|

시장보고서

상품코드

1636481

중국의 전기자동차 배터리 제조 장치 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

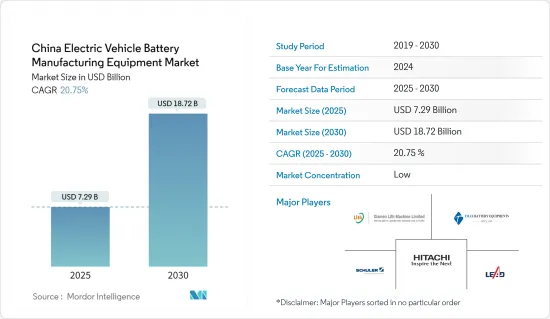

중국의 전기자동차 배터리 제조장치 시장 규모는 2025년 72억 9,000만 달러, 2030년 187억 2,000만 달러로 추정되며, 예측기간(2025-2030년)의 CAGR은 20.75%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전지 제조를 위한 정부의 정책과 투자, 전지 원료(특히 리튬 이온)의 비용 저하가 예측 기간 시장을 견인할 것으로 보입니다.

- 한편, 제조 시설의 설립에 노력하는 타국은 향후 시장의 방해가 될 것으로 예상됩니다.

- 그럼에도 불구하고 중국의 전기자동차의 장기적인 야심적 목표는 예측 기간 동안 큰 기회를 창출할 것으로 예상됩니다.

중국 전기자동차 배터리 제조 장비 시장 동향

리튬 이온 배터리가 큰 점유율을 차지할 전망

- 리튬 이온 배터리 제조 장치에는 리튬 이온 배터리 제조에 특화된 전용 기계 및 공구가 포함됩니다. 중국은 리튬 이온 배터리 제조의 세계 최고의 선두주자이며 다양한 산업 전용 장비를 생산하는 수많은 기업을 보유하고 있습니다. 견고한 인프라, 정부 지원, 풍부한 전문 지식에 힘입어 중국은 리튬 이온 배터리 생산의 핵심 허브로 자리를 잡고 있습니다.

- 게다가 기술의 진보와 규모의 경제로 인해 중국에서는 리튬 이온 배터리 팩이 보다 저렴해지고 있으며, 전기자동차(EV) 수요 증가로 이어지고 있습니다. EV가 보다 가까워짐에 따라 리튬이온 전지 제조장치 수요 급증도 병행하여 밝혀집니다.

- 2023년에는 리튬이온 배터리 팩의 가격은 전년보다 14% 하락해 139달러/kWh에 정착합니다. 이러한 시장 역학에 그치지 않고, 현재 진행중인 연구개발은 EV용의 보다 효율적인 리튬 배터리 재료의 개발을 목표로 하고 있어, 전지 제조 장치 수요를 한층 더 높이고 있습니다.

- 게다가 기술이 발전함에 따라 EV용 배터리 제조업체는 뛰어난 리튬 이온 배터리를 생산하고 있으며, 첨단 EV용 배터리 제조 장치의 필요성이 높아지고 있습니다.

- 예를 들어, 2024년 4월, 중국의 유명 EV 배터리 제조업체인 CATL은 최첨단 인산철 리튬 배터리를 발표하여 한 번 충전으로 1,000km를 넘는 경이로운 주행 거리를 달성했습니다. 이러한 획기적인 기술은 리튬 이온 배터리의 제조 장비에 대한 수요를 높일 것으로 보입니다.

- 게다가 2024년 5월, CATL은 다른 6개사와 공동으로, 미래 EV의 동력원이 되는 종래의 리튬 이온 전지의 차세대 진화형인 전고체 전지(ASSB)의 개발을 목적으로 한, 약 8억 4,500만 달러의 거액 투자를 발표했습니다.

- EV용 리튬 이온 전지의 가격 하락과 지속적인 기술 혁신을 고려하면, 이 분야는 향후 수년간 큰 점유율을 차지할 것으로 예측됩니다.

배터리 제조를 위한 정부의 정책과 투자가 시장을 견인할 전망

- 중국의 전기자동차 배터리 제조 장비 시장은 정부 지원 정책과 배터리 제조에 많은 투자를 지원합니다. 정부는 직접적인 재정지원, 세제우대조치, 보조금을 제공하고, 제조업체의 비용을 효과적으로 인하하고, 최첨단 설비에 대한 투자를 촉진하고 있습니다.

- 메이드 인 차이나 2025 '와 신에너지 자동차의 의무화 등 국가적 이니셔티브는 배터리 기술을 비롯한 하이테크 분야의 성장을 지지하고 특수한 제조 툴 수요를 촉진하고 있습니다. 또한 중국은 전기자동차용 선구적인 배터리 기술에 대한 투자를 추진하고 있습니다.

- 예를 들어 중국은 2024년 5월 EV 차세대 배터리 기술에 8억 4,500만 달러를 투자할 계획을 발표했습니다. 주목할만한 것은 대기업 자동차 제조업체의 BYD와 Geely와 함께 CATL을 포함한 6개사가 전고체 배터리 개발에 있어서 정부 지원의 혜택을 받고 있다는 점입니다.

- 게다가 EV 판매량의 급증은 배터리 제조업체에 투자 확대를 촉진하고 EV용 배터리 제조 툴 수요를 더욱 밀어 올리고 있습니다. 국제에너지기구의 보고에 따르면 2023년 중국의 EV 자동차 판매량은 810만대에 달하며 2022년 590만대에서 급증합니다. 이 나라가 EV 생산을 가속화하고 배터리 제조에 대한 투자를 강화함에 따라 관련 장비 수요도 높아질 것으로 예상됩니다.

- 중국은 세계 EV 시장에서 압도적인 지위를 차지하고 있으며, 2023년 12월 EV 신차 판매 대수의 69%를 차지해 앞으로도 낙관적인 성장 궤도를 그립니다. 전년 판매량은 37% 증가한 약 900만대에 달했고 시장 점유율은 34%에 달했습니다. 또한 국가는 EV 보급의 야망을 수정하고 2030년까지 40%라는 기존 목표에서 2027년까지 45% 시장 점유율을 목표로 하고 있습니다.

- 결론적으로 정부의 강력한 백업과 배터리 생산에 대한 전략적 투자로 시장은 지속적인 성장 태세를 유지하고 있습니다.

중국 전기자동차 배터리 제조 장비 산업 개요

중국의 전기자동차 배터리 제조 장비 시장은 반파편화되었습니다. 이 시장의 주요 기업(순부동)으로는 Xiamen Lith Machine Limited, Wuxi Lead Intelligent Equipment Co Ltd, Schuler AG, Hitachi Ltd, and Xiamen Tmax Battery Equipments Limited. 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 배터리 제조를 위한 정부의 정책과 투자

- 전지 원재료 비용의 저하

- 억제요인

- 제조 시설의 설립을 목표로 하는 타국

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자분석

제5장 시장 세분화

- 공정별

- 혼합

- 코팅

- 캘린더

- 슬릿·전극 가공

- 기타 공정

- 배터리별

- 리튬 이온

- 납축전지

- 니켈 수소 전지

- 기타 배터리

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Xiamen Lith Machine Limited

- Wuxi Lead Intelligent Equipment Co Ltd

- Schuler AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- Durr AG

- Xiamen ACEY New Energy Technology

- Xiamen TOB New Energy Technology Co., Ltd

- List of Other Prominent Companies

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 전기차의 장기적인 야심적 목표

The China Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 7.29 billion in 2025, and is expected to reach USD 18.72 billion by 2030, at a CAGR of 20.75% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government policies and investments towards battery manufacturing, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, other countries striving to establish manufacturing facilities are expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in China are expected to create a significant opportunity in the forecast period.

China Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery is Expected to have a Major Share

- Lithium-ion battery manufacturing equipment includes specialized machines and tools tailored for producing lithium-ion batteries. China stands as a global frontrunner in lithium-ion battery production, hosting a multitude of companies that manufacture a diverse array of industry-specific equipment. Bolstered by robust infrastructure, governmental backing, and a wealth of expertise, China has solidified its status as a central hub for lithium-ion battery production.

- Moreover, due to technological advancements and economies of scale, lithium-ion battery packs are becoming more affordable in China, leading to a rise in electric vehicle (EV) demand. As EVs become more accessible, the parallel surge in demand for lithium-ion battery manufacturing equipment becomes evident.

- In 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD 139/kWh. Beyond these market dynamics, ongoing research and development efforts aim to create more efficient lithium battery materials for EVs, further amplifying the demand for battery manufacturing equipment.

- Moreover, as technology advances, EV battery manufacturers are crafting superior lithium-ion batteries, intensifying the need for advanced EV battery manufacturing equipment.

- For example, in April 2024, CATL, a prominent Chinese EV battery manufacturer, introduced its cutting-edge lithium iron phosphate battery, achieving a remarkable driving range exceeding 1,000 kilometers on a single charge. Such breakthroughs are poised to bolster the demand for lithium-ion battery manufacturing equipment.

- Additionally, in May 2024, CATL, in collaboration with six other firms, announced a substantial investment of nearly USD 845 million aimed at developing all-solid-state batteries (ASSBs), a next-gen evolution of conventional lithium-ion batteries, set to power future EVs.

- Given the declining prices and continuous innovations in EV lithium-ion batteries, this segment is projected to command a significant share in the coming years.

Government Policies and Investments Towards Battery Manufacturing is Expected to Drive the Market

- China's EV battery manufacturing equipment market is propelled by supportive government policies and substantial investments in battery production. The government provides direct financial support, tax incentives, and subsidies, effectively lowering costs for manufacturers and promoting investments in cutting-edge equipment.

- National initiatives, such as "Made in China 2025" and the New Energy Vehicle mandate, champion the growth of high-tech sectors, notably battery technology, thus fueling the demand for specialized manufacturing tools. Moreover, the nation is channeling investments into pioneering battery technologies for electric vehicles.

- For example, in May 2024, China unveiled plans to invest USD 845 million into next-gen battery tech for EVs. Notably, six firms, including CATL, alongside major automakers BYD and Geely, are poised to benefit from government support in developing all-solid-state batteries.

- Additionally, surging EV sales are prompting battery manufacturers to ramp up investments, further driving the demand for EV battery manufacturing tools. The International Energy Agency reported that in 2023, China's EV car sales reached 8.1 million, a jump from 5.9 million in 2022. As the nation accelerates its EV production and bolsters investments in battery manufacturing, the demand for related equipment is projected to rise.

- China holds a commanding position in the global EV landscape, representing 69% of new EV sales in December 2023, with an optimistic growth trajectory ahead. The previous year witnessed a 37% surge in sales, totaling around 9 million new EVs and capturing a 34% market share. Furthermore, the nation has revised its EV penetration ambitions, targeting a 45% market share by 2027, up from the earlier goal of 40% by 2030.

- In conclusion, with robust government backing and strategic investments in battery production, the market is poised for continued growth.

China Electric Vehicle Battery Manufacturing Equipment Industry Overview

The china electric vehicle battery manufacturing equipment market is semi-fragmented. Some of the major players in the market (in no particular order) include Xiamen Lith Machine Limited, Wuxi Lead Intelligent Equipment Co Ltd, Schuler AG, Hitachi Ltd, and Xiamen Tmax Battery Equipments Limited., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments Towards Battery Manufacturing

- 4.5.1.2 Decline in Cost of Battery Raw Materials

- 4.5.2 Restraints

- 4.5.2.1 Other Countries Striving Towards Establishing Manufacturing Facilities

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Xiamen Lith Machine Limited

- 6.3.2 Wuxi Lead Intelligent Equipment Co Ltd

- 6.3.3 Schuler AG

- 6.3.4 Hitachi Ltd

- 6.3.5 Xiamen Tmax Battery Equipments Limited

- 6.3.6 Durr AG

- 6.3.7 Xiamen ACEY New Energy Technology

- 6.3.8 Xiamen TOB New Energy Technology Co., Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles