|

시장보고서

상품코드

1630440

중동 및 아프리카의 항공 연료 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Middle-East and Africa Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

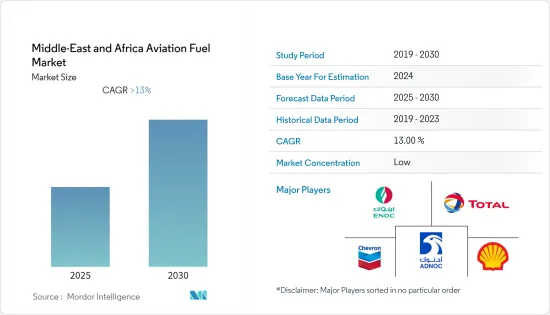

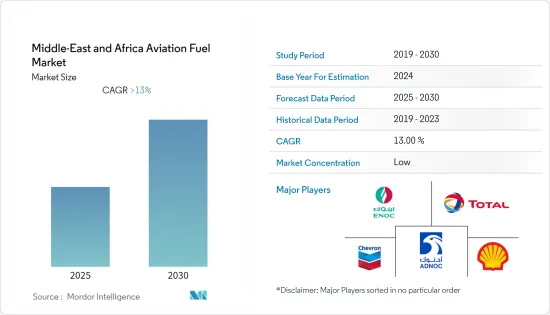

중동 및 아프리카의 항공 연료 시장은 예측 기간 동안 13% 이상의 CAGR을 기록할 것으로 예상됩니다.

COVID-19의 발생으로 인해 지역 폐쇄와 비행 제한이 발생하여 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 이미 전염병 이전 수준에 도달했습니다.

주요 하이라이트

- 최근 항공 운임의 저평가, 경제 상황의 호전, 가처분 소득의 증가 등을 배경으로 한 항공 여객 수의 증가가 시장의 주요 촉진요인으로 작용하고 있습니다. 또한, 이 지역의 여러 국가에서 진행 중이거나 예정된 전투기 거래도 항공 연료 수요를 더욱 증가시킬 것으로 예상됩니다.

- 그러나 항공 연료의 높은 비용과 불안정성이 시장을 억제할 것으로 예상됩니다.

- 중동 지역 국가들은 향후 20년간 2,600대 이상의 새로운 항공기를 필요로 하고 있으며, 이는 중동 지역의 항공 여행객 증가에 대응하기 위한 것입니다. 이러한 대규모 항공기 수요에 따라 항공 연료 시장 진출 기업들에게도 기회가 될 것으로 예상됩니다.

- 중동 및 아프리카에서 가장 큰 시장 규모를 가진 아랍에미리트는 이 지역 시장을 선도하고 있으며, 앞으로도 그 우위를 유지할 가능성이 높습니다.

중동 및 아프리카의 항공 연료 시장 동향

민간부문이 시장을 독식

- 민간 항공은 정기 및 부정기 항공기 운항을 포함하며, 여객 또는 화물의 상업용 항공 운송을 포함합니다. 민간 부문은 항공 연료의 가장 큰 소비자 중 하나이며 항공사의 총 운항 지출의 4분의 1을 차지합니다.

- 러시아와 우크라이나의 분쟁은 OPEC 국가들의 공급 감축으로 인해 원래 가격보다 높게 유지되고 있던 원유 가격 상승 문제를 더욱 악화시켰습니다. 유가 상승은 국내 주요 수요처인 민간 항공 부문의 항공 연료 수요에 부정적인 영향을 미칩니다.

- 2021년 사우디아라비아는 주문한 항공기에 필요한 자금의 일부를 조달하기 위해 30억 달러 상당의 대출 계약을 체결했습니다. 이 금액은 2024년 중반까지 항공사의 항공기 자금 수요를 충당하고 이전에 주문한 73대의 항공기 구매 자금을 지원한다고 항공사는 성명을 통해 밝혔습니다. 이 항공사는 Airbus A320neo, A321neo, A321XLR, Boeing787-10을 주문했습니다.

- 2022년 사우디아라비아의 공항을 통과한 승객 수는 8억 7천만 명이었습니다. 사우디 정부는 2030년까지 연간 여객 수 3억 3,000만 명, 국제선 취항 도시 250개, 관광객 수 1억 명 달성을 목표로 하고 있습니다.

- 지난 1월 카타르는 제너럴 일렉트릭 컴퍼니(General Electric Company)의 초대형 쌍발기 777X 34대를 주문하고 16대의 옵션도 계약했습니다. 또한 보잉의 현재 777 화물기 2대도 주문했으며, 보잉은 777X 여객기의 취항을 예정보다 약 3년 늦은 2023년 하반기로 예상하고 있습니다.

- 2021년 남아프리카공화국은 아프리카 최대 항공 수송량을 기록했으며, 총 여객 수는 약 2,100만 명에 달했습니다.

- 앞서 언급한 요인으로 인해 예측 기간 동안 민간 부문이 시장을 독점할 것으로 예상됩니다.

시장을 독점하는 아랍에미리트연합

- 아랍에미리트 국영 항공사는 전 세계 108개국 224개 도시에 취항하고 있으며, 2021년 10월 기준 아랍에미리트 항공 부문에 대한 투자액은 2,700억 달러에 달합니다.

- 아랍에미리트는 높은 항공 교통량, 높은 원유 생산량, 높은 정제 능력, 국내 항공 연료 공급량, 에미레이트 항공과 에티하드 항공의 양대 항공사가 있는 등 중동의 항공 연료 부문의 주요 국가 중 하나입니다.

- 아부다비 공항의 2022년 1-3월 여객 수는 256만 3,297명으로 2021년 동기 대비 218% 증가했습니다. 같은 기간 아부다비 공항의 항공편 수는 2만 2,689편으로 2021년 대비 38% 증가했습니다.

- 또한, 두바이 알 막툼 국제공항이 완공되면 연간 여객 1억 6천만 명, 항공화물 1,200만 톤에 달하는 세계 최대 규모의 공항이 될 것으로 예상됩니다.

- 에미레이트 항공은 총 88만 3,000편의 항공편을 처리했으며, 두바이 공항은 6,865만 kg의 화물을 수송해 세계 6위의 화물 운송량을 기록했습니다(Dubai Airport Factsheet). 아랍에미리트는 세계 최대 규모의 보잉(Boeing) 항공기 191대를 보유하고 있으며, 에어버스(Airbus380) 기종도 119대를 보유하고 있습니다. 4개 국영 항공사가 보유한 항공기는 약 498대입니다.

- 앞서 언급한 요인으로 인해 아랍에미리트는 예측 기간 동안 시장을 독점할 것으로 예상됩니다.

중동 및 아프리카의 항공 연료 산업 개요

중동 및 아프리카의 항공 연료 시장은 비교적 통합되어 있습니다. 주요 기업으로는 Emirates National Oil Company, Chevron Corporation, Shell PLC, TotalEnergies SE, Abu Dhabi National Oil Company 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 연료 유형

- 에어 터빈 연료(ATF)

- 항공 바이오연료

- 항공 가스

- 용도

- 상업용

- 방위

- 일반 항공

- 지역

- 아랍에미리트

- 사우디아라비아

- 카타르

- 이집트

- 남아프리카공화국

- 기타 중동 및 아프리카

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Emirates National Oil Company

- Repsol SA

- BP PLC

- Shell PLC

- TotalENergies SE

- Chevron Corporation

- Exxon Mobil Corporation

- Abu Dhabi National Oil Company

제7장 시장 기회와 향후 동향

ksm 25.01.23The Middle-East and Africa Aviation Fuel Market is expected to register a CAGR of greater than 13% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and flight restrictions. Currently, the market has reached pre-pandemic levels.

Key Highlights

- The increasing number of air passengers, on account of the cheaper airfare in recent times, stronger economic conditions, and increasing disposable income, are among the major driving factors for the market. Ongoing and upcoming fighter jet deals in different countries in the region are also expected to increase aviation fuel demand further.

- However, the high and volatile cost of aviation fuel is expected to restrain the market.

- Countries in the Middle-Eastern region need over 2,600 new aircraft in the next 20 years to cater to the increasing number of air travelers in the region. With this large-scale, opportunities are expected for the aviation fuel market players.

- With the largest market size in the Middle East and Africa, the United Arab Emirates is leading the market in the region and is likely to continue its dominance.

MEA Aviation Fuel Market Trends

Commercial Sector to Dominate the Market

- Commercial aviation includes operating scheduled and non-scheduled aircraft, which involves commercial air transportation of passengers or cargo. The commercial segment is one of the largest consumers of aviation fuel, and it accounts for a quarter of the total operating expenditure for an airline operator.

- The Russia-Ukraine conflict has further aggravated the issue of high prices of oil, which had been maintained above their original prices due to supply cuts by OPEC+ nations. An increase in the prices of crude oil will adversely impact the requirement for aviation fuel in the commercial aviation sector, which is the major user of the commodity in the country.

- In 2021, Saudi Arabia signed a financing agreement worth USD 3 billion to partially finance requirements for aircraft it has ordered. The amount covers the airline's aircraft financing requirements until mid-2024, helping finance the purchases of 73 aircraft previously ordered, it said in a statement. The airline has ordered Airbus A320neo, A321neo, A321XLR, and Boeing 787-10 jets.

- The number of passengers that passed through Saudi Arabia's airports in 2022 was 8.7 million. Saudi government aims to reach 330 million passengers, 250 international destinations, and 100 million tourists annually by 2030.

- In January 2022, Qatar signed an order for 34 of the 777X, a giant, twin-engine plane powered by General Electric, as well as options for 16 more of the jets. The airline also ordered two of Boeing's current 777 freighter models. Boeing expects the passenger 777X to enter into service in late 2023, about three years behind schedule.

- In 2021, South Africa witnessed the highest air traffic in Africa, with the total air passenger traveled being approximately 21 million.

- Due to the aforementioned factors, the commercial sector is expected to dominate the market during the forecast period.

The United Arab Emirates to Dominate the Market

- The UAE's national carriers fly to 108 countries and 224 cities around the world, and the value of the UAE's investments in the aviation sector amounted to USD 270 billion as of October 2021 (ICAO).

- The United Arab Emirates is one of the major countries in the aviation fuel sector in the Middle East due to significant air traffic, large production of crude oil, significant refining capacity, availability of large domestic aviation fuel supply, and its two major airlines, the Emirates and Etihad.

- Abu Dhabi airports served 2,563,297 passengers during the first three months of 2022, an increase of 218% from the same period in 2021. The airports logged 22,689 flights in the quarter, an increase of 38% from 2021.

- Moreover, once the Al Maktoum International Airport in Dubai is completed, it is expected to emerge as the largest airport in the world, with a capacity of up to 160 million passengers and 12 million metric tons of air freight volume annually.

- A total of 883,000 flights were handled by Emirati airports, with Dubai Airport ranking sixth globally in terms of shipment, transporting 68.65 million kg of goods (Dubai Airport Factsheet). The United Arab Emirates has one of the largest fleets of Boeing aircraft in the world, with 191 aircraft, and it also has 119 Airbus 380 aircraft. Its four national carriers have approximately 498 aircraft.

- Due to the aforementioned factors, the United Arab Emirates is expected to dominate the market during the forecast period.

MEA Aviation Fuel Industry Overview

The Middle East and African aviation fuel market are moderately consolidated. Some of the major companies (in no particular order) include Emirates National Oil Company, Chevron Corporation, Shell PLC, TotalEnergies SE, Abu Dhabi National Oil Company, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Defense

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Qatar

- 5.3.4 Egypt

- 5.3.5 South Africa

- 5.3.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Emirates National Oil Company

- 6.3.2 Repsol SA

- 6.3.3 BP PLC

- 6.3.4 Shell PLC

- 6.3.5 TotalENergies SE

- 6.3.6 Chevron Corporation

- 6.3.7 Exxon Mobil Corporation

- 6.3.8 Abu Dhabi National Oil Company