|

시장보고서

상품코드

1630431

북미의 플릿 관리 솔루션 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Fleet Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

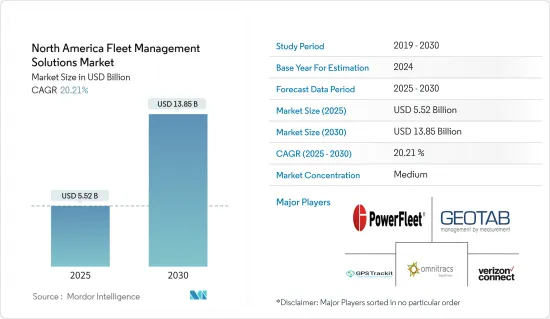

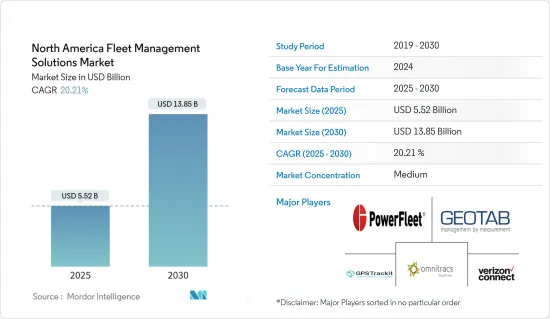

북미의 플릿 관리 솔루션 시장 규모는 2025년 55억 2,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 20.21%의 CAGR로 2030년에는 138억 5,000만 달러에 달할 것으로 예상됩니다.

무선 기술 도입 확대, 차량 운영 비용 최적화를 위한 플릿 관리 솔루션에 대한 투자 증가, 국제 거래 증가 등이 북미 플릿 관리 솔루션 시장의 성장을 촉진하는 주요 요인으로 작용하고 있습니다.

주요 하이라이트

- 통신 기술의 급속한 확장으로 인해 전 세계는 수십억 대의 커넥티드카의 집합체가 되어 운전자가 도로의 다른 차량(차 대 차), 도로변의 인프라(차 대 인프라), 클라우드(차 대 클라우드)와 통신함으로써 더 높은 생산성과 민첩성, 효율성을 달성할 수 있게 될 것입니다. 시장의 견인차 역할을 할 것으로 기대되고 있습니다.

- 또한, 많은 주요 공급업체들이 수요 증가에 대응하기 위해 새로운 첨단 플릿 관리 솔루션을 개발 및 출시하기 위해 협력하고 있습니다. 예를 들어, 2019년 i.D. Systems는 융-하인리히(Jungheinrich)와 협력하여 융-하인리히 차량용 고도로 통합된 원격 측정 플랫폼을 정교한 차량 관리 소프트웨어와 결합하여 개발했습니다. 이번 기술 제휴를 통해 융-하인리히의 고객들은 보다 안전하고 비용 효율적인 내부 물류 업무를 수행할 수 있게 됐습니다.

- 또한, 5G의 급속한 보급은 다양한 산업 분야에서 차량 관리 시스템의 성장을 촉진하고 있습니다. 예를 들어, 에릭슨의 2019년 모바일 산업 보고서에 따르면, 2024년까지 19억 개의 5G 셀룰러 계약이 발생하여 커넥티드카의 성장을 촉진할 것으로 예상했습니다. 북미 시장이 가장 크게 성장할 것으로 예상되며, 모바일 가입자의 63%가 5G 서비스를 이용할 것으로 예상되며, 동아시아 휴대폰 가입자의 47%도 5G에 접속할 수 있게 될 것으로 보입니다. 이러한 성장의 대부분은 칩셋 가격 하락과 NB-IoT 및 Cat-M1과 같은 셀룰러 기술의 확대에 기인합니다.

- 그러나 클라우드 및 서버 기반 서비스의 데이터 보안이 부족하여 시장 성장을 저해하고 있습니다. 클라우드 기반 서비스는 많은 고유한 보안 문제와 도전을 가져옵니다. 데이터는 제3자 제공업체에 저장되고 클라우드에서 액세스됩니다. 즉, 데이터에 대한 가시성과 관리에는 한계가 있습니다.

북미의 플릿 관리 솔루션 시장 동향

운수 부문이 크게 성장

- 스마트 시티 구상에 따른 스마트 교통 프로젝트가 증가함에 따라 예측 기간 동안 플릿 관리 솔루션에 대한 수요가 증가할 것으로 예상됩니다. 스마트 교통 프로젝트의 목적은 자가용에 대한 의존도를 줄이고 대중교통의 매력을 높여 도시 주민과 관광객이 자가용에서 대중교통으로 전환하도록 유도하여 교통 문제를 해결하는 것입니다. 예를 들어, 스마트 교통 시스템은 자가용을 특정 경로로 제한하고 다른 교통 수단을 위해 우선 차선이나 도로 전체를 확보할 수 있습니다.

- 미국과 캐나다에서는 운송 서비스를 강화하기 위해 다양한 기업의 상용차 도입이 증가하고 있으며, 이는 북미 시장을 견인할 것으로 예상됩니다. 예를 들어, 2019년 미국은 1,276만 4,999대의 상용차 판매를 등록하여 1위를 차지했으며, 캐나다는 147만 9,252대의 상용차로 3위를 차지했습니다.

- 또한 미국은 경제 규모를 확대하고 경제 성장을 강화하기 위해 수출을 통해 가장 경쟁력있는 산업과 제품의 생산을 확대하기 위해 노력을 강화하고 있으며, 이는 시장에 활력을 불어 넣을 것으로 예상됩니다. 예를 들어, 보고서에 따르면 2019년 미국 무역 상품 총액은 4조 1,400억 달러에 달할 것으로 예상되며, 이는 경로 진행 상황을 추적하고, 자동 업데이트를 받고, 고객 경험을 개선하고, 도착 시간과 지연을 공유하여 전화 통화를 줄이기위한 플릿 관리 솔루션에 대한 수요 증가를 반영합니다. 수요 증가를 반영하고 있습니다.

미국이 큰 폭으로 성장하며 시장 주도

- 미국에서는 차량 사고가 증가하고 있으며, 이는 기업에게 가장 큰 손해배상 청구로 이어져 플릿 관리 솔루션을 도입할 수밖에 없는 상황입니다. 예를 들어, 미국 연방교통안전국(FMCSA)의 보고서에 따르면 2017년에는 34,247건의 사망사고로 37,133명이 사망했으며, 대형 트럭이나 버스와 관련된 4,455건의 충돌 사고로 5,005명이 사망해 2016년 대비 사망사고가 8% 증가했습니다.

- 따라서 대부분의 기업은 사고를 예방하고 운전자의 안전을 향상시키기 위해 차량 및 교통에 대한 실시간 인사이트를 제공하는 사고 관리 도구를 사용하고 있습니다. 이러한 솔루션은 GPS 도구, 모바일 기술 및 사물인터넷(IoT)을 사용하여 실시간 차량 추적 및 기업 차량 관리를 보다 간단하고 쉽게 할 수 있도록 도와줍니다.

- 또한 미국에서는 온라인 쇼핑의 확산으로 소매업이 확대되고 있어 기업에서 사용하는 차량이 늘어나면서 시장을 견인할 것으로 예상됩니다. 예를 들어, 오크 크릭에 아마존의 새로운 주문 처리 센터가 2020년에 오픈할 예정입니다. 시 관계자는 상품 하역을 위해 하루 175대의 트럭을 추가로 고용할 것으로 예상하고 있습니다.

- 그러나 자동 유도 시스템과 같은 차량 관리 시스템의 대부분은 변환기와 같은 전자부품에 크게 의존하고 있으며, 최근 COVID-19 전염병으로 인한 전자 공급망의 최근 혼란은 상당한 시장 기간 동안 성장률 저해에 반영 될 수 있습니다. 반영될 수 있습니다.

북미의 플릿 관리 솔루션 산업 개요

북미의 플릿 관리 솔루션 시장은 경쟁이 치열하며, PowerFleet, Inc, Geotab, Inc, Verizon Communications Inc(Connect), Omnitracs, LLC, GPS Trackit, Inc.에 의해 지배되고 있습니다. 시장 점유율이 압도적인 이들 대기업들은 해외 고객 기반 확대에 주력하고 있습니다. 이들 기업은 시장 점유율을 확대하고 수익성을 높이기 위해 전략적 공동 이니셔티브를 활용하고 있습니다. 그러나 기술 발전과 제품 혁신에 따라 중견-중소기업들은 신규 계약 체결과 새로운 시장 개척을 통해 시장에서의 입지를 강화하고 있습니다.

- 2020년 6월 - Geotab은 Geotab 공공사업 솔루션의 북미 출시를 발표했습니다. 이 올인원 솔루션은 차량 관리자에게 모든 유형의 정부 차량의 운행 데이터를 하나의 플랫폼에서 완벽하게 시각화하여 효과적으로 규정 준수를 유지하고 비용을 절감하며 교통 안전을 유지할 수 있는 도구 세트를 제공합니다. 이 솔루션은 염화칼슘 살포기, 제설차, 도로 청소차, 폐기물 관리 차량과 같은 차량을 관리하는 정부 기관을 지원하도록 설계되었습니다.

- 2020년 5월 - Omnitracs, LLC는 트럭 운송 산업에 운송 관리 및 트럭 운송 소프트웨어 솔루션을 제공하는 McLeod Software와 제휴했습니다. McLeod LoadMaster 운송 관리 시스템(TMS)과의 통합은 Omnitracs One 플랫폼의 상호운용성을 강화하여 전 세계 차량에 더 많은 가치를 제공할 수 있도록 지원합니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 운영 효율 중시 상승과 함께 유리한 시장 규제

- 그린 플릿 개념의 등장에 의한 시장 성장 촉진

- 기술적 진보에 의한 도달 범위 확대와 설치 비용 하락

- 시장 과제

- 지오 코딩에 관한 프라이버시와 운영상 우려

- 시장 기회

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- COVID-19가 플릿 관리와 텔레매틱스 산업에 미치는 영향

- 산업 표준과 규제

- 산업 밸류체인 분석 - IT 소프트웨어, 플릿 하드웨어(텔레매틱스), 연결성, 자동차 OEM 등

제5장 시장 세분화

- 전개별

- 온프레미스

- 클라우드

- 하이브리드

- 용도별

- 자산 관리

- 정보 관리

- 드라이버 관리

- 안전과 컴플라이언스 관리

- 리스크 관리

- 오퍼레이션 관리

- 기타 솔루션

- 최종 이용 산업별

- 운송

- 에너지

- 건설업

- 제조업

- 기타

- 국가별

- 미국

- 캐나다

제6장 경쟁 구도

- 기업 개요

- PowerFleet, Inc.

- Geotab, Inc.

- Verizon Communications Inc.(Connect)

- Omnitracs, LLC

- GPS Trackit, Inc.

- Astrata Group

- Trimble Navigation Inc.

- Mix Telematics

- Inseego Group

제7장 시장 향후 전망

ksm 25.01.23The North America Fleet Management Solutions Market size is estimated at USD 5.52 billion in 2025, and is expected to reach USD 13.85 billion by 2030, at a CAGR of 20.21% during the forecast period (2025-2030).

The growing adoption of wireless technology, increasing investment in fleet management solutions to optimize the fleet operating expenses, rising international trades are some of the major factors driving the growth of the fleet management solution market in North America.

Key Highlights

- The rapid expansion of communication technologies has turned the world into a cluster of billions of connected vehicles where the driver can communicate with other cars on the road (vehicle-to-vehicle), roadside infrastructure (vehicle-to-infrastructure), and the cloud (vehicle-to-cloud) to yields higher productivity, agility, and efficiency and is expected to drive the market.

- Moreover, most of the key vendors are collaborating to develop and launch new and advanced fleet management solutions to seize the growing demand. For instance, in 2019, I.D. Systems, Inc partnered with Jungheinrich to develop a highly integrated telemetry platform for Jungheinrich vehicles combined with sophisticated fleet management software. This technology partnership will power-up Jungheinrich customers' ability to run safer, more cost-effective intralogistics operations.

- Additionally, the rapid expansion of 5G availability is driving the growth of fleet management systems in various industries. For instance, as per Ericsson's 2019 report on the mobile industry has predicted that by 2024 there will be 1.9 billion 5G cellular subscriptions that will drive the growth of connecting vehicles. North American market is expected to grow most with 63% of mobile subscriptions with 5G service, and 47% of cellular subscribers in East Asia will have 5G access as well. Much of the growth will be credited to reductions in chipset prices and the expansion of cellular technologies such as NB-IoT and Cat-M1.

- However, lack of data security in cloud and server-based services is hampering the growth of the market. Cloud-based services bring many unique security issues and challenges. Data is stored with a third-party provider and accessed in the cloud. This means visibility and control over that data is limited.

North America Fleet Management Solutions Market Trends

Transportation Sector Will Experience Significant Growth

- The growing number of smart transportation projects under the smart city concept is expected to boost the demand for fleet management solutions over the forecast period. The goal of smart transportation projects is to reduce the reliance on private cars, make public transport more attractive, and incentivize city residents and visitors to switch from private to public transport to address the escalating traffic problems. For instance, smart transport systems can limit private cars to certain routes and reserve priority lanes or even entire roads for other modes of transport.

- Increasing the adoption of commercial vehicles by various businesses in the United States and Canada to enhance their transportation offerings is expected to boost the market in North America. For instance, in 2019, the United States secured the first rank and registered a sale of 12,764,999 commercial vehicles; moreover, Canada was third on the list with 1,479,252 commercial vehicles.

- Moreover, the United States increasing efforts to expand the production of most competitive industries and products through exports in order to achieve the scale of economies and strengthen its economic growth is expected to fuel the market. For instance, according to the report, in 2019, the total value of United States trade goods amounted to USD 4.14 trillion which reflects the growing demand for fleet management solutions to track route progress, receive automatic updates, improve client experience and reduce call volume by sharing arrival times and delays.

United States Will Experience Significant Growth and Drive the Market

- An increasing number of fleet accidents in the United States are forcing companies to adopt fleet management solutions as these are the most expensive injury claims for any businesses. For instance, according to the Federal Motor Carrier Safety Administration (FMCSA) report, an estimated 37,133 people died in 34,247 fatal accidents in 2017 and 5,005 people died in 4,455 crashes involving large trucks or buses, fatalities increased 8% from 2016, and fatal crashes also increased by 8%.

- Therefore, most of the companies are using accident management tools that provide real-time insights of the vehicles and traffic to prevent accidents and improve driver safety. These solutions use GPS tools, mobile technology, and the Internet of Things (IoT) and make real-time fleet tracking and enterprise fleet management simpler and easier.

- Further, the expansion of the retail sector in the United States due to the growing popularity of online shopping is expected to drive the market as more vehicles will be employed by companies. For instance, Amazon's new fulfillment center in Oak Creek is expected to open in 2020. It is estimated by the city official to employ in an additional 175 trucks on a daily basis for loading and unloading of goods.

- However, most of the fleet management systems, like automated guidance systems, heavily rely on electronic components like transducers, and the recent disruption of electronic supply chains due to the COVID-19 pandemic could reflect on the growth rates being hindered for a substantial market period.

North America Fleet Management Solutions Industry Overview

The North America fleet management solutions market is competitive and is dominated by a few major players like PowerFleet, Inc., Geotab, Inc., Verizon Communications Inc. (Connect), Omnitracs, LLC and GPS Trackit, Inc. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- June 2020 - Geotab announced the North American launch of its Geotab Public Works solution. The all-in-one solution offers fleet managers full visibility into the operational data of all government vehicle types on one single platform and provides the toolsets to effectively remain compliant, reduce costs, and maintain road safety. It is designed to assist government agencies better manage vehicles such as salt spreaders, snowplows, street sweepers and waste management vehicles.

- May 2020 - Omnitracs, LLC partnered with McLeod Software, a provider of transportation management and trucking software solutions to the trucking industry. The integration with the McLeod LoadMaster transportation management system (TMS) will enhance the interoperability of the Omnitracs One platform, delivering more value to fleets globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favorable market regulations coupled with growing emphasis on operational efficiency

- 4.2.2 Advent of the concept of Green Fleets to further aid market growth

- 4.2.3 Technological advancements enabling greater reach and declining costs of installation

- 4.3 Market Challenges

- 4.3.1 Privacy and operational concerns related to geocoding

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Fleet Management and Telematics industry

- 4.7 Industry Standards & Regulations

- 4.8 Industry Value Chain Analysis - IT Software, Fleet Hardware (Telematics), Connectivity, Automotive OEM's, etc.

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By Application

- 5.2.1 Asset Management

- 5.2.2 Information Management

- 5.2.3 Driver Management

- 5.2.4 Safety and Compliance Management

- 5.2.5 Risk Management

- 5.2.6 Operations Management

- 5.2.7 Other Solutions

- 5.3 By End-User Industry

- 5.3.1 Transportation

- 5.3.2 Energy

- 5.3.3 Construction

- 5.3.4 Manufacturing

- 5.3.5 Other End User Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PowerFleet, Inc.

- 6.1.2 Geotab, Inc.

- 6.1.3 Verizon Communications Inc. (Connect)

- 6.1.4 Omnitracs, LLC

- 6.1.5 GPS Trackit, Inc.

- 6.1.6 Astrata Group

- 6.1.7 Trimble Navigation Inc.

- 6.1.8 Mix Telematics

- 6.1.9 Inseego Group