|

시장보고서

상품코드

1630338

중동 및 아프리카의 종이 및 판지 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Middle East And Africa Paper And Paperboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

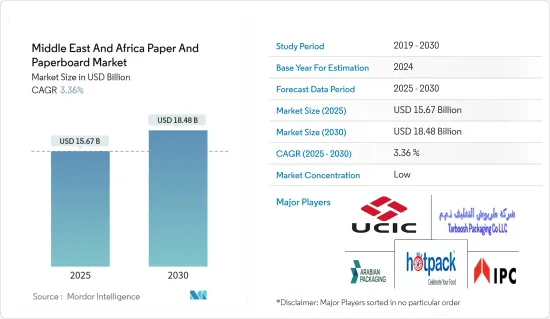

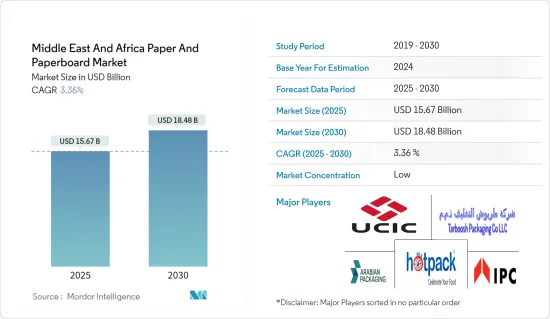

중동 및 아프리카의 종이 및 판지 시장 규모는 2025년 156억 7,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 3.36%의 CAGR로 2030년에는 184억 8,000만 달러에 달할 것으로 예상됩니다.

중동 및 아프리카의 종이 및 판지 포장 시장은 식음료, 퍼스널케어, 의료, E-Commerce 등의 산업 성장에 힘입어 꾸준히 확대될 것으로 보입니다. 또한, 이 지역의 지속가능성에 대한 노력은 재활용이 가능한 종이 및 판지 제품의 채택을 촉진하고 있습니다.

주요 하이라이트

- 목재와 비목재를 원료로 한 펄프는 종이와 판지 포장의 생산 기반입니다. 목재 펄프의 중요한 공급원은 폐지입니다. 목재 펄프는 지속가능성과 저렴한 가격으로 인해 종이 및 판지 포장의 다양한 최종 이용 산업에서 사용되었습니다.

- 중동에서는 기존 포장재의 이산화탄소 배출량 감소에 대한 인식이 높아짐에 따라 지속가능한 포장재 시장이 증가하고 있습니다. 카타르 정부는 국가 비전 2030에 따라 재생 불가능한 자원에 대한 의존도를 낮추고 폐기물 배출을 최소화하기 위해 여러 가지 녹색 경제 프로그램을 시작했습니다.

- 음료 및 식품 부문의 트렌드와 마찬가지로, 건강을 중시하는 소비자들이 식료품 배달 및 식사 키트를 선택함에 따라 식품 공급업체들 사이에서 테이크아웃에 대한 선호도가 눈에 띄게 증가하고 있습니다. 또한, 맥도날드와 같은 세계 패스트푸드 업체들이 친환경 식품 포장의 모멘텀을 포착하여 시장 성장을 촉진하고 있습니다. 소매용 포장은 상당한 비용 절감 효과를 가져와 선반 보충 및 취급 비용을 50%까지 절감할 수 있는 것으로 추정됩니다. 이러한 장점은 식품 배달 서비스에 영향을 미쳐 친환경 종이 기반 포장에 대한 관심을 높이고 있습니다.

- 또한 급속한 도시화와 관광 붐으로 인해 관광객들은 더 안전한 가공식품을 선호하게 되었고, 이는 포장식품과 식음료에 대한 수요를 더욱 촉진하고 있습니다. 사우디아라비아 통계청에 따르면, 음료 및 식품 부문의 매출은 2020년 144억 6,000만 달러에서 2025년 약 160억 3,000만 달러로 증가할 것으로 예상됩니다. 이러한 상승세는 음료 및 식품 부문에서 종이 용기 및 상자와 같은 지속가능한 포장 솔루션에 대한 수요를 증가시킬 것으로 예상됩니다.

- 또한, E-Commerce 붐과 기술 발전은 운송 및 산업용 포장의 성장에 박차를 가할 것으로 예상됩니다. 유망한 시장 전망으로 인해 종이 기반 부문의 국내외 투자자들은 입지를 강화하고 지역 내 제품 역량을 강화하는 데 열중하고 있습니다. 온라인 쇼핑에 대한 수요 증가는 펄프 및 제지 제품에 대한 관심의 증가를 더욱 부각시키고 있습니다.

- 그러나 급증하는 종이 포장 수요는 무책임한 삼림 벌채라는 어려운 도전에 직면해 있습니다. 이는 종이 포장 산업의 원료 공급을 위협할 뿐만 아니라 중요한 생태계에도 위험을 초래합니다. 지속가능하지 않은 종이 생산은 특히 이러한 관행이 여전히 만연한 지역에서 생태계 파괴와 사회적 갈등으로 이어질 수 있습니다.

중동 및 아프리카의 종이 및 판지 시장 동향

E-Commerce 성장에 힘입은 골판지 상자 수요 증가

- 지속가능성이 공급망 전반에 걸쳐 중요한 관심사로 떠오르면서 골판지 포장이 각광을 받고 있습니다. 펄프 및 제지 산업은 재활용이 가능한 최신 골판지 원료를 사용하여 골판지를 생산하고 있습니다. 또한, 스티로폼과 같은 폴리머 기반 대체재보다 골판지의 보호 형태가 점점 더 선호되고 있습니다.

- E-Commerce의 부상은 소매업계의 판도를 바꾸어 놓았습니다. 소비자 행동과 소매 비즈니스 모델을 변화시킨 이 트렌드는 현재 중동에서 확대되고 있으며, 업계 관계자들에게 큰 기회를 가져다주고 있습니다. 중동의 E-Commerce 성장을 이끄는 주요 요인으로는 높은 1인당 소득, 탄탄한 교통 및 물류 네트워크, 인터넷 보급률 증가, 기술 발전 등을 들 수 있습니다.

- 국내 규제 당국과 정부 기관은 환경 및 경제적 이점으로 인해 골판지 상자와 같은 지속가능한 포장 솔루션에 우선순위를 두고 있습니다. 이러한 강조는 시장 확대를 더욱 촉진하고 있습니다. 예를 들어, Apex Business Trading은 2023년 7월 오만의 Samail Industrial City의 Facility Building에 골판지 공장의 새로운 지점을 개설하고 동시에 4개의 혁신적인 제품을 출시했습니다.

- 국제무역국에 따르면 아프리카의 E-Commerce 이용자는 2025년까지 5억 명을 넘어설 것으로 예상됩니다. 식료품 부문은 주로 전염병과 그에 따른 폐쇄로 인해 54%의 급격한 성장을 보였습니다. 식료품 및 패스트푸드 부문을 아우르는 다양한 식품 배송 플랫폼에서도 비슷한 성장세가 두드러졌습니다. 소비자들은 가격에 민감하고 온라인 프로모션과 쿠폰을 활용하는 경우가 많습니다.

- 사우디아라비아는 자국을 세계 E-Commerce의 중요한 진입자로 자리매김하고 국내, 지역 및 국제적으로 큰 입지를 구축하고자 하는 의욕적인 노력을 기울이고 있습니다. 국제 디지털 상거래 관련 저명한 뉴스 미디어인 Cross Border Magazine은 사우디아라비아의 온라인 매출 성장률이 2027년까지 연간 13.5%의 견조한 성장세를 유지할 것으로 예측하고 있습니다. 사우디의 E-Commerce 매출은 2027년까지 300억 달러, 2030년까지 440억 달러로 급증할 것으로 예상됩니다. 이러한 E-Commerce의 급격한 증가는 경량, 무공기 골판지 상자 및 2차 및 3차 포장 솔루션에 대한 수요를 촉진할 것으로 예상됩니다.

아랍에미리트가 가장 빠른 시장 성장세를 보일 것으로 예상

- 아랍에미리트에서는 식품 및 비식품 부문의 최종사용자 산업이 크게 확대됨에 따라 예측 기간 동안 골판지 원지, 종이 용기 및 골판지 상자에 대한 수요가 증가할 것으로 예상됩니다. 성인 인구의 증가로 인한 식습관의 변화는 조사 대상 지역 전체에서 두드러지게 나타나고 있습니다. 이러한 변화로 인해 식품 부문에서 포장 식품, 신선한 야채 및 과일에 대한 수요가 증가하고 있습니다.

- 아랍에미리트의 종이 및 판지 포장 시장은 빠르게 성장하고 있습니다. 이러한 빠른 성장은 국민들의 환경에 대한 인식이 높아지고, 지속가능한 포장 솔루션에 대한 수요가 증가하며, 적절한 포장에 대한 요구가 높아졌기 때문입니다. 또한, 급성장하는 E-Commerce 시장과 경제 성장과 1인당 소득 증가에 힘입어 전자제품, 가정용품, 퍼스널케어 제품에 대한 수요가 증가하고 있는 것도 성장의 요인으로 꼽힙니다.

- 일회용 플라스틱 사용이 금지됨에 따라 산업계는 재활용 및 재사용이 가능한 포장 솔루션으로 전환하고 있습니다. 생분해성 포장지 및 판지에 대한 수요 증가는 이러한 시장 확대에 더욱 박차를 가하고 있습니다. KEZAD 그룹의 칼리파 경제 구역 아부다비(Khalifa Economic Zones Abu Dhabi)는 주목할 만한 사례로 꼽힙니다. 이 회사는 최근 재생 크라프트지 점보 릴 생산에 특화된 새로운 공장을 설립한다고 발표했습니다. 이는 제품 라인업을 다양화하고 아랍에미리트에서 급증하는 생분해성 포장재에 대한 수요에 부응하기 위한 조치입니다.

- 조리된 식품은 2차 포장에 카톤을 사용하는 경우가 많으며, 2024년 4월 현재 아랍에미리트는 이 부문에서 568개의 제조 및 가공업체(주로 중소기업)와 2,000개 이상의 제조회사를 보유하고 있습니다. 주목할 만한 점은 아랍에미리트의 식품 가공 부문이 국내 수요와 지역 및 세계 시장에 대응하고 있다는 점입니다.

- 또한, 온라인 식품 배달 서비스 및 테이크아웃의 성장도 종이 포장 제품에 대한 UAE의 수요를 증가시킬 것으로 보입니다. 식품 소매는 아랍에미리트에서 4번째로 큰 E-Commerce 부문입니다. USDA Foreign Agricultural Service에 따르면, UAE의 식품 E-Commerce는 식료품, 포장 식품, 조리된 식품 등 소매점 및 레스토랑에서 온라인으로 판매되는 상품을 의미하며, USDA Foreign Agricultural Service에 따르면, UAE의 식품 E-Commerce 소매액은 6억 4,100만 달러에서 2023년에는 10억 7,200만 달러로 증가할 것으로 예상됩니다. 이러한 성장은 식품 포장용 종이 용기 및 상자와 같은 제품에 대한 수요가 증가함에 따라 향후에도 지속될 것으로 예상됩니다.

중동 및 아프리카의 종이 및 판지 산업 개요

중동 및 아프리카의 종이 및 판지 시장은 세분화되어 있으며, International Packaging Company LLC, Arabian Packaging Co, United Carton Industries Company, Hotpack Packaging Industries 등 여러 주요 기업들로 구성되어 있습니다. 지속가능성을 중시하는 업체들은 고객 기반을 더욱 확대하고 시장 점유율을 확보하기 위해 전략적 협업 이니셔티브와 인수를 통해 경쟁 우위를 확보하고 제품 라인을 강화하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 경량이고 지속가능한 재료에 대한 수요 상승

- E-Commerce 증가에 의한 다양한 종이·판지 포장 수요 창출

- 시장 성장 억제요인

- 원료 비용 상승

제6장 시장 세분화

- 제품 유형별

- 접는 상자

- 골판지 상자

- 기타

- 최종 이용 산업별

- 식품

- 음료

- 의료

- 퍼스널케어

- 전기

- 기타

- 국가별

- 아랍에미리트

- 사우디아라비아

- 이집트

- 모로코

- 남아프리카공화국

- 나이지리아

제7장 경쟁 구도

- 기업 개요

- International Packaging Company LLC

- Arabian Packaging Co. LLC

- United Carton Industries Company(UCIC)

- Tarboosh Packaging Co. LLC

- Hotpack Packaging Industries LLC

- International Paper

- Al Rumanah Packaging

- Green Packaging Boxes Ind LLC

- Matco Packaging LLC

- Global Carton Boxes Manufacturing LLC

제8장 시장 기회와 향후 동향

ksm 25.01.23The Middle East And Africa Paper And Paperboard Market size is estimated at USD 15.67 billion in 2025, and is expected to reach USD 18.48 billion by 2030, at a CAGR of 3.36% during the forecast period (2025-2030).

Driven by the growth of industries like food and beverages, personal care, healthcare, and e-commerce, the MEA paper and paperboard packaging market is poised for steady expansion. Additionally, the region's commitment to sustainability is boosting the adoption of recyclable paper and paperboard products.

Key Highlights

- Pulp, derived from wood and non-wood materials, is the foundation for producing paper and paperboard packaging. A significant source of wood pulp comes from recycled paper. Given its sustainability and affordability, wood pulp has become the go-to choice for various end-use industries in paper and paperboard packaging.

- In the Middle East, the market for sustainable packaging products is on the rise, primarily due to heightened awareness about reducing the carbon footprint of conventional packaging materials. In alignment with its National Vision 2030, the Qatari government has initiated multiple green economy programs to curtail reliance on non-renewable resources and minimize waste output.

- Similar to trends in the food and beverage sector, a surge in health-conscious consumers opting for grocery delivery and meal kits has led to a notable uptick in take-out preferences among food suppliers. Furthermore, global fast-food giants like McDonald's are seizing the momentum of eco-friendly food packaging, propelling market growth. Retail-ready packaging offers significant cost savings, with estimates suggesting a potential 50% reduction in shelf restocking and handling costs. This advantage has influenced food delivery services and heightened their focus on environmentally friendly, paper-based packaging.

- Moreover, rapid urbanization and a boom in tourism, with visitors prioritizing safer processed foods, have spurred the demand for packaged food and beverages. According to the General Authority for Statistics in Saudi Arabia, the food and beverage sector's revenue is projected to rise from USD 14.46 billion in 2020 to an estimated USD 16.03 billion by 2025. This upward trajectory is set to boost the demand for sustainable packaging solutions, like folding cartons and boxes, in the food and beverage domain.

- Furthermore, the e-commerce boom and technological advancements will likely spur growth in transport and industrial packaging. Given the market's promising outlook, domestic and international investors in the paper-based sector are keen on bolstering their presence and enhancing regional product capacity. The uptick in online shopping demand further underscores the rising interest in pulp and paper products.

- However, the burgeoning demand for paper packaging faces a daunting challenge: irresponsible deforestation. This not only threatens the paperboard packaging industry's raw material supply but also poses risks to vital ecosystems. Unsustainable practices in paper production can lead to ecosystem degradation and even social conflicts, especially in regions where such practices are still rampant.

Middle East And Africa Paper And Paperboard Market Trends

Demand For Corrugated Boxes Backed By E-commerce Growth

- As sustainability becomes a pivotal concern across the supply chain, corrugated packaging is gaining traction. The pulp and paper industry's advancements in producing modern containerboards from raw materials enhance its recyclability. Moreover, there's a growing preference for corrugated protective formats over polymer-based alternatives like foams.

- The rise of e-commerce has reshaped the retail landscape. This trend, which has altered consumer behavior and retail business models, is now expanding in the Middle East, presenting substantial opportunities for industry stakeholders. Key drivers fueling e-commerce growth in the Middle East include high per capita income, robust transportation and logistics networks, rising internet penetration, and technological advancements.

- Regulatory and governmental bodies nationwide are increasingly prioritizing sustainable packaging solutions, such as corrugated boxes, for their environmental benefits and financial advantages. This emphasis is further propelling market expansion. For example, in July 2023, Apex Business Trading inaugurated a new branch of its Corrugated Boxes Factory at the Facility Building in Samail Industrial City, Oman, and simultaneously launched four innovative products.

- According to the International Trade Administration, Africa is projected to have over 500 million e-commerce users by 2025. The grocery sector witnessed a 54% surge, primarily driven by the pandemic and subsequent lockdowns. Similar growth trends were evident across various food delivery platforms, encompassing both the grocery and fast food sectors. Consumers displayed price sensitivity, often capitalizing on online promotions and coupons.

- Saudi Arabia is ambitiously positioning itself as a key player in the global e-commerce landscape, aiming to establish a significant national, regional, and international presence. Cross Border Magazine, a prominent international digital commerce news outlet, projects Saudi Arabia's online revenue growth to maintain a robust annual rate of 13.5% through 2027. E-commerce sales in the kingdom are anticipated to soar to USD 30 billion by 2027, further escalating to USD 44 billion by 2030. This surge in e-commerce engagement is expected to drive demand for lightweight, air-free corrugated boxes and secondary and tertiary packaging solutions.

United Arab Emirates is Expected Witness the Fastest Market Growth

- As end-user industries expand significantly in the food and non-food sectors in the United Arab Emirates, the demand for containerboard, folding cartons, and corrugated boxes will rise during the forecast period. Changing food habits, driven by a growing adult population, are evident across the studied regions. This shift has intensified the food sector's demand for packaged foods, fresh vegetables, and fruits.

- The paper and paperboard packaging market in the United Arab Emirates is witnessing accelerated growth. This surge can be attributed to heightened environmental awareness among the populace, a rising demand for sustainable packaging solutions, and the need for appropriate packaging. Contributing factors include the burgeoning e-commerce market and an uptick in demand for electronic goods, household items, and personal care products, all spurred by economic growth and increasing per capita incomes.

- In light of the ban on single-use plastics, industry players are pivoting towards recyclable and reusable packaging solutions. The growing appetite for biodegradable packaging papers and boards further fuels this market expansion. A notable example is Khalifa Economic Zones Abu Dhabi (KEZAD Group), which recently announced the establishment of a new plant dedicated to producing recycled Kraft Paper Jumbo reels. This move diversifies the company's product offerings and aligns with the surging demand for biodegradable packaging materials in the United Arab Emirates.

- Ready-to-eat meal products prominently utilize cartons as their secondary packaging. Data from the USDA's Foreign Agricultural Service highlights the robust food and beverage landscape in the United Arab Emirates; as of April 2024, the country boasted 568 manufacturers and processors in this sector, predominantly small to medium-sized enterprises, and over 2,000 manufacturing companies. Notably, the United Arab Emirates's food processing sector caters to domestic needs and regional and global markets.

- Also, the growth in online food delivery services and takeaways would bolster the country's demand for paper packaging products. Food retail is the fourth largest e-commerce segment in the United Arab Emirates. Food e-commerce refers to items sold online from retailers or restaurants, whether groceries, packaged food, or ready-to-eat meals. According to the USDA Foreign Agricultural Service, the retail value of food e-commerce in the United Arab Emirates increased from USD 641 million to USD 1072 million in 2023. This growth is expected to be witnessed in the upcoming period with the rise in demand for products like folding cartons and boxes for packaging food.

Middle East And Africa Paper And Paperboard Industry Overview

The Middle East and African paper and paperboard market is fragmented. It consists of several major players, including International Packaging Company LLC, Arabian Packaging Co, United Carton Industries Company, Hotpack Packaging Industries, and others. Vendors with a focus on sustainability are enhancing the product line, leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to expand their customer base further and gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Lightweight and Sustainable Materials

- 5.1.2 Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types

- 5.2 Market Restraint

- 5.2.1 Increasing Costs of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Electrical

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 Morocco

- 6.3.5 South Africa

- 6.3.6 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Packaging Company LLC

- 7.1.2 Arabian Packaging Co. LLC

- 7.1.3 United Carton Industries Company (UCIC)

- 7.1.4 Tarboosh Packaging Co. LLC

- 7.1.5 Hotpack Packaging Industries LLC

- 7.1.6 International Paper

- 7.1.7 Al Rumanah Packaging

- 7.1.8 Green Packaging Boxes Ind LLC

- 7.1.9 Matco Packaging LLC

- 7.1.10 Global Carton Boxes Manufacturing LLC