|

시장보고서

상품코드

1632097

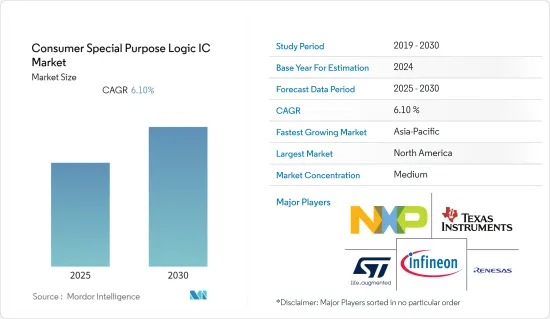

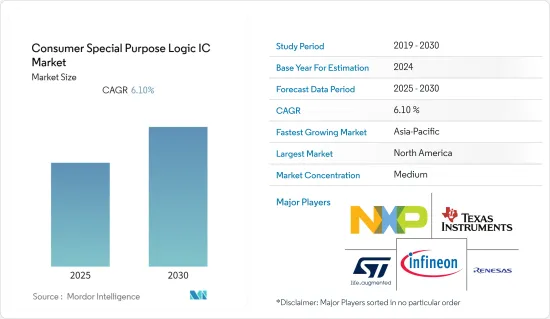

소비자용 특수 용도 로직 IC : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Consumer Special Purpose Logic IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

소비자용 특수 용도 로직 IC 시장은 예측 기간 중 CAGR 6.1%를 기록할 전망

주요 하이라이트

- 저가 스마트폰 수요와 인터넷의 보급으로 세계 특수용 로직 IC 시장 견인 세계 특수용 로직 IC 시장은 비전자 산업에서 로직 IC의 사용이 증가함에 따라 성장하고 있으며, Audi 및 Toyota와 같은 주요 자동차 회사들은 자동차에 내장된 자동차에 내장된 전자장비의 요구와 제공을 추진하고 있으며, 이는 세계 특수용 로직 IC 시장을 촉진하고 있습니다.

- 경제산업성에 따르면 2021년 일본에서 생산되는 로직 집적회로(IC) 규모는 약 1,305억 엔으로 추산됩니다. 금속산화막 반도체 집적회로(로직 IC)는 금속산화막 반도체 집적회로(MOS IC)의 일종입니다. 이 카테고리에는 로직 IC 외에도 마이크로컴퓨터, 메모리 IC, 기타 MOS IC도 포함됩니다. 이러한 방대한 생산량은 특수용 로직 IC의 성장 기회를 창출할 것으로 보입니다.

- GSMA에 따르면 GCC 국가의 5G 이용률은 2025년까지 세계 평균(15%)보다 약간 높은 수준(고객 5G 도입률 16%)을 기록할 것으로 예상됩니다. 또한 중동 및 북아프리카의 5G 계약 건수는 1억 2,962만 건에 달할 것으로 예상되며, 5G의 보급에 따라 민수용 특수목적용 IC에 대한 수요도 크게 증가할 것으로 예상됩니다.

- COVID-19 팬데믹과 재택근무 시나리오는 전 세계 소비자 전자제품 시장의 특정 부문에 대한 수요를 증가시키고 있습니다. 다양한 세계 시장에서 PC와 노트북에 대한 수요가 크게 증가했습니다. 또한 게임기 및 장비와 피트니스용 CE(Consumer Electronics)제품은 팬데믹 기간 중 기록적인 판매량을 기록했습니다. 예를 들어 2020년 노트북의 ASP가 하락했지만 이는 소비자 교육용 PC에 대한 세계 수요 증가의 결과이며, 모든 주요 사용 범주에서 PC 사용 시간이 크게 증가했으며 가구당 PC 대수도 증가했습니다.

- 한편, 반도체 공장에서는 완제품의 수율을 최적화하기 위해 시설내 분위기를 유지하고 웨이퍼를 운반하는 데 사용되는 FOUP(Front Opening Unified Pod)라고 불리는 전용 밀폐형 상자 안에 다량의 액체 질소가 필요합니다. 또한 IC 기판은 얇고, 특히 0.2mm 이하 두께의 기판은 돌출될 경우 변형이 발생하기 쉽습니다. 이러한 난제를 극복하기 위해서는 기판 수축, 적층 파라미터, 레이어 포지셔닝 시스템 등의 측면에서 기판 뒤틀림과 적층 두께를 제어할 수 있는 획기적인 진전을 이루어야 합니다.

민수용 특수용 로직 IC 시장 동향

기술의 급속한 발전이 시장 성장을 촉진할 것으로 예상

- AR과 VR의 급속한 보급은 게임 산업을 변화시키고 XR 시장에 더 많은 기회를 창출하고 있습니다. 여러 기업이 시장 주도권을 잡기 위해 제품 및 솔루션 개발에 박차를 가하고 있습니다. 예를 들어 최근 Oculus Quest VR 헤드셋은 손 추적 기능을 추가하여 VR 시스템을 개선하여 VR 사용자가 손가락으로 VR 세계를 조작할 수 있도록 했습니다.

- 게임, TV, 전자기기, 키오스크 단말기, 의료, 3D 모델링, 엔지니어링, 의료 전문가, 디자이너, 광고주, 심지어 신체적 제약이 있는 사람들도 제스처 기반 컴퓨팅을 채택하고 있습니다. 제스처 기반 게임은 표준 게임기를 넘어 청소년을 위한 교육용 게임에서도 활용도가 높아지고 있습니다. 예를 들어 '매직 터치 산수'는 독특한 제스처 그림으로 산수를 가르치는 데 초점을 맞춘 최초의 게임입니다. 그 결과, 제스처 기반 인식은 기존 게임 외의 분야에도 적용되고 있습니다.

- Snapchat의 보고서에 따르면 2025년까지 전 세계 인구의 약 75%, 거의 모든 스마트폰 사용자가 AR 기술을 자주 사용하게 될 것으로 예상되며 그중 15억 명 이상이 밀레니엄 세대가 될 것으로 예상됩니다. GSMA의 Mobile Economy China 2021에 따르면 중국에서는 2025년까지 약 3억 4,000만 대의 스마트폰 연결이 증가할 것이며, 보급률은 중국 본토에서 15억 대, 홍콩에서 1,230만 대, 마카오에서 190만 대, 대만에서 2,570만 대 등 10개의 연결 중 9개의 연결이 증가할 것으로 예상했습니다.

- 또한 소니에 따르면 2021년 6월 플레이스테이션4의 전 세계 판매량은 1억 1,568만 대에 달했습니다. 플레이스테이션2는 북미와 유럽에서 5,000만 대를 돌파하는 등 전 세계에서 1억 5,768만 대를 판매해 세계에서 가장 인기 있는 게임기로 자리매김했습니다.

- OLED 기술은 화질을 크게 향상시키고 혁신적인 새로운 소비자 디스플레이의 잠재력을 가진 기술입니다. OLED는 종종 디지털 디스플레이와 스크린의 미래형이라는 찬사를 받고 있습니다. 예를 들어 2022년 4월 LG 비즈니스 솔루션즈는 달라스에 위치한 AVI-SPL 사무실에 여러 개의 곡선형 OLED 디스플레이로 고해상도 표면을 형성하는 비디오 '웨이브월'을 출시하고 설치했습니다. 이 비디오월에는 65인치 LG 인터랙티브 디지털 사이니지 보드가 설치되어 길 안내 정보를 제공합니다. 끊임없는 기술 발전과 가전제품의 보급이 결합하여 조사 대상 시장의 성장을 가속할 가능성이 높습니다.

- 경제협력개발기구(OECD)의 조사에 따르면 2025년까지 컴퓨터를 보유한 가구 수는 12억 6,247만 가구로 증가할 것으로 예상됩니다. 컴퓨터를 1대 이상 보유한 가구를 컴퓨터 가구라고 합니다. 이러한 컴퓨터 보급의 대폭적인 증가는 시장 진출기업에게 표준 로직 IC 제품 포트폴리오를 확장하고 다양한 지역에서 입지를 확대하며 시장 점유율을 확대할 수 있는 좋은 기회가 될 것입니다.

아시아태평양은 높은 시장 성장 전망

- 중국 국가통계국에 따르면 2022년 4월 중국에서는 약 3,266만 대의 완제품 컴퓨터가 생산되었습니다. 또한 인도 전자정보기술부에 따르면 인도의 컴퓨터 하드웨어 생산액은 2020 회계연도에 약 2,150억 루피였으며 2021년에는 2,200억 루피로 증가할 것으로 예상됩니다. 컴퓨터 생산에 대한 이러한 막대한 지출은 현지 컴퓨터 제조업체와 소비자 대상 특수용 로직 IC 제조업체에게 제품 포트폴리오를 확장할 수 있는 기회를 창출할 것으로 보입니다.

- 2013년 이후 인도와 같은 신흥 국가에서는 데이터 통신 비용이 하락하고 있습니다. ASSOCHAM에 따르면 인도의 스마트폰 사용자 수는 2017년 약 4억 6,800만 명에서 2022년 8억 5,900만 명으로 두 배로 증가하여 연평균 12.9%의 성장률을 나타낼 것으로 예상됩니다.

- 또한 2021년 5월 현재 구글은 저렴한 스마트폰을 만들기 위한 노력에 대해 파트너인 Reliance Jio와 긴밀히 협력하고 있으며, 프로젝트 작업이 진행 중이라고 발표함. 앞서 구글은 2020년 3,373억 7,700만 루피에 Jio Platforms의 지분 7.7%를 인수했으며, Jio Platforms와 보급형 스마트폰 공동 개발을 위한 상업적 계약도 체결한 바 있습니다. 이러한 제품 개발은 연구 시장이 성장할 수 있는 기회를 창출하고, 각 회사 시장 점유율을 확대할 수 있는 기회를 제공합니다.

- 일본은 칩 공급을 확보하고 세계 공급 부족에 대응하기 위해 재정적 인센티브를 통해 해외 기업을 유치하는 것을 목표로 하고 있습니다. 일본은 해외에서 많은 반도체를 수입하고 있으며, 이 기술공급망을 국내에서 구축하고자 합니다. 예를 들어 2021년 6월 일본은 TSMC와 370억 엔 규모의 반도체 연구 프로젝트를 체결해 국내 칩 기술을 개발하기로 했습니다. 히타치 하이테크를 포함한 약 20개 일본 기업이 TSMC와 함께 이 프로젝트에 참여하며, 일본 정부가 비용의 절반 이상을 부담합니다.

- 또한 인도 정부가 반도체 및 디스플레이 제조를 위해 7,600억 루피 규모의 정책을 내놓은 것은 아시아 시장의 성장을 더욱 촉진할 것으로 예상됩니다. 인도 전자정보기술부(MeitY)는 2022년 1월부터 인도에 제조공장을 설립하려는 기업의 신청을 받기 시작했습니다. 아시아태평양의 반도체 제조 생태계 활성화는 연구 시장에 유리한 기회를 제공할 것으로 예상됩니다.

민수용 특수용 로직 IC 산업 개요

민수용 특수용 로직 IC 시장은 Qualcomm Inc., NXP Semiconductors NV, Texas Instruments Inc., Infenion Technologies 등 주요 기업이 존재하는 비교적 세분화된 시장입니다. 제품 혁신, 제휴, 인수합병은 시장 진출기업이 자주 사용하는 방법 중 일부입니다. 또한 IC 제조 공정이 발전하고 다양한 용도를 지원할 수 있게 됨에 따라 새로운 시장 진출기업이 시장 입지를 확장하고 신흥 국가에서 발자취를 넓혀가고 있습니다.

- 2022년 2월 - 새로운 지정학적 기술 역학이 세계 반도체 사업을 변화시키고 있는 가운데 독일과 일본의 반도체 재료 제조업체들이 대만에서 입지를 강화하고 있습니다. Industrial Technology Research Institute(ITRI)의 컨설팅 디렉터에 따르면 대만 반도체 제조 회사(TSMC)가 새로운 기술을 계속 도입함에 따라 일본과 독일 공장은 산업 경쟁력을 높이기 위해 TSMC와의 제휴를 모색하고 있습니다. 찾고 있다고 합니다.

- 2021년 12월-Samsung Electronics는 2017년 이후 대대적인 조직개편을 통해 모바일과 소비자가전 부문을 통합하고 새로운 공동 CEO를 선임하여 조직 슬림화와 로직 칩 사업 확대에 주력할 것임을 발표하였습니다. 모바일 산업의 영업이익은 3조 3,600억 엔(28억 4,000만 달러)인 반면, CE(Consumer Electronics) 산업은 7,600억 엔이었습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 기술 스냅숏

- 밸류체인 분석

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- Bluetooth, Wi-Fi, NFC 등 통신기술의 진보

- 스마트폰 및 노트북의 보급 확대

- 반도체의 소형화

- 시장 성장 억제요인

- 용도의 증가에 수반하는 설계의 복잡화

- 제품의 끊임없는 진화가 수요에 영향

- 시장 기회

- 사물인터넷과 인공지능의 진보

제6장 시장 세분화

- 지역별 세분화

- 중국

- 일본

- 대만

- 인도

- 기타

제7장 경쟁 구도

- 기업 개요

- Qualcomm Inc.

- NXP Semiconductors NV

- Texas Instruments Inc.

- Microchip Technology Inc.

- Infenion Technologies Ag

- Broadcom Inc.

- STMicroelectronics NV

- Toshiba Corporation

- Renesas Electronics

- Marvell Semiconductor, Inc.

- Intel Corporation

제8장 투자 분석

제9장 향후 전망

KSA 25.01.31The Consumer Special Purpose Logic IC Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- Furthermore, demand for low-cost smartphones, combined with increasing Internet penetration, propels the worldwide special purpose logic IC market forward. The global special purpose logic IC market is growing due to the increasing use of logic ICs in industries other than electronics. Leading automotive businesses like Audi and Toyota are progressively requesting and offering electronic devices incorporated into their vehicles, driving the worldwide special purpose logic IC market forward.

- According to Ministry of Economy, Trade and Industry Japan, In 2021, the value of logic integrated circuits (ICs) produced in Japan was estimated to be around JPY 130.5 billion. Metal oxide semiconductor integrated circuits (Logic ICs) are a form of metal oxide semiconductor integrated circuit (MOS IC). This category also includes microcomputers, memory ICs, and miscellaneous MOS ICs, in addition to logic ICs. Such huge production value will create aopportunity for the Special purpose logic IC to grow.

- According to GSMA, the usage of 5G in GCC states will be slightly higher (16% customer 5G adoption) than the global average (15%) by 2025, mainly driven by governments and mobile operators with the support of mobile technology partners. Moreover, number of 5G subscriptions is expected to reach 129.62 million in Middle East and North African regions. With the increase in the adoption of 5g the demand for consumer special purpose IC will observe significant growth.

- The COVID-19 pandemic and work from home scenarios have also boosted the demand for certain segments in the consumer electronic market across the globe. In various global markets, demand for PCs and laptops witnessed a significant surge. Furthermore, gaming consoles & devices and fitness consumer devices witnessed record-break sales during the pandemic. For instance, in 2020, lower notebook ASPs were recorded, resulting from higher demand for consumer education PCs globally. Time spent on PCs has increased dramatically across all major usage categories, as well as the number of PCs per household.

- On the flip side, semiconductor fabs require vast amounts of liquid nitrogen to maintain the atmosphere within the facility and within specialisedsealed boxes known as front opening unified pods, or FOUPs, that are used to transport the wafers in order to assure optimal yield in the completed product. Further, IC substrate is thin and can easily be deformed, especially in protruding cases, when a board is less than 0.2mm thick. In order to overcome the difficulties, breakthroughs have to be made, in terms of board shrinking, lamination parameters, and layer positioning systems, in order to control substrate warpage and lamination thickness.

Consumer Special Purpose Logic IC Market Trends

Rapid Advancements in Technology is Expected to Drive the Market's Growth

- The rapid adoption of AR and VR is transforming the gaming industry, creating more opportunities for the XR market. Several companies are making rapid developments in their products and solutions to gain robust market traction. For instance, recently, the Oculus Quest VR headset improvised its VR system by adding a hand tracking feature, which may enable the VR users to use fingers to manipulate the VR worlds.

- Gaming, TVs, electronics, kiosks, medical, 3D sculpting, engineering, medical experts, designers, advertisers, and even those with physical limitations are all adopting gesture-based computing. Gesture-based gaming has grown in popularity beyond standard gaming consoles, and it is increasingly being used in instructional games for youngsters. Magic Touch Math, for example, is the first game to focus on teaching arithmetic with unique gesture drawings. As a result, gesture-based recognition can be employed in areas other than traditional gaming.

- According to a report from Snapchat, by 2025, around 75% of all the global population and almost all of the smartphone users will be frequent AR technology users, out of which more than 1.5 billion users are anticipated to be millennials. According to GSMA's Mobile Economy China 2021, China will be adding around 340 million smartphone connections by 2025, with adoption rising to 9 in 10 connections with 1.5 billion in Mainland China, 12.3 million in Hong Kong, 1.9 million in Macao, and 25.7 million in Taiwan.

- Further, according to Sony, PlayStation 4 consoles worldwide sales reached 115.68 million in June 2021. Moreover, PlayStation 2 had record sales of 157.68 million units worldwide, including over 50 million units in North America and Europe, making it the most popular video game console globally.

- OLED technology holds the promise of significantly enhanced picture quality, with the potential for innovative new consumer display presentations. It is often hailed as the future of digital displays and screens. For instance, in April 2022, LG Business Solutions has launched and installed a video "Wave Wall" with multiple curved OLED displays to form a high-definition surface at the AVI-SPL office in Dallas. The video wall features a 65-inch LG interactive digital signage board that provides wayfinding information. The continuous advancements in technology coupled with the increasing penetration of consumer electronics is likely to drive the growth of the studied market.

- According to a survey conducted by Organisation for Economic Co-operation and Development, by 2025, the number of households having a computer is expected to increase to 1,262.47 million. Homes with at least one computer are referred to as computer households. Such huge increase in the computer adoption will create aopportunity for the market players to expand their standard logic IC product portfolio and expand their presence in different regions and increase their market share.

The Asia Pacific Region is Expected to Witness a High Market Growth

- According to National Bureau of Statistics of China, China produced approximately 32.66 million completed computers in April 2022. Furthermore, according to Ministry of Electronics and Information Technology The value of computer hardware output in India was roughly INR 215 billion in fiscal year 2020. In fiscal year 2021, this is expected to rise to INR 220 billion . The value of computer hardware produced in the country has been steadily increasing.Such huge spending on the computer production will create an opportunity for the local computer and consumer special purpose logic IC manufacturers to expand their product portfolio.

- Emerging nations, such as India, have witnessed a decline in data costs since 2013. This has increased the number of smartphone users. According to ASSOCHAM, the number of smartphone users in the country is anticipated to double from around 468 million in 2017 to 859 million by 2022, registering a CAGR of 12.9%.

- Also, as of May 2021, Google announced that it is engaging closely with its partner Reliance Jio on the initiative of creating an affordable smartphone and the work is underway on the project. The company previously picked up a 7.7% stake in Jio Platforms for INR 33,737 crore in 2020 and had also entered into a commercial agreement with the Jio Platforms to jointly develop an entry-level, affordable smartphone. Product developments like these will create aopportunity for the studied market to grow and the enable the companies to expand their market share.

- Japan aims to attract overseas companies through financial incentives to secure its chip supplies and address the global shortage. Japan imports significant semiconductors from overseas and wants to build a supply chain of this technology at home. For instance, in June 2021, Japan signed off on a JPY 37-billion semiconductor research project to develop chip technology in the country with TSMC. About 20 Japanese companies, including Hitachi High-Tech Corp., will work with TSMC on the project, with the Japanese government paying just over half of the cost.

- Also, the move of the Indian government by announcing an INR 76,000 crore policy-push for semiconductor and display manufacturing is anticipated to further bolster the growth of the Asian market. The Ministry of Electronics and Information Technology (MeitY) in India started receiving applications from companies to set up manufacturing fabs in India from January 2022. The boost in semiconductor manufacturing ecosystem in the Asia Pacific region is expected to offer lucrative opportunities for the studied market.

Consumer Special Purpose Logic IC Industry Overview

The Consumer Special Purpose Logic IC Market is a moderately fragmented market with the presence of significant players like Qualcomm Inc., NXP Semiconductors NV, Texas Instruments Inc., Infenion Technologies, etc. Product innovation, collaborations, and acquisitions are some of the techniques frequently employed by market players. Further, as the IC manufacturing process advances, catering to numerous applications, new industry participants are extending their market presence and expanding their corporate footprint in emerging nations.

- February 2022 - As new geopolitical and technological dynamics alter the global semiconductor business, German and Japanese semiconductor material suppliers are continuing to strengthen their presence in Taiwan. According to the Consulting Director of the Industrial Technology Research Institute (ITRI), as Taiwan Semiconductor Manufacturing Company (TSMC) continues to implement new techniques, Japanese and German factories are seeking to collaborate with TSMC in order to improve their own competitive position in the industry.

- December 2021- Samsung Electronics Co Ltd announced the merger of its mobile and consumer electronics divisions and the appointment of new co-CEOs in its significant reorganization since 2017 to streamline its structure and focus on increasing its logic chip business. In the July-September quarter, the mobile industry had an operating profit of JPY 3.36 trillion (USD 2.84 billion), compared to JPY 760 billion in consumer electronics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Value Chain Analysis

- 4.5 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in communication technologies like Bluetooth, Wi-Fi, and NFC

- 5.1.2 Increasing penetration of smartphones and laptops

- 5.1.3 Miniaturization of Semiconductors

- 5.2 Market Restraints

- 5.2.1 Increasing Design Complexity with Increasing Applications

- 5.2.2 Constant Evolution of Products Influencing Demand

- 5.3 Market Opportunities

- 5.3.1 Advancements in Internet of Things and Artificial Intelligence

6 MARKET SEGMENTATION

- 6.1 Segmentation - By Geography

- 6.1.1 China

- 6.1.2 Japan

- 6.1.3 Taiwan

- 6.1.4 India

- 6.1.5 Rest of the world

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Inc.

- 7.1.2 NXP Semiconductors NV

- 7.1.3 Texas Instruments Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Infenion Technologies Ag

- 7.1.6 Broadcom Inc.

- 7.1.7 STMicroelectronics NV

- 7.1.8 Toshiba Corporation

- 7.1.9 Renesas Electronics

- 7.1.10 Marvell Semiconductor, Inc.

- 7.1.11 Intel Corporation