|

시장보고서

상품코드

1630441

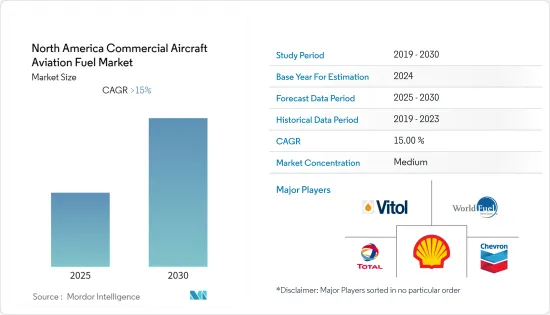

북미의 민간항공기용 항공 연료 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Commercial Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

북미의 민간항공기용 항공 연료 시장은 예측 기간 동안 15% 이상의 CAGR을 기록할 것으로 예상됩니다.

COVID-19의 발생으로 인해 지역 폐쇄와 비행 제한이 발생하여 시장에 부정적인 영향을 미치고 있습니다. 현재 시장은 이미 전염병 이전 수준에 도달했습니다.

주요 하이라이트

- 항공 여객 수송량 증가, 지역 내 저비용항공사(LCC)의 증가, 항공화물 운송 수요 증가 등의 요인이 예측 기간 동안 시장을 견인할 것으로 보입니다.

- 그러나 원유와 제트 연료의 가격 변동은 대상 시장을 억제할 것으로 예상됩니다.

- 민간 항공 산업은 이산화탄소 배출량을 줄이기 위해 국내 재생 가능한 제트 연료 공급을 늘리는 것을 목표로 하고 있습니다. 따라서 재생 가능한 항공 연료와 같은 대체 연료에 대한 수요가 증가하고 있으며, 이는 가까운 장래에 기회가 될 가능성이 높습니다.

- 예측 기간 동안 미국이 북미 민간항공기용 항공 연료 시장을 독점할 것으로 예상됩니다.

북미의 민간항공기용 항공 연료 시장 동향

항공 터빈 연료(ATF) 부문이 시장을 독점할 것으로 예상

- 항공 터빈 연료(ATF) 또는 제트 연료는 가스 터빈 엔진이 장착된 항공기에 사용하도록 설계된 항공 연료의 일종입니다. 제트 A1과 제트 A는 민간항공기에 사용되는 항공 연료의 두 가지 주요 등급입니다.

- 항공 여객 증가, 세계 경제 상황, 항공기 연료 연소 효율 향상 등의 요인이 민간항공기용 항공 연료 시장의 제트 연료 수요에 영향을 미치고 있습니다.

- 미국 이외 지역에서는 제트 A1에 이어 제트 A1이 소비량 측면에서 지배적인 항공 연료로 남아있을 것으로 보입니다. 제트 A-1은 동결점이 영하 47 ℃ 이하 여야합니다. 이 연료에는 일반적으로 정전기 분산제가 포함되어 있습니다.

- Jet A 규격의 연료는 주로 미국에서 사용되며 일반적으로 미국 외 지역과 토론토, 밴쿠버 등 캐나다 일부 공항에서는 사용할 수 없습니다. 제트A 연료의 동결점은 영하 40℃ 이하이어야 하며, 일반적으로 정전기 제거제를 포함하지 않습니다.

- LanzaTech의 에탄올 기반 ATJ-SPK(알코올-제트 합성 파라핀 케로신)는 이제 미국 민간 항공사의 표준 제트 A 혼합 성분으로 사용할 수 있게 되었습니다. 항공기의 기존 제트 연료에 최대 50%까지 혼합하여 사용할 수 있게 되었습니다.

- 따라서 이러한 발전으로 인해 예측 기간 동안 제트 A 연료(에어터빈 연료)에 대한 수요가 증가할 것으로 예상됩니다.

- 또한, IATA에 따르면 캐나다에서 항공기를 이용하는 승객은 2037년까지 1억 1,800만 명으로 증가할 것으로 예상됩니다. 따라서 민간항공기용 항공 터빈 연료에 대한 수요는 향후 몇 년 동안 증가할 것으로 예상됩니다.

미국이 시장을 독식할 것으로 예상

- 일반 항공기는 2인승 연습기 및 실용 헬리콥터부터 대륙간 비즈니스 제트기까지 2021년 현재 전 세계에서 운항 중인 총 440,000대의 일반 항공기를 포함하며, 21만 1,000대 이상의 일반 항공기가 미국에 기반을 두고 있습니다. 독점하고 있습니다.

- Airlines for America(A4A)에 따르면 2021년 미국 항공사는 매일 250만 명의 승객을 전 세계로 운송했으며 이는 미국 항공사 역사상 가장 많은 승객을 수송 한 것으로 기록되었습니다. 또한 2020년 미국 항공사는 하루 6만 8,000톤의 화물을 운송했으며, 이는 미국 항공사 역사상 가장 높은 수치입니다.

- 따라서 지난 몇 년 동안 항공 여행과 화물 물동량의 견조한 성장으로 인해 항공 연료에 대한 수요가 증가했습니다.

- 과거 실질 항공료가 급락하면서 국내 항공 여행이 증가했습니다. 이에 따라 국내외 항공여행을 선호하는 경향이 강해져 항공 연료 소비가 증가했습니다.

- 따라서 예측 기간 동안 미국은 여객 및 화물 항공 운송량이 많은 등의 요인으로 인해 북미 민간항공기 연료 시장에서 우위를 점할 것으로 예상됩니다.

북미의 민간항공기용 항공 연료 산업 개요

북미의 민간항공기용 연료 시장은 상당히 세분화되어 있습니다. 이 시장의 주요 기업으로는 Chevron Corporation, World Fuel Services Corp, Total S.A., Vitol Holding BV, Royal Dutch Shell Plc 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 연료 유형

- 에어 터빈 연료(ATF)

- 항공 바이오연료

- 기타

- 지역

- 미국

- 캐나다

- 기타 북미

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- World Fuel Services Corp

- Chevron Corporation

- TotalEnergies SE

- Vitol Holding BV

- Shell Plc

- Mercury Air Group, Inc.

- Targray Technology International Inc.

- Valero Energy Corporation

- Irving Oil Ltd

- Phillips 66

제7장 시장 기회와 향후 동향

ksm 25.01.23The North America Commercial Aircraft Aviation Fuel Market is expected to register a CAGR of greater than 15% during the forecast period.

The market has been negatively impacted by the outbreak of COVID-19 due to regional lockdowns and flight restrictions. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing air passenger traffic, increasing the number of low-cost carriers (LCC) across the region, and growing demand for air cargo transportation, are expected to drive the market over the forecast period.

- However, volatile crude oil and jet fuel prices are expected to restrain the target market.

- The commercial aviation industry aims to increase domestic renewable jet fuel supply to reduce carbon emissions. Thus, there is an increasing demand for alternatives, such as renewable aviation fuel, which will likely provide an opportunity in the near future.

- The United States is expected to dominate the North American commercial aircraft aviation fuel market over the forecast period.

North America Commercial Aircraft Aviation Fuel Market Trends

Air Turbine Fuel (ATF) Segment is Expected to Dominate the Market

- Aviation turbine fuel (ATF) or jet fuel is a type of aviation fuel designed for use in aircraft powered by gas-turbine engines. Jet A1 and Jet A are two primary grades of aviation fuel used in commercial aircraft.

- Factors such as growth in air traffic passenger, global economic scenario, and improvement in aircraft fuel-burning efficiency are influencing demand for jet fuel in the commercial aircraft aviation fuel market.

- Jet A1 is likely to remain a dominant aviation fuel in terms of consumption, followed by the Jet A type, for locations outside the United States. Jet A-1 must have a freeze point of minus 47°C or below. This fuel normally contains a static dissipator additive.

- Jet A specification fuel is mainly used in the United States, and it is usually not available outside the United States and a few Canadian airports, such as Toronto and Vancouver. Jet A fuel must have a freeze point of minus 40oC or below and does not typically contain a static dissipator additive.

- LanzaTech's ethanol-based ATJ-SPK (alcohol-to-jet synthetic paraffinic kerosene) was made eligible for use as a blending component with standard Jet A for commercial airline use in the United States. Under the revised ASTM D7566, LanzaTech ATJ-SPK is eligible to be used up to a 50% blend in conventional jet fuel for commercial flights.

- Hence, such ongoing developments are expected to increase the demand for Jet A fuel (air turbine fuel) during the forecast period.

- Moreover, according to IATA, passengers traveling by air from Canada are expected to increase to 118 million by 2037. Therefore, the demand for aviation turbine fuel for commercial aircraft is expected to increase in the coming years.

The United States is Expected to Dominate the Market

- General Aviation included a total of 440,000 general aircraft flying worldwide (GAMA) as of 2021, ranging from two-seat training aircraft and utility helicopters to intercontinental business jets. Over 211,000 general planes are based in the United States, which makes the nation dominate the sector.

- According to the Airlines for America (A4A), in 2021, the country's airlines carried 2.5 million passengers worldwide daily, which was an all-time high number of passengers in the country's airline history. Moreover, 68,000 metric tons of cargo per day were ferried by the country's airlines in 2020 (A4A).

- Therefore, the country's robust air travel and cargo volume growth has resulted in greater demand for aviation fuel in the past years.

- Air travel in the country has increased as real airfares have plunged in the past. Therefore, the increased propensity of people to prefer domestic and international air travel has led to increased consumption of aviation fuel.

- Hence, due to factors such as high air traffic passenger and cargo, the United States is expected to dominate in the North American commercial aircraft fuel market over the forecast period.

North America Commercial Aircraft Aviation Fuel Industry Overview

The North American commercial aircraft aviation fuel market is moderately fragmented. Some of the major players in the market (in no particular order) include Chevron Corporation, World Fuel Services Corp, Total S.A., Vitol Holding BV, and Royal Dutch Shell Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 Others

- 5.2 Geography

- 5.2.1 The United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 World Fuel Services Corp

- 6.3.2 Chevron Corporation

- 6.3.3 TotalEnergies SE

- 6.3.4 Vitol Holding BV

- 6.3.5 Shell Plc

- 6.3.6 Mercury Air Group, Inc.

- 6.3.7 Targray Technology International Inc.

- 6.3.8 Valero Energy Corporation

- 6.3.9 Irving Oil Ltd

- 6.3.10 Phillips 66