|

시장보고서

상품코드

1635509

프랑스의 로터 블레이드 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)France Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

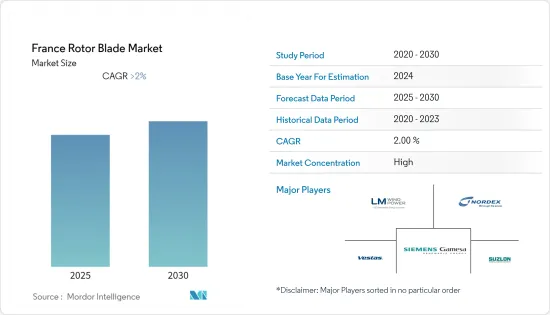

프랑스 로터 블레이드 시장은 예측 기간 중 CAGR 2% 이상이 예상됩니다.

시장은 2020년에 COVID-19의 중간 정도의 영향을 받았습니다.

주요 하이라이트

- 장기적으로는 정부의 지원 시책과 민간 투자가 동국의 로터 블레이드 수요를 견인합니다.

- 반면 관련 수송 비용의 높이와 태양광 발전, 수력 발전 등 대체 클린 전원의 비용 경쟁은 시장의 성장을 저해할 가능성을 가지고 있습니다.

- 제품의 기술 혁신과 최신의 로터 블레이드 기술의 적응은 프랑스의 로터 블레이드 시장에 곧 유리한 성장 기회를 만들어낼 것으로 기대되고 있습니다.

프랑스 로터 블레이드 시장 동향

육상 부문이 시장을 독점

- 육상 풍력 발전 기술은 설치된 메가와트 용량당 발전량을 극대화하고 풍속이 낮은 보다 많은 장소를 커버하기 위해 지난 5년간 진화해 왔습니다. 풍력 터빈의 허브 높이가 높아져 직경이 넓어져 풍력 터빈 블레이드가 대형화하고 있습니다.

- 프랑스는 유럽 풍력 발전 시장의 주요 국가 중 하나입니다. 이 나라의 풍력 발전 시장은 원자력 발전소의 폐쇄에 의해 생긴 갭을 메우기위한 정부의 시책(보조금이나 고정 가격 임베디드 제도 등)에 의해 견인되어 왔습니다.

- 육상 부문이 프랑스의 풍력 발전 시장을 독점해 왔습니다. 또한, 신정부의 계획에서는 육상 풍력 발전 용량은 2030년까지 3배가 될 예정입니다.

- 2022년 7월, Falck Renewables는 지역 개발 프로젝트에 대한 지역 이익 계획에 합의하여 프랑스에서 10번째 장소인 풍력 발전소를 공식적으로 오픈했습니다. Renewables는 프랑스의 세느-마리팀 현 일리노이에 새로운 풍력발전소를 정식으로 오픈했습니다.

- 2022년 9월, Valorem과 ENERCON France는 세유 에 로코젤스(프랑스, 헬로)에 합계 14.1MW의 E-82 E4 풍력에너지 컨버터 6기를 설치하는 계약을 체결했습니다.

- 따라서 위의 요인에 따라 육상 풍력 터빈용 로터 블레이드는 육상 풍력에너지 프로젝트 증가와 함께 정부의 지원 시책이나 이니셔티브에 의해 크게 성장할 것으로 예상됩니다.

시장 수요를 견인하는 정부의 지원 시책과 민간 투자

- 프랑스 정부는 2030년까지 전원 구성에서 차지하는 재생 가능 에너지의 비율을 40%로 끌어올릴 계획을 발표했습니다.

- 또한, 2021년 시점에서 육상 풍력 발전 설비는 약 19GW, 해상 풍력 발전 설비는 2MW입니다. l'Energie(PPE)에 따르면, 이 나라는 2028년까지 34GW의 육상 풍력 발전을 목표로 하고 있으며, 2021년 시점에서는 약 1,908GW입니다. 탈탄소화에 공헌하기 위해 필수적입니다.

- 2021년에는 독일과 영국과 마찬가지로 프랑스의 해상풍력 발전 용량의 신규 추가는 없었지만, 프랑스도 해상풍력발전시장의 개척을 목표로 하고 있습니다. 2022년 2월까지의 해상 풍력 발전 용량을 가지는 것을 목표로 하고 있습니다.

- 2022년 3월 프랑스 정부는 프랑스의 풍력 산업과 해상 부문의 협정에 조인했습니다. 이 협정은 프랑스가 2050년까지 40GW의 해상 풍력을 50의 풍력 발전소에 건설하는 것을 약속하는 것으로, 해상 풍력 발전의 대폭적인 개발이 기대되고 있습니다.

- 이 풍력 발전의 목표를 달성하기 위해, 프랑스는 2025년부터 매년 최소 2GW의 새로운 해상 풍력 발전을 입찰할 예정입니다. 2030년까지 20GW의 용량이 할당되어 2035년에는 18GW의 해상 풍력 발전소가 가동하게 됩니다.

- 지금까지 프랑스는 350만kW의 해상풍력발전을 경매에 걸고 그 중 50만kW는 부체식 해상풍력발전입니다.

- 따라서 풍력발전시장 개척에 도움이 되는 정부의 시책과 민간투자는 예측기간 중 긍정적으로 작용하며 풍력터빈용 로터블레이드 시장의 성장으로 이어질 것으로 예상됩니다.

프랑스 로터 블레이드 산업 개요

프랑스의 로터 블레이드 시장은 통합적인 성질을 가지고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위: 100만 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 전개 장소

- 온쇼어

- 오프쇼어

- 블레이드 재료(정성 분석)

- 탄소섬유

- 유리 섬유

- 기타 블레이드 재료

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- Suzlon Energy Limited

- Enercon GmbH

- LM Wind Power(GE Renewable Energy 사업)

제7장 시장 기회와 앞으로의 동향

JHS 25.01.31The France Rotor Blade Market is expected to register a CAGR of greater than 2% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, supportive government policies and private investments drive the country's rotor blade demand.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder the market's growth.

- Nevertheless, product innovation and adaptation of the latest rotor blade technologies are expected to create soon lucrative growth opportunities for the France rotor blade market.

France Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades. As of 2021, the total onshore installations in the country totaled 19,131 MW.

- France is among the leading countries in the European wind power market. In 2021, it added 1,192 MW, reaching 19.13 GW. The country had an average power rating of 2 MW per turbine. The wind power market in the country has been driven by government policies (such as subsidies and feed-in-tariff) to fill the gap created by the closure of nuclear power plants.

- The onshore sector has dominated the French wind power market. Moreover, under the new government's plans, the onshore wind power capacity is planned to be tripled by 2030. In 2021, the country was third only after Germany and Sweden.

- In July 2022, with a community benefit scheme agreed upon for local development projects, Falck Renewables officially opened its tenth wind farm in France. Falck Renewables officially opened its new wind farm in Illinois, Seine-Maritime department, France. The six-turbine wind farm, which came into commercial operation, has an installed capacity of 12 MW and an estimated annual production of around 28 GWh, sufficient to power approximately 6,600 households.

- In September 2022, Valorem and ENERCON France signed a contract to install six E-82 E4 wind energy converters at Ceilhes-et-Rocozels (Herault, France) with a total capacity of 14.1 MW.

- Therefore, based on the above-mentioned factors, the onshore wind turbine rotor blade is expected to grow significantly due to supportive government policies and initiatives coupled with an increasing number of onshore wind energy projects.

Supportive Government Policies and Private Investments Driving the Market Demand

- The French government planned to increase the share of renewable energy in the power mix to 40% by 2030. The government announced an increase in the expenditure on renewables, from EUR 5 billion to EUR 8 billion annually.

- Moreover, as of 2021, the country's onshore wind energy installation was about 19 GW, and 2 MW of offshore wind energy installation. Further, according to Programmation Pluriannuelle de l'Energie (PPE), the country aims to have 34 GW of onshore wind by 2028, which in 2021 is about 19.08 GW. The expansion is vital for a successful energy transition and to help decarbonize the rest of France's energy mix.

- Though the country had no new offshore capacity added in 2021, like Germany and the United Kingdom, France is also seeking to develop its offshore wind power market. By February 2022, the country aims to have 40 GW of offshore wind power generation capacity by 2050.

- In March 2022, the French government signed an offshore sector deal with France's wind industry. The agreement recognizes that offshore wind is significant energy and industrial opportunity. It commits France to build 40 GW of offshore wind by 2050 spread over 50 wind farms which is expected to see considerable development in offshore wind power.

- To reach the country's wind power target, the country plans to organize auctions for a minimum of 2 GW of new offshore wind capacity each year starting in 2025. As of March 2022, the government is auctioning 1 GW a year. This means 20 GW of capacity is likely to be allocated by 2030, translating into 18 GW of operational offshore wind farms in 2035.

- So far, France has placed 3.5 GW of offshore wind up for auction, 500 MW floating wind. The country is well-suited for floating wind power, due to strong and stable winds in the deep sea, off its coasts.

- Hence, government policies and private investments that are helping in the development of the wind power market are expected to be positive during the forecast period, leading to growth in the wind turbine rotor blades market.

France Rotor Blade Industry Overview

The France rotor blade market is consolidated in nature. Some of the major players in the market (in no particular order) include Nordex SE, Siemens Gamesa Renewable Energy, SA, Vestas Wind Systems A/S, Suzlon Energy Limited, and LM Wind Power (a GE Renewable Energy business).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material (Qualitative Analysis)

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 Vestas Wind Systems A/S

- 6.3.4 Suzlon Energy Limited

- 6.3.5 Enercon GmbH

- 6.3.6 LM Wind Power (a GE Renewable Energy business)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록