|

시장보고서

상품코드

1632054

독립형 메모리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Standalone Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

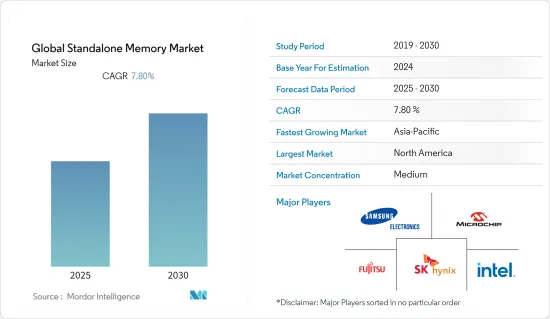

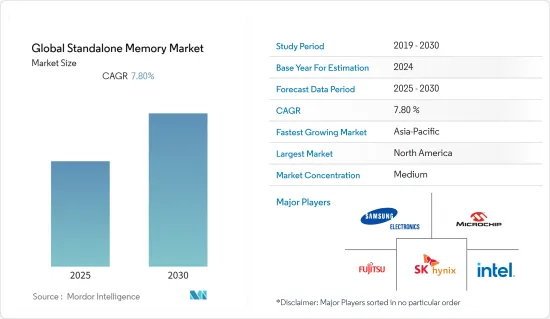

세계 독립형 메모리 시장은 예측 기간 동안 7.8%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 사물인터넷 기기의 사용 증가와 웨어러블 기기, 인공지능(AI) 지원 기기 등 센서 기술의 채택은 빠른 데이터 전송과 높은 저장 밀도에 대한 수요를 증가시켜 전 세계 독립형 메모리 시장의 성장에 큰 기회와 잠재력을 가져다주고 있습니다. 어플라이드 머티어리얼즈에 따르면, IoT, 엣지 디바이스, 인터넷 사용자들이 생성하는 방대한 데이터는 이러한 메모리의 상용화를 촉진하는 촉매제 역할을 할 것으로 보입니다. 인공지능 및 데이터 분석 애플리케이션은 이러한 데이터 수요를 크게 견인하고 있습니다.

- COVID-19 사태로 인해 재택근무가 확산되면서 화상 회의와 같은 애플리케이션을 통해 데이터가 대량으로 증가했으며, AI 및 AR/VR과 같은 새로운 애플리케이션은 예측 기간 동안 보편화되어 더 많은 데이터 붐을 일으킬 것으로 예상됩니다. 추가적인 데이터 붐을 가져올 것으로 예측됩니다. 데이터 증가로 인해 메모리 기술은 새로운 표준을 요구하고 있습니다. 이러한 수요를 충족시키기 위해 DRAM과 NAND는 규모를 확장하고 있습니다.

- 한편, 데이터 증가에 대응하기 위해서는 새로운 메모리 기술을 개발해야 하는데, 2021년 9월 한국 SK하이닉스는 STT-MRAM, 강유전체 메모리, ReRAM의 세 가지 신기술이 더 많은 양의 데이터를 처리하는 역할을 할 수 있다고 밝혔습니다.

- IoT 도입으로 인해 급증하는 데이터를 처리해야 하는 필요성이 증가하면서 IoT 기기 도입이 빠른 속도로 증가하고 있습니다. 스마트 시티와 같은 전 세계 다양한 정부 이니셔티브가 이러한 기기 도입을 더욱 빠르게 촉진하고 있습니다.

독립형 메모리 시장 동향

자동차가 큰 시장 점유율을 차지할 것으로 예상

- 독립형 메모리의 용도는 자율주행차, ADAS 통합 등의 부상으로 자동차 분야로 확대되고 있습니다. 자동차 분야의 발전은 고성능 메모리의 채택을 촉진하고 시장 성장을 뒷받침하고 있습니다.

- 자율주행차의 핵심은 여러 센서(AV)를 갖춘 첨단 운전자 보조 시스템(ADAS)입니다. 차량은 로컬에서 데이터를 수집, 분석, 저장하고 최적의 타이밍에 선택적으로 데이터를 업로드하는 설계가 점점 더 진행될 것으로 보입니다. 이를 위해서는 차량에 데이터 저장 및 컴퓨팅 장비를 설치해야 합니다. 자율주행차의 핵심은 여러 센서(AV)를 갖춘 ADAS(첨단 운전자 보조 시스템)입니다. 차량은 앞으로 점점 더 로컬에서 데이터를 수집, 분석, 저장하고 최적의 타이밍에 선택적으로 데이터를 업로드할 수 있도록 설계될 것입니다.

- 메모리 디바이스의 통합과 수요에 따른 자동차 분야의 괄목할 만한 성장은 예측 기간 동안 시장 성장률을 끌어올릴 것으로 분석됩니다. 예를 들어, 후지쯔(Fujitsu)는 2021년 7월 125℃에서 작동 가능한 차량용 4Mbit FRAM을 양산하기 시작했습니다. 이 FRAM 제품은 산업용 로봇이나 ADAS(첨단 운전자 보조 시스템) 등 고신뢰성 전자부품이 요구되는 차량용 애플리케이션에 적합한 '차량용 등급' 부품의 AEC-Q100 1등급 인증 기준을 충족합니다.

- 또한, 삼성은 2021년 12월 차세대 자율주행 전기자동차를 위한 종합적인 차량용 메모리 솔루션 양산을 시작했습니다. 삼성전자는 차세대 자율주행차를 위한 다양한 첨단 차량용 메모리 솔루션을 출시했습니다. 고성능 인포테인먼트 시스템용 256기가바이트(GB) PCIe Gen3 NVMe 볼 그리드 어레이(BGA) SSD, 2GB GDDR6 D램, 2GB DDR4 D램, 2GB GDDR6 D램, 128GB 유니버설 플래시 스토리지(UFS) 등 자율주행 시스템을 위한 새로운 라인업을 선보입니다.

- 이 시장은 차량용 DRAM에 집중하고 있으며, 이 부문에서는 다양한 혁신이 이루어지고 있습니다. 예를 들어, 2021년 2월 Micron Technology, Inc.는 가장 엄격한 ASIL(Automotive Safety Integrity Level: 자동차 안전 무결성 수준)인 ASIL D를 달성하기 위해 하드웨어 테스트를 거친 차량용 저전력 DDR5 DRAM(LPDDR5)을 출시했습니다. Micron의 국제표준화기구(ISO) 26262 표준에 기반한 새로운 메모리 및 스토리지 제품 포트폴리오는 차량 안전을 위한 기능적 차량 안전성을 목표로 합니다.

아시아태평양이 큰 시장 점유율을 차지할 것으로 예상

- 아시아태평양의 반도체 제조 시장은 가전 시장을 주도하는 가장 중요한 시장입니다. 중국, 인도, 일본, 한국 등의 국가에서 가전, 자동차 등 다양한 제조 부문의 존재와 수요가 이 지역의 독립형 메모리에 대한 수요를 강화하고 있는 것으로 분석됩니다.

- eMemory는 중국에서 장기적인 투자를 통해 파운드리 파트너와 협력하여 성숙한 노드부터 고급 노드까지 다양한 임베디드 비휘발성 메모리(eNVM)를 원타임 프로그래머블(OTP) 및 멀티 타임 프로그래머블(MTP) 솔루션을 사용하여 여러 플랫폼에 구현하고 있습니다. eMemory는 2021년 3분기에 UMC의 40nm ULP(초저전력) 공정에서 첫 번째 ReRAM IP를 발표했으며, 현재 22nm 버전을 연구하고 있습니다.

- 인도 브랜드 주식 재단(IBEF)에 따르면, 2021년 인도의 전자제품 하드웨어 생산액은 633억 9,000만 달러에 달할 것으로 예상됩니다. 또한, India Cellular &Electronics Association(ICEA)에 따르면 인도는 2025년까지 노트북 및 태블릿 제조 분야에서 1,000억 달러의 가치를 달성할 수 있을 것으로 예상됩니다. 이는 메모리 장치에 대한 수요를 증가시켜 예측 기간 동안 시장 성장률에 기여할 것으로 분석됩니다.

- 국가 투자 촉진 및 촉진 기관인 인베스트 인 인디아에 따르면 인도의 자동차 산업은 1,000억 달러 이상으로 평가되며, 총 수출의 8%를 생산하고 GDP의 2.3%를 차지하며, 2025년까지 세계 3위를 차지할 것으로 예상됩니다. 에 5억 3,025만 달러를 투자하고 2028년까지 6종의 전기자동차를 출시할 것이라고 발표했습니다. 2021년 10월, 타타모터스는 사모펀드 TPG와 아부다비의 ADQ가 전기자동차 부문에 10억 달러를 투자하기로 합의했다고 발표했습니다. 이러한 요인들은 전체적으로 예측 기간 동안 시장 성장률에 기여하고 있습니다.

독립형 메모리 산업 개요

독립형 메모리 세계 시장 경쟁은 완만하며, 많은 지역 및 세계 플레이어가 존재합니다. 혁신적인 제품이 시장을 주도하고 있으며, 각 업체들은 기술 혁신에 투자하고 있습니다. 주요 업체로는 삼성전자, SK하이닉스(SK Hynix Inc.), 마이크로칩 테크놀러지(Microchip Technology Inc.), 후지쯔 반도체 메모리 솔루션(Fujitsu Semiconductor Memory Solution), 인텔(Intel Corporation) 등이 있습니다.

- 2022년 5월 - SK하이닉스는 인텔 비전 컨퍼런스에 참가해 DDR5 DIMM, Processing in Memory(PiM), Compute Express Link(CXL)와 같은 차세대 기술을 포함한 서버 및 서버 애플리케이션을 위한 최신 메모리 솔루션을 소개했습니다.

- 2021년 3월 - 삼성전자가 DDR5 D램 메모리 포트폴리오에 HKMG(High-K Metal Gate) 제조 기술 기반의 512GB DDR5 모듈을 추가했습니다. 이 새로운 DDR5는 슈퍼컴퓨팅, 인공지능(AI), 머신러닝(ML), 데이터 분석 애플리케이션에서 가장 고도의 연산이 필요한 광대역폭 워크로드를 처리할 수 있으며, 최대 7,200 메가비트/초(Mbps)로 DDR4의 2배 이상의 성능을 제공합니다. 이상의 성능을 제공합니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 시장에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 클라우드 컴퓨팅, IoT, AI, 모빌리티 등의 메가트렌드의 지속적인 진화가 향후 수요를 창출할 전망

- 자동화 로봇 응용 수요 급증

- 시장 과제/억제요인

- 기술 응용의 복잡성

제6장 시장 세분화

- 제품 유형별

- DRAM

- NAND

- NOR

- (NV) SRAM/FRAM

- 기타 제품 유형

- 최종 이용 산업별

- 자동차

- 가전제품

- 기업

- 기타 최종 이용 산업

- 지역별

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제7장 경쟁 구도

- 기업 개요

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Microchip Technology Inc.

- SK Hynix Inc.

- Fujitsu Semiconductor Memory Solution

- Nanya Technology Corporation

- Powerchip Technology Corporation

- Avalanche Technology

- Intel Corporation

- Infineon Technologies AG

제8장 투자 분석

제9장 시장 전망

ksm 25.02.06The Global Standalone Memory Market is expected to register a CAGR of 7.8% during the forecast period.

Key Highlights

- The increasing use of internet of things devices and adoption of sensor technology such as wearable and AI-enabled devices have boosted demand for fast data transfers and high storage density, providing a tremendous chance or possibility for the growth of the standalone memory market globally. According to Applied Materials, the exponential volumes of data generated via IoT and edge devices and by internet users act as a catalyst to drive the commercialization of such memory. Artificial intelligence and data analytics applications are largely driving the demand for this data.

- The exponential growth of data generated shows no indications of abating. During the COVID-19 pandemic, the work-from-home trend resulted in a massive data increase through applications such as video conferencing. New applications, such as AI and AR/VR, are projected to become commonplace in the forecast period, resulting in a further data boom. As a result of the increase in data, memory technology is being pushed to new standards. To fulfill these demands, DRAM and NAND have scaled up.

- Additional memory technologies, on the other side, must be developed to keep up with the data growth. In September 2021, SK Hynix, a South Korean firm, stated that three new technologies, STT-MRAM, Ferroelectric Memory, and ReRAM, could play a role in processing larger quantities of data.

- The rising need to handle the proliferation of data due to the adoption of IoT further drives the market. The adoption of IoT devices is taking place at a rapid pace. Various government initiatives worldwide, like smart cities, are supporting the deployment of these devices at a much faster pace.

Standalone Memory Market Trends

Automotive Expected to Witness Significant Market Share

- The applications of standalone memory are spanning in the automotive sector due to the rise of self-driving cars and ADAS integration, among others. The advancement in the automotive sector has driven the adoption of high-performance memory, which supports the market's growth.

- The core of autonomous vehicles will be advanced driver assistance systems (ADAS) with multiple sensors (AVs). Vehicles will increasingly be designed to collect, analyze, and store data locally and selectively upload data at the optimal period. This will necessitate the vehicle's installation of data storage and computing equipment. The core of autonomous vehicles will be advanced driver assistance systems (ADAS) with multiple sensors (AVs). Vehicles will increasingly be designed to collect, analyze, and store data locally and selectively upload data at the optimal period.

- The significant growth in the automotive sector alongside the integration and demand for memory devices is analyzed to boost the market growth rate during the forecast period. For instance, In July 2021, Fujitsu began mass production of 4Mbit FRAM that can operate at 125°C and is automotive grade. This FRAM product meets the AEC-Q100 Grade 1 qualification criteria for "automotive grade" components, suitable for industrial robots and automotive applications such as advanced driver-assistance systems (ADAS) that demand high-reliability electronic components.

- Also, In December 2021, Samsung began mass production of comprehensive automotive memory solutions for next-generation autonomous electric vehicles. Samsung Electronics has released a broad range of advanced automotive memory solutions for next-generation self-driving cars. For high-performance infotainment systems, the new lineup includes a 256-gigabyte (GB) PCIe Gen3 NVMe ball grid array (BGA) SSD, 2GB GDDR6 DRAM, 2GB DDR4 DRAM, 2GB GDDR6 DRAM, and 128GB Universal Flash Storage (UFS) for autonomous driving systems.

- The market focuses on automotive DRAMs, and various innovations are witnessed in the segment. For instance, in February 2021, Micron Technology, Inc. announced the launch of the automotive low-power DDR5 DRAM (LPDDR5) memory that has been hardware-tested to achieve the most stringent Automotive Safety Integrity Level (ASIL), ASIL D. Micron's new portfolio of memory and storage products based on the International Organization for Standardization (ISO) 26262 standard is aimed at functional vehicle safety.

Asia Pacific Expected to Witness Significant Market Share

- The semiconductor manufacturing market in Asia Pacific is the most significant in the region, driving the consumer electronics market. The presence and demand from various manufacturing sectors such as consumer electronics, automotive, and so on in the countries such as China, India, Japan, and South Korea are analyzed to bolster the demand for standalone memory in the region.

- eMemory has made a long-term investment in China and partnered with foundry partners to implement various embedded non-volatile memory (eNVM) on multiple platforms, ranging from mature to advanced nodes, using one-time programmable (OTP) and multiple-times programmable (MTP) solutions. In Q3/2021, eMemory launched its initial ReRAM IP on UMC's 40nm ULP (ultra-low power) process, and it is currently researching a 22nm version.

- India Brand Equity Foundation (IBEF) stated that the country's electronics hardware production stood at USD 63.39 billion in 2021. Moreover, according to India Cellular & Electronics Association (ICEA), India has the potential to achieve a value of USD 100 billion in manufacturing of laptops and tablets by 2025. It is analyzed to boost the demand for memory devices, contributing to the market growth rate during the forecast period.

- According to Invest in India, a National Investment Promotion and Facilitation Agency, India's automotive industry is valued at more than USD100 billion, produces 8% of total exports, accounts for 2.3% of GDP, and is on pace to become the global third-largest by 2025. In December 2021, Hyundai announced an investment of USD 530.25 million in R&D in India to launch six EVs by 2028. In October 2021, Tata Motors stated that private equity firm TPG and Abu Dhabi's ADQ had agreed to spend USD 1 billion in its electric vehicle sector. These factors collectively contribute to the market growth rate during the forecast period.

Standalone Memory Industry Overview

The Global Standalone Memory Market is moderately competitive, with many regional and global players. Innovation drives the market in the product offerings, and each vendor invests in innovation. Key players include Samsung Electronics Co. Ltd, SK Hynix Inc., Microchip Technology Inc., Fujitsu Semiconductor Memory Solution, and Intel Corporation.

- May 2022 - SK Hynix, a prominent DRAM manufacturer, displayed at the Intel Vision conference, showcasing the latest memory solutions for server applications, including DDR5 DIMM and next-generation technologies like Processing in Memory (PiM) and Compute Express Link (CXL).

- March 2021- Samsung Electronics has added the 512GB DDR5 module based on the High-K Metal Gate (HKMG) manufacturing technology to its DDR5 DRAM memory portfolio. The new DDR5 will be capable of organizing the most extreme computationally intensive, high-bandwidth workloads in supercomputing, artificial intelligence (AI), and machine learning (ML), as well as data analytics applications, with performance more than twice that of DDR4 at up to 7,200 megabits per second (Mbps).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Evolution of Mega Trends, such as Cloud Computing, IoT, AI, and Mobility, is Expected to Create Demand in the Future

- 5.1.2 Surging Demand for Application of Automation Robots

- 5.2 Market Challenge/Restraint

- 5.2.1 Complexity in Technological Applications

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 DRAM

- 6.1.2 NAND

- 6.1.3 NOR

- 6.1.4 (NV)SRAM /FRAM

- 6.1.5 Other Product Types

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Enterprise

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 Microchip Technology Inc.

- 7.1.4 SK Hynix Inc.

- 7.1.5 Fujitsu Semiconductor Memory Solution

- 7.1.6 Nanya Technology Corporation

- 7.1.7 Powerchip Technology Corporation

- 7.1.8 Avalanche Technology

- 7.1.9 Intel Corporation

- 7.1.10 Infineon Technologies AG