|

시장보고서

상품코드

1635466

동남아시아의 바이오디젤 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)South-East Asia Biodiesel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

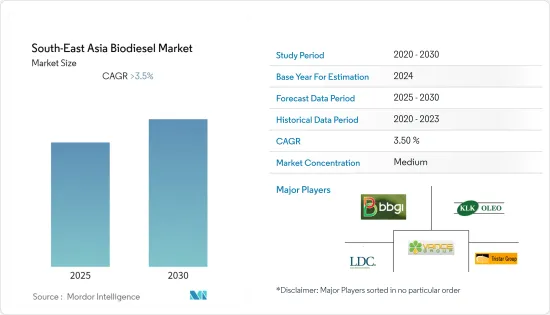

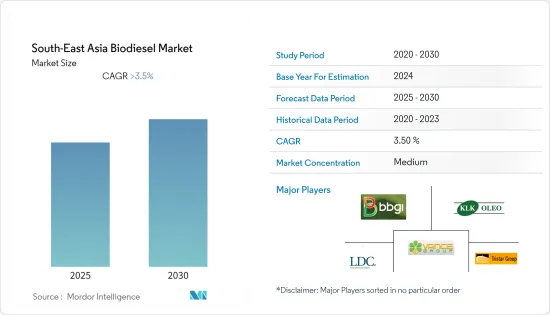

동남아시아의 바이오디젤 시장은 예측 기간 중 3.5% 이상의 CAGR로 추이할 전망

주요 하이라이트

- 단기적으로 동남아시아 바이오디젤 시장은 저탄소 배출 연료에 대한 세계적인 흐름과 다양한 용도의 바이오연료 사용을 촉진하기 위한 동남아시아 국가 정부의 구상에 힘입어 더욱 성장할 것으로 예상됩니다.

- 한편, 식량안보, 토지 이용, 삼림 벌채 등의 문제로 인해 바이오디젤 시장의 위협은 아직 낮습니다.

- 말레이시아, 인도네시아, 태국 등 동남아시아 국가들 사이에서 바이오디젤과 바이오에탄올의 거래가 계속되고 있으며, 다양한 용도로 바이오디젤의 사용이 촉진되고 있으며, 시장에 유리한 기회를 창출하고 있음.

- 인도네시아는 바이오디젤 이용 촉진에 주력하고 있으며, 팜유(바이오디젤 생산의 주원료) 생산량이 많아 시장을 독식할 것으로 예상됩니다.

동남아시아 바이오디젤 시장 동향

성장세가 기대되는 운송 부문

- 바이오디젤은 재생한 청정 연소 디젤로 기존 디젤 엔진에 그대로 사용할 수 있습니다. 바이오디젤은 운송에 사용되는 화석연료와 혼합할 수 있으며, 가장 일반적인 운송용 혼합 연료는 B5(바이오디젤 5% 혼합)와 B20(바이오디젤 6-20% 혼합)입니다. 이 지역의 많은 국가들은 무공해 운송을 위해 혼합 연료 사용을 의무화하고 있습니다.

- 말레이시아의 바이오디젤 소비량은 계속 증가하여 2021년에는 8억 6,300만 리터에 달할 것으로 예상됩니다. 이러한 추세는 주로 운송 부문의 높은 연료 이용률에 기인합니다. 업계 전문가들은 혼합 의무 및 보조금 형태의 정부 정책으로 인해 이러한 추세가 계속될 것으로 예상하고 있습니다.

- 일례로, 말레이시아 정부는 2022년 1월 B20 팜유 바이오연료 프로그램의 일환으로 2022년 말까지 바이오디젤 20% 혼합 의무화를 시행할 계획을 발표했습니다. 이 의무화는 당초 2020년에 계획되었으나 코로나바이러스 발생으로 인해 연기되었습니다.

- 또한 인도네시아는 2021년 12월부터 운송용 연료에 팜유 기반 바이오디젤 30% 혼합을 의무화했으며, 2022년부터는 B40 연료, 즉 팜유 기반 바이오디젤을 40% 혼합한 자동차에 대한 주행 검사도 시작되었습니다.

- 이러한 시장 개척으로 향후 수년간 운송 부문의 바이오디젤 시장 성장이 증가할 것으로 예상됩니다.

인도네시아가 시장을 독식할 것으로 전망

- 인도네시아는 바이오디젤과 바이오에탄올 생산량이 많아 바이오연료 시장에서 지속적으로 성장하고 있습니다. 인도네시아는 바이오디젤 생산에 가장 필수적인 원료인 팜유 생산에서 세계 선두를 달리고 있습니다. 비상장 기업이 이 분야에 대한 투자에 관심을 보이고 있는 것도 바이오디젤 시장 확대의 유일한 이유 중 하나입니다.

- 중국의 바이오디젤 생산량은 2021년 기준 약 95억 리터로 사상 최고치를 기록할 것으로 예상됩니다. 바이오디젤의 높은 수요에 가장 큰 기여를 하는 분야는 운송 부문이며, 그 다음으로 발전 부문을 포함한 산업 부문이 그 뒤를 잇고 있습니다.

- 교통 연료로 바이오디젤 사용을 확대하려는 인도네시아의 노력의 대표적인 예는 2021년 화석연료에 바이오디젤을 30% 혼합하는 것을 의무화하는 도입입니다. 인도네시아는 또한 바이오디젤을 40% 혼합한 B40 바이오디젤 제품에 대한 주행 검사를 실시할 계획도 밝혔습니다.

- 또한 이 연료는 산업 부문에서도 추진력을 얻고 있으며, 2022년 1월 한국의 GS칼텍스와 포스코인터내셔널은 인도네시아에 바이오디젤 공장과 바이오화학제품 제조를 위한 원료 정제 시설을 개발하기로 결정했습니다. 또한 차세대 바이오연료 사업을 시작할 계획도 발표했습니다.

- 이러한 신흥 국가 시장 개척으로 인도네시아는 향후 시장을 독점할 것으로 예상됩니다.

동남아시아 바이오디젤 산업 개요

동남아시아의 바이오디젤 시장은 비교적 세분화되어 있습니다. 주요 기업으로는 Louis Drefus Company, Vance Group Limited, KLK Bioenergy Sdn Bhd, Tristar Global, BBGI Public Company Limited 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 조사의 전제조건과 시장 정의

제2장 조사 방법

제3장 개요

제4장 시장 개요

- 서론

- 2027년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 억제요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협 제품·서비스

- 경쟁 기업 간 경쟁 관계

제5장 시장 세분화

- 원료

- 동물성 유지

- 식물유지

- 기타 원료

- 용도

- 운송

- 산업·상업

- 기타

- 지역

- 태국

- 말레이시아

- 인도네시아

- 기타 동남아시아

제6장 경쟁 구도

- M&A, 합병사업, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Louis Drefus Company

- Vance Group Limited

- KLK Bioenergy Sdn Bhd

- Tristar Global

- BBGI Public Company Limited

- PT Musim Mas

- PT Anugerah Inti Gemanusa

- PT Batara Elok Semesta Terpadu

- PT Bayas Biofuels

- PT Dabi Biofuels

제7장 시장 기회와 향후 동향

KSA 25.01.31The South-East Asia Biodiesel Market is expected to register a CAGR of greater than 3.5% during the forecast period.

Key Highlights

- Over the short term, the South-East Asia biodiesel market is expected to grow more due to the global drift towards low-carbon emission fuels and the initiatives on behalf of the governments of South-East Asian countries to promote the use of biofuels for various applications.

- On the other hand, owing to the issues, such as food security, land use, and deforestation, the threat still subsides for the biodiesel market.

- Nevertheless, the ongoing trade of biodiesel and bioethanol among South-East Asian countries like Malaysia, Indonesia, Thailand etc., creates lucrative opportunities for the market, as it promotes the use of biodiesel for various applications.

- Indonesia is expected to dominate the market due to the country's efforts to promote the use of biodiesel, and high palm oil production (the main raw material for biodiesel production).

South-East Asia Biodiesel Market Trends

Transportation Segment Expected to Witness Significant Growth

- Biodiesel is a renewable, clean-burning diesel replacement used in existing diesel engines without modification. Biodiesel can be blended with fossil-based fuels used in transportation, the most common transport blends are B5 (blended with 5% biodiesel) and B20 (blended with 6-20% biodiesel). Many countries in the region have rolled out blending mandates for emission-free transportation.

- Malaysia witnessed a continuous increase in biodiesel consumption, reaching 863 million liters of consumption, as of 2021. The upscaled trend was predominantly due to the high utilization of fuel in the transportation sector. Industry experts predict that the trend will continue in the future too, due to government policies in the form of blend mandates and subsidies.

- As an example, in January 2022, the Malaysian government announced plans to roll out the 20% blending mandate of biodiesel by the end of 2022, as a part of the B20 palm oil biofuel program. The mandate was first planned in 2020 but faced delays due to coronavirus outbreaks.

- Furthermore, in Indonesia too, in December 2021, the country implemented the blending mandate of 30% palm-oil based biodiesel in the transport fuels. In 2022, the country also began the road tests for B40 fuel i.e 40% blend of palm-oil based biodiesel for vehicles.

- Such developments are expected to result into an augmented growth of biodiesel market in the transportation sector in the coming years.

Indonesia Expected to Dominate the Market

- Indonesia is consistently growing in the biofuels market due to the high volume of biodiesel and bioethanol production. The country is positioned as the leader in palm oil production at the global level, the most essential ingredient for the manufacturing of biodiesel. The private companies showing interest in investing in the sector is also one of the sole reasons for the expansion of the biodiesel market in the country.

- The biodiesel production in the country reached record levels with around 9500 million liters of production, as of 2021. The transportation sector is the major contributor to the high demand for biodiesel, followed by the industrial sector, which exclusively includes the electricity generation sector.

- A classic example of the country's efforts to expand the use of the fuel as a transport fuel is the introduction of a 30% blend mandate of biodiesel in fossil-based diesel fuels in 2021. Indonesia also disclosed plans to do road tests for B40 biodiesel products with 40% blending of biodiesel.

- Furthermore, the fuel is also gaining momentum in the industrial sector. In January 2022, the South Korea-based company GS Caltex and POSCO International decided to develop the Indonesian biodiesel plant and a raw-material refining facility for the production of a biochemical product. They also announced plans to start the business for the next generation biofuels business.

- Owing to such developments, Indonesia is forecasted to dominate the market in the unfolding scene.

South-East Asia Biodiesel Industry Overview

The South-East Asian biodiesel market is a moderately fragmented one. Some of the key players (in no particular order) include Louis Drefus Company, Vance Group Limited, KLK Bioenergy Sdn Bhd, Tristar Global, and BBGI Public Company Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Feedstock

- 5.1.1 Animal Fat

- 5.1.2 Vegetable Oil

- 5.1.3 Other Feedstocks

- 5.2 Application

- 5.2.1 Transportation

- 5.2.2 Industrial & Commercial

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Thailand

- 5.3.2 Malaysia

- 5.3.3 Indonesia

- 5.3.4 Rest of South-East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Louis Drefus Company

- 6.3.2 Vance Group Limited

- 6.3.3 KLK Bioenergy Sdn Bhd

- 6.3.4 Tristar Global

- 6.3.5 BBGI Public Company Limited

- 6.3.6 PT Musim Mas

- 6.3.7 PT Anugerah Inti Gemanusa

- 6.3.8 PT Batara Elok Semesta Terpadu

- 6.3.9 PT Bayas Biofuels

- 6.3.10 PT Dabi Biofuels

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록