|

시장보고서

상품코드

1851090

스몰셀 5G 네트워크 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Small Cell 5G Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

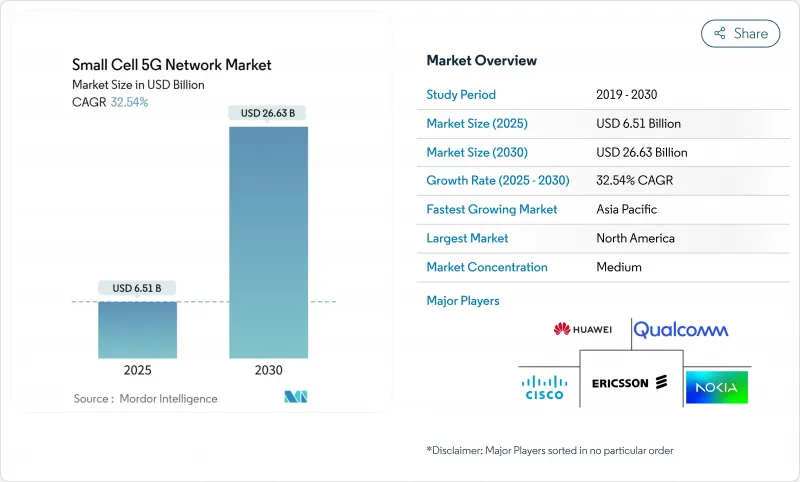

스몰셀 5G 네트워크 시장 규모는 2025년에 65억 1,000만 달러로 추정되고, 예측 기간(2025-2030년) CAGR 32.54%로 성장할 전망이며, 2030년에는 266억 3,000만 달러에 달할 것으로 예측됩니다.

도시 회랑에서 진행되는 고밀도화, 기업의 디지털화, AI 네이티브 네트워크 관리 시스템의 전개에 의해, 통신 사업자나 프라이빗 네트워크의 도입이 가속화되고 있습니다. 피코셀, 중립 호스트 모델, Release-17 NR-U 기능은 주파수 대역과 부지의 제약을 완화하여 대응 가능한 이용 사례를 확대하고 있습니다. 아시아태평양은 인프라 규모 확대로 주목을 받고 있지만, 북미는 인프라를 보다 효율적으로 프리미엄 수입으로 전환하고 있습니다. 경쟁 역학으로는 AI 대응 칩 제조업체나 Open RAN의 스페셜리스트가 틈새 시장을 개척하는 한편, 기존의 무선 벤더가 소프트웨어 정의 아키텍처에 축족을 옮겨가고 있습니다.

세계의 스몰셀 5G 네트워크 시장 동향 및 인사이트

도시 지역에서의 5G 전개에서 급속한 고밀도화의 요구

통신 사업자는 밀집한 도시에서는 매크로셀만으로는 5G의 서비스 레벨 계약을 충족할 수 없다는 것을 확인하고 있습니다. EE는 영국 전역에서 1,000개 이상의 스몰셀을 운영하고 있으며, 런던의 25개 사이트에서는 매주 7.5TB의 데이터를 이동시켜 기존 분야의 혼잡을 완화하고 있습니다. Virgin Media O2는 영국 최초의 5G 독립형 스몰셀을 도입해 매크로 사이트에서는 대응할 수 없는 네트워크 슬라이싱과 저지연을 실현했습니다. 스몰셀 내의 분수 주파수 재사용은 AR 및 산업용 IoT와 같은 업링크를 많이 사용하는 용도가 주류가 됨에 따라 중요한 주파수 이용을 개선합니다. 자치체는 관공서에서 벗어나 세계 100개 이상의 중립 호스트가 운영되고 있습니다. 이러한 요인들이 결합되어 중기적인 고밀도화의 필요성이 증가하고 있습니다.

기업의 사설망 수요(제조, 물류)

정부 정책과 Industry 4.0 로드맵은 공장과 물류의 현장을 결정론적인 무선 연결로 향하게 하고 있습니다. 중국에서는 이미 약 4,000개의 5G 공장 네트워크가 구축되어 있으며, 2027년까지 10,000을 목표로 하고 있습니다. 노키아는 2024년 4분기까지 5G 개인 고객을 850개로 집계했고, 1분기에 55개를 추가했습니다. 태국의 가전공장에서는 5G에 의한 자동화로 생산성이 15-20% 향상되었다고 보고되었습니다. 현재 유럽의 7개국이 26GHz대의 면허를 현지에서 취득하고, 6개국이 3.4-3.8GHz대의 100MHz를 할당하고 있어 기업의 주파수대 조달이 용이하게 되어 있습니다. 스몰셀은 좁은 커버리지 경계를 강제하고, 엣지 컴퓨팅을 통합하며, 동시 네트워크 슬라이스를 지원하기 때문에 무선 레이어로 여전히 선호되고 있습니다.

교외 및 농촌 지역에서 섬유 및 백홀의 경제성에 대한 도전

공중 광섬유의 건설 비용은 교외에서 마일당 6만 달러에서 17만 달러가 소요되며, 인구 밀도가 낮은 지역에서는 수익이 떨어집니다. 크라운 캐슬은 불리한 백홀 계산을 인식한 후 미국의 7,000개의 스몰셀 사이트를 선반으로 올려 미래 자본 지출을 8억 달러 절약했습니다. 마이크로파와 위성 백홀은 설비 투자를 줄이지만 5G 용량과 지연 목표에는 아직 대응할 수 없습니다. 연방 도로 관리국의 데이터에 따르면, 마이크로 트렌치를 사용해도 교외에서는 아직 6-8년의 손익 분기점이 남아 있습니다. 따라서 사업자는 차세대 무선 백홀이 상업적으로 실행 가능하다는 것이 입증될 때까지 수익성이 높은 대도시 지역을 넘어서는 고밀도화를 망설이고 있습니다.

부문 분석

피코셀은 2024년 매출의 41%를 차지하였고, 혼잡한 도심부의 통로에서 100-200m의 커버리지 존에 적합한 것으로 확인되었습니다. 피코셀의 스몰셀 5G 네트워크 시장 규모는 미드밴드 스펙트럼과 다중 사용자 MIMO가 사이트당 용량을 늘리면서 급증하는 경향이 있습니다. EdgeQ의 베이스 스테이션 온칩과 같은 실리콘 혁신은 전력, 비용 및 설치 면적을 줄이는 통합 AI를 제공합니다.

펨토셀은 틈새 주택과 소규모 사무실을 대상으로 하지만 Wi-Fi 7의 압력에 직면하고 있으며, 마이크로셀은 피코셀 밀도가 비용적으로 어려운 교외의 넓은 구획을 지원합니다. Comba Telecom의 ORAN 호환 마이크로 무선 장치는 표준화된 멀티 벤더 에코시스템으로의 흐름을 반영합니다. AI를 활용한 최적화를 통해 폼 팩터 간 성능 격차가 줄어들면서 운영자는 운영 효율성을 희생하지 않고 각 사이트의 용량 요구 사항에 유연하게 대응할 수 있습니다.

실내 사이트는 2024년 전개의 63%를 차지했는데, 이는 미드밴드 5G 신호가 최신 건축 자재를 통해 페이드 아웃하기 때문입니다. 중립 호스트 시스템과 스마트 빌딩 관리는 사무실, 경기장 및 공장에 걸쳐 서비스 품질을 요구하는 기업에게 실내 투자의 설득력을 유지합니다. 옥외 카테고리는 지자체에 의한 허가의 신속화, Release-17 NR-U, 인프라의 공유화에 의해 설치의 마찰이 경감되어 CAGR 33.01%로 가속하고 있습니다. 맨체스터 중심부에 있는 버진 미디어 O2의 옥외 셀 등의 노력이 이 축발을 강조하고 있습니다.

Freshwave는 영국의 4개 통신 사업자 모두를 하나의 실외 및 실내 스몰셀 인클로저에 통합하여 이전 시스템에 비해 비용을 65%, 에너지를 60% 절감하고 있습니다. 실내 제공업체는 현재 Wi-Fi가 미치지 않는 확정적인 지연, 보안, 슬라이스 관리를 강조함으로써 이론 속도 46Gbps를 홍보하는 Wi-Fi 7을 방어해야 합니다.

스몰셀 5G 네트워크 시장 보고서는 셀 유형별(펨토셀, 피코셀, 마이크로셀, 메트로셀), 작동 환경별(실내, 실외), 주파수 대역별(6GHz 미만, Mmwave(24GHz 이상), 1GHz 미만), 최종 사용자별(통신 사업자, 기업, 주택), 지역별로 분류됩니다.

지역 분석

아시아태평양은 2024년 매출의 38%를 차지하였고, 2030년까지 CAGR 32.60%로 성장이 전망됩니다. 이는 중국의 440만 5G 기지국과 300개 도시에서 5G-Advanced 오버레이에 충당되는 30억 위안에 의해 추진됩니다. 중국 유니콤 베이징과 화웨이는 인구 1,000만 명 규모로 11.2Gbps의 다운링크 피크를 달성하여 미래의 고밀도 오버레이 기준점을 설정했습니다. 일본과 한국은 기업용 mmWave를 추진했고, 인도는 경매 후 관민 파트너십을 통한 고밀도화의 여지를 제공했습니다.

북미는 수익 실현의 효율성을 보여줍니다. 에릭슨의 지역별 매출액은 AT&T의 140억 달러의 계약을 배경으로 전년 대비 55% 증가하여 견조한 투자 수익을 실증했습니다. 미국에서는 50개 이상의 중립 호스트 프로젝트가 CBRS에서 운영되고 있으며 캐나다의 TELUS는 최초의 상용 가상화 Open RAN을 배포하고 이 지역을 클라우드 네이티브 RAN 실험의 최전선에 위치하고 있습니다. 그러나 크라운 캐슬의 도입 중단은 교외의 경제성이 뿌리 깊은 장애물임을 부각하고 있습니다.

유럽은 명확한 주파수 정책을 누리고 있지만, 단독으로의 5G 커버리지는 늦어져 2024년 후반까지 보급률은 불과 2%에 달했습니다. 버진 미디어 O2와 EE는 스몰셀의 실적를 강화하고 있지만, 많은 사업자들은 디바이스의 보급률이 높아지면 비즈니스 케이스가 변전되기를 기다리고 있습니다. 중동에서 UAE는 30.5Gbps의 5G 통신 속도를 기록했으며 du는 하이퍼스케일 데이터센터에 20억 AED를 투입했습니다. 라틴아메리카에서는 브라질의 Brisanet과 우루과이의 Antel이 공공 5G를 확대하고 있지만, 거시 경제의 제약과 주파수 대역의 부족이 스몰셀의 전개를 억제하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 도시에서의 5G 전개에서 급속한 고밀도화 요구

- 기업의 사설망 수요(제조, 물류)

- 릴리스 17 5G NR-U는 면허 불필요한 스몰셀 스펙트럼을 가능하게 합니다.

- 규제 당국의 지지를 얻는 중립 호스트 비즈니스 모델

- AI에 의한 자기 최적화 네트워크가 OpEx를 삭감(과소보고)

- 시장 성장 억제요인

- 교외나 농촌 지대에서 섬유 및 백홀의 경제적 과제

- 지자체의 용지 취득 지연 및 수수료

- 오픈 RAN 스몰셀을 둘러싼 뿌리 깊은 보안 우려(과소보고)

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁의 격렬함

제5장 시장 규모 및 성장 예측

- 셀 유형별

- 펨토셀

- 피코셀

- 마이크로셀

- 메트로셀

- 사용 환경별

- 실내

- 아웃도어

- 주파수 대역별

- 서브 6GHz

- mmWave(24GHz 이상)

- 서브 1GHz

- 최종 사용자별

- 전기통신 사업자

- 기업

- 주택용

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Samsung Electronics Co. Ltd

- Qualcomm Technologies Inc.

- Airspan Networks Inc.

- CommScope Inc.

- Cisco Systems Inc.

- NEC Corporation

- Baicells Technologies Co. Ltd

- Qucell Inc.

- JMA Wireless

- Parallel Wireless

- Mavenir Systems

- Casa Systems

- Corning Inc.

- Sercomm Corporation

- Comba Telecom Systems Holdings Ltd

- American Tower Corporation

- Boingo Wireless Inc.

제7장 시장 기회 및 향후 전망

AJY 25.11.12The Small Cell 5G Network Market size is estimated at USD 6.51 billion in 2025, and is expected to reach USD 26.63 billion by 2030, at a CAGR of 32.54% during the forecast period (2025-2030).

Ongoing densification in urban corridors, enterprise digitalization, and the roll-out of AI-native network management systems are accelerating uptake across telecom operators and private-network deployments. Picocells, neutral-host models, and Release-17 NR-U capabilities are expanding addressable use cases by easing spectrum and site constraints. Asia Pacific commands attention through infrastructure scale, yet North America converts infrastructure into premium revenue more efficiently, while Europe's regulatory clarity promises a delayed but sizable second wave of growth. Competitive dynamics feature established radio vendors pivoting toward software-defined architectures even as AI-enabled chipmakers and Open RAN specialists carve out niches.

Global Small Cell 5G Network Market Trends and Insights

Rapid densification needs in urban 5G rollouts

Operators have confirmed that macro cells alone cannot satisfy 5G service-level agreements in dense cities. EE has activated more than 1,000 small cells across the United Kingdom, with 25 London sites moving 7.5 TB of data each week, easing congestion in traditional sectors. Virgin Media O2 introduced the first UK 5G standalone small cells, unlocking network slicing and lower latency that macro sites cannot match. Fractional frequency reuse within small cells improves spectrum utilization, which is critical as uplink-heavy applications such as AR and industrial IoT become mainstream. Municipalities are cutting red tape, and more than 100 neutral-host installations are now live worldwide. Combined, these factors reinforce the densification imperative over the medium term.

Enterprise private-network demand (manufacturing, logistics)

Government policy and Industry 4.0 roadmaps are pushing factories and logistics sites toward deterministic wireless connectivity. China already hosts roughly 4,000 5G factory networks and targets 10,000 by 2027. Nokia counted 850 private 5G customers by Q4 2024, adding 55 in a single quarter. Operational outcomes are compelling: a Thai appliance plant reported 15-20% productivity gains after 5G-enabled automation. Seven European states now license the 26 GHz band locally, and six allocate 100 MHz in the 3.4-3.8 GHz range, making spectrum procurement easier for enterprises. Small cells remain the preferred radio layer because they enforce tight coverage boundaries, integrate edge compute, and support concurrent network slices.

Challenging fiber/backhaul economics in suburban and rural zones

Aerial fiber construction costs between USD 60,000 and USD 170,000 per mile in suburbs, depressing returns where population density is low. Crown Castle shelved 7,000 U.S. small-cell sites, preserving USD 800 million in future capital spending, after recognizing unfavorable backhaul math. Microwave and satellite backhaul trim capex but cannot yet meet 5G capacity or latency targets. Federal Highway Administration data show that using micro-trenching still leaves a six-to-eight-year breakeven in suburban settings. Consequently, operators hesitate to densify beyond profitable metros until next-generation wireless backhaul proves commercially viable.

Other drivers and restraints analyzed in the detailed report include:

- Release-17 5G NR-U enabling unlicensed small-cell spectrum

- AI-driven self-optimizing networks cutting OpEx

- Persistent security concerns around Open RAN small cells

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Picocells contributed 41% of 2024 revenue, confirming their suitability for 100-200 m coverage zones in crowded downtown corridors. The Small Cell 5G Network market size for picocells is on course to expand sharply as mid-band spectrum and multi-user MIMO raise per-site capacity. mmWave picocells show the sharpest 36.51% CAGR, propelled by private networks and fixed wireless access that exploit 28 GHz and 39 GHz to deliver multi-gigabit throughput. Silicon innovation, such as EdgeQ's base-station-on-a-chip, brings integrated AI that shrinks power, cost, and footprint.

Femtocells hold niche residential and small-office positions but face pressure from Wi-Fi 7, while microcells support wider suburban blocks where picocell density is cost-prohibitive. ORAN-compliant micro-radio units from Comba Telecom reflect a drift toward standardized multi-vendor ecosystems. As AI-enabled optimization narrows performance gaps between form factors, operators gain flexibility to match each site's capacity requirements without sacrificing operating efficiency.

Indoor sites represented 63% of 2024 deployments, since mid-band 5G signals fade through modern building materials. Neutral-host systems and smart-building management keep indoor investments compelling for enterprises seeking quality-of-service across offices, stadiums, and factories. The outdoor category is accelerating at a 33.01% CAGR as faster municipal permitting, Release-17 NR-U, and shared infrastructure lower siting friction. Initiatives such as Virgin Media O2's outdoor cells in central Manchester underline this pivot.

Hybrid solutions are emerging, with Freshwave integrating all four UK carriers into a single outdoor-indoor small cell enclosure, cutting costs by 65% and energy by 60% relative to earlier systems. Indoor providers must now defend against Wi-Fi 7, which advertises 46 Gbps theoretical speeds, by highlighting deterministic latency, security, and slice management that Wi-Fi cannot match.

The Small Cell 5G Network Market Report is Segmented by Cell Type (Femtocell, Picocell, Microcell, and Metrocell), Operating Environment (Indoor and Outdoor), Frequency Band (Sub-6 GHz, Mmwave [More Than 24 GHz], and Sub-1 GHz), End-User (Telecom Operators, Enterprises, and Residential), and Geography.

Geography Analysis

Asia Pacific owns 38% of 2024 revenue and tracks a 32.60% CAGR to 2030, propelled by China's 4.4 million 5G base stations and CNY 3 billion earmarked for 5G-Advanced overlays in 300 cities. China Unicom Beijing and Huawei achieved downlink peaks of 11.2 Gbps across a population of 10 million, setting a reference point for future dense overlays. Japan and South Korea push enterprise mmWave, and India's post-auction build-out supplies scope for densification through public-private partnerships.

North America showcases revenue realization efficiency. Ericsson's regional revenue climbed 55% year over year on the back of AT&T's USD 14 billion contract, underlining robust investment returns. More than 50 U.S. neutral-host projects operate in CBRS, and Canada's TELUS is rolling out the first commercial virtualized Open RAN, positioning the region at the forefront of cloud-native RAN experimentation. Still, Crown Castle's canceled deployments highlight suburban economics as a persistent hurdle.

Europe enjoys a clear spectrum policy yet lags in standalone 5G coverage, reaching only 2% penetration by late 2024. Virgin Media O2 and EE are ramping small-cell footprints, but many operators wait for a business-case inflection once device penetration rises. In the Middle East, the UAE logged record 30.5 Gbps 5G speeds, and du committed AED 2 billion to hyperscale data centers, signaling that Gulf operators will leapfrog directly to 5G-Advanced. Latin America sees Brazil's Brisanet and Uruguay's Antel expanding public 5G, though macroeconomic constraints and spectrum scarcity temper small-cell rollouts.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Samsung Electronics Co. Ltd

- Qualcomm Technologies Inc.

- Airspan Networks Inc.

- CommScope Inc.

- Cisco Systems Inc.

- NEC Corporation

- Baicells Technologies Co. Ltd

- Qucell Inc.

- JMA Wireless

- Parallel Wireless

- Mavenir Systems

- Casa Systems

- Corning Inc.

- Sercomm Corporation

- Comba Telecom Systems Holdings Ltd

- American Tower Corporation

- Boingo Wireless Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid densification needs in urban 5G roll-outs

- 4.2.2 Enterprise private-network demand (manufacturing, logistics)

- 4.2.3 Release-17 5G NR-U enabling unlicensed small-cell spectrum

- 4.2.4 Neutral-host business models gaining regulatory support

- 4.2.5 AI-driven self-optimizing networks cutting OpEx (under-reported)

- 4.3 Market Restraints

- 4.3.1 Challenging fiber/backhaul economics in suburban and rural zones

- 4.3.2 Municipal site-acquisition delays and fees

- 4.3.3 Persistent security concerns around Open RAN small-cells (under-reported)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cell Type

- 5.1.1 Femtocell

- 5.1.2 Picocell

- 5.1.3 Microcell

- 5.1.4 Metrocell

- 5.2 By Operating Environment

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By Frequency Band

- 5.3.1 Sub-6 GHz

- 5.3.2 mmWave (More than 24 GHz)

- 5.3.3 Sub-1 GHz

- 5.4 By End-User

- 5.4.1 Telecom Operators

- 5.4.2 Enterprises

- 5.4.3 Residential

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telefonaktiebolaget LM Ericsson

- 6.4.2 Nokia Corporation

- 6.4.3 Huawei Technologies Co. Ltd

- 6.4.4 ZTE Corporation

- 6.4.5 Samsung Electronics Co. Ltd

- 6.4.6 Qualcomm Technologies Inc.

- 6.4.7 Airspan Networks Inc.

- 6.4.8 CommScope Inc.

- 6.4.9 Cisco Systems Inc.

- 6.4.10 NEC Corporation

- 6.4.11 Baicells Technologies Co. Ltd

- 6.4.12 Qucell Inc.

- 6.4.13 JMA Wireless

- 6.4.14 Parallel Wireless

- 6.4.15 Mavenir Systems

- 6.4.16 Casa Systems

- 6.4.17 Corning Inc.

- 6.4.18 Sercomm Corporation

- 6.4.19 Comba Telecom Systems Holdings Ltd

- 6.4.20 American Tower Corporation

- 6.4.21 Boingo Wireless Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment