|

시장보고서

상품코드

1632085

영국의 IT 서비스 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United Kingdom IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

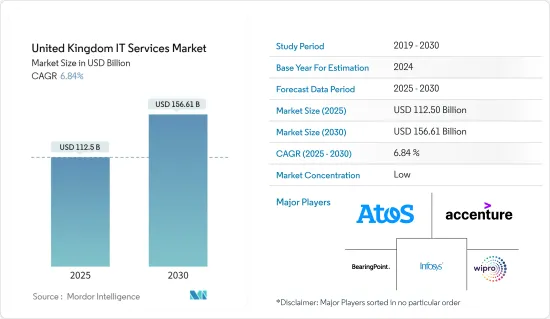

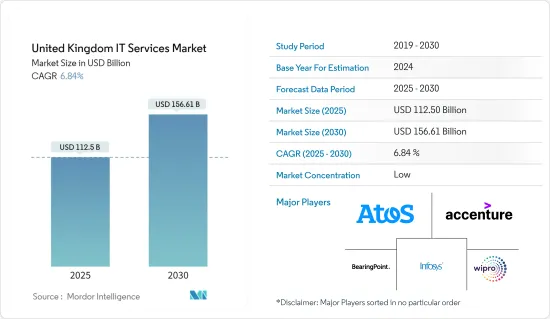

영국의 IT 서비스 시장 규모는 2025년에 1,125억 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 6.84%로, 2030년에는 1,566억 1,000만 달러에 달할 것으로 예측됩니다.

인터넷 용도 및 서비스 이용 증가, 스마트폰 및 기타 스마트 기기, 관련 앱 등 무선 기기의 보급이 영국 IT 서비스 시장의 성장을 크게 촉진하고 있습니다.

주요 하이라이트

- 영국에서는 다양한 IT 솔루션에 많은 투자가 이루어지고 있으며, SaaS(Software-as-a-Service)의 전면적인 도입과 클라우드 기반 제품 증가는 IT 서비스에 대한 산업계의 요구가 증가하고 있음을 입증합니다. 디지털 전환과 자동화 역시 IT 서비스 수요에 박차를 가하는 추세입니다.

- 많은 유명 SaaS 기업이 영국에 진출하여 시장이 확대되고 있으며, SaaS의 성장은 주로 인공지능과 머신러닝의 채택과 같은 기술 발전에 힘입어 성장하고 있습니다. 영국의 SaaS 시장은 아직 성숙 단계에 있으며, 투자자들에게 IT 솔루션에 대한 광범위한 투자 기회를 제공합니다. 예를 들어 아마존웹서비스(Amazon Web Services)는 2022년 3월, 자사 퍼블릭 클라우드 서비스에 대한 수요가 지속적으로 증가함에 따라 향후 2년간 영국 데이터센터 전반에 걸쳐 18억 파운드(22억 달러) 이상을 투자할 계획이라고 발표했습니다. 그 동안 AWS는 영국에서 금융, 의료, 제약 서비스 산업의 민간 기업 및 중앙 부처와 다수의 수익성 있고 주목받는 거래를 체결한 바 있습니다.

- 또한 시장에서는 다양한 합병, 제휴, 인수합병이 이루어지고 있습니다. 예를 들어 2022년 10월, 양자 안전 암호화 프로바이더인 Arqit Quantum Inc.는 주로 영국 규제 산업을 위한 사이버 보안 솔루션 프로바이더인 Nine23 Ltd.와 Arqit의 QuantumCloud를 배포하기 위한 계약을 체결했습니다. 계약을 체결하였습니다. 이는 주로 Nine23의 영국 소버린 시큐어 프라이빗 클라우드 기반인 Platform FLEX의 공통키 합의 소프트웨어로, Nine23의 고객 및 고객에게 최고 수준의 보증을 제공합니다.

- 그러나 다양한 데이터 보안 관련 문제와 데이터 유출 위험 증가는 예측 기간 중 전체 시장 성장을 저해하는 주요 요인으로 작용할 수 있습니다.

- COVID-19가 유행하는 동안 일부 기업에서 일하는 방식이 원격 근무 시나리오로 전환되어 클라우드 컴퓨팅 서비스에 대한 수요가 증가했으며, 그 결과 IT 기업은 직원의 집에 컴퓨터를 배송하고 Wi-Fi 어댑터, 전원 백업 소스, 광대역 접속을 갖추도록 했습니다. 가상사설망의 대역폭이 확장되고, 동시 접속하는 원격 사용자 증가를 수용하기 위해 백엔드 용량이 증가했습니다. 클라우드 기반 원격 액세스 솔루션 덕분에 가상 작업이 가능해졌습니다. 이처럼 팬데믹 초기에는 어려움을 겪었던 시장이었지만, 점차 서비스에 대한 수요가 증가하면서 IT 서비스에 긍정적인 영향을 미치고 있습니다.

영국 IT 서비스 시장 동향

니어쇼어링 IT 아웃소싱과 SaaS(Software-as-a-Service) 산업의 성장이 영국 IT 서비스 시장을 주도

- 국내 아웃소싱은 해당 국가의 기업이 자국내 업체에 서비스를 아웃소싱하는 것을 선호하는 방식입니다. 근접성, 언어, 문화적 공통성, 적은 시차 등의 이유로 해외에 아웃소싱하는 근해 공급업체를 주로 선호합니다. 예를 들어 영국에 본사를 둔 인피니티 그룹(Infinity Group)은 영국 전역의 1,000개 이상의 기업에 IT 지원 아웃소싱을 제공하는 선도적인 IT 아웃소싱 기업 중 하나입니다. 이 회사는 급성장하는 스타트업과 중소기업부터 오래된 대기업에 이르기까지 다양한 고객들과 거래하고 있습니다.

- 근해 IT 서비스의 주요 기술 동향으로는 5G 기술 채택 증가, IT 자동화, 컨테이너 기술, 서버리스 컴퓨팅, 가상 데스크톱 인프라 등을 꼽을 수 있습니다. 향후 수년간 5G는 디지털 경제와 사회 전반의 성장에 필수적인 요소가 될 것이며, 5G 기술은 맞춤형 의료에서 정밀농업, 스마트 에너지 그리드에서 커넥티드 모빌리티에 이르기까지 영국인의 삶의 거의 모든 부문에 영향을 미칠 수 있는 잠재력을 가지고 있습니다. 영향을 미칠 수 있습니다.

- 또한 유럽연합(EU)의 미래 5G 네트워크의 보안을 확보하는 것이 중요하므로 주요 기업은 5G 서비스의 국내 아웃소싱을 우선순위에 두고 있습니다. 예를 들어 2022년 5월 발트해 연안 국가의 통신 및 미디어 그룹인 에릭슨은 영국 시장에 5G 기술을 도입하기 위한 기본 계약을 체결했습니다. 이 계약은 가장 인구 밀도가 높은 도시와 지역에 5G 네트워크 커버리지를 제공하고 미디어 엔터테인먼트, 게임, 클라우드, 데이터센터 및 사물인터넷 분야의 고객 서비스를 확대할 계획입니다.

- 영국은행은 향후 10년간 은행 워크로드의 40-90%가 퍼블릭 클라우드 또는 SaaS에서 호스팅될 것으로 예상하고 있습니다. 공급업체 중 한 곳의 장애가 발생했을 때 비즈니스 연속성에 미치는 영향을 고려하는 것은 매우 중요합니다. 따라서 영국은행, 금융행위감시기구(FCA), 프루덴셜규제청(PRA)을 비롯한 영국 및 전 세계 금융당국은 이러한 추세를 예의주시하고 있습니다. 이로 인해 영국 IT 서비스 시장에는 몇 가지 성장 기회가 생길 것으로 보입니다.

- 2020-2025년 사이 영국에서 SaaS(Software-as-a-Service) 산업이 크게 성장할 것으로 추정됩니다. 또한 이 시장은 2025년 75억 유로에서 145억 유로로 급성장할 것으로 예상됩니다. 이러한 전체 SaaS 부문의 점유율 증가는 예측 기간 중 시장이 크게 성장할 수 있는 충분한 기회를 제공할 것으로 보입니다.

BFSI 부문의 디지털화가 영국 IT 서비스 시장의 성장을 주도

- 풍부한 인재와 높은 서비스 품질을 자랑하는 영국은 가장 매력적인 IT 아웃소싱 국가 중 하나입니다. 영국의 핀테크 투자는 전반적으로 크게 증가하고 있습니다. 이들 핀테크 기업은 디지털 뱅킹, 송금, 개인 재무 관리, 리스크 및 컴플라이언스 관리, P2P 대출 및 기타 다양한 용도 등 다양한 핀테크 솔루션을 설계하는 데 필요한 전문 지식과 경험을 보유하고 있습니다.

- 예를 들어 2022년 6월, 온라인 뱅킹 계좌 확인 서비스를 제공하는 유럽 플랫폼인 SurePay는 영국의 Virgin Money와 제휴하여 영국에서 수취인 확인 솔루션을 출시했습니다.

- 또한 BaaS(Banking-as-a-Service)는 오픈 뱅킹의 핵심 요소입니다. 이는 은행이 시스템을 공개하고 제3자가 실시간으로 데이터에 접근할 수 있도록 함으로써 서비스를 개선하는 것입니다. 국내 BaaS 비즈니스는 소매금융의 비즈니스 모델을 파괴하고 기존 기업의 고객 관계를 변화시키며 핀테크 기업의 영국 시장 진입을 용이하게 하고 있습니다. 규제 구상이 전 세계로 확산되는 가운데, 영국은 오픈 뱅킹 산업을 선도하며 영국 IT 서비스 시장을 주도하고 있습니다. 예를 들어 영국에 기반을 둔 SaaS/PaaS 사업자인 11:FS캐스팅은 주로 민첩성과 확장성 중 하나를 선택하지 않아도 되는 기본적인 뱅킹 기능을 제공하는 플랫폼에 주력하고 있습니다.

- 또한 Bankable은 런던에 본사를 둔 회사로, 전통 금융기관 및 기타 기업이 혁신적인 결제 수단을 쉽게 출시할 수 있도록 돕는 것을 목표로 하고 있습니다. 가상 원장 관리, 디지털 뱅킹, 결제 카드 프로그램, 전자지갑 등은 뱅커블이 제공하는 주요 BaaS 중 하나입니다. Bankable의 엔드투엔드 결제 서비스는 PCI-DSS(Payment Card Industry-Data Security Standard) 인증을 받았으며, 보안을 강화하기 위해 Tier 4 데이터센터에서 호스팅되는 독자적인 상호 운용 가능한 플랫폼을 통해 접근할 수 있습니다. 또한 혁신적인 금융 서비스를 개발할 때 발생하는 기술적, 규제적 장애물을 극복할 수 있도록 파트너를 지원하는 중요한 역할을 담당하고 있습니다.

- 또한 여러 주요 세계 다국적 기업이 영국에 기반을 둔 핀테크 기업 인수에 열을 올리고 있습니다. 예를 들어 2022년 3월 애플은 런던에 본사를 둔 핀테크 기업 크레딧 쿠도스(Credit Kudos)를 인수했는데, 크레딧 쿠도스는 오픈 뱅킹을 활용하여 기업의 수용성과 위험 평가를 개선하는 소프트웨어 스타트업입니다. 금융기관들은 주로 이 소프트웨어를 활용해 대출을 더 빨리 승인하고, 의사결정의 정확성을 높이며, 고객 서비스를 개선하는 데 활용하고 있습니다.

- 영국은행에 따르면 영국에서 영업 중인 금융기관의 총 수는 약 377개이며, 그 중 130개는 영국에 본사를 둔 금융기관입니다. 금융기관(MFI)은 주로 영국에서 예금을 받을 수 있는 허가를 받은 모든 빌딩소사이어티와 은행을 포함합니다. 따라서 국내 금융기관(MFI) 증가에 따라 다양한 IT 서비스에 대한 전반적인 수요, 특히 은행 산업의 다양한 IT 서비스에 대한 전반적인 수요가 크게 증가하여 전체 시장의 성장을 크게 촉진할 것입니다.

영국 IT 서비스 산업 개요

영국의 IT 서비스 시장은 경쟁이 매우 치열하고 경쟁업체가 거의 없습니다. 일부 주요 기업이 시장의 주요 점유율을 차지하고 있습니다. 또한 경쟁사보다 우위를 점하기 위해 다양한 M&A와 제품 혁신 등이 이루어지고 있습니다.

- 2024년 7월: 영국 정부는 발표를 통해 과학기술 혁신부(DSIT)를 강화할 계획을 밝혔습니다. DSIT는 정부 디지털 서비스(GDS), AI 인큐베이터(iAI), 중앙 디지털 및 데이터 오피스(CDDO) 등 주요 조직을 산하로 임베디드하여 그 범위와 규모를 확대할 것이라고 발표했습니다.

- 2024년 4월: 마이크로소프트는 코파일럿(Copilot)을 포함한 소비자 AI 제품 및 연구를 촉진하기 위한 새로운 조직인 마이크로소프트 AI(Microsoft AI)의 설립을 발표했으며, 런던 중심부에 새로운 AI 허브를 개설했습니다. Microsoft AI London은 Microsoft의 AI 팀과 OpenAI를 포함한 파트너들과 긴밀히 협력하여 언어 모델과 이를 지원하는 인프라를 발전시키고 기본 모델을 위한 툴링을 만드는 선구적인 작업을 추진하기 위해 설립되었습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 영국에서 디지털 전환

- 영국에서 니어쇼어 링 IT 아웃소싱의 성장

- 시장 성장 억제요인

- 데이터 보안과 침해 리스크

- 밸류체인/공급망 분석

- Porter's Five Forces 분석

- 신규 진출업체의 위협

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

- 거시경제 요인이 시장에 미치는 영향

제5장 시장 세분화

- 유형별

- IT 아웃소싱

- IT 컨설팅 & 임플리멘테이션

- 비즈니스 프로세스

- 최종사용자별

- IT·통신

- 정부기관

- BFSI

- 에너지·유틸리티

- 소비재·소매

- 기타

제6장 경쟁 구도

- 기업 개요

- Atos Consulting

- Accenture PLC

- BearingPoint

- Infosys

- Wipro

- TCS

- Capgemini

- IBM Corporation

- HCL

제7장 투자 분석

제8장 시장의 미래

KSA 25.01.31The United Kingdom IT Services Market size is estimated at USD 112.50 billion in 2025, and is expected to reach USD 156.61 billion by 2030, at a CAGR of 6.84% during the forecast period (2025-2030).

The increasing use of internet applications and services, as well as the growing availability of wireless devices such as smartphones, other smart gadgets, and associated apps, are significantly driving the growth of the UK IT services market.

Key Highlights

- Significant investments in various IT solutions in the United Kingdom have been made, with the overall adoption of software-as-a-service (SaaS) and increased cloud-based products demonstrating the rising industrial requirements for IT services. Digital transformation and automation are also trending in the country, fueling the demand for IT services.

- Many prominent SaaS companies have ventured into the United Kingdom, where the market is expanding. SaaS growth is mainly fueled by technological advancements, such as the adoption of artificial intelligence and machine learning. The country's SaaS market is still maturing, offering investors a broad scope of opportunities to invest in IT solutions. For example, in March 2022, Amazon Web Services announced plans to invest more than GBP 1.8 billion (USD 2.2 billion) over the next two years in building out its overall UK data center presence as the demand for its public cloud services continues to increase significantly. During the intervening years, its presence in the United Kingdom has allowed AWS to secure many lucrative and high-profile deals with private sector organizations and central government departments in the financial, healthcare, and pharmaceutical services industries.

- Moreover, the market is witnessing various mergers, partnerships, and acquisitions. For instance, in October 2022, Arqit Quantum Inc., a provider of quantum-safe encryption, signed a contract with Nine23 Ltd, a cyber security solutions provider primarily for the UK-compliant and regulated industries, to deploy Arqit's QuantumCloud. It is mainly a symmetric key agreement software on Nine23's UK Sovereign Secure Private Cloud infrastructure, Platform FLEX, to deliver the highest level of assurance for its clients and customers.

- However, the rise in various data security-related issues and data breaching risks in the country could be a significant factor, restricting the overall market's growth throughout the forecast period.

- Working techniques of several companies transitioned to remote working scenarios during the COVID-19 pandemic, resulting in an increased demand for cloud computing services. IT companies shipped computers to employees' homes and had them equipped with Wi-Fi adapters, power backup sources, and broadband connections. The virtual private network bandwidth was increased, and backend capacity was increased to meet the increased number of concurrently connected remote users. Virtual working was made possible because of cloud-based remote access solutions. Thus, the market initially faced challenges during the pandemic, but gradually, it had a good impact on IT services because of the increasing need for service.

United Kingdom IT Services Market Trends

Growth in Nearshoring IT Outsourcing and the SaaS (Software-as-a-Service) Industry Driving the UK IT Services Market

- Domestic outsourcing is a technique in which a country's corporations prefer to outsource services to vendors within their own country. They primarily favor nearshore providers outsourcing overseas because of proximity, language, cultural commonalities, and minor time differences. For example, Infinity Group, a UK-based company, is one of the industry's leading IT outsourcing organizations, providing outsourced IT support to over 1,000 businesses across the United Kingdom. The company works with many kinds of clients, ranging from fast-growing start-ups and SMEs to well-established larger corporations.

- Some key technology trends for nearshore IT services include a rise in the adoption of 5G technology, IT automation, container technology, serverless computing, and virtual desktop infrastructure. Over the coming years, 5G will be critical to the growth of the overall digital economy and society. 5G technology has the full potential to impact practically every area of UK residents' lives, from personalized medicine to precision agriculture and smart energy grids to connected mobility.

- Moreover, the key corporates of the country are prioritizing domestic outsourcing of 5G services because it is critical to ensure the security of the European Union's future 5G networks. For example, in May 2022, Baltic telecommunications and media group Ericsson signed a framework agreement to introduce 5G technology in the UK market. The deal would provide 5G network coverage in the most densely populated cities and districts, with plans to expand customer services in media entertainment and gaming, cloud, data centers, and the Internet of Things.

- The Bank of England estimates that 40-90% of bank workloads will be hosted on the public cloud or software-as-a-service in the coming ten years. It is crucial to examine the impact on business continuity if one of the suppliers fails. Hence, the financial authorities in the United Kingdom and worldwide, notably the Bank of England, the Financial Conduct Authority (FCA), and the Prudential Regulation Authority (PRA), are keeping a close eye on this. This will create several growth opportunities for the UK IT services market.

- Between 2020 and 2025, the SaaS (software-as-a-service) industry is estimated to grow significantly in the United Kingdom. Moreover, the market is anticipated to experience a drastic increase, from EUR 7500 million to EUR 14,500 million in 2025. This rise in the overall share of the SaaS segment will create ample opportunities for the market to grow extensively throughout the forecast period.

Digitalization in the BFSI Segment Driving the Growth of the UK IT Services Market

- With a significant talent pool and high-service quality offerings, the United Kingdom is one of the most appealing IT outsourcing destinations. The overall fintech investments in the country are rising significantly. These fintech companies have the requisite domain expertise and experience in designing various fintech solutions like digital banking, money transfers, personal financial management, risk and compliance management, peer-to-peer lending, and various other applications.

- For instance, in June 2022, SurePay, a European platform that provides online banking account verification services, teamed up with Virgin Money in the United Kingdom to launch its UK Confirmation of Payee solution.

- Moreover, banking-as-a-service (BaaS) is a crucial component of open banking. It involves banks opening their systems and allowing third parties to access their data in real time to improve their services. BaaS businesses within the country are disrupting retail banking business models, altering incumbents' client relationships, and making it easier for fintech companies to enter the UK market. With regulatory initiatives echoing worldwide, the United Kingdom is leading the open banking industry, driving the UK IT services market. For instance, 11:FS Foundry, a UK-based SaaS/PaaS business, is working on a platform to provide fundamental banking features that mainly eliminate the need to choose between agility and scalability.

- In addition, Bankable is a London-based firm aiming to make it easier for traditional financial institutions and other businesses to launch innovative payment options. A virtual ledger manager, digital banking, payment card programs, and e-wallets are among the company's key BaaS offerings. Its end-to-end payment services are accessible through a unique interoperable platform that is PCI-DSS (payment card industry - data security standards) certified and hosted in tier-4 data centers for increased security. Bankable also plays a significant role in assisting its partners in overcoming the technological and regulatory obstacles that arise while creating innovative financial services.

- Moreover, various key global MNCs are well-indulged in acquiring UK-based fintech companies. For instance, in March 2022, Apple purchased Credit Kudos, a fintech firm based in London. Credit Kudos is a software start-up that helps businesses improve their affordability and risk assessments by utilizing open banking. Lenders mainly use the software to expedite underwriting, increase decision-making accuracy, and improve customer service.

- As per the Bank of England, there is a total count of around 377 monetary financial credit institutions operating in the United Kingdom, 130 of which are UK-headquartered. Monetary financial institutions (MFI) primarily include all the building societies and the banks that have permission to accept deposits in the United Kingdom. Hence, with the rise in the number of monetary financial institutions (MFI) within the country, the overall demand for various IT services, especially in the banking industry, will rise significantly, expediting the overall market's growth exponentially.

United Kingdom IT Services Industry Overview

The UK IT services market is extremely competitive, with only a few significant competitors. Some of the key players hold a major share of the market. Moreover, the variables are involved in various mergers and acquisitions and product innovation, among others, to gain a competitive edge over others.

- July 2024: The UK government, in an announcement, revealed plans to bolster the Department for Science, Innovation, and Technology (DSIT). The department announced aims to broaden its scope and scale by incorporating key entities like the Government Digital Service (GDS), the AI Incubator (iAI), and the Central Digital and Data Office (CDDO) under its purview.

- April 2024: Microsoft announced the creation of Microsoft AI, a newly formed organization aimed at advancing its consumer AI products and research, including Copilot. Microsoft AI further opened a new AI hub in the heart of London. Microsoft AI London was established to drive pioneering work to advance language models and their supporting infrastructure and to create tooling for foundation models, collaborating closely with Microsoft's AI teams and partners, including OpenAI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Transformation in the United Kingdom

- 4.2.2 Growth in Nearshoring IT Outsourcing in the United Kingdom

- 4.3 Market Restraints

- 4.3.1 Data Security and Breaching Risks

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 IT Outsourcing

- 5.1.2 IT Consulting & Implementation

- 5.1.3 Business Process

- 5.2 By End User

- 5.2.1 IT and Telecommunication

- 5.2.2 Government

- 5.2.3 BFSI

- 5.2.4 Energy & Utilities

- 5.2.5 Consumer Goods & Retail

- 5.2.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Atos Consulting

- 6.1.2 Accenture PLC

- 6.1.3 BearingPoint

- 6.1.4 Infosys

- 6.1.5 Wipro

- 6.1.6 TCS

- 6.1.7 Capgemini

- 6.1.8 IBM Corporation

- 6.1.9 HCL