|

시장보고서

상품코드

1635442

프랑스의 용기용 유리 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)France Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

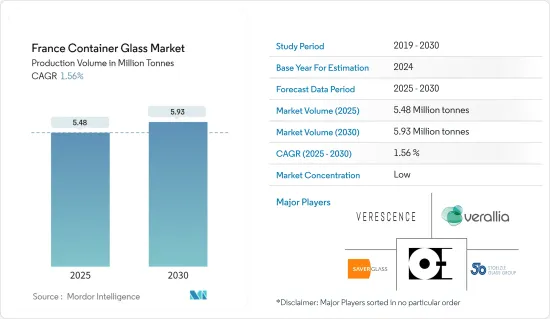

프랑스의 용기용 유리 시장 규모는 생산량 기반으로 2025년 548만 톤에서 2030년에는 593만 톤으로 확대하며, 예측 기간(2025-2030년)의 CAGR은 1.56%로 예측됩니다.

주요 하이라이트

- 음료 수요가 급증하고 화장품 산업이 계속 번창하면서 용기용 유리 시장은 확장의 기로에 서 있습니다.

- 유럽연합(EU)의 주요 음료 생산국인 프랑스는 다양한 환경으로 인해 토착 알코올 생산이 활발합니다. 여기에는 샴페인과 코냑과 같은 고급 주류도 포함되며, 주로 유리 용기에 담겨져 있습니다.

- 또한 맥주와 와인으로 대표되는 알코올성 음료의 소비 증가는 이 시장의 성장을 가속하고 있습니다. 유리는 음료의 화학 물질과 반응하지 않기 때문에 음료의 강도, 향기 및 풍미를 유지하여 선호하는 포장재로 자리 매김하고 있습니다. 주목할 만한 점은 맥주를 유리 용기에 담아 운반하는 추세는 앞으로도 계속될 것이라는 점입니다.

- 재활용과 지속가능성을 옹호하는 국가적 규제가 기업을 유리 포장으로 이끌고 있습니다. 플라스틱 폐기물을 방지하고 재활용을 촉진하기 위해 프랑스는 향후 2년 내에 유리 보증금 제도를 도입할 예정입니다. 이 제도는 슈퍼마켓에서 빈 유리 용기를 의무적으로 받아 들여야 하며, 이는 일회용 플라스틱을 근절하겠다는 정부의 야심찬 2040년 목표에 부합하는 것입니다.

- Owens-Illinois Glass Inc를 포함한 주요 기업은 프랑스 시장 상황을 적극적으로 형성하고 있습니다. 베지에, 지롱쿠르, 라베구드, 퓨이-기욤, 랭스 등 도시에 진출한 이 회사는 2024년 2월 프랑스에 위치한 두 개의 유리 포장 공장에 9,500만 유로( 1억 2,881만 달러)를 투자할 것이라고 발표했습니다.을 발표했습니다. 이번 투자는 지롱쿠르 쉬르 블랑과 랭스의 지속가능성, 유연성, 생산성을 강화하고 프랑스 용기용 유리 시장을 더욱 촉진하기 위한 광범위한 현대화 의제의 일환입니다.

- 그러나 용기용 유리 시장은 금속 및 생분해성 소재와 같은 대체 포장 솔루션의 문제에 직면해 있습니다. 가볍고 비용 효율적이며 다용도한 이러한 대안은 제조업체와 소비자 모두의 관심을 끌고 있습니다. 또한 유리 제조는 에너지 집약적인 공정으로 인해 에너지 가격 변동은 생산자의 수익성에 큰 영향을 미칩니다.

프랑스 용기용 유리 시장 동향

화장품 부문이 큰 성장을 이룰 것으로 예상

- 프랑스의 유리 용기 산업은 화장품, 퍼스널케어 제품 및 고급 향수 부문의 영향을 크게 받고 있습니다. 이들 분야는 재활용 및 포장에 유리 용기의 지속가능한 사용을 적극적으로 장려하고 있습니다.

- 연대를 보여주기 위해 프랑스 화장품 및 향수 부문은 유리 산업을 강화하기 위한 조치를 취했습니다. 뷰티 부문의 12개 회사로 구성된 그룹은 프랑스에서 공급업체를 우선적으로 채택할 것을 강조하는 선언문에 서명했습니다. 이 연합에는 Biologique Recherche, Chanel, Clarins, Coty, Guerlain, Hermes, Kenzo Parfums, Interparfums, L'Oreal, Parfums Christian Dior, Parfums Givenchy, Puig, Shiseido, Sisley, Sarbec, Sothys 등 미용기업연맹(FEBEA)에 가입한 미용시장의 주요 기업이 이름을 올렸습니다.

- 프랑스화장품수출연맹(Febea)의 데이터에 따르면 프랑스 화장품 수출이 크게 증가하여 2023년 수출액은 전년 대비 10.8% 증가한 213억 유로(230억 5,000만 달러)를 기록했습니다. 프랑스 화장품의 세계 매력은 여전히 강합니다. 이 산업은 현대 소비자 수요에 맞추어 지속가능성과 환경 보호에 중점을 두고 계속 진화하고 있습니다.

- 프랑스는 샤넬, 디올, 로레알과 같은 상징적인 브랜드가 국내외 시장 동향을 형성하는 데 매우 중요한 역할을 하는 뷰티와 럭셔리의 세계 허브인 프랑스는 Eurostat의 데이터에 따르면 2020년 프랑스 향수 및 화장품 도매 판매액은에 41억 2,175만 달러, 2024년에는 43억 1,025만 달러에 달할 것으로 예상됩니다.

- 소비자들이 자신의 피부 유형과 취향에 맞는 뷰티 제품을 찾게 되면서 시장에는 기술 혁신의 물결이 일고 있습니다. 브랜드는 친환경 포장과 윤리적으로 조달된 원료에 초점을 맞출 뿐만 아니라, 환경 친화적인 소비자의 공감을 얻어 브랜드 충성도를 높이고 있습니다.

성장하는 음료 산업이 시장 성장을 가속할 것으로 예상

- 프랑스에서는 알코올 음료, 특히 와인이 문화적인 직물에 깊게 짜여져 있습니다. 보르도, 샴페인 등 유명한 와인 산지는 단순한 지역적 위치가 아니라 국가의 정체성과 식문화 전통을 상징합니다. 프랑스는 와인의 주요 생산국이자 주요 소비국입니다.

- 소비자 물가지수(CPI)의 상승은 소비자들이 무알코올 음료에 점점 더 많은 가치를 부여하고 있으며, 더 비싼 대가를 지불할 의향이 있음을 보여줍니다. 이러한 음료를 유리병에 담아 포장하면 그 가치를 더욱 높일 수 있습니다. 유리는 고급 품질의 대명사이며 전체 제품의 외관을 더욱 돋보이게 하기 때문입니다. 프랑스 국립 통계 경제 연구소의 데이터에 따르면 무알코올 음료의 CPI는 2022년 말 114.32, 2023년 7월에는 123.39까지 상승할 것으로 예상됩니다.

- 프랑스는 음료 제조의 다각화를 추진하고 있으며, Eurostat의 보고서에 따르면 프랑스의 음료 제조 산업 매출은 2020년 240억 6,000만 달러, 2023년에는 300억 3,000만 달러에 달할 것으로 예상됩니다. 또한 절제와 건강 지향적인 소비자 행동의 변화가 두드러져 많은 사람들이 저알코올 또는 무알코올 옵션을 선택하게 되었습니다.

- 프랑스에서는 관광산업이 음료 수요를 크게 촉진하고 있습니다. 프랑스는 용기를 포함한 유리 포장 제품을 다양한 지역에 수출하고 있습니다. 데이터에 따르면 유리 제품 수출액은 2020년 7억 2,472만 7,000달러에서 2023년 9억 2,522만 5,000달러로 급증합니다.

- 또한 건강에 대한 관심이 높아짐에 따라 향이 나는 물, 과일 주스, 아이스 티, 허브 음료와 같은 무알코올 음료에 대한 수요가 증가하고 있습니다. 시장의 혁신 정신은 프로바이오틱스 함유와 같은 기능성 음료의 채택으로 분명하게 드러나고 있으며, 독특한 맛과 건강 지향적 성분에 대한 추세를 강조하고 있습니다.

프랑스 컨테이너용 유리산업 개요

프랑스 용기용 유리 시장은 세분화되어 있으며, 많은 지역 및 세계 기업이 진출해 있습니다. 이 시장에 진출한 기업은 시장 점유율과 수익성을 높이기 위해 전략적 협력 구상을 활용하고 있습니다. 또한 크고 작은 양조장들이 현지 양조장에서 생산되는 수제 맥주에 대한 선호도가 높아짐에 따라 유리 용기 제조업체들은 생산량을 조정해야 하며, 경우에 따라서는 식품 및 화장품과 같은 다른 성장 분야로 전환해야 하는 상황입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- PESTEL 분석

- 포장용 용기 유리의 산업 표준과 규제

- 용기용 유리의 수출 입데이터

- 포장용 유리의 원료 분석과 재료에 관한 고려

- 용기 포장의 지속가능성 동향

- 프랑스의 용기용 유리로 용량과 입지

제5장 시장 역학

- 시장 성장 촉진요인

- 주류 소비의 증가

- 지속가능성과 재활용 구상에 의한 브랜드의 유리 포장으로의 이동

- 시장 성장 억제요인

- 유리 제조 프로세스에서 높은 탄소발자국

- 유럽 용기용 유리 시장에서 프랑스의 현황 분석

- 무역 시나리오 - 프랑스의 용기용 유리 산업에서 수출입 패러다임의 역사와 현황 분석

제6장 시장 세분화

- 최종사용자 산업별

- 음료

- 주류

- 비알코올 음료

- 식품

- 화장품

- 의약품(바이알·앰플 제외)

- 기타 최종사용자 수직 시장

- 음료

제7장 경쟁 구도

- 기업 개요

- CANPACK France SAS

- O-I Glass, Inc.

- Ardagh Packaging Group PLC

- Verallia Packaging

- Gerresheimer AG

- Bormioli Pharma S.p.A

- Saver Glass Inc.

- Stoelzle Glass Group

- Verescence France

제8장 투자 분석

제9장 시장의 미래

KSA 25.01.31The France Container Glass Market size in terms of production volume is expected to grow from 5.48 million tonnes in 2025 to 5.93 million tonnes by 2030, at a CAGR of 1.56% during the forecast period (2025-2030).

Key Highlights

- As demand surges for beverages and the cosmetics industry continues to thrive, the container glass market stands on the brink of expansion.

- France, a leading beverage producer in the European Union, benefits from its diverse environment, fostering the creation of indigenous alcohols. This includes premium offerings like champagne and cognac, which are predominantly packaged in glass containers.

- Moreover, the rising consumption of alcoholic drinks, notably beer and wine, fuels this market's growth. Glass's non-reactive nature with drink chemicals ensures the preservation of strength, aroma, and flavor, solidifying its status as a preferred packaging choice. Notably, beer's transportation in glass containers is a trend set to persist.

- National regulations championing recycling and sustainability are steering companies towards glass packaging. In a bid to combat plastic waste and bolster recycling, France plans to introduce a glass deposit system in the next two years. This initiative mandates supermarkets to accept empty glass containers, aligning with the government's ambitious 2040 goal to eradicate single-use plastics.

- Major players, including Owens-Illinois Glass Inc, are actively shaping the market landscape in France. With operations spanning cities like Beziers, Gironcourt, Labegude, Puy-Guillaume, and Reims, the company is making significant strides. In February 2024, Owens-Illinois announced a substantial EUR 95 million (USD 102.81 million) investment across its two glass packaging facilities in France. These investments, part of a broader modernization agenda, aim to bolster sustainability, flexibility, and productivity in Gironcourt-sur-Vraine and Reims, further propelling the container glass market in the nation.

- However, the container glass market faces challenges from alternative packaging solutions like metals and biodegradable materials. These lighter, cost-effective, and versatile options have caught the attention of both manufacturers and consumers. Additionally, the energy-intensive process of glass manufacturing means that any fluctuations in energy prices can have a pronounced impact on producer profitability.

France Container Glass Market Trends

Cosmetics Segment is Expected to Witness Significant Growth

- The French container glass industry is significantly influenced by the cosmetics, personal care products, and luxury perfumes sectors. These sectors are actively promoting recycling and the sustained use of glass containers in their packaging practices.

- In a show of solidarity, the French cosmetics and perfume sector has taken steps to bolster the glass industry. A group of 12 companies from the beauty sector has collectively signed a declaration, underscoring their commitment to prioritize suppliers from France. This coalition features major players in the beauty market, all members of the Federation of Beauty Companies (FEBEA), including Biologique Recherche, Chanel, Clarins, Coty, Guerlain, Hermes, Kenzo Parfums, Interparfums, L'Oreal, Parfums Christian Dior, Parfums Givenchy, Puig, Shiseido, Sisley, Sarbec, and Sothys.

- According to data from the Federation des Entreprises de la beaute (Febea), French cosmetics exports have seen a significant rise. In 2023, these exports grew by 10.8% year-on-year, totaling an impressive EUR 21.3 billion (USD 23.05 billion). The global allure of French cosmetics remains strong. The industry is evolving, placing a premium on sustainability and environmental awareness, in tune with modern consumer demands.

- France, a global hub for beauty and luxury, boasts iconic brands like Chanel, Dior, and L'Oreal, which play a pivotal role in shaping both domestic and international market trends. Eurostat data indicates that the wholesale revenue for perfumes and cosmetics in France was USD 4,121.75 million in 2020, with projections to hit USD 4,310.25 million by 2024.

- As consumers increasingly demand beauty products tailored to their individual skin types and preferences, the market is witnessing a surge in innovation. Brands are not only focusing on eco-friendly packaging and ethically sourced ingredients but are also cultivating brand loyalty by resonating with environmentally-conscious consumers.

Growing Beverage Industry is Expected to Promote Market Growth

- In France, alcoholic beverages, particularly wine, are deeply woven into the cultural fabric. Esteemed wine regions, including Bordeaux and Champagne, are not just geographical locations but are emblematic of the nation's identity and its culinary heritage. France is both a leading producer and a prominent consumer of wine.

- The rising Consumer Price Index (CPI) indicates that consumers are increasingly valuing alcohol-free drinks, willing to pay a premium for them. Packaging these beverages in glass bottles can further elevate their perceived worth, as glass is synonymous with premium quality and enhances the product's overall presentation. Data from the National Institute of Statistics and Economic Studies France reveals that the CPI for alcohol-free drinks was 114.32 at the close of 2022, climbing to 123.39 by July 2023.

- France is also diversifying its beverage manufacturing. Eurostat reports that beverage manufacturing revenue in France was USD 24.06 billion in 2020, with projections to hit USD 30.03 billion by 2023. Additionally, there's a noticeable shift in consumer behavior towards moderation and health, leading many to choose low-alcohol or non-alcoholic options.

- Tourism significantly fuels the demand for beverages in France. The nation exports glass packaging products, including containers, to various regions. Data indicates that the export value for glass products surged from USD 724,727 thousand in 2020 to USD 925,225 thousand in 2023.

- Furthermore, with a growing emphasis on health and wellness, there's a rising demand for non-alcoholic beverages such as flavored waters, fruit juices, iced teas, and herbal drinks. The market's innovative spirit is evident with the introduction of functional beverages, like those infused with probiotics, highlighting a trend towards unique flavors and health-centric ingredients.

France Container Glass Industry Overview

The French container glass market is fragmented, with numerous regional and global players. Companies in the market are leveraging strategic collaborative initiatives to increase their market share and profitability. Additionally, the increasing preference for craft beer brewed locally by small and large breweries is forcing glass packaging manufacturers to adjust their production and, in some cases, switch to other growth areas, such as food and beverage and cosmetics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 PESTEL ANALYSIS

- 4.3 Industry Standards and Regulations for Container Glass Use for Packaging

- 4.4 Export Import Data for Container Glass

- 4.5 Raw Material Analysis & Material Considerations for Packaging

- 4.6 Sustainability Trends for Packaging

- 4.7 Container Glass Furnace Capacity and Location in France

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Alcoholic Beverages

- 5.1.2 Sustainability and Recyclability Initiatives Moving Brands to Glass Packaging

- 5.2 Market Restraint

- 5.2.1 High Carbon Footprint in The Glass Manufacturing Process

- 5.3 Analysis of the Current Positioning of France in the European Container Glass Market

- 5.4 Trade Scenario - Analysis of the Historical and Current Export-Import Paradigm for Container Glass Industry in France

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Beverage

- 6.1.1.1 Alcoholic Beverages

- 6.1.1.2 Non-Alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceuticals (Excluding Vials and Ampoules)

- 6.1.5 Other End-user verticals

- 6.1.1 Beverage

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CANPACK France SAS

- 7.1.2 O-I Glass, Inc.

- 7.1.3 Ardagh Packaging Group PLC

- 7.1.4 Verallia Packaging

- 7.1.5 Gerresheimer AG

- 7.1.6 Bormioli Pharma S.p.A

- 7.1.7 Saver Glass Inc.

- 7.1.8 Stoelzle Glass Group

- 7.1.9 Verescence France