|

시장보고서

상품코드

1635452

스페인의 용기용 유리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Spain Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

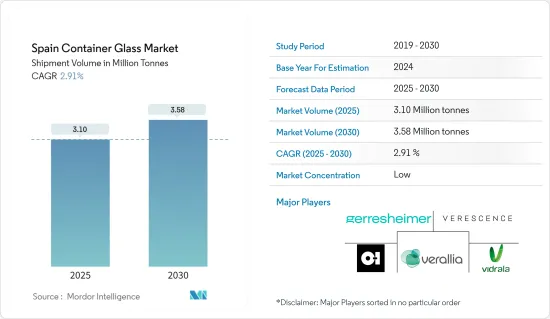

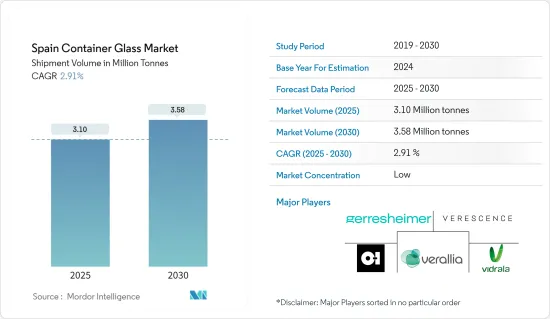

스페인의 용기용 유리 시장 규모(출하량 기준)는 예측 기간(2025-2030년) 동안 연평균 2.91%의 CAGR로 2025년 310만 톤에서 2030년 358만 톤으로 성장할 것으로 예상됩니다.

주요 하이라이트

- 포장 식품 및 음료 식품의 수요 증가에 힘입어 소다석회 실리카 유리의 수요가 급증하고 있으며, 특히 다양한 식품 원료의 보존용으로 수요가 급증하고 있습니다. 이러한 추세는 잼, 소스, 피클, 피클, 조리된 식품 등에서 두드러지게 나타나고 있으며, 유리 용기는 보존성뿐만 아니라 시각적 매력도 높이고 있습니다.

- 이 시장은 식품 가공 분야에서 고급 포장에 대한 열망이 높아지면서 빠르게 성장하고 있습니다. 유리 용기는 제품의 품질을 돋보이게 하고 선반에서 존재감을 높일 수 있기 때문에 점점 더 선호되고 있습니다.

- 플라스틱 오염에 대한 인식이 높아지고 지속가능한 대안을 찾는 목소리가 높아지면서 유리 포장으로의 전환이 가속화되고 있습니다. 이러한 변화는 환경 친화적이고 안전하며 건강한 포장에 대한 소비자의 요구로 인해 더욱 가속화되고 있습니다. 유리 성형, 엠보싱 및 장식 마감의 혁신은 유리 포장의 매력을 더욱 높여주고 있습니다. 이러한 발전은 독특한 디자인을 용이하게 할 뿐만 아니라 브랜딩의 기회를 제공하고 제품이 매장에서 주목을 받을 수 있도록 보장합니다.

- 또한, 친환경 제품에 대한 식음료 부문의 수요 증가, 특히 유리가 100% 재활용이 가능하고 품질 저하 없이 무한히 재사용할 수 있다는 점에서 시장 성장을 견인하고 있습니다.

- 국제무역센터에 따르면 스페인의 용기유리 수입(HS코드-701090)은 2022년 8억 8,886만 1,000달러에서 2023년 10억 7,089만 달러로 급증할 것으로 예상했습니다. 이러한 현저한 수입 증가는 식음료, 의약품, 화장품 등의 분야에서 용기 유리 수요가 급증하고 있음을 보여줍니다. 이러한 소비 증가는 잠재적인 시장 성장의 신호이며, 제조업체와 공급업체는 이에 따라 사업 규모를 확대해야 합니다.

- 고급 식품 브랜드와 주류 및 비알코올 음료 제조업체는 플라스틱과 같은 대체품보다 유리 용기를 선택하는 경향이 증가하고 있습니다. 이러한 선호는 유리의 화학적 불활성, 비다공성, 불투과성 때문입니다. 이러한 특성은 제품의 맛, 향, 품질이 장기간 손상되지 않도록 보장하며, 이는 고급 제품이나 유통기한이 긴 제품에 매우 중요한 요소입니다.

- 용기용 유리는 알코올성 음료에 선호되며 향과 맛을 보존하는 데 적합합니다. 예를 들어, 와인 제조업체는 종종 와인 품질을 손상시킬 수 있는 광선으로부터 와인을 보호하기 위해 착색된 용기 유리를 선택합니다.

- 스페인의 유리 용기 시장은 와인 소비량 증가, 수제 맥주와 고급 증류주에 대한 인식이 높아짐에 따라 호황을 누리고 있습니다. 칵테일 문화의 부상과 장인정신을 바탕으로 한 고급 음료에 대한 트렌드는 주류 산업에서 최고급 유리 용기 포장에 대한 수요를 더욱 증가시키고 있습니다.

- 그러나 스페인의 용기용 유리 시장은 대체 제품의 부상이라는 도전에 직면해 있습니다. 포장 기술의 발전으로 플라스틱, 금속, 카톤 등의 대체품이 인기를 끌고 있습니다. 경량성, 비용 효율성, 디자인 유연성 등이 매력으로 작용하고 있습니다. 이러한 추세는 편의성과 지속가능성이 가장 중요시되는 식음료 산업에서 특히 두드러집니다.

스페인의 용기용 유리 시장 동향

음료 산업이 가장 높은 시장 점유율을 차지

- 유리 용기 포장 시장은 금속 용기 포장 분야, 특히 알코올 음료용 캔과 치열한 경쟁을 벌이고 있습니다. 그러나 고급 제품과의 연관성으로 인해 유리 용기 포장은 예측 기간 동안 시장 점유율을 유지할 것으로 보입니다. 커피, 주스, 차, 유음료, 비유음료, 비알코올 음료 등 비알코올 음료 분야의 성장이 예상됩니다.

- 스페인의 활기찬 밤문화는 관광객을 끌어들일 뿐만 아니라, 고급품을 선호하는 고급 지향적인 고객들을 끌어들이고 있습니다. 뛰어난 보존성과 미적 매력으로 유명한 유리는 고급 음료의 패키지로 선호되고 있습니다. 나이트클럽의 번영과 함께 이러한 고급품에 특화된 고급 유리 용기에 대한 수요가 증가할 것으로 예상됩니다.

- 국제 나이트 라이프 협회의 보고서에 따르면, 2023년 스페인은 27개의 일류 나이트클럽을 보유한 세계 최고의 국가로 부상할 것으로 보입니다. 미국은 전 세계 엘리트 클럽의 5분의 1을 보유하고 있으며, 이후 먼지를 뒤집어쓰고 있습니다.

- 와인, 맥주, 증류주 등 병에 담긴 음료의 주요 소비처인 나이트클럽은 수요가 급증하고 있습니다. 이러한 증가는 접객업의 호황을 나타내며, 용기 유리 시장에서 고급 유리 포장에 대한 수요 증가를 뒷받침하고 있습니다.

- 유리 용기는 요구르트와 크림에서 향이 첨가된 우유와 디저트에 이르기까지 신선도 유지 특성으로 인해 고급 유제품 포장에 가장 적합한 선택이 되고 있습니다. 유제품 부문이 확대됨에 따라 유리 포장에 대한 수요, 특히 고급 제품 및 장인정신을 가진 생산자들의 수요도 확대될 것으로 보입니다.

- 스페인 음료 및 식품 산업 연맹(FIAB)의 데이터는 유제품 부문의 성장을 강조합니다: 스페인의 유제품 금액은 2018년 95억 6,300만 달러에서 2023년 16억 8,600만 달러로 급증할 것으로 예상됩니다.

화장품 산업이 성장을 촉진할 전망

- 기업들은 점점 더 많은 기업들이 유엔의 17개 지속가능발전목표(SDGs)에 맞춰 사업을 조정하고 있습니다. 이러한 노력은 스페인의 화장품 용기용 유리 시장에 이익을 가져다주고 성장을 촉진할 수 있으며, SDGs에 대한 노력을 통해 기업은 지속가능성과 사회적 책임에 대한 헌신을 강조할 수 있습니다. 결과적으로, 이러한 목표를 달성하는 스페인 화장품 회사는 소비자의 신뢰와 충성도를 높이고 시장 점유율을 확대할 수 있는 길을 열 수 있습니다.

- 환경, 사회, 지배구조(ESG) 요소는 투자자와 비즈니스 파트너가 기업을 평가할 때 주목하고 있습니다. 스페인의 화장품 기업들은 SDGs와의 연계를 통해 지속가능한 사업을 추구하는 투자자들에게 어필할 수 있습니다. 또한, 이러한 협력은 지속가능성을 중시하는 다른 기업과의 파트너십을 통해 화장품 용기 유리 시장의 혁신과 성장을 촉진할 수 있는 협업을 촉진할 수 있습니다.

- 화장품 소비가 증가함에 따라 포장재, 특히 유리 용기에 대한 수요도 증가하고 있습니다. 특히 향수, 스킨케어, 고급 화장품과 같은 프리미엄 화장품은 미적 매력과 보호 효과를 중시하여 유리 포장을 선택하는 경우가 많습니다. 유리 용기는 향기의 무결성을 유지하고 오염을 방지할 뿐만 아니라 제품의 유통기한을 연장할 수 있습니다.

- Cosmetic Europe에 따르면 스페인 화장품 시장은 2018년 75억 8,000만 달러에서 2023년 112억 6,000만 달러에 달할 것으로 예상됩니다.

- 시장 확대에 따라 고급 포장 솔루션에 대한 수요가 증가하고 있으며, 특히 고급 제품 및 하이엔드 부문에서 수요가 증가하고 있습니다. 고급스러운 외관, 투명성, 환경 친화적인 특성으로 인해 유리는 고급 화장품에 가장 적합한 선택입니다. 높은 재활용성은 지속가능한 포장에 대한 소비자의 선호도가 높아지는 추세와도 잘 맞아떨어집니다. 또한, 유리의 디자인 다양성으로 인해 브랜드는 독특한 모양을 만들 수 있어 복잡한 시장에서 차별화를 꾀할 수 있습니다.

스페인의 용기용 유리 산업 개요

스페인의 용기용 유리 시장은 세분화되어 있으며, 지역 및 세계 플레이어가 혼합되어 시장 점유율을 놓고 경쟁하고 있습니다. 이러한 다양한 경쟁 상황에는 기존 제조업체와 신규 진입업체가 모두 포함되어 있으며, 각 업체는 시장에서 중요한 위치를 차지하기 위해 경쟁하고 있습니다.

이 시장에서 사업을 영위하는 기업들은 제품 라인업 확대, 시장 내 입지 강화, 시장 내 수익성 향상을 위해 전략적 인수를 적극적으로 추진하고 있습니다. 또한, 이러한 경쟁 환경에서 차별화를 위해 기술 혁신과 지속가능한 노력에 집중하는 기업들도 있습니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 용기용 유리 수출입 데이터

- PESTEL 분석 - 스페인의 용기용 유리 산업

- 포장용 용기 유리 업계 표준과 규제

- 포장용 유리 원자재 분석과 재료 검토

- 용기 포장용 유리의 지속가능성 동향

- 스페인의 용기용 유리 용광로 용량과 입지

제5장 시장 역학

- 시장 성장 촉진요인

- 친환경 제품에 대한 수요 증가

- 식품 및 음료 시장 수요 급증

- 시장 과제

- 대체 제품 이용 확대

- 유럽의 용기용 유리 시장에서 스페인의 시장 상황 분석

- 무역 상황 개요 - 스페인의 용기용 유리 산업의 수출입 패러다임 역사와 현황 분석

제6장 시장 세분화

- 최종 이용 업계별

- 알코올(부문 분석을 위한 정성 분석)

- 맥주와 사이다

- 와인·증류주

- 기타 주류

- 무알코올(부문을 위한 정성 분석)

- 탄산음료

- 우유

- 물·기타 비주류

- 식품

- 화장품

- 의약품(바이알·앰플을 제외)

- 기타 최종 이용 업계별

- 알코올(부문 분석을 위한 정성 분석)

제7장 경쟁 구도

- 기업 개요

- Verallia Group

- BA GLASS GROUP

- O-I Glass, Inc.

- Vidrala, S.A.

- VERESCENCE FRANCE

- Gerresheimer AG

- SAVERGLASS Group

- ALGLASS SA

- Quadpack Industries SA

- Berlin Packaging

제8장 보충 취재 - 스페인의 주요 용기 유리 공장에 대한 주요 가열로 공급업체 분석

제9장 시장 향후 전망

ksm 25.02.07The Spain Container Glass Market size in terms of shipment volume is expected to grow from 3.10 million tonnes in 2025 to 3.58 million tonnes by 2030, at a CAGR of 2.91% during the forecast period (2025-2030).

Key Highlights

- Driven by the rising demand for packaged food and beverages, the need for soda-lime-silica-based glass has surged, especially for storing diverse food ingredients. This trend is notably seen in items like jams, sauces, pickles, and ready-to-eat meals, where glass containers not only preserve but also enhance visual appeal.

- The market is witnessing rapid expansion, fueled by a growing appetite for premium packaging in the food processing sector. Glass containers are increasingly preferred for their ability to highlight product quality and boost shelf presence.

- Heightened awareness of plastic pollution and a collective push for sustainable alternatives have spurred a shift towards glass packaging. This shift is further bolstered by consumer demand for eco-friendly, safe, and healthier packaging. Innovations in glass shaping, embossing, and decorative finishes have amplified the allure of glass packaging. Such advancements not only facilitate unique designs but also present branding opportunities, ensuring products capture attention on store shelves.

- Furthermore, the food and beverage sector's rising demand for eco-friendly products propels market growth, especially given glass's 100% recyclability and infinite reusability without quality loss.

- According to the International Trade Centre, Spain's container glass imports (HS Code-701090) surged to USD 10,70,890 thousand in 2023, up from USD 8,08,861 thousand in 2022. This notable uptick in imports underscores a burgeoning demand for container glass, likely spurred by sectors like food and beverage, pharmaceuticals, and cosmetics. Such heightened consumption signals potential market growth, prompting manufacturers and suppliers to scale operations accordingly.

- Premium food brands and producers of both alcoholic and non-alcoholic beverages are increasingly gravitating towards glass containers over alternatives like plastic. This preference stems from glass's chemical inertness, non-porosity, and impermeability. Such attributes ensure that a product's taste, aroma, and quality remain intact over time, a crucial factor for high-end items and those with extended shelf lives.

- Container glass is a favored choice for alcoholic beverages, adept at preserving their aroma and taste. For instance, wine manufacturers often opt for tinted container glass, shielding the wine from light exposure that could compromise its quality.

- Spain's container glass market has been buoyed by rising wine consumption and a burgeoning appreciation for craft beers and premium spirits. The cocktail culture's ascent and a trend towards premium, artisanal beverages further amplify the demand for top-tier glass packaging in the alcoholic sector.

- However, the Spain container glass market faces challenges from the rising adoption of substitute products. Thanks to advancements in packaging technology, alternatives such as plastic, metal, and carton materials are gaining traction. Their lighter weight, cost-effectiveness, and design flexibility make them appealing. This trend is especially pronounced in the food and beverage industry, where convenience and sustainability are paramount.

Spain Container Glass Market Trends

Beverage Industry to Hold the Highest Market Share

- The container glass packaging market contends fiercely with the metal packaging segment, particularly in the form of cans used for alcoholic beverages. Yet, due to its association with premium products, container glass packaging is poised to retain its market share throughout the forecast period. Growth is anticipated in the non-alcoholic beverage sector, encompassing coffee, juices, tea, and both dairy and non-dairy drinks.

- Spain's vibrant nightlife not only draws tourists but also an upscale clientele with a penchant for premium products. Glass, celebrated for its superior preservation and aesthetic allure, is the preferred choice for high-end beverage packaging. As the nightclub sector flourishes, the demand for specialized luxury glass containers for these premium offerings is set to rise.

- Spain led the world in 2023, boasting 27 top-rated nightclubs, as reported by the International Nightlife Association. The U.S. trailed, hosting one-fifth of the globe's elite clubs.

- Nightclubs, major consumers of bottled beverages like wine, beer, and spirits, are witnessing a surge in demand. This uptick, indicative of a thriving hospitality sector, underscores the rising need for premium glass packaging in the container glass market.

- Glass containers are the go-to choice for packaging premium dairy items, from yogurt and cream to flavored milk and desserts, thanks to their freshness-preserving qualities. As the dairy sector expands, so too will the demand for glass packaging, especially from high-end and artisanal producers.

- Data from the Spanish Federation of Food and Beverage Industries (FIAB) highlights the dairy sector's growth: Spain's dairy product value surged from USD 9,563 million in 2018 to a notable USD 16,862 million in 2023.

Cosmetic Industry is Expected to Bolster Growth

- Companies are increasingly aligning their operations with the United Nations' 17 Sustainable Development Goals (SDGs). This alignment stands to benefit Spain's cosmetic container glass market, potentially fueling its growth. By committing to the SDGs, companies underscore their dedication to sustainability and social responsibility. As a result, Spanish cosmetic firms that embrace these goals could see a boost in consumer trust and loyalty, paving the way for an expanded market share.

- Environmental, social, and governance (ESG) factors are gaining prominence among investors and business partners when assessing companies. By aligning with the SDGs, Spanish cosmetic firms can enhance their appeal to investors on the lookout for sustainable ventures. Furthermore, this alignment can pave the way for partnerships with other sustainability-driven businesses, fostering collaborations that spur innovation and growth in the cosmetic container glass market.

- As cosmetic consumption rises, so does the demand for packaging materials, notably glass containers. Premium cosmetics, especially perfumes, skincare items, and luxury makeup, often opt for glass packaging, valuing its aesthetic charm and protective benefits. Glass containers not only preserve fragrance integrity and prevent contamination but also extend the product's shelf life.

- According to Cosmetic Europe, the Spanish cosmetic market is projected to reach a value of USD 11.26 billion in 2023, up from USD 7.58 billion in 2018.

- With the market's expansion, particularly in the luxury and high-end segments, the demand for premium packaging solutions is on the rise. Glass, favored for its premium look, transparency, and eco-friendly attributes, is the go-to choice for high-quality cosmetics. Its recyclability resonates with the growing consumer preference for sustainable packaging. Moreover, glass's versatility in design allows brands to craft unique shapes, setting them apart in a crowded marketplace.

Spain Container Glass Industry Overview

The container glass market in Spain is characterized as fragmented, with a mix of regional and global players competing for market share. This diverse competitive landscape includes both established manufacturers and newer entrants, each vying for a significant position in the market.

Companies operating in this market are actively pursuing strategic acquisitions to expand their product offerings, increase their market presence, and improve profitability within the market. Additionally, some firms focus on technological innovations and sustainable practices to differentiate themselves in this competitive environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL ANALYSIS - Container Glass Industry in Spain

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace Capacity and Location in Spain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Eco-friendly Products

- 5.1.2 Surging Demand from the Food and Beverage Market

- 5.2 Market Challenges

- 5.2.1 Growing Usage of Substitute Products

- 5.3 Analysis of the Current Positioning of Spain in the European Container Glass Market

- 5.4 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Spain

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.1.1 Beer and Cider

- 6.1.1.2 Wine and Spirits

- 6.1.1.3 Other Alcoholic Beverages

- 6.1.2 Non-Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.2.1 Carbonated Soft Drinks

- 6.1.2.2 Milk

- 6.1.2.3 Water and Other Non-alcoholic Beverages

- 6.1.3 Food

- 6.1.4 Cosmetics

- 6.1.5 Pharmaceutical (Excluding Vials and Ampoules)

- 6.1.6 Other End-user Verticals

- 6.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verallia Group

- 7.1.2 BA GLASS GROUP

- 7.1.3 O-I Glass, Inc.

- 7.1.4 Vidrala, S.A.

- 7.1.5 VERESCENCE FRANCE

- 7.1.6 Gerresheimer AG

- 7.1.7 SAVERGLASS Group

- 7.1.8 ALGLASS SA

- 7.1.9 Quadpack Industries SA

- 7.1.10 Berlin Packaging