|

시장보고서

상품코드

1636109

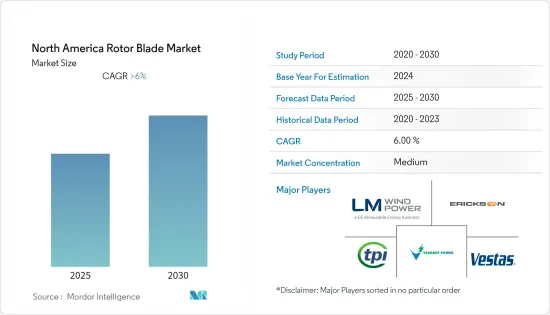

북미의 로터 블레이드 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)North America Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

북미 로터 블레이드 시장은 예측 기간 동안 CAGR 6% 이상을 기록할 전망

주요 하이라이트

- 시장은 2020년에 COVID-19의 악영향을 받았습니다. 현재 시장은 대유행 전 수준에 도달하고 있습니다. 장기적으로 정부의 지원 시책과 민간 투자는 이 나라의 로터 블레이드 수요를 견인합니다.

- 반면, 관련 운송 비용의 높이와 태양광 발전, 수력 발전과 같은 대체 클린 전원의 비용 경쟁은 시장 성장을 방해할 가능성이 있습니다.

- 제품 혁신과 최신 로터 블레이드 기술의 적응은 로터 블레이드 시장에 곧 유리한 성장 기회를 창출할 것으로 예상됩니다. 미국은 풍력에너지 수요가 증가하고 있으며 풍력 터빈용 로터 블레이드 시장을 독점할 것으로 예상됩니다.

북미 로터 블레이드 시장 동향

육상 부문이 시장을 독점

- 육상 풍력 발전 기술은 설치된 메가와트 용량당 발전량을 극대화하고 풍속이 낮은 더 많은 장소를 커버하기 위해 지난 5년간 진화해 왔습니다. 이 외에도 최근에는 풍력 터빈의 대형화가 진행되어 허브의 높이가 높고 직경이 넓고 풍력 터빈의 블레이드가 커지고 있습니다.

- 국제재생가능에너지기구(IRENA)에 따르면 2022년 북미 육상풍력발전설비 용량은 1억6,342만kW로 2021년 대비 약 5.9% 증가할 전망입니다.

- 또한 국제 에너지기구(IEA)에 따르면 평준화 에너지 비용(LCOE)과 세계 가중 평균 총 CAPEX는 2016년 76.1달러/MWh와 1,730.5달러/MWh에서 2021년 48.2 달러/MWh와 1,396.3 USD/MWh로 감소합니다. 또한 LCOE와 평균 가중 CAPEX는 2025년까지 각각 44.6 USD/MWh와 1,338.2 USD/MWh로 감소할 것으로 예상됩니다.

- 캐나다는 북미 제2위의 풍력 발전 설비 용량을 가지고, 2022년의 총 설비 용량은 1,529만 kW입니다.

- 2021년 시점에서 캐나다의 육상 풍력 발전 설비 용량의 합계는 세계 제8위로, 세계의 육상 풍력 발전 설비 용량의 약 2%를 차지하고 있습니다. 는 317의 풍력 발전 프로젝트가 있습니다. 또한, 5년 이내에 약 31의 육상과 해상 풍력 발전 프로젝트가 계획되고 있습니다.

- 2021년, 캐나다의 총 발전량에 차지하는 풍력에너지의 비율은 5.86%에 달하고, 2015년의 4.21%로부터 증가했습니다. 2022년 현재 건설중인 그리즐리 베어 크릭 풍력 발전 프로젝트(152MW)와 와일드 로즈 2 풍력발전 프로젝트(192MW) 등 1.5MW를 넘는 대형 풍력발전소가 증가하고 있습니다. 따라서 로터 블레이드 수요는 예측 기간 동안 증가할 것으로 예상됩니다.

- 따라서, 상기 요인으로부터, 육상 풍력 터빈용 로터 블레이드는 LCOE의 저하와 CAPEX의 삭감, 깨끗한 에너지원에 의한 높은 에너지 수요와 함께, 예측 기간 중에 성장할 것으로 예상됩니다.

시장을 독점하는 미국

- 미국의 풍력발전은 최근 크게 성장하고 있습니다.풍력에너지 기술의 진보에 의해 풍력에 의한 발전비용은 저하하고 있습니다. 대규모 풍력 발전의 성장에 기여하고 있습니다.

- 미국의 대규모 풍력 발전 부문은 국내 에너지 생산을 촉진하는 것을 목적으로 한 미국 퍼스트 시책에 의해 정부로부터 절대적인 지원을 받고 있는 것으로부터, 중요한 개발 부문으고 생각되고 있습니다.

- 국제재생가능에너지기구(IRENA)에 따르면 풍력에너지 시장에서는 풍력발전의 총설비 용량이 대폭 증가하고 있습니다.

- 게다가 2021년 12월, 미국 국립 재생 가능 에너지 실험실(NREL)의 연구자들은 재활용 가능한 열가소성 플라스틱과 적층 조형(3차원 (3D) 인쇄로 알려져 있음)을 조합하여 첨단 풍력 터빈 블레이드를 제조 연구를 실시했습니다. 이 진보는 기술 혁신을 자극하고 미국 제조업의 에너지 생산성을 향상시키고 미국 내에서 최첨단 제품의 제조를 가능하게하는 것을 목적으로 한 미국 에너지부의 선진 제조 오피스로부터의 자금 원조에 의해 실현했습니다.

- 2022년 9월, 바이든-해리스 정권은 정부가 새로운 부양식 해상 풍력 발전 플랫폼의 개발을 위한 협조 행동을 개시한다고 발표했습니다. 대통령 조 바이든은 30 기가와트(GW)의 해상 풍력을 도입하는 목표를 설정했습니다.

- 따라서, 주로 해상에서 계획되고, 계획중의 풍력 발전 프로젝트의 수에 의해 풍력 터빈용 로터 블레이드 수요는 예측 기간 중에 증가할 것으로 예상됩니다.

북미 로터 블레이드 산업 개요

북미의 풍력 터빈용 로터 블레이드 시장은 세분화되어 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 전개 장소

- 온쇼어

- 오프쇼어

- 블레이드 재료

- 탄소섬유

- 유리 섬유

- 기타 블레이드 재료

- 지역

- 미국

- 캐나다

- 멕시코

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- TPI Composites Inc.

- LM Wind Power(GE Renewable Energy 사업)

- Nordex SE

- Siemens Gamesa Renewable Energy, SA

- Vestas Wind Systems A/S

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Enercon GmbH

제7장 시장 기회와 앞으로의 동향

JHS 25.01.31The North America Rotor Blade Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels. Over the long term, supportive government policies and private investments drive the country's rotor blade demand.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder the market's growth.

- Nevertheless, product innovation and adaptation of the latest rotor blade technologies are expected to create soon lucrative growth opportunities for the France rotor blade market. The United States is expected to dominate the wind turbine rotor blade market, with the increasing demand for wind energy in the country.

North America Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- According to the International Renewable Energy Agency (IRENA), in 2022, the North American onshore wind turbine capacity additions registered to be 163.42 GW, an increase of around 5.9% as compared to 2021.

- Moreover, according to the International Energy Agency (IEA), the levelized cost of energy (LCOE) and global weighted average total CAPEX decreased from 76.1 USD/MWh and 1730.5 USD/MWh in 2016 to 48.2 USD/MWh and 1396.3 USD/MWh in 2021. In addition, the LCOE and average weighted CAPEX are expected to decrease to 44.6 USD/MWh and 1338.2 USD/MWh, respectively, by 2025.

- Canada holds North America's second-largest installed wind power capacity, with a total installed capacity of 15.29 GW in 2022. The country increased its installed wind power capacity by around 991 MW in 2021.

- As of 2021, Canada ranked eighth in the globe in terms of total onshore installed capacity, around 2% of the world's onshore wind capacity. According to the Canadian Renewable Energy Association (CREA), Canada has 317 wind energy projects producing power. Additionally, around 31 onshore and offshore wind power projects are planned for five years.

- In 2021, the share of wind energy in the total electricity generation in Canada amounted to 5.86%, which grew as compared to 4.21% in 2015. The development trends indicate not only the increasing investments in the wind sector but also that the size of wind farms is growing. The country is witnessing an increasing number of large wind farms with more than 1.5 MW capacity, such as the Grizzly Bear Creek Wind Project (152 MW) and Wild Rose 2 Wind Project (192 MW) under construction as of 2022. Large-size wind farms are expected to require taller and higher-capacity wind turbines. Hence, the demand for rotor blades is expected to increase during the forecast period

- Therefore, based on the above-mentioned factors, the onshore wind turbine rotor blade is expected to grow due to declining LCOE and reduced CAPEX, coupled with high energy demand through clean sources, during the forecast period.

United States to Dominate the Market

- Wind power generation in the United States has grown significantly in recent years. Advances in wind energy technology have decreased the cost of producing electricity from wind. Various Government regulations and financial incentives for renewable energy in the United States and other countries have contributed to growth in large-scale wind power generation.

- The large-scale wind power sector in the United States is receiving immense support from the government due to the America First policy, which aims to boost domestic energy production. The offshore wind power sector is considered a significant development area, as the country has a large coastal area for leasing.

- According to the International Renewable Energy Agency (IRENA), the wind energy market witnessed a significant rise in the total installed wind power capacity. In 2022, the United States wind turbine capacity additions was140.82 GW, an increase of around 5.9% compared to 2021.

- Furthermore, in December 2021, National Renewable Energy Laboratory (NREL) researchers conducted research on a combination of recyclable thermoplastics and additive manufacturing (better known as three-dimensional [3D] printing) to manufacture advanced wind turbine blades. The advance was made possible by funding from the US Department of Energy's Advanced Manufacturing Office-awards designed to stimulate technology innovation, improve the energy productivity of American manufacturing, and enable the manufacturing of cutting-edge products in the United States.

- In September 2022, the Biden-Harris Administration announced that the country's government was launching coordinated actions to develop new floating offshore wind platforms. The country's president, Joe Biden, set a target of deploying 30 gigawatts (GW) offshore wind by 2030.

- Hence, with the number of wind power projects planned and in the pipeline, majorly in offshore locations, the demand for wind turbine rotor blades is expected to increase during the forecast period.

North America Rotor Blade Industry Overview

The North American wind turbine rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include TPI Composites SA, LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy, S.A., Vestas Wind Systems A/S, and Enercon GmbH., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TPI Composites Inc.

- 6.3.2 LM Wind Power (a GE Renewable Energy business)

- 6.3.3 Nordex SE

- 6.3.4 Siemens Gamesa Renewable Energy, S.A.

- 6.3.5 Vestas Wind Systems A/S

- 6.3.6 MFG Wind

- 6.3.7 Sinoma wind power blade Co. Ltd

- 6.3.8 Aeris Energy

- 6.3.9 Enercon GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록