|

시장보고서

상품코드

1630348

트랜잭션 모니터링 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Transaction Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

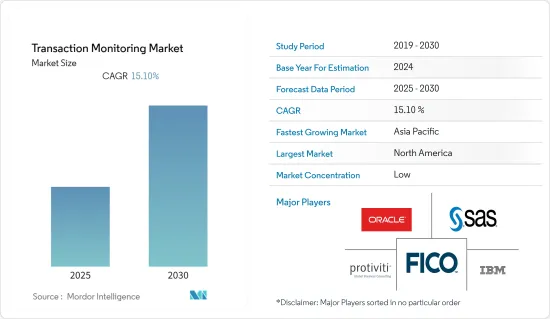

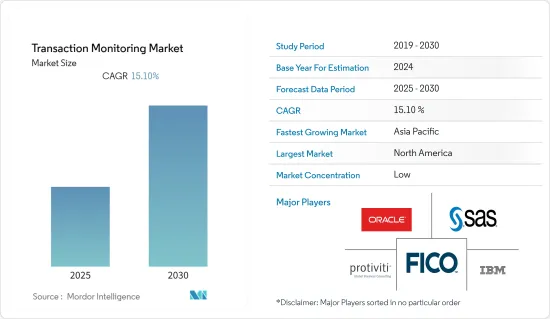

트랜잭션 모니터링 시장은 예측 기간 동안 CAGR 15.1%를 기록할 전망입니다.

주요 하이라이트

- 트랜잭션 모니터링 데이터는 주로 의심스러운 활동 보고서(Suspicious Activity Report : SAR)를 제출하고 여러 AML 및 테러 자금 지원(CTF) 규정을 준수하는 기타 보고 업무에 사용됩니다. 세계 금융 규제 당국은 트랜잭션 모니터링을 법적으로 요구하기 시작했습니다.

- 머신러닝과 인공지능은 궁극적으로 시장에 유익한 것으로 보입니다. 이러한 첨단 기술은 보다 고급 보안을 제공하고 사용자의 기밀 정보를 보호합니다. 고급 애널리틱스는 예방적 위험에 대한 보호와 안전을 제공하여 트랜잭션 모니터링 기술의 국제적 평가를 향상시킵니다.

- 전자상거래를 수행하는 기업은 안전한 결제 게이트웨이를 사용하고 온라인으로 비즈니스를 수행하고 지불을 받기 위한 최신의 엄격한 법률 및 지침을 준수해야 합니다. 이것은 트랜잭션 모니터링 시장의 성장률에 영향을 미치는 중요한 측면입니다.

- 중소기업 카테고리는 데이터 보호 규정이 강화되고 결제 네트워크 인프라 내에 비싼 보안 솔루션이 부족하기 때문에 예측 기간을 통해 더욱 빠르게 성장할 것으로 예상됩니다.

- 트랜잭션 모니터링 시장의 확대는 더 많은 훈련을 받은 숙련된 IT 노동자의 필요성과 국경을 넘어 컴플라이언스를 유지하는 어려움 증가로 인해 개선되어야 합니다.

신용카드 및 기타 온라인 결제 수단을 사용하여 온라인으로 구매하는 사람이 늘어나 해커가 행동할 기회가 늘어나는 가운데 COVID-19의 발생은 트랜잭션 모니터링 업계의 성장을 저하시키는 큰 요인이 되었습니다.

트랜잭션 모니터링 시장 동향

성장이 예상되는 서비스

- 급속도로 진화하는 디지털 환경에서 디지털 트랜잭션 관리는 점점 더 많이 사용되는 소프트웨어 솔루션입니다. 클라우드 기반 소프트웨어 솔루션은 송금, 예금, 인출을 포함한 많은 고객 거래 프로세스를 디지털 방식으로 모니터링하고 관리하는 데 점점 더 많이 사용되고 있습니다.

- 예측 기간 동안 디지털 트랜잭션 모니터링 솔루션이 큰 시장 점유율을 차지할 것으로 예상됩니다. 디지털 트랜잭션 모니터링 솔루션은 주로 문서 기반 고객 기반 거래를 추적하도록 설계된 이러한 획기적인 클라우드 서비스에서 탄생했습니다.

- 클라우드 컴퓨팅 기술과 안티 머니 론더링(AML) 솔루션을 개발함으로써 금융기관의 효율성을 향상시키고 IT 인프라 개발 비용도 절감할 수 있게 되었습니다.

- 보안을 위한 리소스가 제한된 기업의 경우 클라우드 기반 플랫폼은 SaaS 기반 보안 서비스의 형태로 비즈니스 용도을 보호하는 단일 방법을 제공합니다. 소매업 및 제조업은 온라인 구매 패턴 증가로 인해 트랜잭션 모니터링 시스템을 도입함으로써 혜택을 누리고 있습니다.

- 또한 기술 개발은 트랜잭션 모니터링 및 스크리닝 프로세스를 더욱 성공적으로 수행합니다. 분석가는 문제 해결보다 데이터 수집에 80% 이상의 시간을 소비하므로 정보 수집 프로세스를 가속화하는 새로운 방법이 있습니다. 고급 분석, 머신러닝 및 인공지능(AI)이 발전하고 있습니다. 또한 KYC 온보딩의 신속화, 행동 동향의 조사, 본인 확인을 위한 기술의 활용도 중시되고 있습니다.

- 시장을 특징으로 하는 것은 다각적인 기업의 존재입니다. 이러한 공급업체는 다양한 최종 사용자 업계의 수직 고객 증가하는 요구에 대응하는 기술의 발전에 따라 혁신적인 솔루션을 지속적으로 제공합니다.

북미가 큰 시장 점유율을 차지

- 북미는 현재 트랜잭션 모니터링 사업에서 가장 많은 수익을 올리고 있습니다. 이는 미국과 기타 북미가 현재 세계 전자상거래 거래의 대부분을 차지하고 있기 때문입니다.

- 남아있는 북미의 두 나라인 멕시코와 캐나다는 시장 수익 측면에서 미국에 이어지고 있습니다. 멕시코, 캐나다, 미국의 각 정부는 이 지역에서 전자상거래의 인기가 높아짐에 따라 KYC(Know Your Customer) 규정을 제정하고 있습니다.

- 이러한 규정은 신용카드 사기 및 돈세탁을 최소화하기 위한 것입니다. 또, 두 가지 행위를 가능한 한 저지하는 것을 목적으로 한 제도도 있습니다.

- KYC를 관리하는 규제와 기준은 테러 조직에 대한 자금 제공을 최대한 방지하기 위한 것입니다. 이러한 이유로 이러한 법규에는 고급 분석이 자주 포함됩니다.

- 이러한 최첨단 분석은 신용카드 사기나 테러 자금 제공이 발생할 가능성이 높다는 것을, 그것이 행해지는 시점(가능하면 행해지기 전) 또는 적어도 그 직후에 신용카드 회사에 통지하는 것 목적입니다. 북미 시장의 성장은 이러한 모든 요인들에 의해 촉진될 것으로 예상됩니다.

트랜잭션 모니터링 산업 개요

트랜잭션 모니터링 시장은 그 성질상 세분화되고 있으며, 주요 기업은 신제품 도입, 사업 확대, 합병, 인수 등 다양한 방법을 채용하고 있으며, 그 결과 경쟁이 심한 시장이 출현할 가능성이 있습니다.

2022년 9월, FICO는 부정행위, 인공지능(AI)/머신러닝(ML), 디지털 의사결정과 관련된 11건의 새로운 특허를 발표, 부여했습니다. 최신 11건의 특허는 다양한 소프트웨어 솔루션, 부정 분석, 강화된 머신러닝 알고리즘에 초점을 맞추고 고객이 전용 AI 및 ML 알고리즘을 활용하여 책임 있는 효과적인 AI 의사결정 시스템을 구축하는 데 도움이 됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 경쟁 기업 간 경쟁 관계

- 대체품의 위협

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- AI와 ML을 통합한 트랜잭션 모니터링 솔루션의 진보

- 규제 준수의 엄격화

- 시장 성장 억제요인

- 현재 소프트웨어 솔루션의 높은 오탐 비율

- 지역 간의 정보 공유 구조의 개요(미국-314(b), 영국-JMLIT(Joint Money Laundering Intelligence Taskforce) 등)

- 보다 효과적인 정보 공유를 위한 기술 인에이블러(Verafin, Fintel 등의 공급업체의 대처나 접근 포함)

제6장 시장 세분화

- 구성 요소별

- 솔루션

- 서비스

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Fair Isaac Corporation(FICO)

- SAS Institute Inc.

- Oracle Corporation

- Protiviti Inc.

- IBM Corporation

- Fidelity National Information Services Inc.(FIS)

- BAE Systems PLC

- Infrasoft Technologies

- Beam Solutions Inc.

- Experian PLC

- ACTICO GmbH

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

KTH 25.02.05The Transaction Monitoring Market is expected to register a CAGR of 15.1% during the forecast period.

Key Highlights

- Transaction monitoring data is primarily used to submit Suspicious Activity Reports (SARs) and other reporting duties in compliance with several AML and counter-terrorist financing (CTF) regulations. Financial regulators worldwide are beginning to make transaction monitoring a legal necessity.

- Machine learning and artificial intelligence will ultimately be beneficial for the market. Such cutting-edge technologies provide a higher level of security and protect the user's sensitive information. Advanced analytics offers protection and safety against preventative hazards; as a result, this will boost the reputation of transaction monitoring technology internationally.

- Businesses conducting e-commerce must use secure payment gateways and adhere to the most recent and stringent laws and guidelines for conducting business and receiving payments online. This is a crucial aspect influencing the transaction monitoring market's growth rates.

- The SMEs category is anticipated to grow more quickly throughout the projection period due to increasing data protection regulations and a lack of expensive security solutions within the payment network infrastructure.

- The expansion of the transaction monitoring market needs to be improved by the need for more trained and skilled IT workers and the growing difficulty of maintaining cross-border compliance.

As more people purchase online using credit cards and other online payment methods, increasing the opportunity for hackers to act, the outbreak of COVID-19 was a significant factor in the decline in the growth of the transaction monitoring industry.

Transaction Monitoring Market Trends

Service to Witness the Growth

- In the rapidly evolving digital landscape, digital transaction management has become an increasingly adopted software solution. Cloud-based software solutions are increasingly being used to digitally monitor and manage many customer transaction processes involving transfers, deposits, and withdrawals.

- It is projected that digital transaction monitoring solutions will hold a sizeable market share during the forecast period. Digital transaction monitoring solutions have arisen from these ground-breaking cloud services, primarily designed to track document-based customer-based transactions.

- Financial institutions' efficiency has grown due to the development of cloud computing technology and anti-money laundering (AML) solutions, which have also allowed them to cut the cost of developing an IT infrastructure.

- For companies with limited resources for security measures, the cloud-based platform offers a single way to secure business applications in the form of SaaS-based security services. The retail and manufacturing industries have benefited from the deployment of transaction monitoring systems due to the rise in online buying patterns.

- Additionally, technological developments help transaction monitoring and screening processes succeed better. Since analysts spend over 80% of their time acquiring data rather than resolving problems, there are new methods to speed up the information-gathering process. Advanced analytics, machine learning, and artificial intelligence (AI) are improving. The use of technology to speed up KYC onboarding, examine behavioral trends, and verify identification is also emphasized.

- The presence of well-diversified players characterizes the market. These vendors consistently provide innovative solutions in line with the advancement in technologies that cater to customers' increasing needs across various end-user industry verticals.

North American Accounts to Hold Significant Market Share

- The North American region now generates the most revenue from the transaction monitoring business. This is because the United States and the rest of the North American region currently account for most global e-commerce transactions.

- The two remaining North American countries, Mexico and Canada, follow the United States in terms of market revenue generation. The governments of Mexico, Canada, and the United States are enacting Know Your Customer (KYC) rules and regulations as e-commerce grows in popularity in this region.

- These regulations are meant to minimize credit card fraud and money laundering. They also have systems that are intended to stop both actions from happening as often as feasible.

- Regulations and standards governing KYC are also intended to prevent as much funding as possible for terrorist organizations. Because of this, advanced analytics are frequently included in these laws and regulations.

- These cutting-edge analytics are intended to notify credit card firms of probable credit card fraud or terrorist financing activities either at the time they take place (preferably before they do) or, at the least, shortly after. The North American market growth is anticipated to be fueled by all of these factors.

Transaction Monitoring Industry Overview

The transaction monitoring market is fragmented in nature, and the major players have employed various methods, including introducing new products, expansions, mergers, and acquisitions, among others, which may result in the emergence of a highly competitive market.

In September 2022, FICO announced and granted eleven new patents related to fraud, artificial intelligence (AI)/machine learning (ML), and digital decisioning. The latest 11 patents focus on various software solutions, fraud analytics, and enhanced machine learning algorithms to help its customers build responsible and effective AI decisioning systems leveraging purpose-built AI and ML algorithms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Advancement in Transaction Monitoring Solution incorporating AI and ML

- 5.2.2 Increasing Stringent Regulatory Compliance

- 5.3 Market Restraints

- 5.3.1 High Percentage of False Positives with Current Software Solutions

- 5.4 Overview of Information-Sharing Structures across regions (US - 314(b), UK - Joint Money Laundering Intelligence Taskforce (JMLIT), etc.)

- 5.5 Technology Enablers for More Effective Information Sharing (Including initiatives and approaches of vendors such as Verafin, Fintel, etc.)

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fair Isaac Corporation (FICO)

- 7.1.2 SAS Institute Inc.

- 7.1.3 Oracle Corporation

- 7.1.4 Protiviti Inc.

- 7.1.5 IBM Corporation

- 7.1.6 Fidelity National Information Services Inc. (FIS)

- 7.1.7 BAE Systems PLC

- 7.1.8 Infrasoft Technologies

- 7.1.9 Beam Solutions Inc.

- 7.1.10 Experian PLC

- 7.1.11 ACTICO GmbH