|

시장보고서

상품코드

1636521

중동 및 아프리카의 하이브리드 전기자동차 전지 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Middle East And Africa Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

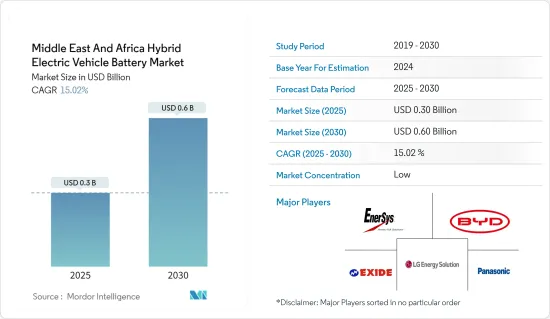

중동 및 아프리카의 하이브리드 전기자동차용 전지 시장 규모는 2025년 3억 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 15.02%로, 2030년에는 6억 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 향후 수년간 전기자동차(EV)의 보급이 급증하고 연료 가격이 상승함에 따라 하이브리드 자동차 수요가 증가하고 하이브리드 전기자동차 전지의 필요성이 커지고 있습니다. 또한 리튬 이온 전지 가격 하락이 시장 성장을 뒷받침 할 가능성이 높습니다.

- 반대로 원료 매장량 부족은 하이브리드 전기자동차 전지 시장의 성장에 큰 과제가 됩니다.

- 그러나 에너지 밀도 향상, 충전 시간 단축, 안전성 향상, 수명 연장 등 전지 기술의 진보는 하이브리드 전기자동차 전지 시장의 진출기업에게 유리한 기회가 됩니다.

- 전기자동차 보급 확대에 따라 남아프리카는 세계의 하이브리드 전기자동차 전지 시장에서 가장 급성장하고 있는 지역이 되고 있습니다.

중동 및 아프리카 하이브리드 전기자동차 전지 시장 동향

리튬 이온 전지 유형이 시장을 독점

- 중동 및 아프리카의 리튬 이온 전기자동차 전지 시장은 기회와 도전이 모두 소용돌이 치는 역동적인 시장입니다. 리튬 이온 이차전지는 뛰어난 용량 대 중량비 덕분에 다른 전지 기술을 능가하는 인기를 끌고 있습니다. 리튬 이온 이차 전지는 긴 수명, 낮은 유지보수, 우수한 저장성, 현저한 가격 저하 등의 이점으로 인해 보급이 더욱 가속화되고 있습니다.

- 리튬 이온 전지는 전통적으로 같은 유형의 전지보다 비싸지만 시장의 대기업은 투자를 강화하여 규모의 경제를 실현하고 연구개발 노력을 강화함으로써 전지 성능을 향상시킬 뿐만 아니라 경쟁을 격화시키고 가격을 인하하고 있습니다.

- 2023년에는 리튬 이온 전지의 가격이 139달러/kWh까지 하락하여 13% 이상의 하락을 기록합니다. 지속적인 기술 혁신과 제조 개선으로 2025년에는 113달러/kWh, 2030년에는 80달러/kWh까지 가격이 더욱 떨어질 것으로 예측됩니다.

- 중동 및 아프리카의 각국 정부는 환경 문제에 대한 관심 증가와 탄소 배출량 순 제로 목표에 대한 노력을 배경으로 전기자동차를 지지하고 있습니다. 이러한 전지의 기본 요소인 리튬은 전기자동차의 축전 용량에 매우 중요합니다.

- 그 예로, 아랍에미리트(UAE) 정부는 2023년 급증하는 에너지 수요에 대응하고 지속 가능한 성장을 가속하기 위해 2050년까지 1,640억 달러를 투자한다는 놀라운 계획을 발표했습니다. 두바이의 에너지 전략 2050은 자연 에너지에 의한 에너지 생산 7%라는 2020년 이정표를 이미 달성하였으며, 2030년까지 25%, 2050년까지 75%라는 대담한 목표를 의욕적으로 내걸고 있다고 합니다. 이러한 야심찬 목표는 청정 에너지 솔루션으로서 리튬 이온 전지의 전망을 강화하고 하이브리드 자동차 및 EV에서 리튬 이온 전지 수요 급증을 시사합니다.

- 동지역의 주요 기업은 하이브리드 자동차와 EV에 탑재되는 리튬 이온 전지의 급증하는 수요에 대응하기 위해 전지 생산을 강화하고 있습니다. 지난 몇 년동안 전지 생산에 대한 노력은 지속적으로 증가하는 경향이 있습니다.

- 2023년 12월, 연방전력부, 중국 생태환경부, 나이지리아 연방전력부 간의 협정이 이 동향을 돋보이게 했습니다. 1억 5,000만 달러 상당의 이 협정은 중국 기업이 주도하는 나이지리아의 리튬 이온 전지 제조 공장으로 이어집니다. 이러한 노력은 동지역에서 전지 생산을 강화할 것입니다.

- 이러한 노력으로 예측 기간 동안 하이브리드 자동차 수요 증가가 예상되기 때문에 리튬 이온 전지의 생산이 급증할 전망입니다.

현저한 성장을 이루는 남아프리카

- 남아프리카의 하이브리드 자동차(HEV)용 전지는 정부 시책, 산업 동향, 시장 상황에 의해 형성됩니다. 온실가스 배출량 감축을 목표로 하는 연방 및 주 수준의 규제가 운송부문의 배출량 감축 솔루션으로서 HEV를 추진하고 있습니다.

- 중동 및 아프리카에서 HEV 생산이 활발한 남아프리카에서는 HEV 수요가 급증하고 있습니다. Naamsa(자동차 비즈니스 협의회)의 데이터에 따르면 2023년 HEV 판매량은 6,484대에 이르렀으며 2022년부터 60.09% 증가했습니다. 판매량은 연간 지속적으로 증가하는 경향을 보이고 있지만, 동지역에 여러 EV 생산 공장이 설립된 것은 HEV용 전지 수요가 계속 증가하고 있음을 나타냅니다.

- 소비자의 선호도 변화는 남아프리카의 하이브리드 자동차 수요 증가에 박차를 가하고 있습니다. 고인플레이션과 제한된 EV 충전 인프라와 같은 요인이 구매자를 하이브리드 자동차로 향하게 합니다. 이러한 전환은 제조업체에 의한 EV의 대폭적인 할인이나 최근의 첨단 하이브리드 모델의 채용 가운데 일어나고 있습니다.

- 2024년 3월 Toyota는 유명한 SUV인 Fortuner의 마일드 하이브리드 모델을 남아프리카 시장에 투입했습니다. 향상된 Fortuner는 2.8 리터 디젤 엔진과 48V 하이브리드 기술의 조합으로 성능과 연비를 모두 향상시키는 고급 파워트레인을 자랑합니다. 이러한 혁신은 일본의 첨단 하이브리드 자동차 수요를 뒷받침하는 것입니다.

- 기술 발전, 정부 지원, 지속 가능한 운송으로 소비자의 변화가 증가함에 따라 남아프리카의 HEV 전지 전망은 밝습니다. 정부는 온실가스 배출 억제를 목표로 하이브리드 차량을 적극적으로 추진하고 있습니다.

- 2023년 남아프리카는 남아프리카 자동차 마스터 플랜(SAAM) 2021-2035를 발표했습니다. 이 야심찬 계획은 2035년까지 세계 자동차 생산 대수의 1%(연간 140만대)를 생산하는 것을 목표로 하고 있습니다. 이러한 움직임은 남아프리카의 세계 자동차 생산의 지위를 강화하고 나중에 수년간 HEV 전지 수요를 증폭시킬 것입니다.

- 이러한 개발은 EV의 에너지 저장에서 HEV 전지 솔루션의 중요성을 강조하고, 가까운 미래에 HEV 전지 수요가 견고하게 변화하고 있음을 시사합니다.

중동 및 아프리카 하이브리드 자동차 전지 산업 개요

중동 및 아프리카의 하이브리드 전기자동차 전지 시장은 양분화되어 있습니다. 주요 기업(순서부동)으로는 BYD Company Ltd, LG Energy Solution, Exide Industries Ltd, EnerSys, Panasonic Holdings Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 전제조건

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서문

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 전기자동차(EV) 생산 증가

- 리튬 이온 전지 가격 하락

- 성장 억제요인

- 원료의 매장량 부족

- 촉진요인

- 공급망 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협 제품 및 서비스

- 경쟁 기업간 경쟁 관계

- 투자 분석

제5장 시장 세분화

- 전지 유형

- 리튬 이온 전지

- 납축전지

- 나트륨 이온 전지

- 기타

- 차종

- 승용차

- 상용차

- 지역

- 사우디아라비아

- 아랍에미리트(UAE)

- 나이지리아

- 이집트

- 카타르

- 남아프리카

- 기타 중동 및 아프리카

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- BYD Company Ltd

- LG Energy Solution

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Exide Industries Ltd

- Saft Groupe SA

- 삼성SDI

- SK Innovation

- Contemporary Amperex Technology Co. Limited(CATL)

- 기타 유력 기업 목록

- 시장 순위/점유율 분석

제7장 시장 기회와 앞으로의 동향

- 전지 재료 기술의 진보

The Middle East And Africa Hybrid Electric Vehicle Battery Market size is estimated at USD 0.30 billion in 2025, and is expected to reach USD 0.60 billion by 2030, at a CAGR of 15.02% during the forecast period (2025-2030).

Key Highlights

- In the coming years, as electric vehicle (EV) adoption surges and fuel prices climb, the demand for hybrid vehicles is set to rise, subsequently boosting the need for hybrid electric vehicle batteries. Further, declining lithium-ion battery price is likely to support the market growth.

- Conversely, a shortage of raw material reserves poses a significant challenge to the growth of the hybrid electric vehicle battery market.

- However, advancements in battery technology-such as enhanced energy density, quicker charging times, heightened safety, and extended lifespan-present lucrative opportunities for players in the hybrid electric vehicle battery market.

- Driven by increasing electric vehicle adoption, South Africa is emerging as the fastest-growing region in the global hybrid electric vehicle battery market.

Middle East And Africa Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion electric vehicle battery market in the Middle East and Africa is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other battery technologies in popularity, thanks to their favorable capacity-to-weight ratio. Their adoption is further fueled by advantages like extended lifespan, low maintenance, superior shelf life, and a notable drop in prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been ramping up investments. By achieving economies of scale and intensifying R&D efforts, they've not only enhanced battery performance but also intensified competition, driving prices down.

- In 2023, lithium-ion battery prices dipped to USD 139/kWh, marking a decline of over 13%. With ongoing technological innovations and manufacturing refinements, projections suggest prices will further drop to USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- Governments in the Middle East and Africa are championing electric vehicles, driven by mounting environmental concerns and a commitment to net-zero carbon emission targets. Lithium, a cornerstone element in these batteries, is pivotal for EV storage capacity.

- As a case in point, the UAE government unveiled plans in 2023 to invest a staggering USD 164 billion by 2050, aiming to meet surging energy demands and foster sustainable growth. Dubai's Energy Strategy 2050, having already achieved its 2020 milestone of 7% energy production from renewables, is ambitiously targeting 25% by 2030 and a bold 75% by 2050. Such ambitious targets bolster the outlook for lithium-ion batteries as a clean energy solution, signaling a surge in demand for these batteries in hybrids and EVs.

- Leading companies in the region are ramping up battery production to meet the burgeoning demand for lithium-ion batteries in hybrids and EVs. Over the past few years, battery production initiatives have seen a consistent upward trajectory.

- Highlighting this trend, in December 2023, an agreement was inked between the Federal Ministry of Power, the China Ministry of Ecology and Environment, and Nigeria's Federal Ministry of Power. This pact, valued at USD 150 million, paves the way for a lithium-ion battery manufacturing plant in Nigeria, spearheaded by a Chinese firm. Such endeavors are set to bolster battery production in the region.

- Given these initiatives, a surge in lithium-ion battery production is on the horizon, coinciding with an anticipated uptick in hybrid vehicle demand during the forecast period.

South Africa to Witness Significant Growth

- Government policies, industry trends, and market forces shape the landscape of hybrid electric vehicle (HEV) batteries in South Africa. Regulations at both federal and state levels, targeting a reduction in greenhouse gas emissions, are promoting HEVs as a solution to lower emissions from the transportation sector.

- Demand for HEVs is surging in South Africa, a prominent producer of these vehicles in the Middle East and Africa. Data from Naamsa (the Automotive Business Council) reveals that in 2023, sales of HEVs reached 6,484 units, marking a 60.09% increase from 2022. While sales have shown a consistent upward trend in previous years, the establishment of multiple EV production plants in the region signals a continued rise in demand for HEV batteries.

- Changing consumer preferences are fueling the growing demand for hybrid cars in South Africa. Factors like high inflation and limited EV charging infrastructure are nudging buyers towards hybrids. This shift occurs amidst significant discounts on EVs from manufacturers and the introduction of advanced hybrid models in recent years.

- In March 2024, Toyota introduced a new mild-hybrid variant of its renowned SUV, the Fortuner, to the South African market. The revamped Fortuner boasts an advanced powertrain, enhancing both performance and fuel efficiency, featuring a 2.8-litre diesel engine paired with 48V hybrid technology. Such innovations are poised to boost the demand for advanced hybrids in the nation.

- With technological strides, supportive government initiatives, and a growing consumer shift towards sustainable transport, the outlook for HEV batteries in South Africa is bright. The government is actively promoting hybrid vehicles, aiming to curb greenhouse emissions.

- In 2023, the nation unveiled the South African Automotive Masterplan (SAAM) 2021-2035. This ambitious plan targets producing 1% of the global vehicle output, equating to 1.4 million vehicles annually, by 2035. Such moves are set to bolster South Africa's global vehicle production standing and, in turn, amplify the demand for HEV batteries in the years ahead.

- These developments underscore the significance of HEV battery solutions in energy storage for EVs, suggesting a robust demand trajectory for HEV batteries in the near future.

Middle East And Africa Hybrid Electric Vehicle Battery Industry Overview

The Middle East and Africa hybrid electric vehicle battery market is semi-fragmented. Some key players (not in particular order) are BYD Company Ltd, LG Energy Solution, Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Nigeria

- 5.3.4 Egypt

- 5.3.5 Qatar

- 5.3.6 South Africa

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 LG Energy Solution

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Exide Industries Ltd

- 6.3.7 Saft Groupe SA

- 6.3.8 Samsung SDI

- 6.3.9 SK Innovation

- 6.3.10 Contemporary Amperex Technology Co. Limited (CATL)

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials