|

시장보고서

상품코드

1636487

중동 및 아프리카의 전기자동차 전지 전해액 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Middle East And Africa Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

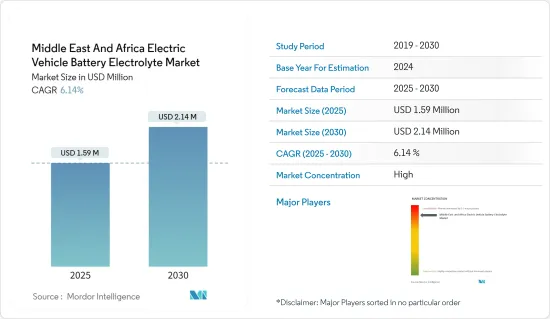

중동 및 아프리카 전기차용 전지 전해액 시장 규모는 2025년 159만 달러로 추정되며 예측 기간(2025-2030년)의 CAGR은 6.14%로, 2030년에는 214만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 중동에서는 정부의 시책이나 관련 투자에 의해 전기자동차의 보급이 진행되면서 시장을 견인할 것으로 보입니다.

- 한편, 전기자동차 전지나 원료의 수입 의존도가 높은 것이 시장 성장의 방해가 될 가능성이 높습니다.

- 분리막 재료의 지속적인 R&D는 시장에 미래의 성장 기회를 가져올 것으로 예상됩니다.

- 조사 기간 중 중동 및 아프리카 전기자동차 전지 전해액의 최대 시장은 남아프리카가 될 것으로 예상됩니다.

중동 및 아프리카 전기자동차 전지 전해액 시장 동향

리튬 이온 전지 부문이 큰 점유율을 차지

- 리튬은 전기자동차(EV)용 전지 제조에 중요한 역할을 합니다. 충전 가능한 리튬 이온 전지의 주요 성분인 리튬의 높은 에너지 밀도는 주행 거리의 연장을 용이하게 합니다. 최근, 중동 및 아프리카에서는 리튬 이온 전지 제조와 연구가 급증하고 있어, 전해액 등의 전지 부품에 대한 관심이 높아지고 있습니다.

- 예를 들어, 2023년 7월, 카타르 대학의 첨단 재료 센터(CAM)는 유명 세계기구와 협력하여 해수에서 리튬을 추출하는 혁명을 일으켰습니다. 이 획기적인 기술은 청정 에너지에 대한 수요 증가에 대응하고 지속가능성을 증진할 것을 보장합니다.

- 2024년 7월, 이집트의 Raya Auto는 전지 생산과 차량전동화에 특화된 신흥기업 Shift EV와 전략적 제휴를 맺었습니다. 이 제휴하에 Shift EV는 Raya Auto의 경전동차 시리즈에 전력을 공급하기 위해 현지에서 리튬 이온 전지를 공급합니다. 이러한 대처는 중동 전역에서 예상되는 리튬 전지 수요 증가에 맞추어 전해액 시장을 강화하고 있습니다.

- 마찬가지로 중동 및 아프리카에서 리튬 이온 탐사 프로젝트가 확대됨에 따라 전지 생산에서 전해액에 대한 수요도 증가하고 있습니다. 2024년 6월 EV Metals Group plc는 사우디아라비아의 발사가 리튬 프로젝트에서 탐사를 마쳤습니다. 지다 동쪽 450km, 아라비아 순상지 남동부에 위치한 이 프로젝트는 1,200제곱킬로미터에 이르는 13개의 광구에 걸쳐 있습니다. 이는 사우디아라비아의 리튬 전지 제조 전망을 강화하고 전해액 수요를 증가시켜 예측 기간 동안 시장 성장에 영향을 줄 가능성이 높습니다.

- 역사적으로, 리튬 이온 전지의 가격은 급락하고 있으며, 전해액과 같은 관련 부품 수요는 급증하고 있습니다. Bloomberg NEF에 따르면 2023년 리튬 이온 전지의 평균 가격은 139달러/kWh로 2014년보다 5배 떨어졌습니다. 따라서 가격 하락에 따라 리튬 이온 전지의 채용이 급증하면 전해액 시장은 이익을 얻게 됩니다.

- 앞서 언급한 리튬 이온 전지와 전해액 생산의 동향을 근거로 중동 및 아프리카의 전기자동차 전지 전해액 시장은 성장이 예상됩니다.

남아프리카의 높은 시장 독점 가능성

- 2023년 12월 남아프리카 정부는 자국 내 자동차 부문에서 2026년까지 전기자동차(EV)를 출범할 계획을 발표했습니다. 저탄소에서 기후 변화에 강한 경제 육성을 목표로 하는 남아프리카의 Just Energy Transition(JET) 전략의 핵심은 운송 전동화에 중점을 두는 것입니다. JET의 틀에는 2023년부터 2027년까지의 기간동안 약 68억 4,000만 달러라는 많은 투자가 필요합니다.

- 2024년 2월 남아프리카 정부는 자국 내 EV 생산을 강화하기 위한 세제 우대 정책을 내세웠습니다. 이 우대 정책은 제조 기업에 150%의 세액 공제를 제공하는 것입니다. 이러한 우대 정책은 EV 생산 확대에 열성적인 Ford Motor Company 및 Volkswagen AG와 같은 산업 선도기업들에게 특히 유리합니다. 그 결과, EV의 생산 대수는 증가하고, 남아프리카에서는 EV용 전지나 관련 부품(특히 전해액) 수요가 높아지고 있습니다.

- 2024년 7월 중국의 유명한 전기자동차 제조업체인 BYD는 대중교통의 전동화라는 세계적 비전에 따라 남아프리카공화국에서 첫 전기 버스 주문을 확보했습니다. 163년의 역사를 가진 남아프리카 버스 운행사인 골든 아로우는 이 신에너지 차량(NEV) 제조업체와 협력하여 120대의 전기 버스를 주문했습니다. 남아프리카공화국이 전기 버스를 채택함에 따라 이 기세는 시장 예측 기간 동안 전지 제조에 필수적인 전해액 생산을 증가시킬 것으로 예상됩니다.

- 게다가 남아프리카공화국에서는 최근 전기자동차의 도입이 현저하게 증가하고 있습니다. 국제에너지기구의 데이터에 따르면 인도의 전기차 판매량은 2023년 1,080대에 달하여 전년 대비 74% 증가하는 경이로운 급증을 기록했습니다. 이러한 기록을 근거로 남아프리카의 전기자동차 수요는 회복기조에 있고 이는 전해액 시장을 더욱 활성화시킬 것으로 예상됩니다.

- 이러한 동향을 근거로 전기자동차와 전지의 채용이 증가해 전해액의 제조가 강화되게 됩니다. 이처럼 중동 및 아프리카 전기자동차 전지 전해액 시장은 향후 수년간 크게 성장할 전망입니다.

중동 및 아프리카 전기자동차 전지 전해액 산업 개요

중동 및 아프리카의 전기자동차 전지 전해액 시장은 집중되어 있어 소수의 진출기업이 존재합니다. 주요 진출기업(순서부동)에는 Dubi Chem, Oasis Chemical Materials Trading Co, Targray Technology International, Inc, Andrea FZCO, Rekoser 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 전제조건

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서문

- 2029년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 전기차 도입을 지원하는 정부의 시책

- 리튬 이온 전지 가격 저하

- 억제요인

- 수입 전지와 원료에 대한 높은 의존도

- 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 전지 유형

- 납축전지

- 리튬 이온 전지

- 기타

- 전해질 유형

- 액체 전해질

- 겔 전해질

- 고체 전해질

- 지역

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 이집트

- 카타르

- 나이지리아

- 기타 중동?아프리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Dubi Chem

- Oasis Chemical Materials Trading Co

- Targray Technology International, Inc.

- Andrea FZCO

- Rekoser

- 기타 유력 기업 목록

- 시장 순위 분석

제7장 시장 기회와 앞으로의 동향

- 전해질 재료 연구개발

The Middle East And Africa Electric Vehicle Battery Electrolyte Market size is estimated at USD 1.59 million in 2025, and is expected to reach USD 2.14 million by 2030, at a CAGR of 6.14% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles in the Middle East region due to government policies and associated investments in them is likely to drive the market.

- On the other hand, high dependency on imported electric vehicle batteries and raw materials are likely to hinder the market growth.

- Continuous research and development in separator material is expected to provide future growth opportunities for the market.

- The South Africa is expected to be the largest market for the Middle East and Africa Electric Vehicle Battery Electrolyte during the study period.

Middle East And Africa Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery Segment to Hold Significant Share

- Lithium plays a crucial role in manufacturing batteries for electric vehicles (EVs). As the key ingredient in rechargeable lithium-ion batteries, lithium's high energy density facilitates extended driving ranges. Recently, the Middle East and Africa have seen a surge in lithium-ion manufacturing and research, heightening interest in battery components like electrolytes.

- For example, in July 2023, Qatar University's Center for Advanced Materials (CAM) collaborated with renowned global institutions to revolutionize lithium extraction from seawater. This breakthrough promises to address the escalating demand for clean energy and promote sustainability.

- In July 2024, Raya Auto in Egypt entered a strategic partnership with Shift EV, a startup focused on battery production and fleet electrification. Under this alliance, Shift EV will supply locally made lithium-ion batteries to power Raya Auto's light e-mobility range. Such initiatives are poised to bolster the electrolyte market, aligning with the anticipated rise in lithium battery demand across the Middle East.

- Similarly, as lithium-ion exploration projects expand in the Middle East and Africa, the demand for electrolytes in battery production is set to grow. In June 2024, EV Metals Group plc wrapped up its exploration at the Balthaga Lithium Project in Saudi Arabia. Located 450km east of Jeddah, within the Arabian Shield's southeastern area, the project spans 13 tenements over 1,200 square kilometers. This bolsters Saudi Arabia's lithium battery manufacturing prospects, likely driving up electrolyte demand and influencing market growth during the forecast period.

- Historically, lithium-ion battery prices have plummeted, spurring demand for related components like electrolytes. Bloomberg NEF reported that in 2023, the average price of lithium-ion batteries was USD 139 USD/kWh, marking a fivefold drop since 2014. Thus, as lithium-ion battery adoption surges with falling prices, the electrolyte market stands to gain.

- Given the aforementioned trends in lithium-ion batteries and electrolyte production, the electric vehicle battery electrolyte market in the Middle East and Africa is poised for growth.

South Africa is Likely to Dominate the Market

- In December 2023, South Africa's government announced plans for the nation's automotive sector to debut its electric vehicles (EVs) by 2026. Central to South Africa's Just Energy Transition (JET) strategy, which aims to cultivate a low-carbon and climate-resilient economy, is the emphasis on transport electrification. The JET framework highlights a significant investment requirement of approximately USD 6.84 billion, slated for the period from 2023 to 2027.

- In February 2024, the South African government rolled out a tax incentive to bolster domestic EV production. This initiative offers manufacturing companies a generous 150% tax deduction. Such incentives particularly benefit industry titans like Ford Motor Company and Volkswagen AG, both eager to amplify their EV output. Consequently, this uptick in EV production is set to escalate the demand for EV batteries and associated components, notably electrolytes, within the South African landscape.

- In July 2024, BYD Company, a prominent Chinese electric vehicle manufacturer, secured its inaugural order for electric buses in South Africa, aligning with its global vision to electrify public transport. Golden Arrow, a 163-year-old South African bus operator, has collaborated with the new energy vehicle (NEV) maker, placing an order for 120 electric buses. As South Africa embraces electric buses, this momentum is expected to amplify the production of electrolytes vital for battery manufacturing during the market's forecast period.

- Furthermore, South Africa has seen a notable uptick in electric vehicle adoption in recent years. Data from the International Energy Agency reveals that electric car sales in India reached 1,080 units in 2023, marking a staggering 74% surge from the prior year. Given this trajectory, South Africa's demand for electric vehicles is poised for a rebound, further energizing the electrolyte market.

- Given these trends, the rising adoption of electric vehicles and their batteries is set to bolster electrolyte manufacturing. Thus, the electric vehicle battery electrolyte market in the Middle East and Africa is poised for significant growth in the coming years.

Middle East And Africa Electric Vehicle Battery Electrolyte Industry Overview

The Middle East and Africa Electric Vehicle battery Elecrolytr market is concentrated, with few players. Some of the major players (not in particular order) include Dubi Chem, Oasis Chemical Materials Trading Co, Targray Technology International, Inc., Andrea FZCO, and Rekoser.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 High dependecy on imported batteries and raw materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 South Africa

- 5.3.3 United Arab Emirates

- 5.3.4 Egypt

- 5.3.5 Qatar

- 5.3.6 Nigeria

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Dubi Chem

- 6.3.2 Oasis Chemical Materials Trading Co

- 6.3.3 Targray Technology International, Inc.

- 6.3.4 Andrea FZCO

- 6.3.5 Rekoser

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in Electrolyte material