|

시장보고서

상품코드

1636175

아시아태평양의 전기자동차용 리튬이온 배터리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Asia-Pacific Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

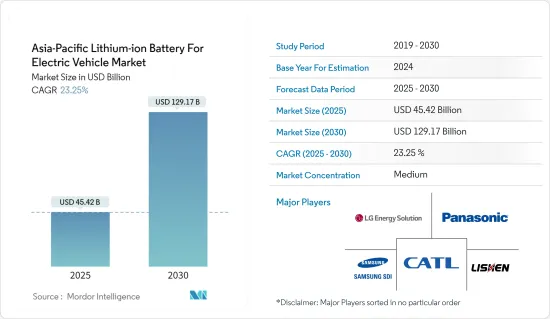

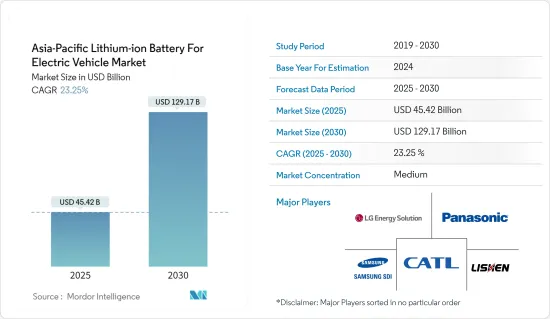

아시아태평양의 전기자동차용 리튬이온 배터리 시장 규모는 2025년에 454억 2,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 23.25%의 CAGR로 2030년에는 1,291억 7,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 리튬이온 배터리 가격 하락, 전기자동차 보급 확대, 정부 지원 정책 및 이니셔티브는 예측 기간 중기적으로 아시아태평양의 전기자동차용 리튬이온 배터리 시장의 성장을 촉진할 것으로 예상됩니다.

- 반면, 대체 배터리 기술의 부상은 예측 기간 동안 시장 성장을 저해할 가능성이 높습니다.

- 신흥국의 하이브리드 전기자동차(HEV)용 리튬이온 배터리 수요는 아시아태평양의 전기자동차용 리튬이온 배터리 시장에 막대한 기회를 창출할 것으로 예상됩니다.

아시아태평양의 전기자동차용 리튬이온 배터리 시장 동향

배터리 전기자동차(BEV) 부문은 괄목할 만한 성장세를 보이고 있습니다.

- 배터리 전기자동차(BEV)는 일반적으로 전기 모터가 장착된 전기자동차라고도하며, BEV는 내연 기관(ICE), 연료 탱크, 배기관을 장착하지 않고 추진력을 전기에 의존하는 완전 전기자동차입니다. 차량의 에너지는 배터리 팩에서 공급되고 그리드에서 충전되며, BEV는 무공해 차량으로 기존 가솔린 차량이 배출하는 유해한 배기가스와 대기 오염을 발생시키지 않습니다.

- 아시아태평양의 자동차 산업은 전기자동차, 특히 배터리 전기자동차(BEV)의 인기가 높아짐에 따라 해마다 변화하고 있습니다. 기술의 발전, 정부의 지원, 환경 문제에 대한 관심의 증가로 BEV는 기후 변화 문제를 해결하고 화석 연료에 대한 의존도를 낮추기 위한 유망한 솔루션으로 부상하고 있습니다.

- 최근 배터리 전기자동차의 채택은 전 세계적으로 크게 성장하고 있습니다. 배터리 기술의 향상으로 주행거리가 늘어나고 충전 인프라가 급증하면서 초기 진입장벽이 극복되고 있습니다. 또한 Tesla, BYD, Tata, Toyota, Honda 등의 자동차 제조업체들이 BEV 보급에 중요한 역할을 하고 있으며, 다양한 소비자들에게 어필할 수 있는 합리적인 가격대의 모델을 제공하고 있습니다.

- 국제에너지기구(IEA)에 따르면 2023년 중국의 배터리 전기자동차(BEV) 재고는 약 1,600만 대에 달합니다. 같은 해 인도, 일본, 한국의 BEV 재고량은 각각 약 15만대, 약 29만대, 약 46만대였습니다. 마찬가지로 2023년 중국의 BEV 판매량은 540만대 이상입니다. 인도의 BEV 판매량은 약 8만 2,000대, 일본과 한국의 BEV 판매량은 각각 8만 8,000대, 12만 대. BEV 판매량이 계속 증가함에 따라 리튬이온 배터리와 같은 EV용 배터리에 대한 수요는 점점 더 중요해지고 있습니다.

- 또한, BEV의 최대 시장 중 하나인 아시아태평양은 세계 최대 전기자동차 배터리 생산 지역이기도 하며, 2023년 전기자동차 배터리 수요는 중국이 연간 약 417GWh로 세계 수요의 약 54%를 차지할 것으로 예상되며, 2022년 이후 32% 이상 급성장할 것으로 예상됩니다. 이는 EV 배터리 기술에서 이 지역의 우위가 얼마나 중요한지 잘 보여줍니다. 마찬가지로 국제에너지기구(IEA)에 따르면 아시아태평양의 리튬이온 배터리 생산능력은 중국을 필두로 향후 몇 년 동안 크게 성장할 것으로 예상됩니다. IEA는 중국의 리튬이온 배터리 생산능력이 2022년 약 1.20TWh에서 2030년 4.65TWh로 증가할 것으로 추정하고 있습니다.

- 각국은 BEV의 보급을 가속화하기 위해 다양한 노력과 인센티브를 시행하고 있습니다. 예를 들어, 인도 정부는 2021년 초 전기자동차용 첨단화학전지(ACC)의 수입 의존도를 낮추기 위해 ACC의 국내 생산을 위한 생산연계 인센티브(PLI) 제도를 승인했습니다. 이 제도의 총액은 5년간 21억 2,000만 달러에 달합니다. 이 제도는 국내에서 50GWh 규모의 경쟁 ACC 배터리 생산 체제를 구축하는 것을 목표로 하고 있습니다. 또한, 5GWh의 틈새 ACC 기술도 이 계획의 대상입니다. 이러한 구상은 EV용 리튬이온 배터리의 수요를 뒷받침하고 있습니다.

- 또한, 태국, 인도네시아, 싱가포르, 말레이시아, 필리핀 등 동남아시아 국가에서는 전기자동차 보급이 확대되고 있으며, 전기자동차 이용을 가속화하기 위한 정부 이니셔티브가 있어 리튬이온 배터리의 채택이 빠르게 확대될 것으로 예상됩니다. 예를 들어, 인도네시아는 2025년까지 전체 자동차 판매량의 20%를 EV로 채우겠다는 야심찬 목표를 세우고 있으며, 인도네시아 정부는 2030년까지 60만 대의 EV를 국산화하는 것을 목표로 하고 있습니다. 이러한 목표는 리튬이온 배터리 시장을 포함한 EV 공급망 내 다양한 마일스톤으로 대체될 수 있습니다.

- 2024년 초, 태국 EV위원회는 EV 산업의 지속적인 발전을 촉진하고 신규 진입 기업의 태국 내 EV 제조에 대한 투자 기회를 촉진하기 위해 4년간(2024-2027년) EV 패키징의 두 번째 단계인 EV3.5를 승인했습니다. 이 패키지는 EV 산업 생태계 전반에 걸친 투자를 촉진하는 것을 목표로 하고 있습니다. 이 패키지의 일환으로 태국 정부는 전기자동차, 전기 픽업 트럭, 전기이륜차 구매에 대해 차종과 배터리 용량에 따라 보조금을 지급하는 내용을 담고 있습니다. 태국은 2017년 이후 지속적인 전기자동차 촉진 패키지를 통해 BEV, 배터리 전기이륜차, 전기자동차 부품 및 구성품, 충전소 제조에 18억 달러 상당의 전기자동차 산업 투자가 이루어지고 있습니다.

- 따라서 위의 요인으로 인해 예측 기간 동안 BEV 부문이 전기자동차(EV)용 리튬이온 배터리 시장을 독점할 가능성이 높습니다.

급성장하는 인도

- 인도는 전기자동차(EV) 보급을 위한 강력한 추진력을 바탕으로 리튬이온 배터리의 급성장 시장 중 하나로 부상하고 있습니다. 예를 들어, 국제에너지기구(IEA)에 따르면 인도의 배터리 전기자동차(BEV) 판매량은 2023년 약 8만 2,000대에 달할 것으로 예상되며, 2022년부터 70% 이상 증가할 것으로 전망하고 있습니다. 또한, 인도 정부는 2030년까지 신규 등록 승용차의 30%, 버스의 40%, 상용차의 70%, 이륜차 및 3륜차의 80%를 EV로 전환하는 것을 목표로 하고 있습니다. 이에 따라 리튬이온 배터리와 같은 EV용 배터리의 수요가 향후 크게 증가할 가능성이 높습니다.

- 또한, 인도 정부는 기존 내연기관 차량에서 전기자동차로의 전환을 장려하는 다양한 정책과 인센티브를 시행하고 있으며, FAME(Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) 계획 등의 노력을 통해 인도는 충전 인프라, 배터리 제조, 전기자동차 구매자에 대한 보조금 등에 많은 투자를 통해 시장 성장을 위한 환경을 조성하고 있습니다.

- 최근 인도 정부는 2024년 3월에 5억 달러 규모의 새로운 전기자동차 정책을 승인하고, 세계 전기자동차 기업의 투자를 유치하고 인도를 첨단 전기자동차 제조의 중심지로 만들기 위해 다양한 인센티브를 제공했습니다. 이 외에도 인도 소비자들이 최첨단 전기자동차 모델을 이용할 수 있도록 하고, Make in India의 생태계를 확장하고, 생산 비용을 낮추며, 경쟁력 있는 국내 자동차 제조 산업을 육성하는 등 다양한 목표를 달성하기 위해 노력하고 있습니다.

- 국내외 다양한 기업들이 인도의 리튬이온 배터리 시장에 투자하고 있으며, 에너지 저장에 대한 수요가 급증하고 지속가능한 솔루션으로의 전환을 활용하기 위해 노력하고 있습니다. 예를 들어, 2022년 4월 배터리 대기업 Exide Industries는 카르나타카 주에 리튬이온 배터리 제조 공장을 설립하기 위해 약 7억 1,800만 달러를 투자할 계획을 발표했습니다. 1단계로 2024년까지 6GWh 규모의 리튬이온 배터리 제조 시설을 가동하고, 향후 몇 년 동안 12GWh 규모의 종합 리튬이온 배터리 시설로 점진적으로 확장할 것으로 보입니다.

- 또한, 2023년 4월에는 배터리 기술 스타트업인 Log9 Materials가 벵갈루루의 자쿠르(Jakkur)에 국내 최초의 리튬이온 배터리 제조 시설을 설립했습니다. 이 공장의 초기 생산능력은 50MWh입니다. 이 회사는 2025년 1분기까지 리튬이온 배터리 생산능력을 1GWh, 배터리 팩 생산능력을 2GWh로 확대할 계획입니다.

- 전반적으로 인도의 전기자동차(EV)용 리튬이온 배터리 시장은 대규모 소비자 기반, 지원 정책, 배터리 제조의 발전으로 인해 향후 몇 년 동안 더욱 성장할 것으로 예상됩니다.

아시아태평양의 전기자동차용 리튬이온 배터리 산업 개요

아시아태평양의 전기자동차용 리튬이온 배터리 시장은 절반으로 나뉘어져 있습니다. 이 시장의 주요 기업들(순서는 무관)은 Panasonic Corporation, Contemporary Amperex Technology Co.Ltd., Tianjin Lishen Battery Joint-Stock, Samsung SDI, LG Energy Solution Ltd. 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부 정책 및 규정

- 시장 역학

- 성장 촉진요인

- 리튬이온 배터리 가격 하락

- 전기자동차 보급 확대

- 정부 지원 시책과 이니셔티브

- 성장 억제요인

- 새로운 대체 배터리 기술

- 성장 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 차종별

- 승용차

- 상용차

- 기타(이륜차, 스쿠터 등)

- 추진력 유형별

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 자동차(PHEV)

- 하이브리드 전기자동차(HEV)

- 지역별

- 인도

- 중국

- 일본

- 한국

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략과 SWOT 분석

- 기업 개요

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Contemporary Amperex Technology Co. Ltd(CATL)

- BYD Company Limited

- Tianjin Lishen Battery Joint-Stock Co. Ltd

- Trontek Electronics Pvt. Ltd

- Greenfuel Energy Solutions Pvt. Ltd

- LG Energy Solution Ltd

- SK Innovation Co Ltd

- AESC Group Ltd

- Tesla Inc.

- 기타 저명한 기업 리스트(회사명, 본사 소재지, 관련 제품과 서비스, 연락처 등)

- 시장 순위 분석

제7장 시장 기회와 향후 동향

- 전기자동차에 대한 고체 리튬이온 배터리 채용

The Asia-Pacific Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 45.42 billion in 2025, and is expected to reach USD 129.17 billion by 2030, at a CAGR of 23.25% during the forecast period (2025-2030).

Key Highlights

- Declining lithium-ion battery prices, the increasing adoption of electric vehicles, and supportive government policies and initiatives are expected to drive the growth of the Asia-Pacific lithium-ion battery for electric vehicle market over the medium term of the forecast period.

- On the other hand, emerging alternative battery technologies are likely to hinder market growth during the forecast period.

- Nevertheless, the need for lithium-ion batteries for hybrid electric vehicle (HEV) applications in emerging economies is expected to create vast opportunities for lithium-ion batteries for the electric vehicle market in Asia-Pacific.

Asia-Pacific Lithium-ion Battery for Electric Vehicle Market Trends

The Battery Electric Vehicle (BEV) Segment to Witness Significant Growth

- Battery electric vehicles (BEVs) are also commonly referred to as electric vehicles with an electric motor. BEVs are fully electric vehicles that typically do not include an internal combustion engine (ICE), fuel tank, or exhaust pipe and rely on electricity for propulsion. The vehicle's energy comes from a battery pack, which is recharged from the grid. BEVs are zero-emission vehicles, as they do not generate harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- The automotive industry in Asia-Pacific has been transforming over the years, with electric vehicles, particularly battery electric vehicles (BEVs), gaining momentum and popularity. With growing technological advancements, government support, and increasing environmental concerns, BEVs have emerged as a promising solution to address the challenges of climate change and reduce reliance on fossil fuels.

- In recent years, the adoption of battery-electric vehicles has grown significantly worldwide. The improvement of battery technology has led to extended driving ranges and a surge in charging infrastructure that is helping overcome the initial entry barriers. Further, automakers such as Tesla, BYD, Tata, Toyota, and Honda have been playing a vital role in popularizing BEVs, offering affordable models that appeal to a broader range of consumers.

- According to the International Energy Agency (IEA), the battery electric vehicle (BEV) car stocks in China stood at around 16 million units in 2023. Similarly, in the same year, countries such as India, Japan, and South Korea had approximately 0.15 million, 0.29 million, and 0.46 million units of BEV car stock, respectively. Similarly, in 2023, BEV sales in China stood at over 5.4 million. India sold around 82,000 units of BEV cars, while Japan and South Korea sold 88,000 and 120,000 units of BEV cars, respectively. As the sales of BEVs continue to rise, the demand for EV batteries, such as lithium-ion batteries, has become increasingly vital.

- Moreover, being one of the largest markets for BEV vehicles, Asia-Pacific is also the largest EV battery manufacturing region in the world. China led from the front with an EV battery demand of about 417 GWh per year, or about 54% of the world demand in 2023, recording a surge of over 32% from 2022. This highlights the importance of the region's dominance in EV battery technologies. Similarly, as per the International Energy Agency (IEA), the lithium-ion battery manufacturing capacity in the Asia-Pacific region is expected to grow significantly in the coming years, with China leading the way. The agency estimated that the Chinese lithium-ion battery manufacturing capacity will rise to 4.65 TWh in 2030 from around 1.20 TWh in 2022.

- To accelerate the adoption of BEVs, countries have been implementing various initiatives and incentives. For example, to reduce dependency on imported advanced chemistry cell (ACC) batteries for electric vehicles, the Indian government approved a Production Linked Incentive (PLI) Scheme in early 2021 for the manufacturing of ACCs in the country. The total outlay of the Scheme is USD 2.12 billion for five years. The scheme envisages establishing a competitive ACC battery manufacturing setup in the country (50 GWh). In addition, 5 GWh of niche ACC technologies is also covered under the scheme. Such initiatives are supporting the demand for lithium-ion batteries for EV applications.

- Further, Southeast Asian countries such as Thailand, Indonesia, Singapore, Malaysia, and the Philippines are expected to see rapid growth in the adoption of lithium-ion batteries due to the increasing prevalence of EVs and government initiatives to accelerate EV use. For example, Indonesia has an ambitious target of having EVs make up 20% of all car sales by 2025, and the Indonesian government aims for 600,000 EVs to be domestically produced by 2030. Such targets are translated into different milestones within the EV supply chain, including the lithium-ion batteries market.

- In early 2024, the EV Board in Thailand approved the second phase of the EV Package, known as EV 3.5, for four years (2024-2027) to promote the EV industry's continuous progress and facilitate investment opportunities in EV manufacturing in Thailand for new players. The package aims to boost investments covering the entire EV industry ecosystem. As part of the package, the Thai government will offer subsidies for the purchase of electric cars, electric pickup trucks, and electric motorcycles based on the vehicle types and battery capacities. Thailand's continuous EV promotion package since 2017 has resulted in investments in the EV industry worth USD 1.8 billion in manufacturing BEVs, battery electric motorcycles, EV parts and components, and charging stations.

- Therefore, due to the factors mentioned above, the BEV segment is likely to dominate the lithium-ion battery for electric vehicle (EV) market during the forecast period.

India to Witness Fastest Growth

- India is emerging as one of the fastest-growing markets for lithium-ion batteries, driven by a strong push toward the adoption of electric vehicles (EVs). For example, according to the International Energy Agency (IEA), battery electric vehicle (BEV) sales in India reached around 82,000 units in 2023, an increase of over 70% from 2022. Additionally, the Indian government aims for an EV target of 30% of newly registered private cars, 40% of buses, 70% of commercial cars, and 80% of 2-wheelers and 3-wheelers by 2030. These are likely to create a substantial demand for EV batteries, such as lithium-ion batteries, in the coming years.

- Besides, the government has also implemented a range of policies and incentives to encourage the shift from traditional internal combustion engine vehicles to EVs, significantly boosting the demand for lithium-ion batteries. With initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, India is making substantial investments in charging infrastructure, battery manufacturing, and subsidies for EV buyers, creating a conducive environment for market growth.

- More recently, in March 2024, the Indian government approved a new USD 500-million-worth EV Policy, offering a range of incentives to draw investments from global EV companies and position India as a prime manufacturing hub for state-of-the-art EVs. Other objectives include providing Indian consumers with access to cutting-edge EV models, expanding the Make in India ecosystem, lowering costs of production, and fostering a competitive domestic auto manufacturing industry.

- Various local and international players are investing in the Indian lithium-ion battery market, aiming to capitalize on the country's burgeoning energy storage needs and its transition toward sustainable solutions. For example, in April 2022, battery behemoth Exide Industries announced plans to invest about USD 718 million to set up a lithium-ion cell manufacturing plant in Karnataka. In its first phase, a 6 GWh lithium-ion cell manufacturing facility is likely to become operational by 2024, gradually expanding to a 12 GWh capacity integrated lithium-ion battery facility over the next few years.

- Furthermore, in April 2023, the battery technology startup Log9 Materials inaugurated the country's first lithium-ion cell manufacturing facility in Jakkur, Bengaluru. The plant has an initial capacity of 50 MWh. The company is also working on expanding its lithium-ion cell manufacturing capacity to 1 GWh and its battery pack manufacturing capacity to 2 GWh by the first quarter of 2025.

- Overall, with a large consumer base, supportive policies, and increasing progress in the batteries manufacturing, the lithium-ion battery for electric vehicle (EV) market in India is poised for further growth in the coming years.

Asia-Pacific Lithium-ion Battery for Electric Vehicle Industry Overview

The Asia-Pacific lithium-ion battery market for electric vehicles is semi-fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, Tianjin Lishen Battery Joint-Stock Co. Ltd, Samsung SDI Co. Ltd, and LG Energy Solution Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD until 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Prices

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.1.3 Supportive Government Policies and Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Emerging Alternative Battery Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicle Types (Bikes, Scooters, etc.)

- 5.2 By Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicle (HEV)

- 5.3 By Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Vietnam

- 5.3.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Samsung SDI Co. Ltd

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 BYD Company Limited

- 6.3.5 Tianjin Lishen Battery Joint-Stock Co. Ltd

- 6.3.6 Trontek Electronics Pvt. Ltd

- 6.3.7 Greenfuel Energy Solutions Pvt. Ltd

- 6.3.8 LG Energy Solution Ltd

- 6.3.9 SK Innovation Co Ltd

- 6.3.10 AESC Group Ltd

- 6.3.11 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-state Lithium-ion Batteries for Electric Vehicles