|

시장보고서

상품코드

1636256

폐기물 재활용 서비스 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Waste Recycling Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

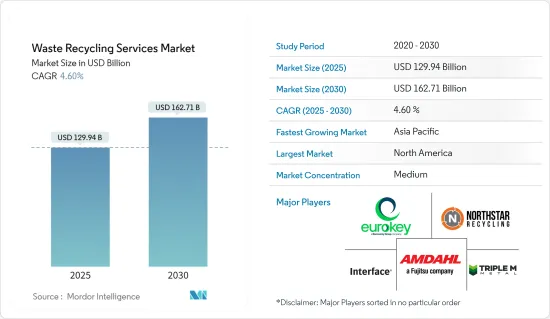

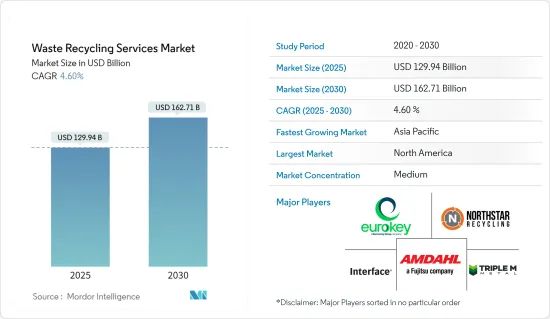

폐기물 재활용 서비스 시장 규모는 2025년에 1,299억 4,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 4.6%의 CAGR로 2030년에는 1,627억 1,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 지속가능성에 대한 수요 증가와 급속한 인구 증가가 폐기물 재활용 서비스 시장을 주도하고 있습니다.

- 현대 경제에서 폐기물의 양이 증가하고 복잡해짐에 따라 생태계와 인간의 건강이 점점 더 위험에 처해 있습니다. 전 세계적으로 연간 112억 톤의 고형 폐기물이 수거되는 것으로 추정되며, 그 유기물 부패는 전 세계 온실가스 배출량의 약 5%에 기여하고 있습니다. 특히 전기-전자기기에서 배출되는 폐기물에는 유해물질이 포함되어 있어 선진국이나 개발도상국 모두에서 가장 중요한 과제로 떠오르고 있습니다.

- 회수 시스템 부족에서 부적절한 폐기 방법에 이르기까지 폐기물 관리의 부재는 대기 오염으로 이어져 물과 토양을 오염시킵니다. 부적절한 매립지는 식수를 오염시키고 건강 위험과 질병 전염을 유발할 수 있습니다. 쓰레기의 비산은 생태계에 해를 끼치고, 전자폐기물과 산업 폐기물에서 나오는 유해 물질은 도시의 건강과 환경 모두에 부담을 줍니다.

- 첫 번째 해결책은 폐기물을 최소화하는 것입니다. 폐기물을 피할 수 없는 경우, 재제조 및 재활용과 더불어 재료와 에너지의 회수에 중점을 둡니다. 특히 재활용은 자원을 크게 절약할 수 있습니다. 예를 들어, 1톤의 종이를 재활용하면 17그루의 나무를 심을 수 있고, 일반적으로 사용되는 물의 50%를 절약할 수 있습니다. 또한, 재활용 산업은 브라질, 중국, 미국 전체에서 1,200만 명 이상을 고용하는 중요한 고용 창출원입니다.

- 2024년 3월 15일, 인도 환경산림기후변화부(MOEFCC)는 2016년 플라스틱 폐기물 관리 규정을 더욱 정교하게 개선한 '2024년 플라스틱 폐기물 관리(개정) 규정'을 인도 관보를 통해 발표하였습니다. 발표와 동시에 발효된 이 개정안은 플라스틱 오염에 대한 인도의 노력을 강조하고 있습니다. 이에 따라 각 지역 정부 기관은 폐기물을 최소화하고 재활용 서비스를 촉진하기 위한 노력을 강화하고 있습니다.

폐기물 재활용 서비스 시장 동향

폐기물 재활용 활동이 활성화되는 지자체 부문

유엔환경계획(UNEP)의 최신 보고서에 따르면, 한 세대에 걸쳐 지자체에서 발생하는 폐기물이 3분의 2로 급증하고 관련 비용이 거의 두 배로 증가할 것으로 예상됨에 따라, 지속가능하고 저렴한 미래를 보장하기 위해서는 폐기물 발생을 대폭 줄이는 것이 시급하다고 강조하고 있습니다.

UNEP 보고서는 2023년 23억 톤이었던 전 세계 도시 고형 폐기물 발생량이 2050년에는 38억 톤에 달할 것으로 예측하고 있습니다. 부적절한 폐기물 관리가 초래하는 광범위한 영향(오염, 건강 피해, 기후 변화 등)을 고려하면 그 비용은 3,610억 달러에 달할 것으로 추산됩니다. 폐기물 관리 문제를 신속히 해결하지 않으면 2050년까지 연간 6,403억 달러에 달하는 엄청난 비용이 발생할 것으로 예상되며, 각국의 폐기물 재활용 이니셔티브에 대한 우선순위를 정해야 한다는 점을 강조하고 있습니다.

세계에서 두 번째로 인구가 많은 중국은 산업, 농업, 가정 부문에서 연간 100억 톤 이상의 폐기물을 배출하는 엄청난 과제에 직면해 있습니다. 중국 생태환경부가 2024년 1월에 발표한 이 데이터는 이 문제의 심각성을 잘 보여줍니다. 그러나 중국의 국내 폐기물 처리에 있어 긍정적인 진전도 있습니다. 생활 환경을 개선하고 경제적 이익을 강화하기 위해 자오와 같은 기업은 혁신적인 접근 방식을 채택하고 있습니다. 특정 지역에서 폐기물을 수집하고, 재활용할 수 없는 폐기물을 소각하여 도시 지역에 전력을 공급하고, 소각하기 전에 과일 껍질을 발효 및 탈수하는 등 까다로운 폐기물에 대해 독자적인 방법을 채택하고 있습니다.

사우디 투자 재활용 회사(Saudi Investment Recycling Company, SIRC)는 2030년까지 3GW의 폐기물 발전 용량을 달성하겠다는 사우디의 야심찬 계획에 따라 폐기물 발전소에 대한 투자 계획을 발표했으며, SIRC의 핵심 초점은 폐기물 발전 공정의 비용 효율성을 높이는 것입니다. 이를 위해 지역 정부는 재활용을 촉진하기 위한 다양한 이니셔티브를 주도하고 있습니다.

아시아태평양 시장 성장세가 두드러짐

아시아의 급속한 경제 성장과 도시화는 고형폐기물 발생과 관리에 대한 우려를 증폭시키고 있습니다. 더욱 복잡한 문제는 아시아 국가와 지역이 같은 지역임에도 불구하고 폐기물 관리와 물질 순환 정책에 대한 접근 방식이 각기 다르다는 점입니다.

전 세계가 순환 경제를 추진함에 따라 아시아태평양 시장에서 폐기물 관리에 대한 관심이 점점 더 높아지고 있습니다. 유엔 지역 개발 센터의 보고서에 따르면, 2014년 아시아태평양에서 발생한 플라스틱 폐기물의 양은 무려 7,000만-1억 400만 톤에 달합니다. 이 수치는 버진 플라스틱 소비의 지속적인 증가로 인해 2030년까지 1억 4,000만 톤으로 급증할 것으로 예상됩니다.

재활용 플라스틱에 대한 수요가 증가하는 반면, 이 지역은 폐기물 인프라 부족으로 어려움을 겪고 있습니다. 그러나 이러한 장애물을 극복하고 순환경제의 비전을 실현하기 위해 협력, 규제, 투자에 대한 협력적 노력이 진행되고 있습니다.

아시아태평양, 특히 동북아시아와 인도 아대륙에서 기계 재활용의 존재감이 확립되어 있습니다. 이 지역의 기계 재활용의 현재 설비 용량은 연간 1,800만 톤을 초과합니다. 특히 중국이 이 생산능력의 66%를 차지하고, 인도가 약 8%의 점유율을 차지하고 있으며, 2012년부터 2022년까지 이 지역의 기계식 재활용 생산능력은 두 배로 증가하여 2018년 이후 연평균 약 4%의 성장률을 유지하고 있습니다. 2023년 1,200만 톤에서 2040년에는 연간 3,500만 톤에 달할 것으로 예상됩니다. 이에 따라 아시아태평양은 매일 발생하는 폐기물을 줄이기 위해 엄청난 노력을 기울이고 있습니다.

폐기물 재활용 서비스 산업 개요

폐기물 재활용 서비스 시장은 세분화되어 있습니다. 경쟁 상황은 다양하고 역동적입니다. 다양한 기업들이 재활용 서비스, 폐기물 수집, 선별, 처리, 처리 및 폐기물을 제공하기 위해 경쟁하고 있습니다. 시장의 주요 기업으로는 Eurokey Recycling Ltd, Northstar Recycling, Triple M Metal LP, Amdahl Corp.

중소기업도 폐기물 재활용 서비스 시장에서 중요한 역할을 하고 있으며, 전문적인 서비스를 제공하거나 특정 지역 및 폐기물 흐름에 대응하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학과 인사이트

- 현재 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 지속가능성에 대한 수요 상승이 시장을 견인

- 환경 문제에 대한 관심 상승

- 성장 억제요인

- 시장에 영향을 미치는 규제 요인

- 시장에 영향을 미치는 인프라 과제

- 시장 기회

- 시장을 견인하는 기술의 진보

- 성장 촉진요인

- 밸류체인/공급망 분석

- 정부 규제, 무역 협정, 이니셔티브

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 폐기물 재활용 서비스 시장의 기술 개척

- COVID-19의 시장에 대한 영향

제5장 시장 세분화

- 제품별

- 종이·판지

- 금속

- 플라스틱

- 유리

- 전지·일렉트로닉스

- 기타

- 공급원별

- 지방자치체(주택과 상업시설)

- 산업용

- 기타 공급원

- 지역별

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 남미

제6장 경쟁 구도

- 시장 집중 개요

- 기업 개요

- Eurokey Recycling Ltd

- Northstar Recycling

- Triple M Metal LP

- Amdahl Corp.

- Interface Inc.

- Covanta

- Epson Inc.

- Collins & Aikman

- Xerox Corp.

- Fetzer Vineyards*

- 기타 기업

제7장 시장 전망

제8장 부록

ksm 25.02.05The Waste Recycling Services Market size is estimated at USD 129.94 billion in 2025, and is expected to reach USD 162.71 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for sustainability and rapid population growth drives the waste recycling services market.

- The modern economy's escalating waste volume and complexity are increasingly endangering ecosystems and human health. Globally, an estimated 11.2 billion tonnes of solid waste are collected annually, with the decay of its organic fraction contributing to about 5% of the world's greenhouse gas emissions. Notably, waste from electrical and electronic equipment, laden with new and hazardous substances, is emerging as a top challenge in both developed and developing nations.

- Poor waste management, spanning from absent collection systems to inadequate disposal methods, leads to air pollution and contaminates water and soil. Improper landfills further contaminate drinking water, posing health risks and disease transmission. Debris dispersal harms ecosystems, while hazardous substances from electronic and industrial waste strain both urban health and the environment.

- The primary solution lies in waste minimization. When waste is inevitable, the focus shifts to material and energy recovery, alongside remanufacturing and recycling. Recycling, in particular, offers significant resource savings. For instance, recycling a tonne of paper saves 17 trees and 50% of the water typically used. Additionally, the recycling industry is a significant job creator, employing over 12 million individuals across Brazil, China, and the United States.

- On March 15, 2024, the Ministry of Environment, Forest and Climate Change (MOEFCC) announced the Plastic Waste Management (Amendment) Rules, 2024, in the Gazette of India, further refining the 2016 Plastic Waste Management Rules. Effective immediately upon publication, this amendment underscored India's commitment to combating plastic pollution. Hence, government bodies across various regions are intensifying efforts to minimize waste and promote recycling services.

Waste Recycling Services Market Trends

Municipal Segment Seeing an Upsurge in Waste Recycling Activities

With municipal waste projected to surge by two-thirds and its associated costs nearly doubling within a generation, a recent report by the UN Environment Programme (UNEP) highlights the urgent need for a significant reduction in waste generation to ensure a sustainable and affordable future.

The UNEP report forecasts that global municipal solid waste generation, which stood at 2.3 billion tonnes in 2023, will reach 3.8 billion tonnes by 2050. When considering the broader impacts of inadequate waste management-such as pollution, health hazards, and climate change-the estimated cost escalates to a substantial USD 361 billion. Failing to address waste management issues promptly could see this annual global cost soar to a monumental USD 640.3 billion by 2050, underscoring the pressing need for nations to prioritize municipal waste recycling initiatives.

China, the world's second most populous country, faces a monumental challenge, producing over 10 billion tons of waste annually, spanning industrial, agricultural, and domestic sectors. This data, released by the Ministry of Ecology and Environment in January 2024, underscores the scale of the issue. However, there are positive strides in China's domestic waste treatment. In an effort to enhance living conditions and bolster economic gains, companies like Zhao's are adopting innovative approaches. They are gathering waste from specific zones, incinerating non-recyclables to power urban areas, and employing unique methods for challenging waste, like fermenting and dehydrating fruit peels before incineration.

Saudi Investment Recycling Company (SIRC) announced plans to invest in waste-to-energy plants, aligning with the nation's ambition to achieve a 3GW waste-to-energy capacity by 2030. A key focus for SIRC is enhancing the cost-efficiency of waste-to-energy processes. Hence, regional governments are spearheading various initiatives to promote recycling endeavors.

Asia-Pacific Observing Significant Growth in the Market

Asia's rapid economic growth and urbanization are amplifying concerns about solid waste generation and management. Adding complexity, each Asian country and region boasts unique approaches to waste management and material-cycle policies despite their shared geographic region.

As the world pushes toward a circular economy, the spotlight on waste management in the Asia-Pacific market intensifies. The United Nations Centre for Regional Development reported that in 2014, the region generated a staggering 70-104 million tonnes of plastic waste. Projections indicate this number could surge to 140 million tonnes by 2030, propelled by a relentless rise in virgin plastic consumption.

While the demand for recycled plastics is on the upswing, the region grapples with a glaring deficit in waste infrastructure. However, concerted efforts in collaboration, regulation, and investment are underway, aiming to surmount this hurdle and actualize the circular economy vision.

In Asia-Pacific, mechanical recycling, especially in Northeast Asia and the Indian subcontinent, has a well-established presence. The region's current installed capacity for mechanical recycling stands at over 18 million tonnes annually. Notably, China leads, accounting for 66% of this capacity, with India following with an approximately 8% share. From 2012 to 2022, the region's mechanical recycling capacity doubled, and it has maintained an average annual growth rate of about 4% since 2018. Projections from ICIS indicate a significant surge in mechanical recycling output, from 12 million tonnes in 2023 to an estimated 35 million tonnes annually by 2040. With this, Asia-Pacific is making a surmountable effort to reduce the waste generated every day.

Waste Recycling Services Industry Overview

The waste recycling services market is fragmented in nature. The competitive landscape is diverse and dynamic. Various companies compete to provide recycling services, waste collection, sorting, processing, and disposal. Some key players in the market include Eurokey Recycling Ltd, Northstar Recycling, Triple M Metal LP, Amdahl Corp., and Interface Inc.

Small and medium-sized enterprises also play a significant role in the waste recycling services market, offering specialized services or catering to specific regions or waste streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Demand for Sustainability Driving the Market

- 4.2.1.2 Environmental Concerns Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Factors Affecting the Market

- 4.2.2.2 Infrastructure Challenges Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Developments in the Waste Recycling Services Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Paper & Paperboard

- 5.1.2 Metals

- 5.1.3 Plastics

- 5.1.4 Glass

- 5.1.5 Batteries & Electronics

- 5.1.6 Other Products

- 5.2 By Source

- 5.2.1 Municipal (Residential and Commercial)

- 5.2.2 Industrial

- 5.2.3 Other Sources

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Eurokey Recycling Ltd

- 6.2.2 Northstar Recycling

- 6.2.3 Triple M Metal LP

- 6.2.4 Amdahl Corp.

- 6.2.5 Interface Inc.

- 6.2.6 Covanta

- 6.2.7 Epson Inc.

- 6.2.8 Collins & Aikman

- 6.2.9 Xerox Corp.

- 6.2.10 Fetzer Vineyards*

- 6.3 Other Companies