|

시장보고서

상품코드

1635491

남미의 로터 블레이드 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South America Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

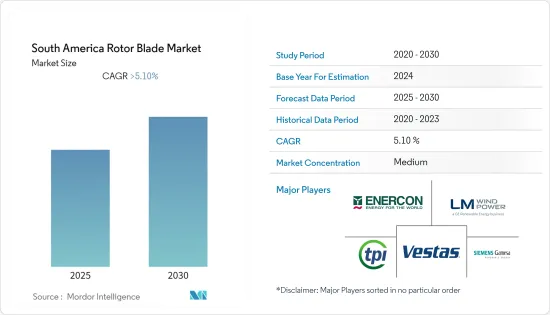

남미의 로터 블레이드 시장은 예측 기간 중에 5.1% 이상의 CAGR로 추이할 전망입니다.

시장은 2020년에 COVID-19의 중간 정도의 영향을 받았습니다.

주요 하이라이트

- 장기적으로는 이 지역 전체에서 해상과 육상 풍력 발전 설비의 수가 증가하고 있는 것이, 시장의 주요 촉진요인이 될 것으로 예상됩니다.

- 그 반면, 높은 수송 비용, 태양광 발전, 수력 발전 등의 대체 클린 전원 시장 경쟁이, 시장 성장을 저해할 가능성도 있습니다.

- 풍력발전산업은 비용 효율적인 솔루션이 요구되고 있으며, 고효율 제품은 산업의 세력도를 바꿀 수 있습니다. 보다 효율적인 블레이드가 시장에 나왔기 때문입니다. 따라서, 기술 개발은 남미의 로터 블레이드 시장에 있어서 기회입니다.

- 브라질은 국가 전체에서 풍력 발전 설비가 증가하고 있어 로터 블레이드 시장을 독점할 것으로 예상됩니다.

남미 로터 블레이드 시장 동향

육상 부문이 시장을 독점

- 육상 풍력 발전 기술은 지난 5년간 설치된 메가와트 용량당 발전량을 극대화하고 풍속이 낮은 장소를 보다 많이 커버하도록 진화해 왔습니다. 허브 높이가 높고, 직경이 넓고, 풍력 터빈 블레이드가 커지고 있습니다.

- 2021년 11월 현재 풍력발전의 설비용량은 20GW를 넘었습니다. 총 용량 12GW를 넘는 350개 이상의 신규 풍력 발전 프로젝트를 승인하고 있으며, 그 중 170개 프로젝트가 건설 중입니다.

- Global Wind Energy Report 2022에 따르면 브라질의 육상 풍력 발전 설비 용량은 21.5GW로 세계 랭킹 6위입니다. 브라질은 2024년까지 적어도 3,000만 kW의 풍력 발전 설비 용량을 가지게 됩니다.

- 칠레의 육상 풍력 발전 설비 용량은 1기가와트를 넘는데, 이것은 남미에서 두 번째로 높습니다. 되어 있습니다.

- 게다가, 특히 브라질, 칠레, 아르헨티나에서는 발전 비용의 저하와 투자 증가가 육상 풍력 터빈의 설치를 촉진하고, 나아가서는 예측 기간 중에 동지역의 풍력 로터 블레이드 시장을 견인할 것으로 기대되고 있습니다.

- 이러한 요인으로부터, 예측 기간중은 육상 부문이 시장을 독점할 것으로 예상됩니다.

브라질이 시장을 독점할 전망

- 풍력에너지는 브라질에서 두 번째로 큰 발전전원이며, 그 중요성은 해마다 높아지고 있습니다.

- 또한 풍력 터빈의 대형화가 풍력에너지의 비용 절감에 기여하고 있으며 화석 연료 대체품에 비해 경제적으로 경쟁하는 것으로 나타났습니다. 65개 육상풍력발전 프로젝트가 계획되어 있으며 총 투자액 는 230억 달러입니다. 바이어(70억 달러), 리오 그란데 드 노르테(60억 달러), 리오 그란데 드 수르(30억 달러), 피아위(20억 달러) 육상 풍력 발전 프로젝트에 가장 투자하고 있는 주입니다.

- 2022년 4월 덴마크의 풍력 발전 대기업 Vestas는 블레이드 제조업체의 LM Wind Power와 수출 유연성을 갖춘 브라질의 육상 시장에 초점을 맞춘 다년 공급 계약을 체결했습니다. LM Wind Power는 베스타스의 V150-4.2MW 터빈 블레이드를 페르난부코주 이포주카의 공장으로부터 납입합니다.

- 2021년 12월, 중국 제조업체인 Sinoma Science and Technology는 풍력 터빈 블레이드를 생산하는 2,880만 달러의 공장을 건설하고 브라질 사업을 확대할 계획을 발표했습니다. China National Building Material Group(CNBMG) 산하의 계약자인 Sinoma Overseas Development과 합작회사를 설립해, 살바도르에 공장을 건설합니다. 신공장에서는 연간 260 세트의 파워 블레이드를 생산할 예정입니다.

- 이상의 점으로부터, 예측 기간중, 브라질이 시장을 독점할 것으로 예상됩니다.

남미 로터 블레이드 산업 개요

남미의 로터 블레이드 시장은 세분화되어 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 풍력 터빈 로터 블레이드의 가격 분석

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 설치 장소별

- 온쇼어

- 오프쇼어

- 블레이드 재료별

- 탄소섬유

- 유리 섬유

- 기타 블레이드 재료

- 지역별

- 브라질

- 아르헨티나

- 콜롬비아

- 페루

- 칠레

- 기타 남미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- LM Wind Power(a GE Renewable Energy business)

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- Enercon GmbH

제7장 시장 기회와 앞으로의 동향

JHS 25.01.31The South America Rotor Blade Market is expected to register a CAGR of greater than 5.1% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market are expected to be the growing number of offshore and onshore wind energy installations across the region.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder market growth.

- The wind power industry has been in demand for cost-effective solutions, and a highly efficient product can change the industry's dynamics. There were instances where old turbines were replaced, not because of the damage but due to the availability of more efficient blades in the market. Hence, technological developments are opportunities for the South American rotor blade market.

- Brazil is expected to dominate the rotor blade market, with growing wind power installations across the country.

South America Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- As of November 2021, the installed wind power capacity surpassed 20 GW. The nation has over 10,000 wind turbines installed across 750 operational wind parks. The Brazilian Electricity Regulatory Agency (ANEEL) has approved more than 350 new wind power projects with a total capacity of over 12 GW, out of which 170 projects are under construction.

- According to the Global Wind Energy Report 2022, Brazil is in sixth place in the global ranking, with 21.5 GW of onshore wind installed capacity. Furthermore, according to the Brazilian Association of Wind Energy (ABEEolica), Brazil will have at least 30 GW of installed wind energy capacity by 2024. This, in turn, aids the growth of using rotor blades for wind plants across the region.

- Chile has more than a gigawatt of installed onshore wind capacity, which is the second-highest in South America. Chile has ambitious plans for renewable energy, which, in turn, is expected to drive the onshore market in the region.

- Furthermore, decreasing the cost of power generation and growing investments, particularly in Brazil, Chile, and Argentina, are expected to drive the onshore wind turbine installation, which, in turn, is expected to drive the wind rotor blade market in the region during the forecast period.

- Owing to these factors, the onshore segment is expected to dominate the market during the forecast period.

Brazil is Expected to Dominate the Market

- Wind energy is Brazil's second-largest source of power generation, and its importance grows yearly. Wind energy production in the country hit a record in 2021, exceeding 20 GW of installed capacity, and wind power generation was about 72.286 Gwh.

- In addition, the growing size of wind turbines has assisted in lowering the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives. As of June 2022, 65 onshore wind projects are planned over the next five years, with a total investment of USD 23 billion. The Bahia (USD 7 billion), Rio Grande do Norte (USD 6 billion), the Rio Grande do Sul (USD 3 billion), and Piaui (USD 2 billion) are the states investing the most in onshore wind energy projects.

- In April 2022, Danish wind giant Vestas finalized a multi-year supply agreement with blade maker LM Wind Power, focused on the onshore Brazilian market with the flexibility for export. Under the deal, LM Wind Power will deliver Vestas's V150-4.2MW turbine blades from its factory in Ipojuca in Pernambuco.

- In December 2021, Chinese manufacturer Sinoma Science and Technology announced its plan to expand business in Brazil by building a USD 28.8 million plant to manufacture wind turbine blades. Sinoma will set up a joint venture with Sinoma Overseas Development, a contractor under Sinoma Science's parent company China National Building Material Group (CNBMG), to build the plant in Salvador. The new plant will produce 260 power blade sets a year.

- Owing to the above points, Brazil is expected to dominate the market during the forecast period.

South America Rotor Blade Industry Overview

The South American rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include TPI Composites SA, LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy SA, Vestas Wind Systems A/S, and Enercon GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Wind Turbine Rotor Blades Price Analysis

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.2 Market Restraints

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Peru

- 5.3.5 Chile

- 5.3.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TPI Composites Inc.

- 6.3.2 Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- 6.3.3 LM Wind Power (a GE Renewable Energy business)

- 6.3.4 Nordex SE

- 6.3.5 Siemens Gamesa Renewable Energy SA

- 6.3.6 Vestas Wind Systems A/S

- 6.3.7 MFG Wind

- 6.3.8 Sinoma wind power blade Co. Ltd

- 6.3.9 Aeris Energy

- 6.3.10 Suzlon Energy Limited

- 6.3.11 Enercon GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록