|

시장보고서

상품코드

1636432

선박 중개 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Shipbroking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

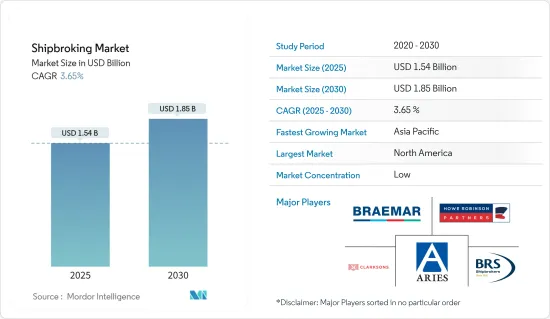

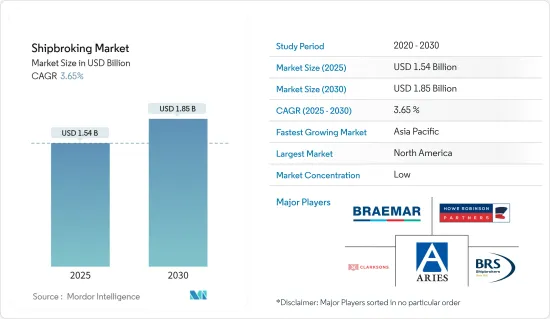

선박 중개 시장 규모는 2025년 15억 4,000만 달러, 2030년 18억 5,000만 달러로 추계되며, 예측기간(2025-2030년)의 CAGR은 3.65%에 달할 것으로 예측됩니다.

세계 무역 동향, 해운 산업의 건전성, 지정 학적 변화는 선박 중개 시장을 크게 형성하고 있습니다. 선박 중개는 일반적으로 드라이블 카, 유조선, 컨테이너 선박, 해양 지원 선박 등 특정 선종에 특화되어 있습니다. 각 선종에는 시장 역학이 있으며 전문 지식이 필요합니다. 운임은 수급, 선박의 가동률, 화물량, 항로 등에 따라 변동하여 선박 중개의 상황을 크게 좌우합니다. 이러한 운임의 변동은 용선이나 선박 거래에 관계없이 선박 중개 업무의 수익성에 직접 영향을 미칩니다.

선박 중개 섹터는 경기후퇴, 지정학적 긴장, 규제의 변화, 세계무역 패턴의 변화 등 다양한 영향을 받기 쉽습니다. 이러한 요인은 선박 수요, 공급, 시장 전체의 상황을 종합적으로 좌우합니다. 또한, 선박 중개 업계는 디지털화의 변화를 목격하고 있습니다. 온라인 플랫폼과 디지털 툴은 공정을 간소화하고, 시장의 투명성을 높이고, 구매자, 판매자, 선주, 선박의 보다 효율적인 연결을 촉진해 매우 중요합니다.

선박 중개 시장 동향

석유 및 가스 산업의 대두가 선박 중개 시장을 견인

석유 및 가스 산업의 대두는 선박 중개 시장에 큰 영향을 주고 있습니다. 석유 및 가스 수요 증가는 효율적인 운송 및 물류의 중요성을 돋보이게 합니다. 선박 중개는 구매자와 판매자를 연결하고 계약을 협상하고 이러한 귀중한 자원의 선적을 준비하는 중요한 역할을 담당합니다. 석유 및 가스가 안전하고 효율적으로 운송되고 업계 수요에 부응할 수 있도록 지원합니다. 석유 및 가스산업의 성장은 선박중개업·서비스 수요를 직접적으로 촉진합니다.

석유 및 가스산업은 원유, 석유정제품, LNG 및 기타 관련 상품의 수송을 해상운송에 크게 의존하고 있습니다. 원유 유조선과 LNG 운반선을 포함한 유조선은 에너지 자원이 대양을 건너고 대륙간을 수송하는 데 필수적입니다. 석유 및 가스산업의 확대와 증산에 따라 이러한 물자를 수송하기 위한 선박도 필요합니다.

성장하는 아시아 선박 중개 시장

아시아태평양은 여전히 세계 해운의 중심지이며 세계 해상 무역의 상당한 점유율을 차지하고 있습니다. 최근, 아시아 전역의 선박 중개 시장에 큰 변화가 보입니다. 특필해야 할 점은 중국이 이 지역의 선박 중개 업계에서 주도적인 지위를 굳히고 많은 유명한 국내 기업들이 아시아 전역에서 사업을 전개하고 있다는 것입니다. 중국 브로커는 현재 중요한 항로와 상품 거래소에서 큰 영향력을 행사하고 있습니다.

게다가 아시아 선박 중개는 제공하는 서비스를 다양화해 기존의 선박과 판매에 그치지 않고 운임 파생상품, 컨설턴트, 데이터 분석 등의 서비스를 제공하여 고객 수요 변화에 대응하고 있습니다. 아시아 선박 중개는 디지털화를 통합하여 온라인 거래 플랫폼과 데이터 분석 도구를 점점 더 활용하고 있습니다. 이러한 기술 도입은 업계의 효율성을 높이고 투명성과 의사 결정 프로세스를 강화합니다.

선박 중개 업계 개요

선박 중개 시장은 세분화되어 있으며 많은 기업로 구성되어 있습니다. 전자상거래, 기술통합, 경제 성장 등의 요인으로 인해 예측기간 동안 시장이 성장할 것으로 예상됩니다. 지역의 주요 기업은 창고 관리 시스템, 자동화, 운송 관리 시스템 등의 최신 기술을 채택하고 있습니다. 이러한 도입은 계획과 추적 기능을 강화하여 생산성 향상과 보다 매력적인 가치 제안을 이끌어 냅니다. 주요 기업으로는 Aries Shipbroking(Asia) Pte Ltd, BRS Group, Braemar Shipping Services PLC, Clarkson PLC, Howe Robinson Partners 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 상정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 해상 수송 증가가 시장을 견인

- 세계 시장의 상호 연결성 증가

- 시장 성장 억제요인

- 해운운임의 변동이 시장을 억제

- 시장 기회

- 디지털 기술의 대두가 선박 중개에 새로운 길을 연다

- 밸류체인/서플라이체인 분석

- Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장에서의 혁신에 관한 통찰

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 유형별

- 건화물 중개

- 유조선 중개

- 컨테이너선 중개

- 기타 유형

- 서비스별

- 차트 작성

- 매매

- 해외 서비스

- 신조선 서비스

- 설비 및 예선 서비스

- 산업별

- 석유 및 가스

- 제조업

- 항공우주 및 방위

- 정부기관

- 기타 산업

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중

- 기업 프로파일

- Aries Shipbroking(Asia) Pte Ltd

- BRS Group

- Braemar Shipping Services PLC

- Clarkson PLC

- Howe Robinson Partners

- Simpson Spense Young

- Fearnleys A/S

- ACM Shipping Group PLC

- Chowgule Brothers Pvt. Ltd

- Affinity(Shipping) LLP*

제7장 시장 동향

제8장 면책사항과 출판사에 대해서

JHS 25.02.10The Shipbroking Market size is estimated at USD 1.54 billion in 2025, and is expected to reach USD 1.85 billion by 2030, at a CAGR of 3.65% during the forecast period (2025-2030).

Global trade trends, the shipping industry's health, and geopolitical shifts significantly shape the shipbroking market. Shipbrokers typically specialize in specific types of vessels, such as dry bulk carriers, tankers, container ships, or offshore support vessels. Each vessel type has its market dynamics and requires specialized knowledge. Freight rates significantly shape the shipbroking landscape, responding to supply and demand, vessel availability, cargo volumes, and trade routes. These rate fluctuations directly influence the profitability of shipbroking activities, be it chartering or vessel transactions.

The shipbroking sector is notably sensitive to various influences, including economic downturns, geopolitical tensions, regulatory shifts, and alterations in global trade patterns. These factors collectively sway vessel demand, supply, and overall market conditions. Moreover, the shipbroking industry is witnessing a digital metamorphosis. Online platforms and digital tools are now pivotal, streamlining processes, bolstering market transparency, and fostering more efficient connections among buyers, sellers, owners, and charterers.

Shipbroking Market Trends

Rise in Oil and Gas Industry is Driving the Shipbroking Market

The rise in the oil and gas industry has had a significant impact on the shipbroking market. The rising demand for oil and gas underscores the critical importance of efficient transportation and logistics. Shipbrokers play a crucial role in connecting buyers and sellers, negotiating contracts, and arranging the shipment of these valuable resources. They help ensure that oil and gas are transported safely and efficiently, meeting the demands of the industry. The growth of the oil and gas industry directly drives the demand for shipbroking services.

The oil and gas industry depends significantly on maritime transportation for moving crude oil, refined petroleum products, LNG, and other related commodities. Tankers, including crude oil tankers and LNG carriers, are essential for transporting these energy resources across oceans and between continents. As the oil and gas industry expands or experiences increased production, there is a corresponding need for more vessels to transport these commodities.

Growing Shipbroking Market in Asia

Asia-Pacific remains a pivotal center for global shipping, commanding a substantial share of the world's seaborne trade. Significant shifts have been witnessed in the shipbroking market across Asia in recent years. Notably, China has solidified its position as a leading force in the regional shipbroking landscape, with many prominent domestic firms expanding operations throughout Asia. Chinese brokers now wield considerable influence in critical shipping lanes and commodity exchanges.

Moreover, Asian shipbrokers are diversifying their offerings, moving beyond traditional chartering and sales to include services like freight derivatives, consultancy, and data analytics, aligning with their clients' changing demands. By embracing digitalization, Asian shipbrokers increasingly turn to online trading platforms and data analytics tools. This tech adoption is enhancing industry efficiency and bolstering transparency and decision-making processes.

Shipbroking Industry Overview

The shipbroking market is fragmented and consists of many players. The market is expected to grow during the forecast period due to factors such as e-commerce, technology integration, and growing economies. Major regional companies have embraced modern technologies like warehousing management systems, automation, and transportation management systems. These adoptions have enhanced their planning and tracking capabilities, leading to heightened productivity and a more compelling value proposition. Some major players include Aries Shipbroking (Asia) Pte Ltd, BRS Group, Braemar Shipping Services PLC, Clarkson PLC, and Howe Robinson Partners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Maritime Transport is Driving the Market

- 4.2.2 The Increasing Interconnectedness of Global Markets

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Shipping Rates is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Rise in Digital Technologies has Opened up New Avenues for Shipbrokers

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Dry Cargo Broking

- 5.1.2 Tanker Broking

- 5.1.3 Container Vessel Broking

- 5.1.4 Other Types

- 5.2 By Service

- 5.2.1 Charting

- 5.2.2 Sales and Purchases

- 5.2.3 Offshore Services

- 5.2.4 Newbuilding Services

- 5.2.5 Salvage &Towage Services

- 5.3 By Industry

- 5.3.1 Oil and Gas

- 5.3.2 Manufacturing

- 5.3.3 Aerospace and Defense

- 5.3.4 Government

- 5.3.5 Other Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 Aries Shipbroking (Asia) Pte Ltd

- 6.2.2 BRS Group

- 6.2.3 Braemar Shipping Services PLC

- 6.2.4 Clarkson PLC

- 6.2.5 Howe Robinson Partners

- 6.2.6 Simpson Spense Young

- 6.2.7 Fearnleys A/S

- 6.2.8 ACM Shipping Group PLC

- 6.2.9 Chowgule Brothers Pvt. Ltd

- 6.2.10 Affinity (Shipping) LLP*