and setting ambitious recycling goals. These regulations are poised to influence the market landscape.

German Packaging Market Trends

Germany's Plastic Packaging Sector Navigates Growth Amidst Stricter Regulations

- Germany is increasingly adopting plastic packaging solutions, driven by advancements from solution suppliers and end users. The "Made in Germany" reputation has fostered a conducive environment for the region's plastic packaging companies. However, the German government has imposed stringent regulations on the plastic packaging industry. The German Packaging Law mandates that packaging be designed for recycling, emphasizing recyclability and using recyclable and renewable materials.

- Manufacturers are witnessing an expansion in the use of plastic bottles, with rising demand across various sectors. For instance, in June 2023, Coca-Cola Europacific Partners Germany activated an unused returnable PET line at its Bad Neuenahr facility. This line will bottle popular carbonated soft drinks, including Coca-Cola, Fanta, and Sprite, and reintroduce sugar-free variants.

- Soft drinks, especially carbonated ones, are primarily packaged in plastic bottles, especially polyethylene terephthalate (PET) bottles. As consumption rises, so does the demand for these plastic bottles, fueling growth in the plastic packaging sector. Data from the Economic Association of Non-Alcoholic Beverages (wafg) indicates that in 2023, the average German consumed approximately 124.5 litres of soft drinks, up from 114.7 litres in 2020.

- This growing consumption trend may lead to a pivot towards sustainable plastic packaging solutions, such as recycled materials or biodegradable plastics. Companies will likely invest in these innovations to align with consumer and regulatory demands for environmental responsibility.

- Plastic bottles and containers are favoured for personal care products like shampoos, conditioners, and lotions due to their cost-effectiveness, ease of handling, and resistance to breakage. Moreover, advancements in eco-friendly plastic materials, including recycled and biodegradable options, have alleviated sustainability concerns, making them more appealing to environmentally conscious consumers. For instance, in August 2024, Alpla Werke Alwin Lehner GmbH & Co KG and zerooo initiator SEA ME GmbH unveiled a reusable and fully recyclable PET bottle tailored for cosmetics and personal care products.

Germany's Packaging Industry is Driven by Food Trends and Environmental Concerns

- The food sector, bolstered by the persistent work-from-home trend, primarily drives Germany's packaging industry. Lightweight, cost-effective, and design-flexible, plastics dominate food packaging, making them ideal for easy product storage and use.

- While rigid plastic packaging boasts cost advantages for large-scale production, paper and cardboard packaging are rising in popularity, mentioned for their portability and convenience. These materials not only extend shelf life without refrigeration but also back environmental friendliness.

- As economies flourish, modern retail outlets, from supermarkets to convenience stores, are broadening their horizons, especially in frozen food offerings. This retail evolution accelerates the adoption of diverse packaging technologies in emerging markets, including shrink films, flexible bags, lidding films, high-barrier materials, thermoforming films, and skin films.

- In response to growing environmental concerns, major FMCG companies in Germany are ambitiously cutting down on plastic use in food packaging, pivoting towards eco-friendly materials, with paper-based packaging witnessing a notable surge.

- Ensuring safe delivery to consumers, food packaging plays a pivotal role. As demand rises for both functional and visually appealing packaging, companies in the food packaging sector are gearing up to meet these expectations.

- Ready meals, with their diverse packaging needs ranging from trays to pouches and boxes, are driving innovation in the packaging market. Manufacturers are actively developing varied solutions to cater to these demands.

- Data from Statistisches Bundesamt reveals a notable uptick in Germany's ready meals revenue, soaring from USD 4.39 million in 2021 to USD 6.35 million in 2023. This revenue surge, indicative of heightened sales volumes, directly correlates to an increased demand for packaging materials, as each ready meal necessitates its own packaging.

German Packaging Industry Overview

The fragmented German packaging market includes various global players with significant market presence. Key players encompass Amcor plc, Berry Global Inc., Mondi plc, O-I Germany GmbH & Co. KG (a subsidiary of Owens-Illinois Inc.), Smurfit WestRock plc, and Ball Corporation, among others. The German packaging industry has consistently witnessed trends such as product launches, acquisitions, and collaborations among businesses and their units, all aimed at strategic growth.

- November 2024: Mondi plc has inaugurated an innovative hub in Germany, aimed at co-creating the future of flexible packaging solutions. These experiential studios are designed for Mondi's customers to engage directly in the innovation process. This hands-on involvement allows them to leverage the company's vast expertise, cutting-edge technology, and commitment to driving sustainable change in the flexible packaging sector. By consolidating pilot lines, testing capabilities, and collaborative spaces, Mondi is poised to accelerate the market introduction of its new packaging and paper solutions.

- October 2024: Ardagh Glass Packaging-Europe (AGP-Europe), a division of Ardagh Group S.A., has unveiled a new lightweight range of standard wine bottles. Manufactured in Germany, these bottles cater specifically to the European market. Notably, the bottles have undergone a weight reduction from 410g to 360g. This achievement was made possible by incorporating a high recycled glass cullet level of up to 80%, resulting in a commendable 12% decrease in carbon emissions for each bottle produced.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Innovative and Customized Packaging Solution Aided with Country-s Adoption of Advanced Technology

- 5.1.2 Increasing Demand for Eco-friendly and Convenient Packaging Solution

- 5.2 Market Restraints

- 5.2.1 Government Regulations and Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Paper and Paperboard

- 6.1.2 Glass

- 6.1.3 Plastic

- 6.1.4 Metal

- 6.1.5 Other Materials

- 6.2 By Packaging Type

- 6.2.1 Rigid

- 6.2.2 Flexible

- 6.3 By End-user Vertical

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor plc

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi plc

- 7.1.4 Ball Corporation

- 7.1.5 Ardagh Group S.A.

- 7.1.6 Crown Holdings, Inc.

- 7.1.7 O-I Germany GmbH & Co. KG (Owens-Illinois Inc.)

- 7.1.8 Smurfit WestRock plc

- 7.1.9 Stora Enso Oyj

- 7.1.10 Constantia Flexibles GmbH