|

시장보고서

상품코드

1636164

스페인의 전자상거래 물류 시장 전망 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Spain E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

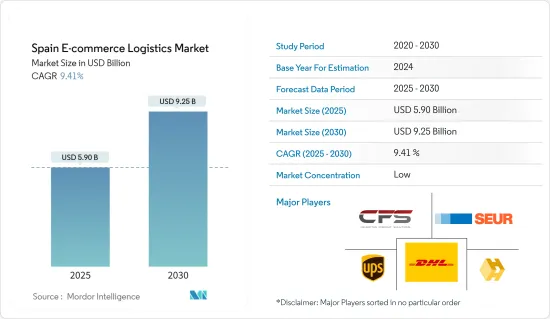

스페인의 전자상거래 물류 시장 규모는 2025년에 59억 달러로 추정되며, 예측 기간(2025-2030년)의 연평균 성장율(CAGR)은 9.41%를 나타낼 전망이며, 2030년에는 92억 5,000만 달러에 달할 것으로 예측됩니다.

업계 전문가들에 따르면 2022년 스페인의 전자상거래 시장에서 온라인으로 제품이나 서비스를 구매한 35-44세 인구는 약 550만 명, 45-54세 인구는 545만 명으로 그 뒤를 이었습니다.

Statista 설문조사 응답자의 25%는 2022년 스페인의 소비자들이 오프라인 매장이 아닌 온라인에서 특정 제품을 구매한 주요 이유 중 하나로 편안함을 꼽았습니다. 또한 응답자의 14%는 더 나은 가격, 할인 또는 혜택 때문에 온라인에서 구매했다고 답했습니다. 그러나 온라인 쇼핑의 원동력으로 간편한 프로세스를 꼽은 응답자는 전체 표본의 5%에 불과했습니다.

업계 전문가가 2023년 7월 실시한 조사에 따르면 스페인은 다른 참여국 중 전자상거래 지출액으로 5위였습니다. 전자상거래의 보급은 팬데믹(세계적 대유행) 중에 급증했지만, 봉쇄규제가 해제되어 오프라인 매장이 재개된 직후에는 완만해졌습니다.

스페인의 전자상거래 물류 시장 동향

온라인 쇼핑 이용자 증가

스페인 통계청에 따르면 2022년에는 31.7%의 기업이 전자상거래에 참여하여 2021년에 비해 20.3% 증가했습니다. 변화하는 소비자 선호도와 시장 역학 관계에 대응하기 위해 많은 기업이 디지털 전환을 추진했습니다.

2023년에 발표된 유로스탯 보고서에 따르면 전자상거래 상품과 서비스를 구매한 인터넷 사용자의 비율은 2020년 67%에서 2023년 76%로 급증했습니다. 스페인의 전반적인 인터넷 보급률 증가로 인해 더 많은 사람들이 온라인 쇼핑 플랫폼에 접속할 수 있게 될 것입니다.

업계 전문가들이 그 해에 작성한 보고서에 따르면 스페인 인구의 인터넷 접속률은 2018년 87%에서 2023년 95%까지 증가할 것으로 예상됩니다. 2020년 1월에 발간된 유럽 연합의 통신 보안 5G 구축에 따르면 스페인은 5G와 그 발전의 원동력이 되어 왔으며 계속해서 유럽연합을 지원하고 있습니다.

상승하는 창고 임대료

2022년 마드리드 물류시장은 2012년 대비 5% 증가한 126만㎡에 달했습니다. 물류 공간에 대한 수요는 왕성했으며 2021년 86건에 대해 92건의 거래가 기록되었습니다.

2022년 말까지 발렌시아 물류시장의 취득면적은 약 39만㎡가 되어 전년 기록(37.7만㎡)을 3% 웃돌았습니다.

업계 보고서에 따르면 2022년 마드리드의 5,000㎡ 이상의 창고 임대료는 2020년 이후 1㎡당 EUR75(80.48달러)로 안정적으로 유지되었습니다. 반면 발렌시아의 창고 임대료는 2021년 54유로(57.95달러)에서 2022년에는 66유로로 상승했습니다. 바르셀로나도 평방미터당 임대료가 2021년 87유로(93.36달러)에서 2022년에는 90유로(96.58달러)로 상승했습니다.

바르셀로나의 카탈루냐 물류 시장은 2022년에도 긍정적인 추세를 유지했습니다. 정보통에 따르면, 창고 면적은 821,000㎡를 넘어, 바르셀로나의 60건의 거래에 분포되어 있습니다.

스페인의 전자상거래 물류 산업 개요

스페인의 전자상거래 물류 시장은 다양한 기업이 존재하기 때문에 경쟁이 치열합니다. 스페인의 전자상거래 물류 시장은 세분화되어 있으며 시장 참여자 간의 경쟁이 치열합니다. 경쟁 환경은 역동적이며, 지속적인 개발과 경쟁으로 인해 기업은 새로운 트렌드, 기술 발전 및 변화하는 소비자 선호도에 적응해야 합니다. UPS와 같은 글로벌 물류 대기업은 특급 배송부터 공급망 관리까지 다양한 서비스를 제공하며 강력한 입지를 구축하고 있습니다. 그러나 스페인의 전자상거래 물류 산업은 진입 장벽이 낮거나 중간 정도이기 때문에 새로운 기업이 시장에 진입할 수 있습니다. 이 시장에서 가장 중요한 업체로는 DHL International Gmbh, Celeritas, Seur가 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 현재의 시장 시나리오

- 기술 동향

- 업계의 밸류체인 분석

- 정부의 규제와 대처

- 전자상거래에 대한 통찰

- 밸류체인, 서플라이체인 분석

- 수요 및 공급 분석

제5장 시장 역학

- 성장 촉진요인

- B2C 전자상거래 성장

- 도시화와 인구밀도

- 억제요인

- 인프라의 과제

- 마지막 마일 배송의 복잡성

- 기회

- 월경 전자상거래 확대

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자, 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제6장 시장 세분화

- 서비스별

- 수송

- 창고 및 재고 관리

- 부가가치 서비스(라벨링 및 패키징)

- 사업별

- B2B

- B2C

- 목적지별

- 국내

- 국제, 크로스 테두리

- 상품별

- 패션, 의류

- 가전제품

- 가구

- 미용 및 퍼스널케어 제품

- 기타(완구, 식품 등)

제7장 경쟁 구도

- 기업 프로파일

- FedEx Corporation

- UPS

- DHL

- Amphora Logistics

- CTT Express

- Celeritas

- Correos Express

- Citibox

- SEUR

- Nacex*

- 기타 기업

제8장 시장 기회와 앞으로의 동향

제9장 부록

HBR 25.02.10The Spain E-commerce Logistics Market size is estimated at USD 5.90 billion in 2025, and is expected to reach USD 9.25 billion by 2030, at a CAGR of 9.41% during the forecast period (2025-2030).

As indicated by industry experts, in 2022, about 5.50 million people between 35 and 44 years of age bought products or services online in the Spanish e-commerce market, followed by 5.45 million users aged between 45 and 54 years.

According to 25% of Statista survey respondents, comfort was among the main reasons Spanish consumers bought certain products online rather than from bricks and mortar shops in 2022. In addition, 14% of respondents said that they had purchased online due to better prices, discounts, or offers. However, only 5% of the sample mentioned the easy process as the driving factor for online shopping.

As per a study conducted in July 2023 by industry experts, Spain ranked fifth in terms of e-commerce expenditure among other participating countries. E-commerce penetration surged during the pandemic, though moderated shortly after the ending of lockdown restrictions and the re-opening of physical retail stores.

Spain E-commerce Logistics Market Trends

The Rise in the Number of Online Shoppers

According to the National Statistics Institute of Spain, in 2022, 31.7% of businesses were involved in e-commerce, increasing the volume of business by 20.3% compared to 2021. In order to cope with changing consumer preferences and market dynamics, a number of businesses have undertaken digital transformation initiatives.

A Eurostat report published in 2023 stated that the percentage of internet users who bought e-commerce goods and services leaped from 67% in 2020 to 76% in 2023. More people will be able to access online shopping platforms due to an increase in the overall internet penetration rate in Spain.

The Spanish population's access to the Internet increased from 87% in 2018 to 95% by 2023, according to a report compiled by industry experts for that year. Spain has been a driving force for 5G and its development and continues to support the Union, as outlined in the Communication Secure 5G Deployment in the European Union, published in January 2020.

Warehouse Rent on the Rise

In 2022, Madrid's logistics market reached a take-up volume of 1.26 million sq. m, a 5% increase from 2012. There was a strong demand for logistics space, with 92 transactions recorded compared to 86 in 2021.

By the end of 2022, the Valencia logistics market had almost 390,000 sq. m of take-up, exceeding the previous year's record by 3% (377,000 sq. m).

In 2022, Madrid's rent for warehouses sized over 5,000 sq. m remained steady at EUR 75 (USD 80.48) per square meter since 2020, according to industry reports. Meanwhile, rent for warehouses in Valencia shot from EUR 54 (USD 57.95) in 2021 to EUR 66 in 2022. Barcelona also recorded an increase in rent from EUR 87 (USD 93.36) in 2021 to EUR 90 (USD 96.58) in 2022 per sq. m.

The Catalan logistics market in Barcelona continued its positive trend in 2022. As per sources, warehouse take-up exceeded 821,000 sq. m, distributed across 60 transactions in Barcelona.

Spain E-commerce Logistics Industry Overview

The market for e-commerce logistics in Spain is competitive, owing to the presence of various companies. The e-commerce logistics market in Spain is fragmented and depicts intense competition among the market players. The competitive landscape is dynamic, with ongoing developments and competition driving companies to adapt to emerging trends, technological progress, and changing consumer preferences. Global logistics giants such as UPS have a strong presence, providing a range of services from express delivery to supply chain management. However, the e-commerce logistics industry in Spain has low to moderate barriers to entry, allowing new companies to enter the market. DHL International Gmbh, Celeritas, and Seur are among the most important players in this market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Insights into the E-commerce

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Demand and Supply Analysis

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Growth of B2C E-commerce

- 5.1.2 Urbanization and Population Density

- 5.2 Restraints

- 5.2.1 Infrastructure Challenges

- 5.2.2 Last-mile Delivery Complexities

- 5.3 Opportunities

- 5.3.1 Cross-border E-commerce Expansion

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling and Packaging )

- 6.2 By Business

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross-border

- 6.4 By Product

- 6.4.1 Fashion and Apparel

- 6.4.2 Consumer Electronics and Home Appliances

- 6.4.3 Furniture

- 6.4.4 Beauty and Personal Care Products

- 6.4.5 Other Products (Toys, Food Products, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 FedEx Corporation

- 7.2.2 UPS

- 7.2.3 DHL

- 7.2.4 Amphora Logistics

- 7.2.5 CTT Express

- 7.2.6 Celeritas

- 7.2.7 Correos Express

- 7.2.8 Citibox

- 7.2.9 SEUR

- 7.2.10 Nacex*

- 7.3 Other Companies