|

시장보고서

상품코드

1636255

냉동 식품 물류 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Frozen Food Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

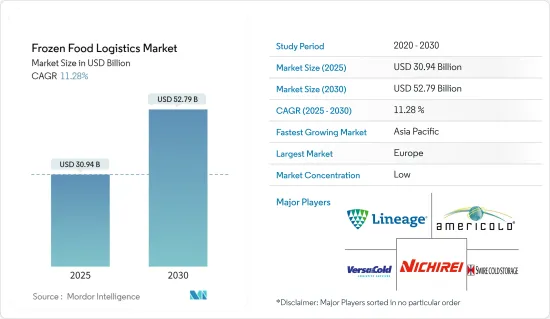

냉동 식품 물류 시장 규모는 2025년에 309억 4,000만 달러로 추정되며, 예측 기간 중(2025-2030년) 연평균 성장율(CAGR)은 11.28%로, 2030년에는 527억 9,000만 달러에 이를 것으로 예측됩니다.

주요 하이라이트

- 냉동 식품 수요의 급증과 도시화의 진전이 주로 냉동 식품 물류 시장을 주도하고 있습니다.

- 지난 몇 년 동안 프리미엄 냉동 식품 산업은 괄목할 만한 성장을 보였습니다. 편리하고 영양가 높은 최고급 식품에 대한 소비자의 욕구가 높아진 것이 이러한 급증을 주도하고 있습니다. 이러한 추세는 특히 균형 잡힌 식단과 즉석식품의 신속성을 추구하는 건강에 민감한 개인들 사이에서 두드러지게 나타납니다.

- 또한, 소비자들은 맛과 영양을 효과적으로 유지하는 최신 냉동 기술로 인해 가능해진 제품의 우수한 품질을 점점 더 인정하고 있습니다.

- 특히 부유한 도시 가정이 이러한 프리미엄 냉동 식품의 판매를 주도하고 있습니다. 이러한 제품은 종종 미식가 레시피, 책임있는 재료 조달, 최고의 풍미를 자랑합니다.

- 이러한 수요의 급증은 가정식 요리, 실험적 요리, 레스토랑 수준의 식사를 집에서 편안하게 즐기려는 소비자의 광범위한 변화를 반영합니다. 이는 품질, 맛, 영양에 타협하지 않으려는 안목 있는 음식 애호가들을 위한 트렌드입니다.

- 2023년에는 냉동 식품의 소매 매출이 7.9% 급증하여 742억 달러에 달했습니다. 이는 최근 보고서에서 강조한 바와 같이 지난 3년간 100억 달러의 현저한 증가를 보여줍니다. 다른 식료품 부문과 마찬가지로 냉동 식품의 달러화 가치 증가는 주로 인플레이션에 따른 가격 인상에 의해 촉진되었습니다.

- 이에 따라 냉동 식품에 대한 소비자 행동도 변화하고 있습니다. 미국냉동식품협회(AFFI)와 식품산업협회(FMI)가 공동으로 진행한 2023년 소매업에서 냉동식품의 힘 보고서에 따르면 소비자들은 냉동식품에 대해 개당 평균 4.99달러를 지출하는 것으로 나타났습니다. 이는 2023년에 비해 13.5% 상승한 수치이며, 지난 3년 동안 29.6%나 급증한 수치입니다.

- 냉동 식품 매출에서는 냉동 식품과 디저트가 선도하고 있으며, 2023년에는 각각 266억 달러와 154억 달러를 벌어들입니다. 그 뒤를 이어 과일 및 채소, 해산물, 육류 및 가금류가 같은 해 각각 81억 달러, 70억 달러, 57억 달러의 매출을 기록할 것으로 예상됩니다.

냉동 식품 물류 시장 동향

업계를 주도하는 냉동식품 수요

최근 몇 년 동안 소비자 선호도 변화에 맞춘 제품 혁신이 급증하면서 즉석식품 시장은 크게 진화하고 있습니다. 이러한 변화는 특히 편의성과 맛을 가장 중요시하는 인도에서 두드러지게 나타나고 있습니다.

소비자들은 즉석식품 업계에서 점점 더 건강하고 자연적인 옵션을 선호하고 있습니다. 이로 인해 깨끗한 라벨, 최소한의 첨가물, 유기농 재료를 사용한 제품에 대한 수요가 증가하고 있습니다. 또한 식물성 식품과 비건 식품에 대한 선호도도 높아지고 있습니다. 식물성 식단을 채택하거나 육류 소비를 줄이는 사람들이 늘어나면서 식물성 또는 비건 친화적인 즉석식품에 대한 수요가 증가하고 있습니다.

업계 성장의 핵심은 기존 업체와 스타트업 모두의 혁신에 대한 확고한 의지입니다. 닐슨의 최근 연구에 따르면 특히 인도에서 더 건강한 즉석식품을 선호하는 소비자가 크게 증가하고 있는 것으로 나타났습니다. 이 연구에 따르면 인도 소비자의 72%가 영양이 풍부하고 균형 잡힌 즉석식품을 적극적으로 찾는 것으로 나타나 건강에 대한 의식이 높아진 것으로 나타났습니다.

이에 따라 기업들은 기술과 요리 기술을 활용하여 영양 요구 사항을 충족하고 다양한 인도인의 입맛을 충족하는 제품을 개발하고 있습니다. 여기에는 글루텐 프리, 유기농, 현지에서 영감을 받은 옵션의 도입이 포함됩니다.

즉석식품 브랜드와 영양 기관 또는 전문가 간의 파트너십을 통해 제품군을 확대하고 소비자 인식을 변화시켜 즉석식품을 더 건강한 식사 선택으로 자리매김하고 있습니다.

두드러진 위치를 차지하는 유럽의 시장

2023년 독일의 총 냉동 식품 판매량은 404만 3,000톤으로 2022년의 390만 9,000톤보다 3.4% 증가했습니다. 이러한 급증으로 판매량은 처음으로 400만 톤을 넘어섰습니다.

가정외 시장은 6.5%의 성장을 보였으며 2022년 193만 5,000톤에서 2023년에는 206만 1,000톤이 됐습니다. 이러한 성장세에 힘입어 시장은 200만 톤을 넘어섰습니다.

식품 소매 및 가정 서비스 산업에서 2023년 냉동 식품 판매량은 198만 2,000톤으로 2022년 197만 4,000톤에서 0.4% 소폭 증가했습니다. 특히 이 수치는 코로나19 팬데믹 이전 수준이었던 2019년의 186만 1,000톤보다 6.5% 높은 수치입니다.

1인당 냉동 식품 소비량은 2022년 47.7kg에서 2023년 49.4kg으로 사상 최고치를 기록했습니다. 가구 수준에서 소비는 3kg 증가했으며 2022년 96.4kg에서 2023년 99.4kg에 이르렀습니다.

냉동 식품 물류 산업 개요

냉동 식품 물류 시장은 세분화 되어있습니다. Lineage Logistics, Americold Logistics, Swire Cold Storage, Nichiirei Logistics, VersaCold Logistics Services와 같은 대기업은 콜드체인 물류 업계를 선도하고 있습니다.

이러한 주요 업체들은 냉동 식품 산업의 특정 요구에 맞춘 온도 조절 보관, 운송 및 유통을 포함한 일련의 서비스를 제공합니다. 이 기업들은 광범위한 네트워크, 첨단 기술, 냉동 제품 관리에 대한 전문 노하우를 활용하여 시장에서 경쟁력을 공고히 하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학과 인사이트

- 현재의 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 시장을 주도하는 전자상거래의 상승

- 소비자의 라이프 스타일의 변화가 시장을 주도

- 억제요인

- 콜드체인 물류 유지에 따른 높은 운영 비용

- 시장에 영향을 미치는 규제 준수

- 기회

- 시장을 주도하는 기술의 진보

- 성장 촉진요인

- 밸류체인, 서플라이체인 분석

- 정부의 규제, 무역협정, 지원

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 지정학과 팬데믹이 시장에 미치는 영향

제5장 시장 세분화

- 제품별

- RTE

- RTC

- 제품 유형별

- 냉동과일?야채

- 냉동고기, 생선

- 냉동 조리가 끝난 즉석 식품

- 냉동 디저트

- 냉동 스낵

- 기타 제품 유형

- 수송별

- 도로

- 철도

- 해로

- 항공

- 지역별

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Lineage Logistics

- Americold Logistics

- Swire Cold Storage

- Nichirei Logistics

- VersaCold Logistics Services

- Burris Logistics

- Kloosterboer

- NewCold

- Interstate Cold Storage

- Preferred Freezer Services*

- 기타 기업

제7장 시장의 미래

제8장 부록

- 거시경제지표

- 자본 흐름의 통찰(운수 및 창고 부문에 대한 투자)

- 전자상거래와 소비 관련 통계

- 대외무역 통계

The Frozen Food Logistics Market size is estimated at USD 30.94 billion in 2025, and is expected to reach USD 52.79 billion by 2030, at a CAGR of 11.28% during the forecast period (2025-2030).

Key Highlights

- A surge in demand for frozen food products and growing urbanization mainly drive the frozen food logistics market.

- Over the past few years, the premium frozen food industry has witnessed remarkable growth. A heightened consumer appetite for top-tier, convenient, and nutritious food choices predominantly propels this upsurge. This trend is especially pronounced among health-conscious individuals seeking balanced diets and the swiftness of ready-to-eat meals.

- Moreover, consumers increasingly acknowledge the superior quality of products made possible by modern freezing technologies, which effectively retain taste and nutritional value.

- Notably, affluent urban households are spearheading the sales of these premium frozen offerings. These products often boast gourmet recipes, responsibly sourced ingredients, and cutting-edge flavors.

- This surge in demand mirrors a broader consumer shift toward home cooking, culinary experimentation, and a desire for restaurant-grade meals-all enjoyed from the comfort of their homes. It is a trend tailored for discerning food enthusiasts unwilling to compromise on quality, taste, or nutrition.

- In 2023, retail sales of frozen foods surged by 7.9%, hitting USD 74.2 billion. This marked a notable USD 10 billion increase over the last three years, as highlighted in a recent report. Like many grocery segments, the growth of frozen food's value in dollars was primarily fueled by inflation-driven price hikes.

- Consequently, consumer behavior toward frozen food is changing. The Power of Frozen in Retail 2023 report, a collaboration between the American Frozen Food Institute (AFFI) and the Food Industry Association (FMI), revealed that consumers shelled out an average of USD 4.99 per unit for frozen items. This represented a 13.5% uptick from 2023 and a substantial 29.6% leap in the last three years.

- Frozen meals and desserts are leading the pack in frozen food sales, raking in USD 26.6 billion and USD 15.4 billion, respectively, in 2023. These are followed by fruits/vegetables, seafood, and meat/poultry, each boasting sales figures of USD 8.1 billion, USD 7 billion, and USD 5.7 billion, respectively, in the same year.

Frozen Food Logistics Market Trends

Demand for Frozen Food Products Gaining Traction in the Industry

The ready-to-eat market has witnessed a significant evolution in recent years, driven by a surge in product innovation tailored to changing consumer preferences. This transformation is especially pronounced in India, where convenience and taste preferences are paramount.

Consumers are increasingly gravitating toward healthier, natural options in the ready-to-eat industry. This has increased demand for products with clean labels, minimal additives, and organic ingredients. Furthermore, there is a growing appetite for plant-based and vegan choices. As more individuals adopt plant-based diets or reduce meat consumption, the demand for plant-based or vegan-friendly ready-to-eat options is rising.

Key to the industry's growth is the unwavering commitment to innovation by both established players and startups. Recent research from Nielsen underscores a significant consumer pivot toward healthier ready-to-eat choices, particularly in India. The study indicates that 72% of Indian consumers actively seek nutritious, well-balanced, ready-to-eat meals, showcasing a heightened health consciousness.

In response, companies are harnessing technology and culinary skills to craft products that meet nutritional needs and cater to the diverse Indian palate. This includes the introduction of gluten-free, organic, and locally-inspired options.

Partnerships between ready-to-eat brands and nutrition institutes or experts are broadening product offerings and reshaping consumer perceptions, positioning ready-to-eat foods as a healthier meal choice.

Europe is Holding a Prominent Position in the Market

In 2023, Germany's total frozen food sales reached 4.043 million tonnes, marking a 3.4% increase from 3.909 million tonnes in 2022. This surge pushed sales past the 4-million-tonne milestone for the first time.

The out-of-home market saw a notable 6.5% uptick in sales, hitting 2.061 million tonnes in 2023, up from 1.935 million tonnes in 2022. This growth propelled the market past the 2-million-tonne threshold.

Within the food retail and home services industry, frozen food sales in 2023 reached 1.982 million tonnes, reflecting a modest 0.4% increase from 1.974 million tonnes in 2022. Notably, this figure stood 6.5% higher than the pre-COVID-19-pandemic levels in 2019, which were at 1.861 million tonnes.

Individually, per capita consumption of frozen food hit a record high of 49.4 kg in 2023, up from 47.7 kg in 2022. At the household level, consumption saw a 3 kg increase, reaching 99.4 kg in 2023, compared to 96.4 kg in 2022.

Frozen Food Logistics Industry Overview

The frozen food logistics market is fragmented in nature. Giants like Lineage Logistics, Americold Logistics, Swire Cold Storage, Nichirei Logistics, and VersaCold Logistics Services are leading the pack in the cold chain logistics industry.

These key players provide a suite of services, including temperature-controlled storage, transportation, and distribution, tailored to the specific needs of the frozen food industry. These companies have solidified their competitive edge in the market by leveraging expansive networks, cutting-edge technologies, and specialized know-how in frozen goods management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rise in E-Commerce Driving The Market

- 4.2.1.2 Changing Consumer Lifestyles Driving The Market

- 4.2.2 Restraints

- 4.2.2.1 High Operating Costs Associated With Maintaining Cold Chain Logistics

- 4.2.2.2 Regulatory Compliances Affecting The Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving The Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ready-to-eat

- 5.1.2 Ready-to-cook

- 5.2 By Product Type

- 5.2.1 Frozen Fruits and Vegetables

- 5.2.2 Frozen Meat and Fish

- 5.2.3 Frozen-Cooked Ready Meals

- 5.2.4 Frozen Desserts

- 5.2.5 Frozen Snacks

- 5.2.6 Other Product Types

- 5.3 By Transportation

- 5.3.1 Roadways

- 5.3.2 Railways

- 5.3.3 Seaways

- 5.3.4 Airways

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lineage Logistics

- 6.2.2 Americold Logistics

- 6.2.3 Swire Cold Storage

- 6.2.4 Nichirei Logistics

- 6.2.5 VersaCold Logistics Services

- 6.2.6 Burris Logistics

- 6.2.7 Kloosterboer

- 6.2.8 NewCold

- 6.2.9 Interstate Cold Storage

- 6.2.10 Preferred Freezer Services*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 8.3 E-commerce and Consumer Spending-related Statistics

- 8.4 External Trade Statistics