|

시장보고서

상품코드

1636229

석유 및 가스용 정지 및 회전 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Oil & Gas Static And Rotating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

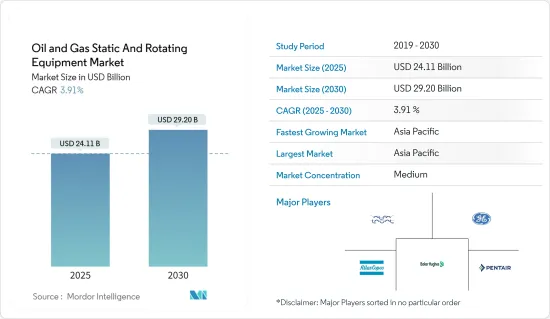

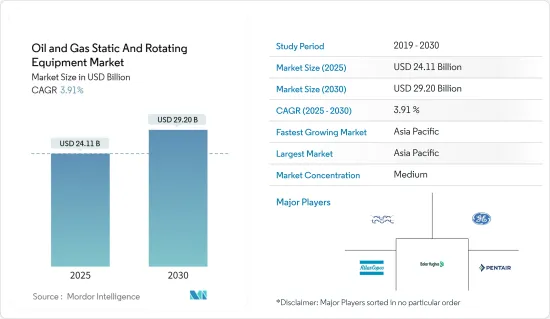

석유 및 가스용 정지 및 회전 장비 시장 규모는 2025년에 241억 1,000만 달러로 추정 및 예측되며, 예측 기간(2025-2030년) 동안 3.91%의 CAGR로 2030년에는 292억 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 석유 및 가스용 정지 및 회전 장비 시장은 세계 에너지 수요 증가와 해양 탐사 활동의 활성화로 인한 정지 및 회전 장비에 대한 수요 증가로 인해 예측 기간 동안 성장할 것으로 예상됩니다.

- 한편, 재생가능하고 깨끗한 에너지원의 채택이 증가하고 있다는 점이 향후 시장 성장의 걸림돌이 될 것으로 예상됩니다.

- 그러나 예측 기간 동안 장비의 효율성을 향상시키는 기술 발전으로 인해 시장이 크게 성장할 수 있는 기회가 있습니다.

- 아시아태평양은 예측 기간 동안 시장이 크게 성장할 것으로 예상됩니다.

석유 및 가스용 정지 및 회전 장비 시장 동향

회전 장비 부문은 큰 수요가 예상

- 석유 및 가스 산업에서 회전 장비는 중요한 역할을 합니다. 이 장비의 회전 부품은 엔진, 압축기, 터빈, 산업용 밸브 등으로 구성됩니다. 회전 장비의 대부분은 한 장소에서 다른 장소로 물질을 운반하거나 프로펠러를 회전시키는 등 물질을 강제로 회전시키는 데 사용됩니다.

- 회전 장비는 업스트림, 다운스트림, 다운스트림, 다운스트림 등의 산업에서 사용됩니다. 펌프와 압축기는 석유 및 가스 생산 및 저장에 여러 가지 용도를 가진 회전 장비의 한 예입니다.

- 일부 석유 및 가스 프로젝트에서는 회전 장비를 설치하기 위해 다른 회사와 협약 및 계약을 체결하고 있습니다. 예를 들어, 2024년 5월 Larsen & Toubro(L&T), L&T Energy Hydrocarbon(LTEH)은 ONGC로부터 ONGC의 뭄바이 하이와 타프티 해안에 위치한 새로운 공정 가스 압축기(PGC) 모듈의 엔지니어링, 조달, 건설, 설치 및 시운전을 수주했습니다. 설치 및 시운전을 수주했습니다.

- 또한 가스 생산량 증가로 인해 압축기 및 펌프와 같은 회전 장비에 대한 수요가 증가할 것으로 예상되며, Statistical Review of World Energy Data에 따르면 2023년 세계 가스 생산량은 4조 592억 입방미터에 달할 것으로 예상됩니다. 가스 생산량은 2010년 이후 지속적으로 증가하고 있으며, 2020년에는 약간 감소할 것으로 예상됩니다.

- 또한, 각 기업들은 연구개발에 대한 투자를 늘리고 회전 장비의 효율을 높이기 위해 노력하고 있으며, 이는 향후 회전 장비의 비즈니스 기회를 창출할 것입니다.

- 예를 들어, 2024년 5월, 회전 장비 솔루션 및 에너지 전환 기술의 세계 리더인 John Crane은 캐나다 앨버타 주에서 5년간의 계약을 체결하였습니다. 이 계약에는 주요 복합 시설에 대한 산업용 씰링 지원 서비스가 포함되어 있습니다. 이 계약의 일환으로 존크레인은 현장의 중요한 자산의 수명을 연장하기 위해 관리 신뢰성 프로그램(MRP)을 시행하고 있습니다. 여기에는 원심 펌프 및 산업용 씰과 같은 회전 장비가 포함됩니다. 이러한 프로그램은 회전 장비의 효율성을 향상시켜 향후 수요를 촉진할 것으로 기대됩니다.

- 따라서 석유 및 가스 산업에서 회전 장비의 사용과 수요 덕분에 이 부문은 예측 기간 동안 큰 수요가 있을 것으로 예상됩니다.

아시아태평양은 시장 성장세가 두드러질 것으로 예상됩니다.

- 아시아태평양은 세계 인구의 절반 이상이 거주하고 있어 세계 에너지의 미래에 큰 영향을 미칠 수 있는 잠재력을 가지고 있습니다. 이 지역에는 급속한 도시화와 산업화를 경험하고 있는 인도, 중국, 일본과 같은 신흥국들이 포함되어 있습니다.

- 따라서 이 지역의 에너지 수요는 지속적으로 증가하고 있으며, 석유 및 가스 산업의 생산 및 탐사 활동이 요구되고 있습니다. 향후 석유 및 가스 프로젝트에 따라 이 지역에서는 정지 및 회전 장비에 대한 수요가 확대될 것으로 예상됩니다.

- 예를 들어, 2022년 10월, SENEX Energy는 퀸즐랜드 남서부 아틀라스 프로젝트에 인접한 새로운 가스 압축 시설을 건설할 것이라고 발표했습니다. 이 가스 플랜트는 생산 라이선스 PL209를 이용하여 건설될 예정입니다. 석유 및 가스 생산량 증가에 따라 이 설비에 대한 수요는 예측 기간 동안 확대될 것으로 예상됩니다.

- Statistical Review of World Energy Data에 따르면, 2023년 아시아태평양의 총 가스 생산량은 6,918억 입방미터로 전년 대비 0.6% 증가할 것으로 예상됩니다.

- 또한, 다운스트림 프로젝트 개발이 이 지역의 시장을 견인할 것으로 예상됩니다. 2023년 3월, Indian Oil Corporation Ltd는 오디샤 주 팔라딥에 석유화학단지를 건설하기 위해 7억 4,200만 달러를 투자할 것이라고 발표했습니다. 이러한 신규 프로젝트는 장비 수요를 증가시켜 시장을 견인할 것으로 예상됩니다.

- 이 지역의 천연가스 생산 수요 증가는 석유 및 가스 시동 장치 및 회전 장비에 대한 수요를 급증시킬 것으로 예상됩니다. 예를 들어, 가스 수출국 포럼에 따르면 2050년까지 천연가스는 동남아시아 전체 발전 구성의 36%를 차지할 것으로 예상됩니다. 요약하면, 아시아태평양의 천연가스 수요는 크게 증가할 것으로 예상되며, 2050년에는 710bcm에 달할 것으로 예상됩니다.

- 석유 및 가스 산업의 발전과 에너지 수요의 증가로 아시아태평양은 크게 성장할 것으로 예상됩니다.

석유 및 가스용 정지 및 회전 장비 산업 개요

석유 및 가스용 정지 및 회전 장비 시장은 반분할되어 있습니다. 이 시장의 주요 기업으로는 Alfa Laval AB, Atlas Copco AB, General Electric Co., Baker Hughes Co., Pentair PLC 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 정책 및 규정

- 시장 역학

- 성장 촉진요인

- 에너지 수요 증가

- 해양 탐사 활동 활발화

- 성장 억제요인

- 재생 및 청정한 에너지원 채용 증가

- 성장 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협 제품·서비스

- 경쟁 기업 간의 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 용도

- 업스트림

- 미드스트림

- 다운스트림

- 유형

- 정지형

- 회전식

- 지역

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 러시아

- 북유럽

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 호주

- 일본

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트

- 이집트

- 카타르

- 나이지리아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 북미

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Alfa Laval AB

- Atlas Copco AB

- General Electric Co

- Baker Hughes Co.

- Pentair PLC

- Siemens AG

- Sulzer Limited

- FMC Technologies Inc.

- Flowserve Corporation

- Mitsubishi heavy Industries Ltd

- Doosan Group

- 기타 저명한 기업 리스트

- 시장 순위 분석

제7장 시장 기회와 향후 동향

- 효율성을 높이는 기술의 진보

The Oil & Gas Static And Rotating Equipment Market size is estimated at USD 24.11 billion in 2025, and is expected to reach USD 29.20 billion by 2030, at a CAGR of 3.91% during the forecast period (2025-2030).

Key Highlights

- The oil and gas static and rotating equipment market is expected to grow during the forecast period due to increasing global energy demand and the need for static rotating equipment from increased offshore exploration activities.

- On the other hand, the rising adoption of renewable and cleaner energy sources is expected to hamper the market growth in the future.

- However, there is an opportunity for significant market growth through technological advancements to improve equipment efficiency during the forecast period.

- Asia-Pacific is expected to witness significant growth in the market during the forecast period.

Oil & Gas Static And Rotating Equipment Market Trends

The Rotating Equipment Segment is Expected to Have a Significant Demand

- Rotating equipment plays a significant role in the oil and gas industry. The rotating components of this equipment may consist of engines, compressors, turbines, and industrial valves. Most of the rotating equipment is used to transport substances from one area to another, or it may be used to force materials to rotate, such as by making a propeller turn.

- Rotating equipment is used in industries, including upstream, downstream, and downstream. Pumps and compressors are examples of rotating equipment that have several uses in the production and storage of oil and gas.

- In several oil and gas projects, agreements and contracts are made with other companies to install rotating equipment. For example, in May 2024, Larsen & Toubro (L&T), L&T Energy Hydrocarbon (LTEH), got a contract from ONGC for the engineering, procurement, construction, installation, and commissioning of new process gas compressor (PGC) modules at ONGC's Mumbai High and Tapti offshore locations.

- Further, increasing gas production is expected to create demand for rotating equipment like compressors and pumps. According to the Statistical Review of World Energy Data, in 2023, global gas production accounted for 4059.2 billion cubic meters. Gas production has increased continuously since 2010, with a slight drop in 2020.

- Moreover, companies are making efforts to improve the efficiency of rotating equipment by investing more and more in research and development, which, in turn, will create opportunities for these equipment in the future.

- For instance, in May 2024, John Crane, a global leader in rotating equipment solutions and energy transition technologies, secured a five-year contract in Alberta, Canada. The contract involves providing industrial seal support services for a major complex. As part of this agreement, John Crane is implementing a managed reliability program (MRP) to enhance the longevity of critical site assets. This includes rotating equipment like centrifugal pumps and industrial seals. Such programs are expected to improve rotating equipment efficiency, driving future demand.

- Thus, owing to the use and demand for rotating equipment in the oil and gas industry, the segment is expected to have a significant demand during the forecast period.

Asia-Pacific is Expected to Have a Significant Growth in the Market

- Asia-Pacific is home to over half of the world's population, giving it the potential to influence the future of global energy significantly. The region includes developing countries like India, China, and Japan, which are experiencing rapid urbanization and industrialization.

- Thus, the region's energy demand is increasing continuously, which, in turn, demands production and exploration activities in the oil and gas industry. With the upcoming oil and gas projects, the demand for static and rotating equipment is expected to grow in the region.

- For example, in October 2022, SENEX Energy announced the construction of a new gas compression facility adjacent to its Atlas project in southwest Queensland. The gas plant will be constructed using production license PL209. With increasing oil and gas production, demand for this equipment is expected to grow during the forecast period.

- According to Statistical Review of World Energy Data, in 2023, Asia-Pacific total gas production accounted for 691.8 billion cubic meters, an annual growth rate of 0.6% compared to the previous year.

- Further, the development of downstream projects is expected to drive the market in the region. In the petrochemical industry, static and rotating equipment are used in refining. In March 2023, Indian Oil Corporation Ltd announced it would invest USD 742 million in building a petrochemical complex at Paradip in Odisha. Such new projects are expected to increase the demand for equipment, thereby driving the market.

- The increasing demand for natural gas production in the region is expected to surge the need for oil and gas starting and rotating equipment. For instance, according to the Gas Exporting Countries Forum, natural gas is projected to account for 36% of Southeast Asia's total generation mix by 2050. In summary, Asia-Pacific's demand for natural gas is expected to grow significantly, with estimates reaching 710 bcm by 2050.

- Due to the development of the oil and gas industry and the increasing energy demand, Asia-Pacific is expected to grow significantly.

Oil & Gas Static And Rotating Equipment Industry Overview

The oil and gas static and rotating equipment market is semi-fragmented. The key players in the market (in no particular order) include Alfa Laval AB, Atlas Copco AB, General Electric Co, Baker Hughes Co., and Pentair PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Energy Demand

- 4.5.1.2 More Offshore Exploration Activities

- 4.5.2 Restraints

- 4.5.2.1 Rising Adoption of Renewable and Cleaner Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Type

- 5.2.1 Static

- 5.2.2 Rotating

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Russia

- 5.3.2.6 NORDIC

- 5.3.2.7 Italy

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Egypt

- 5.3.4.4 Qatar

- 5.3.4.5 Nigeria

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Atlas Copco AB

- 6.3.3 General Electric Co

- 6.3.4 Baker Hughes Co.

- 6.3.5 Pentair PLC

- 6.3.6 Siemens AG

- 6.3.7 Sulzer Limited

- 6.3.8 FMC Technologies Inc.

- 6.3.9 Flowserve Corporation

- 6.3.10 Mitsubishi heavy Industries Ltd

- 6.3.11 Doosan Group

- 6.4 List of Other Prominent Companies

- 6.5 Market RankingAnalysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement to Increase the Efficiency

샘플 요청 목록