|

시장보고서

상품코드

1636476

유럽의 전기자동차 전지 전해액 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

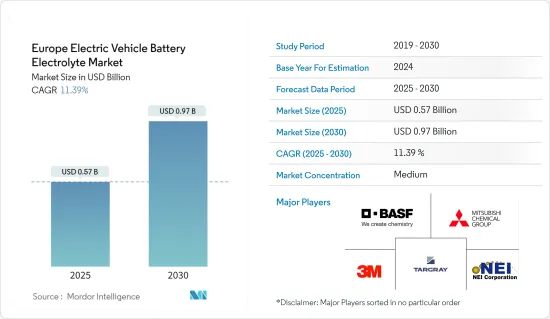

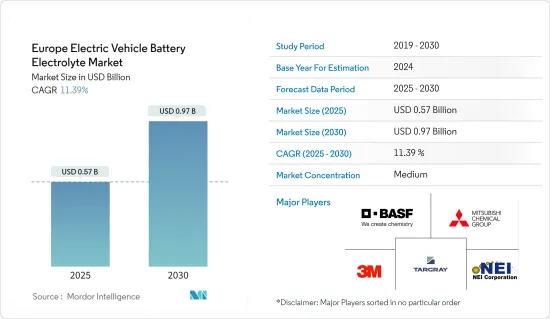

유럽의 전기자동차 전지 전해액 시장 규모는 2025년에 5억 7,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 11.39%로, 2030년에는 9억 7,000만 달러에 달할 전망입니다.

주요 하이라이트

- 중기적으로는 동지역 전체에서 전기자동차의 보급과 전지 기술의 진보가 진행되고 있어 예측 기간 중 전기차용 전지 전해액 시장 수요를 견인할 것으로 예상됩니다.

- 한편, 고체 전해질의 기술적 과제는 전기자동차 전지 전해질 시장의 성장을 크게 억제할 수 있습니다.

- 전지 성능, 안전성 및 수명을 향상시키는 전해액 배합 기술 혁신은 특히 고성능 또는 장거리 EV를 위해 가까운 미래에 전기자동차 전지 전해액 시장에 큰 성장 기회를 창출합니다.

- 독일은 EV 보급률 상승으로 예측 기간 동안 유럽 전기자동차 전지 전해액 시장에서 가장 급성장하는 국가가 될 것으로 예상됩니다.

유럽 전기자동차 전지 전해액 시장 동향

리튬 이온 전지 유형이 크게 성장

- 유럽 전기자동차 전지 전해액 시장은 전기자동차(EV) 공급망의 매우 중요한 부분이며 EV의 주요 에너지 저장 솔루션인 리튬 이온 전지의 생산과 밀접한 관련이 있습니다. 유럽에서는 엄격한 배기 가스 규제, 정부 인센티브 및 환경 의식이 높아짐에 따라 전기자동차 도입이 현저하게 증가하고 있습니다. 이러한 요소들은 동지역 전체에서 리튬 이온 전지와 전지 전해액 수요를 현저하게 높이고 있습니다.

- 리튬 이온 전지는 높은 에너지 밀도, 긴 수명, 상대적으로 낮은 자가방전율을 특징으로하며 EV 시장에 필수적입니다. 리튬 이온 전지 가격은 전기자동차 전체의 비용에 크게 영향을 미치며 매우 중요한 역할을 하는 전해액은 전지 가격에 직접 영향을 미칩니다.

- 예를 들어 Bloomberg NEF의 보고서에 따르면 2023년 전지 가격은 전년 대비 13% 감소한 139달러/kWh가 될 전망으로 지속적인 기술 진보와 제조 최적화로 인해 전지 팩 가격은 2025년까지 113달러/kWh, 2030년까지 80달러/kWh까지 더 하락할 것으로 예상됩니다. 제조 효율성 향상, 원료 대량 조달, 공급망의 합리화로 리튬 이온 전지의 생산이 확대됨에 따라 전지 전해액의 단가도 예측 기간 동안 감소할 것으로 예상됩니다.

- 또한 EV 산업이 보다 높은 에너지 밀도, 급속 충전, 수명 연장, 안전성의 향상을 요구하는 가운데 리튬 이온 전지 기술은 이러한 요구에 부응하기 위해 진화하고 있습니다. 최근 EV용 전지의 주요 기업은 리튬 이온 전지 기술을 발전시키기 위해 여러 노력을 기울이고 있습니다.

- 예를 들어, Toshiba Corporation은 2023년 11월 코발트가 없는 5V급 고전위 양극 재료를 채용한 혁신적인 리튬 이온 전지를 발표했습니다. 다양한 응용분야를 갖는 이 전지는 전동 공구에서 전기자동차에 이르기까지 광범위한 응용 분야에 사용됩니다. Toshiba Corporation의 첨단 양극은 특히 표준 고전도 전해액과 함께 사용하면 가스 발생을 현저히 감소시키고 이러한 진보는 정교한 리튬 이온 전지, 나아가서는 EV 전지용 전해액 수요를 당분간 강화하게 될 것으로 예상됩니다.

- 게다가 주요 전지 제조업체는 유럽에서 생산 능력을 증강하고 있으며, 급증하는 EV 수요에 대응하고 나아가 전해액 시장을 뒷받침하고 있습니다. 2023년 11월 영국 정부는 EV 전지 공급망을 강화하기 위해 5,000만 파운드(6,300만 달러)를 투자할 것이라고 발표했습니다. 2030년까지 계속되는 전지 전략은 새로운 자본 및 R&D 자금을 포함하여 제로 배출 차량, 전지 및 공급망에 대한 헌신적인 지원을 약속합니다. 이러한 노력은 예측 기간 동안 리튬 이온 전지의 생산, 그리고 EV용 전해액 수요 증가로 이어질 것으로 예상됩니다.

- 결론적으로 이러한 노력과 기술 혁신은 유럽에서 리튬 이온 전지의 생산을 확대하고 EV 전지용 전해액 수요를 향후 몇 년동안 증가시킬 것으로 예상됩니다.

현저한 성장을 이루는 독일

- 유럽 최대 자동차 시장인 독일은 전기자동차(EV) 도입의 최전선에 있으며, 동지역의 다른 주요 국가를 압도하고 있습니다. 녹색 에너지에 대한 노력과 엄격한 환경 규제가 EV의 보급을 가속화하고 있고, 이러한 EV 도입의 급증에 의해 EV용 전지 전해액을 비롯한 필수 부품 수요가 높아지고 있습니다.

- 최근 독일에서는 소비자 수요 증가, 환경 의식 증가, 세액 공제 및 리베이트 등 정부 우대 정책으로 EV 판매량이 현저하게 증가하고 있으며 EV의 보급에 따라 리튬 이온 전지와 그 고품질 전해액 수요도 급증하고 있습니다.

- 국제에너지기구(IEA)에 따르면 독일의 전기차 판매 대수는 70만대로 2022년의 숫자에 필적하지만 2019년부터는 5.5배로 급증했습니다. 정부가 지원 시책을 내세우고 있는 경우도 있어, EV의 판매 대수는 향후 수년간 증가할 전망입니다.

- 자동차 제조와 전지 제조의 두 부문에서 압도적인 지위를 차지하는 독일은 전지의 효율성과 성능 향상을 목표로 연구개발에 많은 투자를 하고 있습니다. 최첨단 전지 전해액 배합은 전지의 수명, 안전성, 에너지 밀도를 향상시키는데 있어서 매우 중요하기 때문에 독일의 EV용 전지 기술 혁신에 중심점이 될 것으로 예상됩니다.

- 주목할 만한 개발로 VARTA가 주도하는 15개 기업과 대학 연구원으로 구성된 컨소시엄이 2024년 5월 획기적인 나트륨 이온 전지 기술을 발표했습니다. 이 컨소시엄의 목표는 EV 및 기타 용도를 위해 고성능, 비용 효율적이고 친환경적인 전지를 개발하는 것이며, 프로젝트 완료 목표는 2027년 중반으로 설정되었습니다. 이러한 진보로 동지역에서는 최첨단 EV용 전지와 전해액 수요가 높아질 것으로 예상됩니다.

- 우수한 에너지 밀도와 안전성으로 알려진 고체 전지로 산업이 전환하면서 새로운 전해질에 대한 요구가 커지고 있고 최근 자동차 부문에서 급증하는 전지 수요에 대응하기 위해 여러 협정이 맺어졌습니다.

- 예를 들어, 2024년 7월 Volkswagen Group의 전지 부서인 Powerco는 QuantumScape와 파트너십을 맺어 최첨단 고체 리튬 금속 전지 기술을 상업화했습니다. QuantumScape는 일정한 기술적 수준을 달성한 시점에서 PowerCo에 회사 고유의 플랫폼을 기반으로 한 전지의 양산 라이선스를 제공한다는 입장입니다. 이러한 제휴에 의해 고체 전지 수요가 확대되어 제조에 필요한 전해액의 안정적인 공급이 확보됩니다.

- 이러한 개발 상황을 감안하면 독일의 EV 생산이 상승 기조에 있다는 것은 분명하며, 가까운 미래에 EV용 전지 전해액 수요가 더욱 높아질 것으로 예상됩니다.

유럽 전기자동차 전지 전해질 산업 개요

유럽 전기자동차 전지 전해액 시장은 완만합니다. 주요 진입기업(순서부동)은 3M Company, BASF Corporation, Mitsubishi Chemical Group Corporation, Targray Technology International Inc, NEI corporation 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 전제조건

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서문

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 전기자동차 보급 확대

- 전지 기술의 진보

- 억제요인

- 고체 전해질의 기술 과제

- 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 전지 유형

- 리튬 이온 전지

- 납축전지

- 기타

- 전해질 유형

- 액체 전해질

- 겔 전해질

- 고체 전해질

- 지역

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 노르딕

- 러시아

- 터키

- 기타 유럽

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- 3M Company

- BASF Corporation

- LG Chem Ltd

- Mitsubishi Chemical Group

- Panasonic Holdings Corporation

- Solvay SA

- Asahi Kasei America, Inc.

- Targray Technology International Inc

- Dongwha Electrolyte Co.,Ltd.

- 삼성SDI

- NEI corporation

- 기타 유력 기업 목록

- 시장 순위 분석

제7장 시장 기회와 앞으로의 동향

- 전해질 배합의 혁신

The Europe Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.57 billion in 2025, and is expected to reach USD 0.97 billion by 2030, at a CAGR of 11.39% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles and advancements in battery technology across the region are expected to drive the demand for the electric vehicle battery electrolyte market during the forecast period.

- On the other hand, the technological challenges in Solid-State electrolytes can significantly restrain the growth of the electric vehicle battery electrolyte market.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs creates significant growth opportunities in the electric vehicle battery electrolyte market in the near future.

- Germany is anticipated to be the fastest-growing country in the European electric vehicle battery electrolyte market during the forecast period due to rising EV adoption.

Europe Electric Vehicle Battery Electrolyte Market Trends

Lithium-Ion Batteries Type to Witness Significant Growth

- The European EV battery electrolyte market is a pivotal segment of the electric vehicle (EV) supply chain, intricately linked to the production of lithium-ion batteries, the primary energy storage solution for EVs. Europe has seen a notable uptick in electric vehicle adoption, spurred by stringent emissions regulations, government incentives, and heightened environmental consciousness. These elements are driving a pronounced demand for lithium-ion batteries and, by extension, battery electrolytes throughout the region.

- Lithium-ion batteries are indispensable to the EV market, prized for their high energy density, extended cycle life, and relatively low self-discharge rate. The pricing of lithium-ion batteries significantly influences the overall cost of electric vehicles. Given their pivotal role, electrolytes directly impact battery pricing.

- For example, a Bloomberg NEF report highlighted that in 2023, battery prices fell to USD 139/kWh, marking a 13% drop from the prior year. With ongoing technological advancements and manufacturing optimizations, projections suggest battery pack prices will further decline to USD 113/kWh by 2025 and USD 80/kWh by 2030. As lithium-ion battery production ramps up-thanks to enhanced manufacturing efficiencies, bulk raw material procurement, and streamlined supply chains-the per-unit cost of battery electrolytes is also expected to decrease during the forecast period.

- Additionally, as the EV industry demands higher energy densities, quicker charging, extended life cycles, and enhanced safety, lithium-ion battery technology is evolving to meet these needs. Recently, top EV battery firms have embarked on multiple initiatives to advance lithium-ion battery technology.

- For instance, in November 2023, Toshiba Corporation introduced an innovative lithium-ion battery featuring a cobalt-free, 5V-class high-potential cathode material. This versatile battery finds applications ranging from power tools to electric vehicles. Significantly, Toshiba's advanced cathode, especially when used with a standard high-conductivity electrolyte, shows a notable decrease in gas generation. Such advancements are poised to bolster the demand for sophisticated lithium-ion batteries and, consequently, EV battery electrolytes in the foreseeable future.

- Furthermore, leading battery manufacturers are ramping up production capacities in Europe, responding to the surging EV demand and, in turn, propelling the electrolyte market. In November 2023, the UK government announced a GBP 50 million (USD 63 million) investment to fortify the EV battery supply chain, emphasizing lithium-ion batteries. The Battery Strategy, extending to 2030, promises dedicated support for zero-emission vehicles, batteries, and their supply chains, including fresh capital and R&D funding. Such initiatives are anticipated to boost lithium-ion battery production and, subsequently, the demand for EV battery electrolytes during the forecast period.

- In conclusion, these initiatives and innovations are set to amplify lithium-ion battery production in Europe and elevate the demand for EV battery electrolytes in the coming years.

Germany to Witness Significant Growth

- Germany, the largest automotive market in Europe, is at the forefront of electric vehicle (EV) adoption, outpacing other major countries in the region. The nation's commitment to green energy, coupled with stringent environmental regulations, has accelerated the uptake of EVs. This surge in EV adoption has, in turn, heightened the demand for essential components, notably EV battery electrolytes.

- In recent years, Germany has seen a notable uptick in EV sales, driven by heightened consumer demand, growing environmental consciousness, and government incentives like tax credits and rebates. As EV adoption has surged, so too has the demand for lithium-ion batteries and their high-quality electrolytes.

- According to the International Energy Agency (IEA), Germany recorded sales of 0.7 million electric vehicles, matching 2022's figures but representing a 5.5-fold leap from 2019. With the government rolling out supportive policies, EV sales are poised to climb in the coming years.

- As a dominant player in both automotive and battery manufacturing, Germany is channeling substantial investments into R&D, aiming to bolster battery efficiency and performance. Given that advanced battery electrolyte formulations are pivotal for enhancing battery life, safety, and energy density, they are set to be a central focus of innovation in the nation's EV batteries.

- In a notable development, a consortium of 15 companies and university researchers, spearheaded by VARTA, introduced groundbreaking sodium-ion battery technology in May 2024. Their ambition is to develop high-performance, cost-effective, and environmentally friendly batteries for EVs and other applications, with a project completion target set for mid-2027. Such advancements are anticipated to boost the demand for sophisticated EV batteries and, by extension, their electrolytes in the region.

- As the industry pivots towards solid-state batteries, heralded for their superior energy density and safety, there's an emerging need for novel electrolytes. Recently, multiple agreements have been inked to cater to the burgeoning demand for these batteries in the automotive realm.

- For example, in July 2024, Volkswagen Group's battery arm, Powerco, entered into a partnership with QuantumScape to commercialize its state-of-the-art solid-state lithium-metal battery technology. Upon achieving certain technical benchmarks, QuantumScape is poised to grant PowerCo a license for mass-producing batteries based on its proprietary platform. Such collaborations are set to amplify the demand for solid-state batteries and ensure a consistent supply of electrolytes for their production.

- Given these developments, it's evident that Germany's EV production is on an upward trajectory, further fueling the demand for EV battery electrolytes in the foreseeable future.

Europe Electric Vehicle Battery Electrolyte Industry Overview

The Europe Electric Vehicle Battery Electrolyte market is moderated. Some of the key players (not in particular order) are 3M Company, BASF Corporation, Mitsubishi Chemical Group, Targray Technology International Inc, NEI corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Battery Technology

- 4.5.2 Restraints

- 4.5.2.1 Technological Challenges in Solid-State Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M Company

- 6.3.2 BASF Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 Mitsubishi Chemical Group

- 6.3.5 Panasonic Holdings Corporation

- 6.3.6 Solvay SA

- 6.3.7 Asahi Kasei America, Inc.

- 6.3.8 Targray Technology International Inc

- 6.3.9 Dongwha Electrolyte Co.,Ltd.

- 6.3.10 Samsung SDI

- 6.3.11 NEI corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Electrolyte Formulations