|

시장보고서

상품코드

1635525

아시아태평양의 태양광 발전 인버터 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Asia Pacific Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

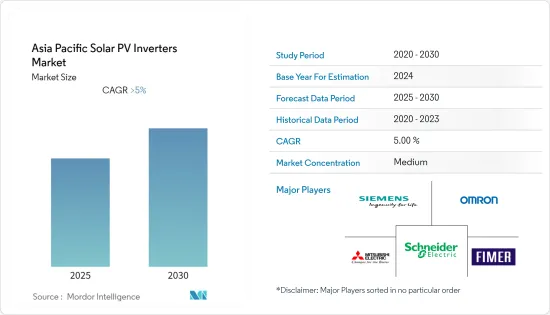

아시아태평양의 태양광 발전 인버터 시장은 예측 기간 중에 5% 이상의 CAGR을 나타낼 것으로 예측됩니다.

시장은 2020년 COVID-19 팬데믹에 의해 부정적인 영향을 받았습니다.

주요 하이라이트

- 중기적으로는 투자 증가와 야심적인 태양에너지 목표가 시장의 성장을 견인할 것으로 예상됩니다.

- 한편, 스트링 인버터의 기술적인 단점이, 예측 기간중의 태양광 발전 인버터의 성장을 방해할 것으로 예상됩니다.

- 태양광 발전 인버터에 있어서의 제품 혁신과 최신 기술의 채용은 예측 기간 중에 아시아태평양의 태양광 발전 인버터 시장에 유리한 성장 기회를 가져올 것으로 보입니다.

- 중국은 시장을 독점하고 있으며 예측기간 중 가장 높은 CAGR로 추이할 가능성이 높습니다.

아시아태평양 태양전지 인버터 시장 동향

높은 성장이 예상되는 중앙 인버터 시장

- 센트럴 인버터는 대형 그리드 피더입니다. 정격 출력이 100kWp를 넘는 태양광 발전 시스템에서 사용되는 경우가 많습니다. 접속용의 교류 전력으로 변환합니다. 이 장치의 용량은 약 50kW에서 1MW로, 실내에서도 옥외에서도 사용할 수 있습니다.

- 일반적으로 중앙 인버터는 하나의 DC-AC 변환 스테이지로 구성되어 있습니다. 절연을 위해 저주파 변압기가 사용되는 경우도 있습니다.

- 2021년에는 중국이 세계의 신규 태양광 발전(PV) 용량의 31%를 설치하여 최대의 점유율을 차지했습니다.

- 2022년 3월 중국의 인버터 제조업체인 Sungrow는 인도에서 제조능력의 규모 확대를 시작했습니다. 리드 타임과 보다 좋은 서비스 체험을 기재하고 있습니다. X 모듈형 인버터 등, 스트링 인버터와 센트럴 인버터의 신제품을 발표했습니다.

- 그 때문에 전력 수요 증가, 전력 섹터의 탈탄소화를 향한 정부의 대처, 센트럴 인버터의 비용 저하가 향후 수년간 이 부문을 견인할 것으로 예상됩니다.

시장을 독점하는 중국

- 중국에는 세계 최대 규모의 태양광 발전(PV) 패널·기기 제조 기업과 시설이 거의 모두 있으며, 중국 전체의 태양광 발전 제조 능력의 약 70%를 차지하고 있습니다. 이 기업들은 태양에너지 공급망의 다른 사업을 지배하고 있습니다. 예를 들면, 패널용 폴리실리콘, 잉곳, 웨이퍼나, 인버터나 관련 하드웨어 등의 기기의 제조입니다.

- 중국은 세계적으로도 태양광 발전의 주요 시장 중 하나이며 태양광 인버터의 최대 시장 중 하나입니다. IRENA에 따르면 2021년 중국 태양광 발전의 총 설비 용량은 306.97GW였습니다. 2021년 중국은 약 5,000만 kW의 태양광 발전을 설치했습니다.

- 중국 시장은 상당히 성장하고 있습니다. 산업정보화성(MIIT)에 따르면, 2022년 4월부터 5월에 걸쳐, 이 나라는 31GW의 태양광 발전 인버터를 생산했습니다. 시장을 견인하는 주요 요인 중 하나는 급증하는 국내 수요입니다.

- 중국 태양광발전산업협회(CPIA)에 따르면 2021년 중국이 설치한 태양광 발전 용량은 전년대비 13.9% 증가한 합계 5,488만kW로, 2022년에는 7,500-9,000만kW의 성장이 전망됨 있습니다. 게다가 2021년 중국제품의 수출액은 280억 달러 이상으로 역사적인 고수준에 달하고, 전년대비 72%의 성장세를 기록했습니다. 이는 인버터 등 중국제 태양광 발전 하드웨어에 대한 해외 수요의 높이를 보여줍니다.

- 경제 규모의 확대를 가능하게 하는 인건비와 조달 비용의 저하 등, 몇몇 거시경제적 요인에 의해 중국 기업은 인버터를 포함한 태양광 하드웨어의 세계의 비용 동향을 밀어 왔습니다. 이 때문에 국내 가격은 세계 최저 수준에 있으며 국제 인버터 비용을 낮추고 있습니다.

- 따라서 위의 요인으로 인해 중국은 세계 최대의 태양에너지 및 장비 시장으로 지속될 것으로 예상됩니다. 태양광 인버터 수요는 예측 기간 동안 꾸준히 증가할 것으로 예상됩니다.

아시아태평양 태양광 발전 인버터 산업 개요

아시아태평양의 태양광 발전 인버터 시장은 세분화되어 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2027년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 인버터 유형별

- 센트럴 인버터

- 스트링 인버터

- 마이크로 인버터

- 용도별

- 주택용

- 상업용과 산업용

- 실용규모

- 지역별

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- FIMER SpA

- Schneider Electric SE

- Siemens AG

- Mitsubishi Electric Corporation

- Omron Corporation

- General Electric Company

- SMA Solar Technology AG

- Delta Energy Systems Inc.

- Enphase Energy Inc.

- Genus Innovation Limited

- Huawei Technologies Co. Ltd

제7장 시장 기회와 앞으로의 동향

JHS 25.01.31The Asia Pacific Solar PV Inverters Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investments and ambitious solar energy targets are expected to drive the market's growth.

- On the other hand, technical drawbacks of the string inverters are expected to hamper the growth of solar PV inverters during the forecast period.

- Nevertheless, product innovation and adaptation of the latest technologies in solar PV inverters are likely to create lucrative growth opportunities for the Asia-Pacific solar PV inverters market in the forecast period.

- China dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies.

APAC Solar PV Inverters Market Trends

Central Inverters Segment Expected to Witness High Growth

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50 kW to 1 MW and can be used indoors or outdoors.

- Generally, a central inverter consists of one DC-AC conversion stage. Some inverters also have a DC-DC boost stage to increase their MPP (Maximum Power Point) voltage range. Low-frequency transformers are sometimes used to boost the AC voltage and provide isolation at the output. However, this reduces efficiency and increases the inverter's size, weight, and cost.

- In 2021, China installed the largest share of the world's new solar photovoltaic (PV) capacity, at 31% of the total capacity. In comparison, India accounted for about 7% of the world's solar PV installed capacity.

- In March 2022, Chinese inverter manufacturer Sungrow inaugurated its expanded scale of manufacturing capacity in India. The company developed and scaled the India factory to 10 GW/annum capacity for its customers locally and globally with lesser lead time and better service experience. At the inauguration ceremony, Sungrow launched new products in the string and central inverter categories, including models SG350HX and 1+X modular inverter.

- Therefore, the growing electricity demand, the government's efforts to decarbonize the power sector, and the declining costs of central inverters are expected to drive the segment in the coming years.

China to Dominate the Market

- China is home to nearly all the largest solar photovoltaic (PV) panel and equipment manufacturing companies and facilities globally, with about 70% of China's global solar PV manufacturing capacity. These companies also dominate other businesses in the solar energy supply chain. For example, the manufacture of polysilicon, ingot, and wafers for panels and equipment, such as inverters and related hardware.

- China is one of the major solar PV markets globally, and it is one of the largest markets for solar inverters. According to IRENA, in 2021, China had a total installed solar capacity of 306.97 GW. In 2021, China installed nearly 50 GW of solar power.

- The Chinese market has been growing considerably. According to the Ministry of Industry and Information Technology (MIIT), from April to May 2022, the country produced 31 GW of solar PV inverters. One of the primary factors driving the market is the burgeoning domestic demand.

- According to the China Photovoltaic Industry Association (CPIA), China installed a total of 54.88 GW solar capacity in 2021, up 13.9% year-on-year, and is expected to grow by 75-90 GW in 2022. Additionally, in 2021, Chinese-made products' export value hit a historic high at over USD 28 billion, witnessing a 72% year-on-year growth. It demonstrates the overseas demand for Chinese solar PV hardware, such as inverters.

- Due to several macroeconomic factors, such as lower labor and procurement costs enabling larger scales of economies, Chinese companies have driven down the global cost trends in solar PV hardware, including inverters. Due to this, domestic prices are among the lowest in the world, driving down international inverter costs.

- Hence, due to the above factors, China is expected to remain the world's largest solar energy and equipment market. The demand for solar inverters is expected to rise steadily during the forecast period.

APAC Solar PV Inverters Industry Overview

The Asia-Pacific solar PV inverters market is fragmented in nature. Some of the major players in the market (in no particular order) include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIMER SpA

- 6.3.2 Schneider Electric SE

- 6.3.3 Siemens AG

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 Omron Corporation

- 6.3.6 General Electric Company

- 6.3.7 SMA Solar Technology AG

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Enphase Energy Inc.

- 6.3.10 Genus Innovation Limited

- 6.3.11 Huawei Technologies Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록