|

시장보고서

상품코드

1636485

중국의 전기자동차 배터리 애노드 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

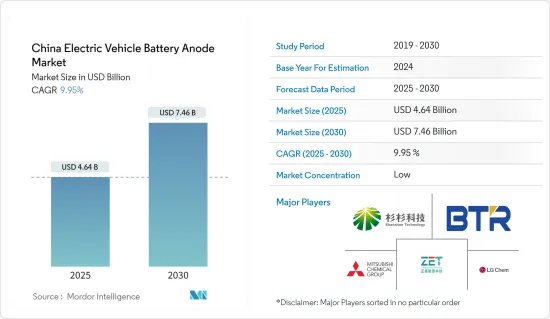

중국의 전기자동차 배터리 애노드 시장 규모는 2025년 46억 4,000만 달러, 2030년 74억 6,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 9.95%에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전지 제조에 대한 정부의 지원 정책과 투자, 리튬 이온 전지의 가격 저하가 예측 기간 시장을 견인할 것으로 보입니다.

- 한편, 애노드 재료의 제조 비용이 높은 것이 향후 시장 성장을 억제할 것으로 예상됩니다.

- 그럼에도 불구하고, 애노드 재료와 효율적인 전해질에 대한 지속적인 조사와 진보는 시장 성장 기회를 제공할 수 있습니다.

중국 전기자동차 배터리 애노드 시장 동향

리튬 이온 배터리 유형이 큰 점유율을 차지할 전망

- 당초 리튬 이온 배터리는 주로 휴대폰나 PC 등의 가전제품에 전력을 공급하고 있었습니다. 그러나 리튬 이온 배터리의 용도는 크게 확대되어 중국에서는 하이브리드 자동차와 완전 전기자동차(EV)의 주요 동력원이 되고 있습니다. 이 전환은 주로 CO2나 질소산화물과 같은 온실가스를 배출하지 않는 EV의 환경적 이점에 의해 추진되고 있습니다.

- 리튬 이온 배터리는 에너지 밀도가 높고 비용 효율적이고 효율적이기 때문에 전기자동차(EV)에 선호되는 옵션입니다. 이러한 채용 증가는 제조 공정에서 애노드 재료 수요 증가에 박차를 가하고 있습니다.

- 게다가, 리튬 이온 재료의 비용이 저하되고 있는 것도, 전기자동차용 리튬 이온 전지 제조 수요 증가의 큰 이유가 되고 있습니다. 2023년 리튬 이온 배터리 팩의 가격은 전년 대비 14% 감소한 139달러/kWh입니다. 배터리 가격이 하락함에 따라 EV는 합리적인 가격이 되어 전기자동차의 보급과 시장 점유율 확대가 진행되고 있습니다. 이러한 수요의 급증은 음극을 포함한 배터리 부품의 소비량을 증가시키며 배터리 성능을 향상시키기 위한 기술 발전을 촉진합니다.

- 향후 기술 혁신에 의해 전기자동차의 리튬 이온 전지의 효율이 향상되는 동시에, 애노드 수요도 증가할 것으로 예측됩니다.

- 예를 들어 2024년 4월 중국의 전기자동차 제조업체인 Contemporary Amperex Technology Co.는 전기자동차용 인산철 리튬(LFP) 배터리를 출시했습니다. 이 새로운 건전지의 에너지 조밀도는 kg 당 205Wh이고, 그런 건전지의 현재 기술 수준 보다는 8% 가까이 높습니다. 이러한 개발은 예측기간 동안 EV용 리튬이온 애노드 수요가 높아질 것으로 예상됩니다.

- 또한 중국공업정보화부의 감독하에 책정된 '자동차산업 그린·저탄소 개발 로드맵 1.0'에 따르면 중국의 승용차용 신에너지차(NEV) 전기차 판매 대수는 2025년까지 점유율 50%를 나타낼 것으로 예상되고 있습니다. 이러한 로드맵은 중국의 EV 애노드 제조에도 미래의 기회를 가져올 것으로 기대됩니다.

- 따라서, 전기자동차에서 리튬 이온 배터리의 사용 증가 및 가격 감소로 인해, 리튬 이온 배터리 애노드 부문은 예측 기간 동안 크게 성장할 것으로 예상됩니다.

배터리 제조를 위한 정부의 정책과 투자가 시장을 견인할 전망

- 정부의 지원 정책과 배터리 제조에 대한 많은 투자의 조합은 중국의 전기자동차 배터리 제조를 뒷받침하고 있으며, 이는 전기자동차 배터리 애노드 수요를 높일 것으로 예상됩니다. 정부는 직접적인 재정 지원, 세제 우대 조치, 보조금을 제공하고, 제조업체의 비용을 줄이고, 첨단 장비에 대한 투자를 장려하고 있습니다. 중국의 전기자동차 제조업체는 정부 보조금의 혜택을 받고 있습니다. 예를 들어, 항속 거리가 400km를 넘는 올 일렉트릭 플러그인 카에는 12,600 위안(약 2,000달러)의 보조금이 지급됩니다. 한편 항속거리가 300-400km인 차에는 9,100위안(약 1,400달러)의 보조금이 지급됩니다.

- 또한, 이 나라의 전기자동차 수요 증가는 전기자동차 배터리 제조 프로젝트에 대한 투자를 촉진하고 전기자동차 배터리 애노드 재료의 잠재적인 요구를 낳고 있습니다. 국제에너지기구(IEA)에 따르면 2023년 중국의 전기자동차 배터리 수요는 417GWh로 지난해 314GWh에서 증가하고 있습니다.

- 게다가 전기차 판매량 증가는 전지 제조업체가 전기자동차용 전지의 생산에 더욱 투자하는 동기부여가 되어, 전기자동차 배터리 애노드 재료 수요가 창출되고 있습니다. 국제에너지기구(IEA)에 따르면 2023년 EV차 판매 대수는 810만대로 2022년 590만대를 웃돌았습니다.

- 향후, 이 나라에서는 전기자동차의 제조가 급격히 진행되고 있어, EV 배터리 제조에 대한 투자가 확대되기 때문에 전기자동차 배터리 애노드 수요는 증가할 것으로 예상됩니다. 예를 들어 중국은 2024년 5월 전기차를 구동하는 차세대 배터리 기술을 개발하기 위해 8억 4,500만 달러를 투자할 것이라고 발표했습니다. 이러한 투자는 예측 기간 동안 전기자동차 배터리 제조에 대한 수요를 높일 것으로 보입니다.

- 따라서 정부의 지원 정책과 배터리 제조에 대한 투자는 시장을 견인할 것으로 예상됩니다.

중국 EV 배터리 애노드 산업 개요

중국의 EV 배터리 애노드 시장은 반분열 상태입니다. 시장의 주요 기업(순부동)으로는 Shanghai Shanshan Technology Co., Ltd., BTR New Material Group Co., Ltd., Jiangxi Zhengtuo New Energy Technology, Mitsubishi Chemical Group., and LG Chemical Group 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 배터리 제조를 위한 정부의 정책과 투자

- 전지 원재료 비용의 저하

- 억제요인

- 애노드재의 높은 제조 비용

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 유형별

- 리튬 이온

- 납축

- 기타 유형

- 재료별

- 리튬

- 흑연

- 실리콘

- 기타

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Shanghai Shanshan Technology Co., Ltd.

- BTR New Material Group Co., Ltd.

- Jiangxi Zhengtuo New Energy Technology

- Mitsubishi Chemical Group.

- Shanghai Putailai New Energy Technology

- Targray Industries Inc.

- Ningbo Shanshan Co., Ltd.

- LG Chemical Group

- Tokai Carbon Co., Ltd.

- Resonac Holdings Corporation.

- List of Other Prominent Companies

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 다른 애노드 재료의 연구개발 증가

The China Electric Vehicle Battery Anode Market size is estimated at USD 4.64 billion in 2025, and is expected to reach USD 7.46 billion by 2030, at a CAGR of 9.95% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, supportive government policies and investments in battery manufacturing and the decreasing price of lithium-ion batteries are expected to drive the market in the forecast period.

- On the other hand, high production cost for anode materials is expected to restrain market growth in the future.

- Nevertheless, the ongoing research and advancement in anode material and efficient electrolytes may offer opportunities for market growth.

China Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Type is Expected to Have a Major Share

- Initially, lithium-ion batteries primarily powered consumer electronics, including mobile phones and personal computers. However, their application has broadened significantly, making them the dominant power source for hybrid and fully electric vehicles (EVs) in China. This transition is primarily driven by the environmental advantages of EVs, which emit no CO2, nitrogen oxides, or other greenhouse gases.

- Due to their high energy density, cost-effectiveness, and efficiency, lithium-ion batteries have become the preferred choice for electric vehicles (EVs). This growing adoption has spurred a rising demand for anode materials during the manufacturing process.

- Further, the decreasing cost of lithium-ion materials is also a significant reason for the increasing demand for lithium-ion battery manufacturing for electric vehicles. In 2023, the price of lithium-ion battery packs decreased by 14% compared to the previous year to USD139/kWh. As battery prices drop, EVs become more affordable, increasing adoption and a larger market share for electric vehicles. This surge in demand will drive higher consumption of battery components, including the anode, and encourage technological advancements to improve battery performance.

- In the future, as technological innovations enhance the efficiency of lithium-ion batteries in electric vehicles, the demand for anode materials is projected to rise simultaneously.

- For instance, in April 2024, Contemporary Amperex Technology Co., a Chinese electric vehicle manufacturer, launched a lithium iron phosphate (LFP) battery for electric vehicles. The new battery has an energy density of 205 Wh per kg, almost 8% higher than the current state of the art for such batteries. Such developments are expected to boost the demand for EV lithium-ion anode materials in the forecast period.

- Additionally, as per Automotive Industry Green and Low-Carbon Development Roadmap 1.0 developed under the supervision of China's Ministry of Industry and Information Technology, electric car sales in China for passenger new energy vehicle (NEV) is expected to reach a 50% share by 2025. Such roadmaps are expected to raise a futuristic oppotunity for EV anode manufacturing too in China.

- Thus, owing to the increasing use of lithium-ion batteries in electric vehicles and decreasing prices, the lithium-ion battery anode segment is expected to grow significantly in the forecast period.

Government Policies and Investments Towards Battery Manufacturing is Expected to Drive the Market

- A combination of supportive government policies and significant investment in battery production drives China's EV battery manufacturing, which, in turn, is expected to boost the demand for electric vehicle battery anodes. The government offers direct financial support, tax incentives, and subsidies, reducing manufacturers' costs and encouraging investment in advanced equipment. Manufacturers of electric vehicles in China benefit from government subsidies. For instance, all-electric plug-in cars boasting a range exceeding 400 km qualify for a subsidy of RMB 12,600 (around USD 2,000). Meanwhile, those ranging between 300 to 400 km receive a subsidy of RMB 9,100 (approximately USD 1,400).

- Further, the country's increasing demand for electric vehicles is fueling investment in electric vehicle battery manufacturing projects, thereby creating a potential need for electric vehicle battery anode materials. According to the International Energy Agency, in 2023, the demand for electric vehicle batteries in China accounted for 417 GWh, up from 314 GWh last year.

- Moreover, rising electric vehicle sales are motivating battery manufacturing companies to invest more in EV battery production, thereby creating demand for EV battery anode materials. According to the International Energy Agency, in 2023, the country's total EV car sales accounted for 8.1 million, higher than 5.9 million in 2022.

- In the future, the demand for EV battery anode materials is expected to increase as the country rushes towards manufacturing electric vehicles, and investments are expected to grow in EV battery manufacturing. For instance, in May 2024, China announced to invest 845 USD million to develop next-generation battery technology powering electricl vehicles. Such investments will boost the demand for electric vehicle battery manufacturing in the forecast period.

- Thus, supportive government policies and investments in battery manufacturing are expected to drive the market.

China Electric Vehicle Battery Anode Industry Overview

The China electric vehicle battery anode market is semi-fragmented. Some of the major players in the market (in no particular order) include Shanghai Shanshan Technology Co., Ltd., BTR New Material Group Co., Ltd., Jiangxi Zhengtuo New Energy Technology, Mitsubishi Chemical Group., and LG Chemical Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High Production Cost for Anode Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shanghai Shanshan Technology Co., Ltd.

- 6.3.2 BTR New Material Group Co., Ltd.

- 6.3.3 Jiangxi Zhengtuo New Energy Technology

- 6.3.4 Mitsubishi Chemical Group.

- 6.3.5 Shanghai Putailai New Energy Technology

- 6.3.6 Targray Industries Inc.

- 6.3.7 Ningbo Shanshan Co., Ltd.

- 6.3.8 LG Chemical Group

- 6.3.9 Tokai Carbon Co., Ltd.

- 6.3.10 Resonac Holdings Corporation.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Anode Materials