|

시장보고서

상품코드

1630365

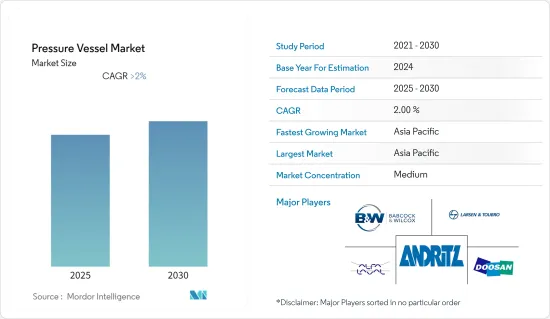

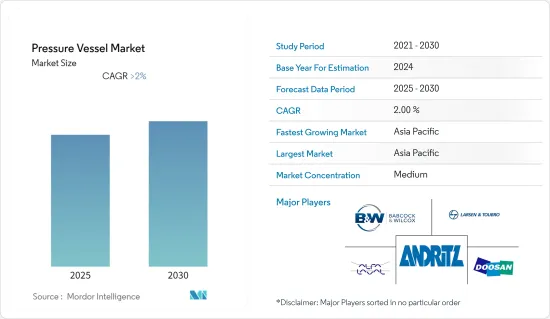

압력 용기 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Pressure Vessel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

압력 용기 시장은 예측 기간 동안 CAGR 2% 이상을 기록할 것으로 예상됩니다.

COVID-19는 2020년 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 전염병이 발생하기 전의 수준에 도달했습니다.

주요 하이라이트

- 중기적으로는 총 발전 용량과 석유 및 가스 정제 능력의 지속적인 증가가 압력 용기 시장을 견인할 것으로 보입니다.

- 한편, 압력용기를 거의 필요로 하지 않는 재생에너지 발전에 대한 투자 증가는 시장을 억제할 것으로 예상됩니다.

- 압력 보일러와 같은 압력 용기의 기술 개척은 다양한 종류의 연료를 연소시킬 수 있기 때문에 전력의 가용성과 비용 효율성으로 인해 향후 압력 용기 시장에서 몇 가지 기회를 창출할 것으로 예상됩니다.

- 아시아태평양이 시장을 지배하고 있으며 예측 기간 동안 가장 높은 CAGR을 보일 가능성이 높습니다. 이러한 성장은 인도, 중국, 일본을 포함한 이 지역 국가들의 석유 및 가스, 화학 및 비료 산업에 대한 투자 증가에 기인합니다.

압력 용기 시장 동향

큰 폭으로 성장할 것으로 예상되는 처리 용기 부문

- 처리 용기는 통제된 환경에서 제품을 제거, 결합, 교반 및 분해하는 데 사용되는 압력 용기입니다. 처리 용기의 예로는 보일러, 분리기 등이 있습니다. 이러한 처리 용기는 처리 물질과 반응하지 않는 탄소강 및 다양한 합금과 같은 재료로 만들어집니다.

- 중동, 아프리카, 아시아태평양 등 지역에는 많은 개발도상국이 있습니다. 이 지역의 많은 국가들은 인구의 상당 부분에 에너지를 공급할 수 없습니다. 이들 국가는 발전 능력을 강화하기 위해 노력하고 있으며 압력 용기 시장을 주도할 것으로 예상됩니다.

- BP Statistical Review of World Energy에 따르면 2021년 세계 발전량은 약 28466.3테라와트시(TWh)로 2017년 대비 6.2%, 전년 대비 10.1% 증가했습니다. 이 중 화력 기술(석유, 석탄, 천연가스, 원자력발전소)이 2021년 총 발전량의 71.25%를 차지했습니다. 발전량 증가는 전 세계적으로 발전소 수가 증가하여 압력 용기 시장을 주도할 것으로 예상됩니다.

- 알파라발은 2022년 12월, 미국 재생 가능 연료 및 정유 회사 CVR Energy의 자회사에 분리기, 열교환기, 펌프, 교반기 등 다양한 장비로 구성된 전처리 시스템을 공급하는 계약을 체결했다고 발표했습니다.

- 따라서 위의 관점에서 볼 때, 처리 용기 부문은 예측 기간 동안 압력 용기 시장에서 가장 빠르게 성장하는 부문이 될 가능성이 높습니다.

아시아태평양이 시장 성장을 주도할 것으로 예상

- 아시아태평양은 지속적인 에너지 수요 증가로 인해 압력 용기 시장에서 가장 빠르게 성장하고 가장 큰 시장이 될 가능성이 높습니다. 이 지역의 많은 정부와 기업들은 여러 압력 용기를 사용하는 전력 및 정유 부문에 많은 투자를 하고 있습니다.

- 중국과 인도와 같은 국가에서는 압력 용기를 사용하는 부문에서 진행 중이거나 예정된 프로젝트가 있습니다. 이러한 프로젝트의 배경에는 이 지역의 에너지 수요와 에너지 소비의 격차를 해소하려는 동기가 있습니다. 석탄, 천연가스, 석유, 원자력 등 화력 에너지원에 의한 발전에는 상당한 수의 동력 용기가 필요합니다.

- 2021년 아시아태평양의 화력 에너지 발전량은 전년 대비 8% 증가한 1만299.6테라와트시(TWh)로 전체 발전량의 73.6%를 차지했습니다.

- Sumitomo Heavy Industries, Ltd.는 2022년 5월 Tosoh Corporation으로부터 야마구치현 주난시 난요단지에 건설하는 74MW급 목질계 바이오매스 재활용 연료 연소 보일러를 EPC(설계-조달-시공) 계약으로 수주했습니다. 이 보일러는 목질연료를 주연료로 하고 재열방식을 채택한 고효율 바이오매스 연소 보일러입니다.

- Thermax의 100% 자회사인 Thermax Babcock and Wilcox Energy Solutions(TBWES)는 2021년 8월, 인도 서부에 위치한 정유 및 석유화학 콤비나트를 위한 석유 및 가스 연소 보일러 3기 보일러 패키징을 EPC 29억 3,000만 인도 루피에 수주했습니다.

- 이상과 같이 예측 기간 동안 아시아태평양이 압력 용기 시장을 장악할 것으로 예상됩니다.

압력 용기 산업 개요

압력 용기 시장은 적당히 통합되어 있습니다. 시장의 주요 기업(순서는 무관)으로는 Babcock &Wilcox Enterprises Inc, Doosan Heavy Industries & Construction, Alfa Laval AB, Andritz AG, Larsen & Toubro Limited 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

제5장 시장 세분화

- 용도

- 저장 용기

- 가공 용기

- 기타

- 최종 이용 산업

- 석유 및 가스

- 화학·비료

- 전력

- 기타

- 지역

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

제6장 경쟁 구도

- 합병, 인수, 제휴, 합작투자

- 주요 기업의 전략

- 기업 개요

- Babcock & Wilcox Enterprises Inc

- Doosan Heavy Industries & Construction

- Alfa Laval AB

- Andritz AG

- Larsen & Toubro Limited

- Aager GmbH(Ergil)

- IHI Plant Services Corporation

- Frames Group BV

- GEA Group AG

제7장 시장 기회와 향후 동향

ksm 25.01.23The Pressure Vessel Market is expected to register a CAGR of greater than 2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as a constant increase in the total power generation capacity and refining capacity of oil and gas will likely drive the pressure vessel market.

- On the other hand, rising investments in renewable energy generation that rarely require pressure vessels are expected to restrain the market.

- Nevertheless, technological development in pressure vessels such as pressure boilers, which can be used to combust different types of fuels and thus are used under the availability and cost-effectiveness of the power, is expected to create several opportunities for the Pressure Vessel Market in the future.

- The Asia-Pacific region dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments in oil and gas, chemical, and fertilizer industries in the countries of this region, including India, China, and Japan.

Pressure Vessel Market Trends

Processing Vessel Segment Expected to Grow Significantly

- Processing vessels are pressure vessels used to remove, combine, agitate, or break down products in a controlled environment. A few examples of processing vessels include boilers and separators. These processing vessels are made up of materials such as carbon steel and a wide variety of alloys, which do not react with processing substances.

- Regions such as the Middle East and Africa and the Asia Pacific have many developing countries. Many of these countries in the region are unable to provide energy to a significant percentage of their population. These countries are working to increase their power generation capacities, which are expected to drive the pressure vessel market.

- According to BP Statistical Review of World Energy, in 2021, the global electricity generation was about 28466.3 Terawatt-Hour (TWh), up by 6.2% year-on-year and 10.1% since 2017. Of this, thermal technologies (oil, coal, natural gas, and nuclear power plants) accounted for nearly 71.25% of the total electricity generation in 2021. The increase in electricity generation depicts the worldwide increase in the number of power plants expected to drive the Pressure Vessel Market.

- In December 2022, Alfa Laval announced that it had won a contract to supply pre-treatment systems consisting of various equipment such as separators, heat exchangers, pumps, and agitators for the US-based renewable fuels and petroleum refining company, a subsidiary of CVR Energy and the aim is to supply processing systems for feedstock pre-treatment, part of a strategic investment in the refinery supporting CVR's expansion into renewable biofuel production.

- Hence, owing to the above points, the processing vessel segment is likely to be the fastest-growing segment in the pressure vessel market during the forecast period.

Asia-Pacific Expected to Dominate the Market Growth

- Asia-Pacific region, due to the constant increase in the energy demand in the region, is likely to be the fastest-growing and the largest market for the pressure vessel market. Many governments and companies in the region are investing a significant amount in power and refining sectors, which include the usage of several pressure vessels.

- Countries such as China and India have ongoing projects and upcoming projects in the sectors that use pressure vessels. The motive behind these projects is to fill the gap between energy demand and energy consumption in the region. Power generation from thermal energy sources such as coal, natural gas, oil, and nuclear, require a considerable number of power vessels.

- In 2021, the electricity generation of Asia-Pacific from thermal energy was 10299.6 terawatt-hours (TWh), which was 8% higher year-on-year, and accounted for neraly 73.6% of the total electricity generation in 2021.

- In May 2022, Sumitomo Heavy Industries, Ltd. secured an order from Tosoh Corporation for a 74 MW-class wood biomass and recycled fuel-fired boiler for a palnned power plant in Nanyo Complex, Shunan City, Yamaguchi Prefecture based on an EPC (engineering, procurement and construction) contract. The boiler is a a high-efficiency biomass-fired boiler that uses wood-based fuel as its primary fuel and employs the reheating system.

- In August 2021, Thermax Babcock and Wilcox Energy Solutions (TBWES), a wholly-owned subsidiary of Thermax, has concluded a INR 2.93 billion order for a boiler package comprising 3 oil and gas-fired boilers on an EPC basis for a refinery and petrochemical complex in Western India.

- Hence, owing to the above points, Asia-Pacific is expected to dominate the pressure vessel market during the forecast period.

Pressure Vessel Industry Overview

The Pressure Vessel Market is moderately consolidated in nature. Some of the major players in the market (not in particular order) include Babcock & Wilcox Enterprises Inc, Doosan Heavy Industries & Construction, Alfa Laval AB, Andritz AG, and Larsen & Toubro Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Storage Vessel

- 5.1.2 Processing Vessel

- 5.1.3 Others

- 5.2 End-User Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemicals and Fertilizers

- 5.2.3 Power

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Babcock & Wilcox Enterprises Inc

- 6.3.2 Doosan Heavy Industries & Construction

- 6.3.3 Alfa Laval AB

- 6.3.4 Andritz AG

- 6.3.5 Larsen & Toubro Limited

- 6.3.6 Aager GmbH (Ergil)

- 6.3.7 IHI Plant Services Corporation

- 6.3.8 Frames Group BV

- 6.3.9 GEA Group AG