|

시장보고서

상품코드

1636110

유럽의 로터 블레이드 시장 : 점유율 분석, 산업 동향·통계, 성장 예측(2025-2030년)Europe Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

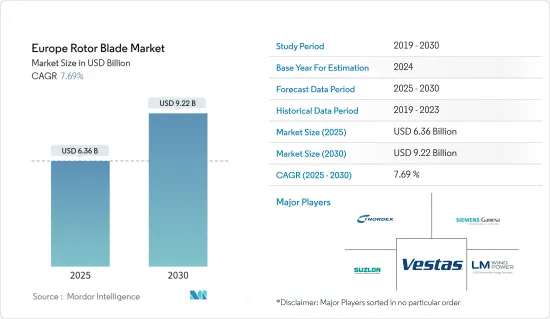

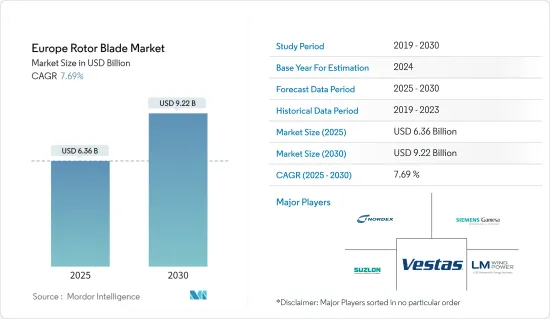

유럽의 로터 블레이드 시장 규모는 2025년에 63억 6,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 7.69%로, 2030년에는 92억 2,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 해외 및 온쇼어 풍력 발전 설비 증가, 풍력 발전 비용의 감소, 풍력 발전 부문에 대한 투자 증가 등의 요인이 예측 기간 동안 유럽 로터 블레이드 시장을 견인할 것으로 예측됩니다.

- 한편, 이에 따른 운송 비용 상승, 태양광 발전, 수력 발전 등 대체 클린 전원의 비용 경쟁 등의 요인은 예측 기간 동안 시장 성장을 억제할 수 있습니다.

- 풍력발전 사업에서는 비용 효율적인 솔루션이 요구되고 있으며, 고효율 제품은 산업의 역학을 바꿀 수 있는 힘이 있습니다. 오래된 터빈이 교체된 이유는 파손의 원인이 아니라 보다 효과적인 블레이드가 시장에서 판매되었기 때문입니다. 따라서 기술의 진보는 결국 로터 블레이드 시장에 훌륭한 기회를 만들어냅니다.

유럽 로터 블레이드 시장 동향

해외 부문이 시장을 독점

- 유럽의 2022년 신규 풍력 발전 설비 용량은 1,859만 kW. 유럽의 전력 수요는 유행의 종식 후 산업 활동의 시작과 급속한 도시화와 함께 증가하고 있습니다. 이 지역은 또한 증가하는 전력 수요를 충족시키기 위해 재생 가능 에너지의 비율이 증가하고 있습니다.

- 유럽에는 태양광, 풍력, 수력, 바이오매스, 지열 등 발전에 필요한 재생 가능 에너지 자원이 풍부하게 있다고 생각되고 있습니다. 탈탄소화, 전력 계통의 지속가능성, 야심적인 목표, 클린 에너지로의 이행이라고 하는 요인이, 유럽의 풍력에너지 시장을 견인하고 있습니다.

- 2022년 12월, 유럽 위원회는 2023년 재생 가능 에너지 원법을 승인하고, 2023년 해양 풍력에너지법은 환경을 개선하고, 유럽 전력 시장에서 온실가스 중립적인 전력 공급 실현에 중점을 둡니다.

- 또한 2022년 5월 유럽위원회는 REPowerEU 계획을 발표했습니다. 구체적인 방안이 담겨 있습니다.

- REPowerEU의 발표에 따라, 해외 풍력의 추가 확대를 달성하기 위해 에스비엘 선언이 형성되어 벨기에, 덴마크, 독일, 네덜란드를 연결하는 해외 재생 가능 에너지 시스템 인 유럽 녹색 발전소로서의 북해와 경우에 따라서는 북해에너지협력(NSEC) 회원국을 포함한 다른 북해 파트너를 공동 개발하기로 결정되어 2050년까지 150GW의 해외풍력이라는 새로운 목표를 내걸었습니다.

- 국제재생가능에너지기구에 따르면, 유럽은 세계의 해양풍력발전시장의 주요 지역 중 하나입니다. 풍력 산업과 해외 부문 협정 이 협정은 해외 풍력이 중요하고 필수적인 기회임을 인식하고 2050년까지 50 개의 윈드 팜에서 40GW의 해양 풍력을 개발할 것을 약속합니다. 풍력 발전의 대폭적인 개발이 기대됩니다.

- 또한 2022년 6월에는 Killybegs 어업조합과 Sinbad Marine Services가 아일랜드의 도니골 앞바다에 건설하는 부양식 풍력발전소를 제안하고, 스웨덴의 부양식 풍력발전 개발기술 제공업체인 헥시콘과 각서를 나누었습니다.

- 이상의 것으로부터, 예측 기간중은 오프쇼어 부문이 시장을 독점할 것으로 예상됩니다.

시장을 독점하는 영국

- 영국은 풍력발전으로 성장하고 있는 국가 중 하나입니다.

- 또한 영국은 러시아의 가스 공급에 의존하지 않기 때문에 다른 EU 국가와 비교하여 러시아 우크라이나 분쟁의 영향을 크게 받지 않았습니다. 영향을 줄이고 국내의 재생 가능 에너지 개발을 촉진하기 위해 에너지 안보 전략을 실시했습니다.

- 이 국가는 해외 풍력 발전 프로젝트의 선구자 중 하나이기 때문에 2016-2021년 사이 영국에서는 해외 풍력 발전에 약 257억 9,000만 달러가 투자되고 해외 풍력 발전 부문의 좋은 투자 환경으로 실증되었습니다.

- 게다가 2022년 4월, 정부는 영국의 에너지 안보를 강화하는 전략적 계획을 발표하고, 2030년까지 최대 50GW의 해양 풍력 발전 용량을 가동시키는 목표가 담겨졌습니다. 목표에는 5GW의 대규모 부양식 해양 풍력 발전 설비가 포함됩니다.

- 또한 2022년 1월 영국 정부는 부양식 해양 풍력 발전 프로젝트의 연구 개발을 추진하기 위해 8,250만 달러 이상의 공적·민간 자금을 투입한다고 발표했습니다. 11개의 프로젝트에 4,190만 달러를 투자할 예정입니다.

- 따라서, 상기의 점으로부터, 예측 기간중은 영국이 시장을 독점할 것으로 예상됩니다.

유럽 로터 블레이드 산업 개요

유럽의 로터 블레이드 시장은 세분화되어 있습니다.

2022년 2월 Nordex는 독일 로스토크 GVZ 로터 블레이드 공장에서 로터 블레이드 생산을 2022년 6월 말까지 중단한다고 발표했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 오프쇼어와 육상 풍력발전설비 증가

- 풍력발전 비용의 저하

- 억제요인

- 대체 재생 가능 에너지와의 경쟁 격화

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 전개 장소

- 온쇼어

- 오프쇼어

- 블레이드 재료

- 탄소섬유

- 유리 섬유

- 기타 블레이드 재료

- 지역

- 독일

- 프랑스

- 스페인

- 영국

- 이탈리아

- 노르딕

- 터키

- 러시아

- 기타 유럽

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- Suzlon Energy Limited

- Enercon GmbH

- LM Wind Power(GE Renewable Energy 사업)

- BayWa RE AG

- Market Ranking/Share Analysis

제7장 시장 기회와 앞으로의 동향

- 고효율·경량 풍력 터빈의 개발

The Europe Rotor Blade Market size is estimated at USD 6.36 billion in 2025, and is expected to reach USD 9.22 billion by 2030, at a CAGR of 7.69% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing number of offshore and onshore wind energy installations, the declining cost of wind energy, and increasing investments in the wind power sector are anticipated to drive the Europe rotor blade market during the forecast period.

- On the other hand, factors such as the accompanying high cost of transportation and cost competitiveness of alternate clean power sources like solar power, hydropower, etc., can potentially restrain the market growth during the forecast period.

- Nevertheless, the wind power business has sought cost-effective solutions, and a highly efficient product has the ability to alter the industry's dynamics. There were instances where old turbines were replaced not owing to damage but because more effective blades were sold in the market. Thus, technological advancements eventually create a wonderful opportunity for the market of rotor blades.

Europe Rotor Blade Market Trends

Offshore Segment to Dominate the Market

- Europe accounted for 18.59 GW of new wind installed capacity in 2022. The electricity demand in Europe has increased after the departure of the pandemic, coupled with the commencement of industrial activities and rapid urbanization. The region has also witnessed a growing share of renewables to fulfill the increasing electricity demand.

- Europe is considered to have ample renewable energy resources to generate electricity, such as solar, wind, hydro, biomass, geothermal, etc. A good number of countries in Europe have become at the forefront of utilizing renewable energy globally. Factors such as decarbonization, sustainability of power systems, ambitious targets, and clean energy transition have driven the offsore wind energy market of Europe.

- In December 2022, the European Commission approved the 2023 Renewable Energy Sources Act, and the 2023 Offshore Wind Energy Act aims to improve the environment and focus on achieving a greenhouse gas-neutral electricity supply in the power market of Europe.

- Further, in May 2022, the European Commission published the REPowerEU plan, which contains a series of concrete measures designed to phase out Russian fossil fuels and boost the production of renewable energy in the EU. This plan would help further develop offshore wind energy in the region.

- With the REPowerEU announcement, the Esbjerg Declaration was formed to achieve the further expansion of offshore wind and decided to jointly develop The North Sea as a Green Power Plant of Europe, an offshore renewable energy system connecting Belgium, Denmark, Germany, and the Netherlands, and possibly other North Sea partners, including the members of the North Seas Energy Cooperation (NSEC) and set out a new target of 150 GW of offshore wind by 2050.

- According to International Renewable Energy Agency, Europe is among the leading regions in the global offshore wind power market. In 2022, it added 4,264 MW, reaching 30.66 GW. In March 2022, the French government entered into an offshore sector agreement with France's wind industry. The agreement recognizes that offshore wind is a significant and vital opportunity and commits to developing 40 GW of offshore wind by 2050 spread over 50 wind farms. This is expected to witness considerable development in offshore wind power.

- Also in June 2022, The Killybegs Fishermen's Organization and Sinbad Marine Services have proposed a floating wind farm to be built offshore Donegal, Ireland, and have signed a Memorandum of Understanding with Swedish floating wind developer and technology provider, Hexicon.

- Therefore, owing to the above points, the offshore segment is anticipated to dominate the market during the forecast period.

United Kingdom to Dominate the Market

- The United Kingdom is one of the growing countries in wind energy generation. The country stands as the best location for wind power in Europe. By 2022, the United Kingdom installed a wind capacity of 28.54 GW.

- Moreover, the United Kingdom is not heavily affected by the Russia-Ukraine conflict compared to the other EU countries, Since the country is not dependent on the Russian gas supply. However, in April 2022, the former UK Prime Minister implemented an energy security strategy to lessen the war impact and boost renewable energy development within the country. This will, in turn, support the growth of the wind energy market and further aid the development of the wind rotor blade market.

- Since the country is one of the forerunners in offshore wind projects, between 2016 and 2021, nearly USD 25.79 billion was invested in offshore wind in the United Kingdom, witnessing a favorable investment environment in the offshore wind sector.

- Furthermore, in April 2022, the government announced a strategic plan to boost Britain's energy security, including an increased target of up to 50 GW of operating offshore wind capacity by 2030. The 50GW offshore wind target includes 5 GW of large-scale floating wind installations.

- Moreover, in January 2022, the UK government announced more than USD 82.5 million of public and private funding to advance research and development in floating offshore wind projects. The government plans to invest USD 41.9 million in 11 projects as part of the Floating Offshore Wind Demonstration Program.

- Therefore, owing to the above points, the United Kingdom is anticipated to dominate the market during the forecast period.

Europe Rotor Blade Industry Overview

The Europe rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include Nordex SE, Siemens Gamesa Renewable Energy, SA, Vestas Wind Systems A/S, Suzlon Energy Limited, and LM Wind Power (a GE Renewable Energy business), among others.

In February 2022, Nordex announced that it would cease the production of rotor blades at the Rostock GVZ rotor blade site in Germany by the end of June 2022. The decision has been taken primarily due to a shift towards larger blades that are not manufactured at Rostock.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing number of offshore and onshore wind energy installations

- 4.5.1.2 Declining cost of wind energy

- 4.5.2 Restraints

- 4.5.2.1 Increasing Competition from Alternate Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 Spain

- 5.3.4 United Kingdom

- 5.3.5 Italy

- 5.3.6 NORDIC

- 5.3.7 Turkery

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 Vestas Wind Systems A/S

- 6.3.4 Suzlon Energy Limited

- 6.3.5 Enercon GmbH

- 6.3.6 LM Wind Power (a GE Renewable Energy business)

- 6.3.7 BayWa R.E AG

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of High Efficiency and light weight wind turbines