|

시장보고서

상품코드

1630392

중국의 디지털 화물 운송 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

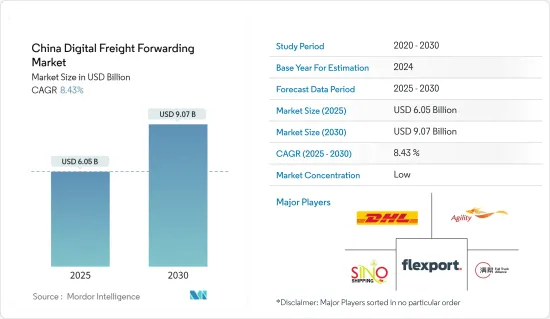

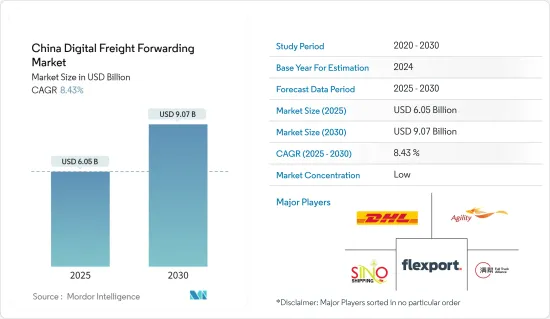

중국의 디지털 화물 운송 시장 규모는 2025년 60억 5,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 8.43%의 CAGR로 2030년에는 90억 7,000만 달러에 달할 것으로 예상됩니다.

중국의 디지털 화물 운송 시장 분석은 중국 내 전통적인 화물 운송 프로세스를 간소화하고 강화하기 위해 디지털 기술을 적용하는 데 초점을 맞추고 있습니다. 화물 운송은 해상, 항공, 철도, 트럭 등 운송 수단을 이용하여 화주를 대신하여 국경 간 화물 운송을 조직하고 촉진하는 것을 포함합니다. 중국의 디지털 화물 운송은 온라인 플랫폼, 소프트웨어 및 고급 데이터 분석을 채택하여 이 프로세스를 현대화하고 운송의 다양한 측면을 최적화하고 있습니다.

최근 중국 교통운수부가 2023년 언급했듯이, 중국의 디지털 화물 운송 시장은 E-Commerce 붐과 실시간 물류 솔루션에 대한 수요 증가로 인해 최근 몇 년 동안 괄목할만한 성장세를 보이고 있습니다.

중국 정부에 따르면 2023년 상하이, 선전, 닝보-저우산항이 세계에서 가장 많은 컨테이너를 처리하는 항구로 상하이의 처리량이 3,600만 TEU를 넘어섰고 닝보-저우산이 3,500만 TEU로 근소한 차이로 그 뒤를 이었으며 선전항은 2,700만 TEU를 넘어섰다고 합니다. 이러한 급격한 증가는 중국의 경제 회복과 항만 인프라의 확장으로 지역 무역과 세계 무역을 촉진하고 있으며, 2023년 9월까지 중국 항만의 총 물동량은 전년 대비 5.2% 증가한 2억 3,000만 TEU를 넘어설 것으로 예상됩니다. 중국의 디지털 화물 운송 시장이 확대됨에 따라 국내외 기업들은 기술을 활용하여 업무를 최적화하고 비용을 절감하고 있습니다.

중국의 디지털 화물 운송 시장 동향

E-Commerce 부문의 부상이 시장을 주도

중국 E-Commerce 산업의 급격한 성장에는 몇 가지 요인이 있습니다. 중국 정부는 E-Commerce와 디지털 경제를 강화하기 위해 일련의 조치를 취하고 있으며, 특히 인터넷 인프라 강화와 기업가 정신 촉진에 중점을 두고 있습니다.

모바일 기술의 발전과 인터넷 연결의 확산으로 중국 전역에서 E-Commerce를 쉽게 이용할 수 있게 되어 소비자와 사업주 모두에게 이익이 되고 있습니다. 또한, 소비자들은 알리페이, 위챗페이 등 다양한 모바일 결제 솔루션의 편리함을 누리고 있으며, 이는 원활한 온라인 거래를 촉진하고 있습니다.

업계 전문가에 따르면 2023년 중국은 수익 면에서 세계 화물 운송 시장의 6.0%를 차지할 것이며, 2030년을 내다보면 미국이 수익 면에서 세계 시장을 독식할 것으로 보입니다. 아시아태평양에서는 중국의 화물 운송 시장이 2030년까지 매출에서 1위를 차지할 것입니다. 아시아태평양에서 가장 빠르게 성장하는 시장으로 인정받고 있는 인도는 2030년까지 177억 3,210만 달러의 가치를 달성할 것으로 예상됩니다.

항공화물 운송 증가가 시장을 주도할 것으로 예상

중국의 디지털 화물 운송 시장은 기술 발전과 효율적이고 비용 효율적인 물류 솔루션에 대한 수요 증가로 인해 빠르게 변화하고 있습니다. 화주와 운송업체 모두 디지털 플랫폼과 솔루션의 채택이 확대됨에 따라 향후 몇 년 동안 이 시장은 큰 성장을 이룰 것으로 예상됩니다.

업계 전문가들에 따르면 항공 운송은 가장 빠른 운송 수단 중 하나이며, 신선식품이나 긴급 배송이 필요한 고가 상품과 같이 시간이 촉박한 상품을 운송하는 데 가장 적합하다고 합니다. 물류에서 항공 운송의 가장 큰 장점은 빠른 배송 속도입니다.

2023년 중국의 국경 간 E-Commerce 제품 수출입액은 2조 3,800억 위안(3,283억 달러)으로 전년 대비 15.6% 증가했습니다. 세관총서에 따르면, 국경 간 E-Commerce로 수출된 제품만 1조 8,300억 위안(2,500억 달러)에 달해 전년 대비 20% 가까이 증가했다고 합니다.

중국의 디지털 화물 운송 산업 개요

이 보고서는 중국의 디지털 화물 운송 시장에서 사업을 전개하는 주요 기업들을 소개합니다. 시장 경쟁은 치열하며, 어느 누구도 주요 점유율을 차지하지 못하고 있습니다. 시장은 세분화되어 있으며 예측 기간 동안 성장할 것으로 예상됩니다. 중국의 디지털 화물 운송 시장의 주요 기업으로는 DHL, Flexport, Agility Logistics, Freightos 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 인사이트

- 현재 시장 시나리오

- 밸류체인/공급망 분석

- 투자 시나리오에 관한 인사이트

- 정부 규제와 대처에 관한 인사이트

- 온라인 화물 운송과 디지털 플랫폼의 기술 개발 개요

- 중국의 E-Commerce 물류와 화물 운송 개요

- 지정학과 팬데믹이 시장에 미치는 영향

제5장 시장 역학

- 성장 촉진요인

- 정부의 일대일로 구상

- 화물 물류의 5G 기술 통합

- 성장 억제요인

- 물류 시장 세분화

- 지정학적 무역장벽

- 기회

- 탄소 중립물류 목표

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 고객의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

제6장 시장 세분화

- 운송 형태별

- 해양

- 항공

- 도로

- 철도

- 기업 유형별

- 중소기업

- 대기업과 정부

제7장 경쟁 구도

- 시장 집중도 개요

- 기업 개요

- Flexport

- Youtrans

- Full Truck Alliance(Manbang group)

- Agility Logistics Pvt. Ltd(Shipa Freight)

- Twill

- Freightos

- DHL Group

- Kuehne+Nagel International AG

- FreightBro

- Cogoport

- SINO SHIPPING

- DB Schenker

- MOOV

- WICE Logistics*

- 기타 기업

제8장 시장 향후 전망

제9장 부록

- 거시경제 지표(GDP 분포, 활동별)

- 경제 통계 - 운송·창고업의 경제에 대한 기여

The China Digital Freight Forwarding Market size is estimated at USD 6.05 billion in 2025, and is expected to reach USD 9.07 billion by 2030, at a CAGR of 8.43% during the forecast period (2025-2030).

The China Digital Freight Forwarding Market Analysis focuses on the application of digital technologies to streamline and enhance the traditional freight forwarding process within China. Freight forwarding involves organizing and facilitating the shipment of goods across international borders on behalf of shippers, utilizing ocean, air, rail, or truck transportation modes. By employing online platforms, software, and advanced data analytics, digital freight forwarders in China are modernizing this process, optimizing various facets of shipping.

In recent years, China's digital freight forwarding market has experienced significant growth, driven by e-commerece boom and incresing demand for real-time logistics solutions as mentioned by the Chinese Ministry of Transport in 2023.

According to the Government of China, in 2023, Shanghai, Shenzhen, and Ningbo-Zhoushan led the world as some of the busiest container ports, with Shanghai processing over 36 million TEUs, closely followed by Ningbo-Zhoushan at 35 million TEUs, and Shenzhen surpassing 27 million TEUs. This surge underscores China's economic recovery and its expanding port infrastructure, bolstering both regional and global trade. By September 2023, Chinese ports collectively managed over 230 million TEUs, reflecting a year-on-year uptick of 5.2%. As China's digital freight forwarding market expands, both domestic and international companies are harnessing technology to optimize operations and curtail costs.

China Digital Freight Forwarding Market Trends

Rise in E-Commerce Sector Driving the Market

Several factors have fueled the rapid growth of China's e-commerce industry. The Chinese government has rolled out a series of policies to bolster e-commerce and the digital economy, with a particular focus on enhancing internet infrastructure and promoting entrepreneurship.

With advancements in mobile technology and widespread internet connectivity, e-commerce has become both available and accessible across China, benefiting consumers and business owners alike. Furthermore, residents enjoy the convenience of diverse mobile payment solutions, such as Alipay and WeChat Pay, facilitating seamless online transactions.

According to industry experts, in 2023, China represented 6.0% of the global freight forwarding market in terms of revenue. Looking ahead to 2030, the U.S. is poised to dominate the global market in terms of revenue. Within the Asia Pacific region, China's freight forwarding market is set to take the lead in revenue by 2030. India, recognized as the fastest-growing market in the Asia Pacific, is on track to achieve a valuation of USD 17,732.1 million by 2030.

Increasing Air Cargo Shipments Expected to Drive the Market

The digital freight forwarding market in China is undergoing rapid transformation, driven by technological advancements and the growing need for efficient and cost-effective logistics solutions. The market is expected to achieve significant growth in the coming years, fueled by the increasing adoption of digital platforms and solutions by both shippers and carriers.

According to industrial experts, air transportation is one of the fastest modes of transportation available, making it ideal for transporting time-sensitive products, such as perishable goods and high-value items requiring urgent delivery. The primary advantage of air transport in logistics is the speed of delivery.

In 2023, China's imports and exports of cross-border e-commerce products were worth CNY 2.38 trillion (USD 328.3 billion), up 15.6 percent year-on-year. Products exported for cross-border e-commerce alone reached CNY 1.83 trillion (USD 0.25 trillion), up nearly 20 percent year-on-year, according to the General Administration of Customs.

China Digital Freight Forwarding Industry Overview

The report covers the major players operating in the Chinese digital freight forwarding market. The market is highly competitive, with none of the players occupying the major share. The market is fragmented, and it is expected to grow during the forecast. The major players in the Chinese digital freight forwarding market include DHL, Flexport, Agility Logistics, and Freightos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Insights on Investment Scenarios

- 4.4 Insights on Government Regulations and Initiatives

- 4.5 Brief on Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding in China

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Government's Belt and Road Initiative

- 5.1.2 Integration of 5G Technology in Freight Logistics

- 5.2 Restraints

- 5.2.1 Fragmentation in the Logistics Market

- 5.2.2 Geopolitical Trade Barriers

- 5.3 Opportunities

- 5.3.1 Carbon-Neutral Logistics Goals

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Customers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Ocean

- 6.1.2 Air

- 6.1.3 Road

- 6.1.4 Rail

- 6.2 By Firm Type

- 6.2.1 SMEs

- 6.2.2 Large Enterprises and Governments

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Youtrans

- 7.2.3 Full Truck Alliance (Manbang group)

- 7.2.4 Agility Logistics Pvt. Ltd (Shipa Freight)

- 7.2.5 Twill

- 7.2.6 Freightos

- 7.2.7 DHL Group

- 7.2.8 Kuehne + Nagel International AG

- 7.2.9 FreightBro

- 7.2.10 Cogoport

- 7.2.11 SINO SHIPPING

- 7.2.12 DB Schenker

- 7.2.13 MOOV

- 7.2.14 WICE Logistics*

- 7.3 Other Companies

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 Economic Statistics - Transport and Storage Sector Contribution to Economy