|

시장보고서

상품코드

1635524

북미의 양수 발전 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)North America Pumped Hydro Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

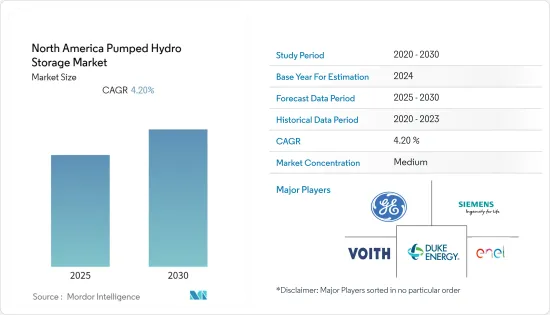

북미 양수발전시장은 예측기간 동안 CAGR 4.2%를 기록할 전망입니다.

시장은 2020년 COVID-19 팬데믹에 의해 부정적인 영향을 받았습니다.

주요 하이라이트

- 장기적으로는 가변적인 재생 가능 에너지원의 통합이나 송전망의 안정성 확보 등 다양한 요인이, 예측 기간중의 양수 발전(PHS) 시장을 견인할 것으로 예상됩니다.

- 한편, PHS 프로젝트가 환경이나 사회에 미치는 영향이나 다른 에너지 저장 기술과의 경쟁 격화가 예측 기간 중 시장 조사를 억제할 것으로 예상됩니다.

- 미국과 캐나다에서는 현재 몇 가지 신규 PSH 기술이 개발 중이며, 장래에는 비용과 환경에 대한 영향을 저감하면서 에너지 저장을 위한 PSH 기술의 개발과 보급이 진행될 것으로 예상된다 때문에 예측 기간중, 시장에는 몇개의 기회가 태어나게 됩니다.

- 미국은 국가 전체에서 양수 발전 프로젝트가 증가하고 있기 때문에 시장을 독점할 것으로 예상됩니다.

북미의 양수 발전 시장 동향

폐쇄 루프 부문이 시장을 독점할 전망

- 폐쇄 루프 시스템에서는 양수 발전소가 건설되고 저장소 중 하나 또는 둘 다가 인공적으로 건설되며 두 저장소 모두 자연적인 물 유입이 없습니다. 큰 수역을 두 번째 수역 근처, 가능한 한 높은 위치에 설치하는 것입니다. 어떤 장소에서는 자연스럽게 일어날 수 있습니다.

- 클로즈드 루프 양수 발전은 높은 유연성, 신뢰성, 고출력을 기재하고 있습니다. 또한, 송전망에의 서포트가 필요한 장소에 설치할 수 있기 때문에 기존의 하천의 근처에 설치할 필요도 없습니다.

- 2021년 현재 미국의 양수 발전 용량은 약 2,191만 2,000kW에 달하고 있으며, 최근에 비해 증가하고 있습니다. 미국 에너지국의 Pacific Northwest National Laboratory의 과학자가 2021년 발표한 내용에 따르면, 클로즈드 루프 시스템의 예비 허가나 라이선싱의 신청 건수는 최근 꽤 증가하고 있습니다.

- 게다가 2022년 6월, 미국 에너지국의 수력 발전 기술실은 클로즈드 루프 양수 발전에 적합한 장소는 전국에 수천 개소 있다고 조사·발표했습니다. PSH 사이트 식별에 대한 대규모 연구이며 개발자와 이해 관계자에게 중요한 참고 자료입니다. 1만 5,000 근처의 장소를 특정했습니다.

- 이상의 점과 최근의 동향으로부터, 예측 기간중은 클로즈드 루프 부문이 시장을 독점할 것으로 예상됩니다.

시장을 독점하는 미국

- 미국은 이 지역에서 최대의 수력 발전의 유저이며, 양수 발전과 같은 근대적인 수력 에너지 저장 시스템의 상당한 유저입니다. 정부는 동국의 수력 발전 설비 용량 증가를 추진하고 있습니다.

- 양수식 수력발전시스템은 일반적으로 저수수로 발전하는 것보다 상단의 저수지에 물을 펌핑하기 위해 많은 전력을 사용합니다. 2021년 양수발전의 여름 순발전능력에 대해 미국의 상위 5개 주는 캘리포니아 주, 버지니아 주, 사우스 캐롤라이나 주, 미시간 주, 조지아 주였습니다.

- 2022년 5월, 연방 에너지 규제 위원회는 27개의 양수 발전 프로젝트가 인가되어 총 설비 용량은 약 1,890만 kW라고 보고했습니다. 설비 용량은 약 16.5GW입니다. 또한, FERC는 2014년 초부터 3개의 양수 발전 프로젝트안에 라이선스를 발행하고 있습니다. Valley Authority의 라쿤 마운틴 플랜트와 같은 연방 소유의 시설이며, 미국 육군 공병대에 의해 운영되고 있는 것도 있습니다.

- 또한 2022년 10월 미국 에너지부의 수력발전기술국은 “Hydropower and Water Innovation for a Resilient Electricity System(HydroWIRES) 이니셔티브를 통해 전력망에서 수력 발전의 역할을 촉진하기 위해 전력 개발자 및 기타 이해 관계자가 기술 지원을받을 기회를 제공한다고 발표했습니다. 프로젝트 개발에 있어서의 평가의 허들에 대처하기 위한 전문 지식과 능력을, 개발자나 이해 관계자에게 제공하는 것을 목적으로 하고 있습니다.

- 이상의 점으로부터, 예측 기간중, 미국이 양수 발전 시장을 독점할 것으로 예상됩니다.

북미의 양수 발전 산업 개요

북미의 양수 발전 시장은 적당히 세분화되어 있습니다. 이 시장의 주요 기업(순부동)에는 General Electric Company, Siemens AG, Enel SpA, Duke Energy Corporation, Voith GmbH & Co.KGaA 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 북미의 양수 발전 설비 용량(GW)과 2027년까지의 예측

- 북미의 수력 발전 설비 용량과 예측(GW 베이스, 2027년)

- 북미의 수력 발전량(TWh 베이스, 2013-2021년)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 오픈 루프

- 폐쇄 루프

- 지역별

- 미국

- 캐나다

- 멕시코

제6장 경쟁 구도

- 인수합병(M&A), 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- General Electric Company

- Siemens AG

- Enel SpA

- Duke Energy Corporation

- Voith GmbH & Co. KGaA

제7장 시장 기회와 앞으로의 동향

JHS 25.01.31The North America Pumped Hydro Storage Market is expected to register a CAGR of 4.2% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, various factors, such as the integration of variable renewable energy sources and ensuring grid stability, are expected to drive the pumped hydro storage (PHS) market during the forecast period.

- On the other hand, the environmental and social impacts of PHS projects, coupled with increasing competition from other energy storage technologies, are expected to restrain the market studied during the forecast period.

- Nevertheless, several novel PSH technologies are currently under development in the United States and Canada, which are expected to increase the development and deployment of PSH technology for energy storage while reducing costs and environmental impacts in the future, thus creating several opportunities for the market during the forecast period.

- The United States is expected to dominate the market due to growing pumped hydro storage projects across the country.

North America Pumped Hydro Storage Market Trends

Closed-loop Segment Expected to Dominate the Market

- In closed-loop systems, pumped hydro storage plants are created, in which one/both the reservoirs are artificially built, and no natural inflows of water are involved with either reservoir. The only way to store a substantial amount of energy is by locating a large body of water near the second body of water but as high above as possible. In some places, this happens naturally. In others, one or both water bodies are artificial. The moderately low energy density of pumped storage systems entails either large differences in height or large flows between reservoirs.

- Closed-loop pumped hydro storage offers high flexibility, reliability, and high-power output. Since the closed-loop pumped-hydro systems are not connected to existing river systems, their impact on the environment is less compared to open-loop pumped hydro storage systems. Moreover, they can be located where support to the grid is required and therefore do not need to be positioned near an existing river.

- As of 2021, the pumped hydro storage capacity of the United States reached around 21.912 GW, which is growing compared with recent years. According to a study published by scientists from the US Department of Energy's Pacific Northwest National Laboratory (PNNL) in 2021, the number of preliminary permits and licensing applications for closed-loop systems has considerably increased in recent years.

- Furthermore, in June 2022, the US Department of Energy's Water Power Technologies Office researched and stated that thousands of locations across the country are suitable for closed-loop pumped storage hydropower. The closed-loop pumped storage hydropower resource assessment for the United States is a large-scale study to identify closed-loop PSH sites and an important reference for developers and stakeholders. The study used spatial mapping at 30-meter resolution and identified nearly 15,000 sites where this PSH technology can be best deployed in the future.

- Owing to the above points and recent developments, the closed loop segment is expected to dominate the market during the forecast period.

United States to Dominate the Market

- The United States is the largest user of hydropower in the region and a considerable user of modern water energy storage systems like pumped hydro storage. The government is pushing to increase the installed hydro capacity of the country.

- Pumped-storage hydroelectric systems generally use more electricity to pump water to upper water storage reservoirs than they produce with stored water. In 2021, the top five states in the United States with respect to pumped-storage hydroelectricity net summer generation capacity were California, Virginia, South Carolina, Michigan, and Georgia.

- Going forward, in May 2022, the Federal Energy Regulatory Commission reported 27 licensed pumped storage projects with a total installed capacity of nearly 18.9 GW. Of these, 24 are in operation with a total capacity of about 16.5 GW. Furtherly, FERC has issued licenses for three proposed pumped storage projects since the beginning of 2014. The remaining pumped storage plants are federally owned facilities, like the Tennessee Valley Authority's Raccoon Mountain plant, and several operated by the US Army Corps of Engineers.

- Furthermore, in October 2022, the US Department of Energy's Water Power Technologies Office announced an opportunity for power developers and other stakeholders to receive technical assistance to advance hydropower's role on the electric grid through the Hydropower and Water Innovation for a Resilient Electricity System (HydroWIRES) initiative. The technical assistance opportunity aims to provide the developers and stakeholders with national lab expertise and capabilities to address valuation hurdles in pumped hydro storage project development.

- Owing to the above points, the United States is expected to dominate the pumped hydro storage market during the forecast period.

North America Pumped Hydro Storage Industry Overview

The North American pumped hydro storage market is moderately fragmented. Some of the key players in the market (in no particular order) include General Electric Company, Siemens AG, Enel SpA, Duke Energy Corporation, and Voith GmbH & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 North America Pumped Hydro Installed Capacity and Forecast in GW, till 2027

- 4.4 North America Hydro Power Installed Capacity and Forecast in GW, till 2027

- 4.5 North America Hydroelectricity Generation in TWh, 2013-2021

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.2 Restraints

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Open-loop

- 5.1.2 Closed-loop

- 5.2 By Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Siemens AG

- 6.3.3 Enel SpA

- 6.3.4 Duke Energy Corporation

- 6.3.5 Voith GmbH & Co. KGaA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록