|

시장보고서

상품코드

1630356

중동 및 북아프리카의 가상 이동통신망 사업자(MVNO) : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)MENA Mobile Virtual Network Operator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

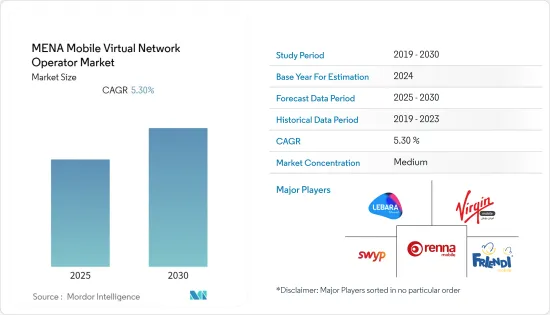

중동 및 북아프리카의 가상 이동통신망 사업자 시장은 예측 기간 동안 CAGR 5.3%를 기록할 전망입니다.

주요 하이라이트

- 강화된 네트워크 인프라를 이용한 통신 기반 서비스에 대한 요구 증가는 세계의 모바일 가상 이동통신망 사업자 시장을 견인하고 있습니다. 또한 클라우드 기반 솔루션, 머신 투 머신(M2M) 트랜잭션, 모바일 머니 등 디지털 서비스의 인기가 높아지고 있는 것도 성장에 박차를 가하는 중요한 요인이 되고 있습니다. 또한 소비자의 네트워크 서비스에 대한 액세스를 개선하고 디지털 서비스를 향상시키는 것을 목표로 한 참신한 정부 이니셔티브의 소개는 유럽 전역에서 MVNO 수요를 밀어 올리고 있습니다.

- 가상 이동통신망 사업자는 몇 안 되는 경쟁사, 정부의 대처의 활성화, 기업에 의한 클라우드 서비스의 채용률의 상승을 배경으로 신흥 경제 국가에 진출하고 있습니다. 예를 들어 지난해 11월 사우디아라비아의 정보통신기술산업을 단속하는 통신정보기술위원회(CITC)는 루트 모바일에도 'CITC 라이선스'를 부여했습니다. 이 개발을 통해 Route Mobile은 A2P SMS를 포함한 전체 CpaaS 제품군에서 사우디아라비아 기업 고객 및 중소기업 부서에 서비스를 제공할 수 있습니다.

- 또한 중동 및 북아프리카 국가에서는 통신 가입자 수가 증가하고 있으며 이는 시장을 견인합니다. 통신 규제청에 따르면 아랍에미리트(UAE)에서는 작년 6월 현재 약 190만 건의 고정 회선 계약이 유효했습니다. 같은 달 UAE의 인터넷 가입자 수는 약 370만명이었습니다.

- 또한 VoLTE, ViLTE, VoWiFi 등의 서비스를 제공하는 LTE 인프라 개발은 세계 시장에 긍정적인 영향을 미치고 있습니다. 예측 기간을 통한 임베디드 SIM 카드의 인기 증가와 저지연, 효과적인 통신 서비스 제공을 위한 5G MVNO 기술에 많은 투자를 포함한 몇 가지 추가 요인이 세계 가상 이동통신망 사업자 시장을 지원할 것으로 예상됩니다.

- 게다가 모든 국민과 제국민이 인터넷과 그 경제적·사회적 잠재력의 혜택을 충분히 받을 수 있도록 하기 위해서는 국내에 인터넷 인프라를 구축하고 이 인프라 위에서 디지털 경제를 발전시키기 위한 행동을 취해야 합니다. COVID-19의 상황은 이러한 문제에 대한 인식을 비약적으로 높여주었고, 많은 경우 솔루션의 개발을 가속화했습니다. 장기적으로는 새로운 인프라를 구축하는 것이 가능하며, 이는 여러면에서 현재의 요구를 충족시키면서 위기 중에 등장한 새로운 인터넷 이용에 적응하는 것입니다. 각국 정부는 인터넷 인프라의 가용성을 확대하고 보다 광범위한 디지털 포함을 보장하기 위한 국가 광대역 계획을 수립하거나 수정함으로써 이 단계에 대한 준비를 시작할 수 있습니다.

중동 및 북아프리카의 가상 이동통신망 사업자 시장 동향

5G 기술의 전개가 시장을 견인할 전망

- Ericsson의 모빌리티 보고서에 따르면 중동 및 북아프리카에서는 예측 기간 동안 처음 5G 가입이 예상되며 올해 가입 건수는 약 1,700만 건에 달할 전망입니다. 또한 이 지역의 LTE 계약수는 같은 시기에 1억 9,000만에서 8억 6,000만으로 약 5배로 증가합니다.

- 5G의 보급 확대는 사물의 인터넷화에도 박차를 가하고, 산업의 디지털 전환을 촉진하고, 이 지역의 모바일 사업자에게 새로운 수익원을 개척할 기회를 제공합니다. 예를 들어, 터키와 아프리카의 스마트 농업에 대한 노력, 사우디아라비아의 유정 및 재해시 임시 네트워크의 원격 모니터링, 남아프리카의 유틸리티 및 스마트 미터 대응에 사용되는 Narrowband-IoT(NB-IoT) 등이 있습니다. 즉, 5G나 IoT와 같은 기술은 업계의 디지털화의 결과로서 새로운 수입원을 개척해, MENA 각국의 생활 수준을 향상시킴으로써, 이 지역의 다양한 사업자의 요구에 부응하는 것에 됩니다.

- 엔터프라이즈 부문에는 풍부한 비즈니스 기회가 있기 때문에 대부분의 국제 서비스 제공업체는 이익을 극대화하기 위해 서비스를 시작할 계획입니다. 예를 들어 이탈리아의 서비스 제공업체인 Sparkle은 모로코에 새로운 연결 기지(PoP)를 개설한다고 발표했습니다. Orange Maroc의 오픈 데이터센터 내에 설치되어 모로코에서의 사업 확대를 목표로 하는 다국적 기업에 기업용 통신 서비스를 제공합니다. 또한 이탈리아 및 유럽의 다국적 기업에 이더넷과 가상 사설 IP-VPN 네트워크를 제공하여 기업 내 통신을 가능하게 하고 본사와 모로코 지점을 연결합니다.

- COVID-19의 발생은 민첩하고 유연한 작업 스타일에 대한 수요를 가속화하고 작업 라이프 밸런스를 높이는 통신 서비스의 도입을 더욱 추진할 것으로 보입니다. 그러나 전 세계 팬데믹 중 통신규제 당국은 5G 주파수 경매 계획을 연기한 바 있습니다.

새로운 기술이 시장을 견인할 전망

- 세계의 디지털 전환은 중동 및 북아프리카 국가에서 주로 사물 인터넷(IoT)과 머신 투 머신(M2M)의 도입이 진행될 것으로 예상됩니다. 따라서 MVNO는 사물인터넷(IoT), 머신투머신(M2M), 블록체인, 5G, 인공지능 등 신기술의 비즈니스 기회를 모색할 것으로 예상됩니다.

- 쿠웨이트에서는 stc, Zain Kuwait, Ooredoo Kuwait의 세 회사가 모바일 통신 서비스를 제공합니다. ICT 분야의 규제기관인 통신정보기술규제청(CITRA)은 쿠웨이트 모바일 시장의 경쟁력을 높이고 보다 이용하기 쉽고 가격 경쟁력 있는 모바일 서비스를 창출할 계획을 가지고 있습니다.

- 이 회사가 최근 발표한 'Worldwide Internet of Things Spending Guide'의 최신판에 따르면 정부와 기업이 디지털 전환 이니셔티브에 대한 투자를 늘리는 가운데 중동 및 아프리카의 IoT 지출은 작년 대비 15.9% 증가 올해는 176억 3,000만 달러에 달한다고 합니다. 공공 부문과 민간부문은 또한 고객 서비스 제공 개선, 시장 출시 시간을 단축하는 제품과 서비스의 질 향상, 비용 절감, 수익성 향상에 주력하고 있으며, 이는 신기술 활용 촉구하고 시장 성장을 밀어 올릴 것으로 예상됩니다.

- MVNO의 성장은 기술의 발전에 달려 있습니다. 외국인 노동자와 청소년을 포함한 소비자 시장과 다양한 틈새 시장은 이 비즈니스 모델이 처음 검토한 시장 분야입니다. 5G 기술과 사물 인터넷 생태계 개발로 MVNO가 B2B 서비스 제공업체로 자리매김할 가능성이 높아지고 있습니다. MVNO의 비즈니스 모델은 세계의 통신 생태계에 새로운 비즈니스를 통합하는 것을 용이하게했습니다. 예를 들어, MVNO는 자동차 및 화물 산업에서 사용되며, 특히 기존 네트워크가 다루지 않는 도시 중심부를 제외하고는 소비자에게 직접 통신 서비스를 제공합니다.

중동 및 북아프리카의 가상 이동통신망 사업자 산업 개요

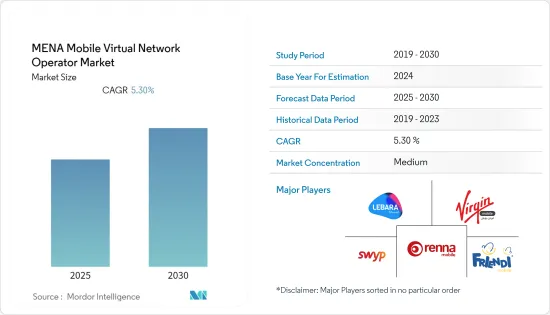

중동 및 북아프리카의 가상 이동통신망 사업자(MVNO) 시장은 Virgin Mobile KSA, Lebara Mobile KSA, Swyp (Etisalat UAE), Majan Telecommunication LLC (Renna Mobile), FRiENDi mobile 등 소수의 기업들에 집중되고 지배됩니다. 압도적인 시장 점유율을 자랑하는 이러한 대기업은 해외에서 고객 기반의 확대에 주력하고 있습니다. 이러한 기업들은 시장 점유율과 수익성을 높이기 위해 전략적 공동 이니셔티브를 활용합니다. 그러나 기술의 진보와 제품의 혁신에 따라 중소기업은 새로운 계약을 획득하고 신시장을 개척함으로써 시장에서의 존재감을 높이고 있습니다. 2022년 6월, 쿠웨이트 최초의 가상 이동통신망 사업자인 Virgin Mobile Kuwait가 두바이를 기반으로 하는 Virgin Mobile Middle East and Africa(VMMEA)에 의해 도입되었습니다. Wafra International Investment Company, Impulse International for Telecommunications, VMMEA가 쿠웨이트 진출에 자금을 제공했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자·소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계의 강도

- 업계 밸류체인 분석

- COVID-19가 가상 이동통신망 사업자 시장에 미치는 영향

제5장 기술 스냅샷

제6장 시장 역학

- 시장 성장 촉진요인

- 비즈니스 환경을 강화하고 업계 전반에 걸쳐 국제 모범 사례 도입을 촉진하는 정부 전략

- 인구가 많은 국가에 있어서 모바일 계약수의 대폭적인 성장 기회

- 시장을 견인하는 5G 기술의 전개

- 시장의 과제

- 중동 국가의 인프라 파괴, 인도주의적 위기, 안보 관련 문제

제7장 주요 통신 업계 통계

- 휴대전화 계약수(단위 : 백만)

- 인구 100명당 휴대전화 계약수

- 모바일 총소득과 ARPU

- 이동통신사(MNO) 시장 점유율

- 모바일 OS 시장 점유율

- 모바일 장치 제공업체의 시장 점유율

제8장 시장 세분화

- 가입자별

- 사업체

- 소비자

- 국가별

- 아랍에미리트(UAE)

- 사우디아라비아

- 오만

- 이란

- 기타 중동 및 아프리카

제9장 경쟁 구도

- 벤더의 시장 점유율

- 합병과 인수

- 기업 프로파일

- Lebara Mobile KSA

- Virgin Mobile KSA

- Swyp(Etisalat UAE)

- Majan Telecommunication LLC(Renna Mobile)

- FRiENDi mobile

- Integrated Telecommunications Oman(TeO)

- Awasr-Oman

- Amin Smart Mobile Communications

- AzarTel

제10장 투자 분석

제11장 시장의 미래

KTH 25.02.05The MENA Mobile Virtual Network Operator Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- The growing need for communication-based services with enhanced network infrastructure primarily drives the global market for mobile virtual network operators (MVNOs). Another vital reason for spurring growth is the rising popularity of digital services, including cloud-based solutions, machine-to-machine (M2M) transactions, mobile money, etc. In addition, the introduction of novel government initiatives designed to improve consumer access to network services and advance digital services across Europe is boosting demand for MVNOs.

- Mobile virtual network operators are entering developing economies due to low competitors, increasing government initiatives, and the rising adoption rate of cloud services by business organizations. For instance, in November last year, The Communications and Information Technology Commission (CITC) of Saudi Arabia, which is in charge of policing the country's information and communication technology industry, also granted Route Mobile a "CITC License." With this development, Route Mobile will be able to serve enterprise clients and the Small and Medium Business sector in Saudi Arabia with its whole CPaaS product suite, including A2P SMS.

- Moreover, the number of telecommunications subscribers is increasing in Middle East &North African countries, which will drive the market. According to the Telecommunication Regulatory Authority, Around 1.9 million fixed-line subscriptions were active in the United Arab Emirates (UAE) as of June last year. In that month, there were approximately 3.7 million internet subscribers in the UAE.

- Additionally, the development of LTE infrastructures, which offer services like VoLTE, ViLTE, and VoWiFi, is positively impacting the world market. Throughout the forecast period, several additional factors, such as the rising popularity of embedded SIM cards and significant investments in 5G MVNO technology to provide effective communication services with low latency, are anticipated to support the global mobile virtual network operator (MVNO) market.

- Further, to ensure that all citizens and nations can fully benefit from the Internet and its economic and social potential, actions must be taken to build Internet infrastructure in a country and develop a digital economy on top of this infrastructure. The COVID-19 situation has dramatically increased awareness of these issues and, in many cases, has hastened the development of solutions. Long-term, new infrastructure can be built, which in many ways meets current needs while adjusting to new Internet uses that emerged during the crisis. Governments can start preparing for this phase by creating or modifying a national broadband plan to expand the availability of Internet infrastructure and guarantee broader digital inclusion.

MENA Mobile Virtual Network Operators Market Trends

Deployment of 5G Technologies is Expected to Drive the Market

- According to the Ericsson mobility report, the first 5G subscriptions in the Middle East & North Africa are expected during the forecasted period and will reach around 17 million subscriptions this year. Further, the region will witness a nearly five-fold increase in LTE subscriptions, from 190 million to 860 million in the same timeframe.

- Increased 5G penetration will also fuel the Internet of Things, facilitating the digital transformation of industries and providing mobile operators in the region with opportunities to explore new revenue streams. For instance, smart agriculture initiatives in Turkey and Africa, remote monitoring of oil wells and temporary networks in case of disasters in Saudi Arabia, and Narrowband-IoT (NB-IoT) being used to address utilities and smart meters in South Africa. So, technologies like 5G and IoT will serve the region's diverse operator needs by opening new revenue streams as a result of industry digitization, improving standards of livings in countries across MENA.

- Due to an abundance of opportunities in the enterprise sector, most International service providers are planning to launch their services to maximize their profit. For instance, Sparkle, an Italian service provider, has announced opening of a new Point of Presence (PoP) in Morocco. It will be located in Orange Maroc's open data center and provide corporate communication services to multinational enterprises aiming to expand their business in Morocco. It will also offer ethernet and virtual private IP-VPN networks to Italian and European multinationals to enable intracompany communication and connect their headquarters with their branches in Morocco.

- The COVID-19 outbreak will accelerate the demand for agile and flexible work styles and further push the adoption of communication services that enhance work-life balance. However, telecom regulators have postponed their 5G spectrum auction plans amidst the global pandemic.

Emerging Technologies is Expected to Drive the Market

- Digital transformation across the world is expected to increase the adoption of mainly the Internet of Things (IoT) and machine-to-machine (M2M) in Middle Eastern and North African countries. Hence, it is expected that MVNOs will explore opportunities for emerging technologies such as the Internet of Things (IoT), machine-to-machine (M2M), blockchain, 5G, and Artificial Intelligence.

- Three local carriers-stc, Zain Kuwait, and Ooredoo Kuwait-offer mobile telecommunications services in Kuwait. The ICT sector's regulatory body, the Communication and Information Technology Regulatory Authority (CITRA), has plans to make Kuwait's mobile market more competitive and to produce more readily available and price-competitive mobile services.

- According to a recent update to the company's Worldwide Semiannual Internet of Things Spending Guide, as governments and businesses increase their investments in digital transformation initiatives, IoT spending in the MEA region will increase 15.9% year over year in last year and reach $17.63 billion this year. Public and private sectors are also focusing on improving their provision of customer services, improving the quality of products and services that accelerate their time to market, reducing costs, and increasing their profitability which will encourage them to utilize the emerging technologies and is expected to boost the market growth.

- The growth of MVNOs depends on technological advancements. The consumer market and its various niches, such as foreign workers and younger consumers, were the initial market sector examined by this business model. There is increasing potential for MVNOs to position themselves as B2B service providers due to the development of 5G technology and the internet-of-things ecosystem. The MVNOs business model has made it easier to include new businesses into the global telecoms ecosystem. For instance, MVNOs are used by the automotive and freight industries to provide direct-to-consumer communication services, especially outside urban centers that traditional networks do not cover.

MENA Mobile Virtual Network Operators Industry Overview

The MENA mobile virtual network operator market is concentrated and dominated by a few major players like Virgin Mobile KSA, Lebara Mobile KSA, Swyp (Etisalat UAE), Majan Telecommunication LLC (Renna Mobile), and FRiENDi mobile. With a prominent market share, these major players focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. In June 2022, the first mobile virtual network operator (MVNO) in Kuwait, Virgin Mobile Kuwait, was introduced by the Dubai-based Virgin Mobile Middle East and Africa (VMMEA). Wafra International Investment Company, Impulse International for Telecommunications, and VMMEA contributed funding to the expansion into Kuwait.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the MVNO Market

5 TECHNOLOGY SNAPSHOT

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Government Strategy to Enhance Business Environment, and Foster the Adoption of International Best Practices Across Industry

- 6.1.2 Significant Growth Opportunities for Mobile Subscriptions in Largely Populated Countries

- 6.1.3 Deployment of 5G technology to drive the market

- 6.2 Market Challenges

- 6.2.1 Issue Regarding Infrastructure Destruction, Humanitarian Crises, and Security Concerns in Middle East Countries

7 KEY TELECOM INDUSTRY STATISTICS*

- 7.1 Number of Mobile Cellular Subscriptions (in million)

- 7.2 Number of Mobile Cellular Subscriptions per 100 inhabitants

- 7.3 Total Mobile Revenue and ARPU

- 7.4 Market Share of Mobile Network Operators(MNOs)

- 7.5 Market Share of Mobile Operating Systems

- 7.6 Market Share of Mobile Device Vendors

8 MARKET SEGMENTATION

- 8.1 By Subscriber

- 8.1.1 Business

- 8.1.2 Consumer

- 8.2 By Country

- 8.2.1 United Arab Emirates

- 8.2.2 Saudi Arabia

- 8.2.3 Oman

- 8.2.4 Iran

- 8.2.5 Rest of Middle East & North Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Vendor Market Share

- 9.2 Mergers and Acquisitions

- 9.3 Company Profiles

- 9.3.1 Lebara Mobile KSA

- 9.3.2 Virgin Mobile KSA

- 9.3.3 Swyp (Etisalat UAE)

- 9.3.4 Majan Telecommunication LLC (Renna Mobile)

- 9.3.5 FRiENDi mobile

- 9.3.6 Integrated Telecommunications Oman (TeO)

- 9.3.7 Awasr-Oman

- 9.3.8 Amin Smart Mobile Communications

- 9.3.9 AzarTel