|

시장보고서

상품코드

1636554

유럽의 플라스틱 폐기물 관리 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Plastic Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

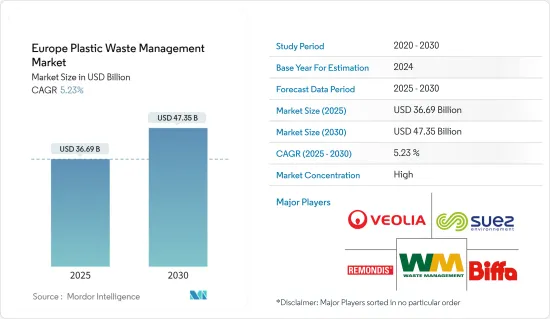

유럽의 플라스틱 폐기물 관리 시장 규모는 2025년에 366억 9,000만 달러로 추정되고, 예측 기간 중(2025-2030년) CAGR은 5.23%로 전망되며, 2030년에는 473억 5,000만 달러에 이를 것으로 예측됩니다.

주요 하이라이트

- 유럽의 플라스틱 폐기물 관리 시장은 급속한 폐기물 발생을 억제하기 위한 정부의 이니셔티브와 지속가능성에 대한 취향 증가가 주요 요인입니다.

- 플라스틱 폐기물 오염은 세계의 긴급한 도전입니다. 플라스틱의 대량 소비국인 유럽은 이 문제를 악화시키는데 있어 매우 중요한 역할을 하고 있습니다. 이 지역의 연간 플라스틱 폐기물 발생량은 특히 포장과 같은 일회용 품목에서 증가하는 경향이 있습니다. 그러나 재활용률은 늦어지고 플라스틱의 순환형 경제를 실현하기 위해서는 유럽이 상당한 거리를 넘어야 하는 것이 부각되고 있습니다.

- 2023년 유럽연합(EU)은 6,000만 톤의 플라스틱 폐기물을 배출합니다. 예측에 따르면, 이러한 추세는 앞으로도 계속되고, 2060년까지 플라스틱 폐기물 발생량이 두 배로 증가하여 연간 1억 톤을 초과할 수 있습니다.

- 유럽에서는 포장재가 플라스틱 폐기물의 주요 원천이 되고 있으며 EU 회원국은 2023년에는 총 1,600만 톤을 넘어선다. 지난 10년간 EU의 플라스틱 포장 폐기물은 약 30% 급증했습니다.

- 유럽에서는 매립 및 에너지 회수를 위한 소각이 플라스틱 폐기물 관리의 대부분을 차지하고 있지만, 재활용은 지연되고 있으며, 유럽 대륙의 폐기물 처리의 15%에도 미치지 못하고 있습니다. 유럽연합(EU) 플라스틱 포장의 재활용률은 다소의 진보는 볼 수 있는 것, 50%에는 도달하지 않고, EU가 내거는 2025년의 재활용 목표에는 도달하지 않았습니다.

- EU 지역 밖으로 수출되는 플라스틱 폐기물은 EU 지역 내에서 처리된다고 가정하여 재활용률에 통합되어 있습니다. 그러나 이러한 수출품은 수락국의 폐기물 인프라가 부족하기 때문에 종종 불시말에 직면하고 있습니다. 그럼에도 불구하고이 지역의 플라스틱 폐기물 수출은 감소하는 경향이 있습니다. 이는 플라스틱 폐기물의 수입을 금지 및 제한하는 국가가 증가하고 있기 때문입니다.

- 유럽에서는 플라스틱 오염이 긴급한 과제가 되고 있으며, 이 지역에서는 새로운 정책의 제정을 촉구하고 있습니다. 예를 들어, 유럽 연합(EU)의 단일 사용 플라스틱 지침에는 유럽 해안에서 자주 볼 수 있는 다양한 일회용 플라스틱 제품의 사용 금지가 포함되어 있습니다. 유럽에서는 보다 광범위한 일회용 플라스틱 금지 기운이 증가하고 있습니다. 특히 2023년 11월 EU는 2026년까지 OECD 비가맹국으로의 플라스틱 폐기물 수출을 중단하겠다고 약속했으나 전반적인 수출 금지를 요구하는 목소리는 꾸준합니다.

유럽 플라스틱 폐기물 관리 시장 동향

EU의 새로운 정책은 포장 산업을 변화시키고 2050년까지 기후 중립성을 추진

유럽 연합(EU)은 2023년부터 포장 및 포장 폐기물에 관한 법률을 개정했습니다. 이 개정은 2050년까지 포장 산업을 기후 중립으로 이끄는 보다 광범위한 목표의 일부입니다.

2023년부터 음식점, 택배 서비스, 레스토랑은 테이크아웃 식품의 옵션으로 재사용 가능한 용기를 제공하도록 의무화되었으며 일회용 플라스틱에서 벗어나게 되었습니다. 영국에서는 2025년까지 일회용 음료 병에 25% 이상의 재생 플라스틱을 사용할 것을 의무화할 것으로 예상됩니다.

이러한 새로운 정책은 특히 중소기업에 혜택을 주며 비즈니스 기회의 파도가 도래할 준비가 되어 있습니다. 또한 버진 소재에 대한 의존도를 줄이고 유럽의 재활용 능력을 강화하며 유럽 대륙의 1차 자원과 외부 공급업체에 대한 의존도를 줄일 수 있습니다. 중요한 것은 이러한 이니셔티브가 2050년까지 기후 중립성 목표에 포장 산업을 맞추도록 설정되어 있다는 것입니다.

넷 제로와 넷 긍정적인 야심찬 목표를 목표로 하는 한편, 플라스틱 산업은 세 가지 기둥, 즉 속도, 노동력, 정책에 달려 있습니다. 이러한 이정표를 달성하는 것은 유럽의 경쟁력을 높이고 기후 변화와의 싸움에서 큰 전진을 의미합니다. 향후 3-5년은 금세기 중반까지 탈탄소화를 달성할 수 있을지 어떨지를 파악하는데 있어서 매우 중요한 해가 됩니다.

세계의 변화 속에서 플라스틱 폐기물에 대한 노력을 강화하는 영국

합리적인 가격, 내구성, 다용도로 칭찬되는 플라스틱은 세계 사회에 정착하고 있습니다. 그러나 그 폐기의 한계는 환경에 큰 위협이 되고 있습니다. 영국은 플라스틱 폐기물 배출량에서 두드러지며, 그 가정은 연간 1,000억 개라는 엄청난 양의 플라스틱 포장재를 폐기하고 있습니다. 2021년에는 250만 톤의 플라스틱 포장 폐기물이 발생했습니다.

환경 의식이 증가함에도 불구하고, 2021년 플라스틱 포장 폐기물의 재활용률은 44%에 그쳤으며, 이 반세기는 비교적 평평했습니다. 이 비율에는 직접 재활용과 소각에 의한 에너지 회수가 모두 포함됩니다. 놀랍게도 영국의 플라스틱 폐기물의 절반 근처가 에너지로 소각되는 반면, 국내에서 재활용되는 것은 불과 12%, 25%는 매립지로, 나머지는 해외로 운반됩니다.

국내에서의 처리 능력이 부족하기 때문에 영국은 점점 수출에 의존하고 있으며, 특히 네덜란드로의 수출이 많아 2022년에는 영국의 플라스틱 폐기물 수입의 4분의 1을 차지했습니다. 그러나 세계 시나리오는 변화하고 있습니다. 전통적인 폐기물 수입국인 중국과 같은 국가들은 그러한 관행을 엄격히 단속하고 폐기물 관리 전략을 검토하기 위해 영국에 대한 압력을 강화하고 있습니다. 재활용 인프라를 강화하고 고급 재활용 기술을 도입하도록 요구하는 목소리가 커지고 있습니다.

플라스틱의 분해 속도가 느리기 때문에 영국에서는 공해에 대한 우려가 높아지고 있습니다. 이에 대해 영국 정부는 슈퍼마켓의 레지봉투 발행을 현저하게 억제한 일회용 레지봉투 유료화 등 다양한 정책을 개시했습니다. 추가 금지를 요구하는 목소리도 나오고 있으며, 스코틀랜드는 칼집, 접시, 커피컵 등 문제가 있는 일회용 플라스틱을 금지함으로써 선을 그었습니다. 이에 이어 영국도 2023년 10월 1일부터 같은 금지조치를 실시하기로 했습니다. 게다가 2023년에 예정된 음료 용기의 전국적 예금 수익 제도(DRS)는 2025년 경제적 과제로 인해 연기되었습니다.

유럽 플라스틱 폐기물 관리 산업 개요

유럽의 플라스틱 폐기물 관리 시장은 세분화되어 있습니다. 다음과 같은 주요 기업이 경쟁 구도를 형성하고 있습니다. Veolia Environnement SA, Suez, Remondis, Biffa, Waste Management Inc., and Renewi. These industry leaders vie for market share through pioneering recycling technologies, streamlined collection and sorting, and eco-conscious waste disposal methods. bing the environmental toll of plastic waste.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학 및 인사이트

- 현재의 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 지속가능성에 대한 수요 증가가 시장 견인

- 환경 문제에 대한 관심 증가

- 억제요인

- 시장에 영향을 미치는 규제 요인

- 시장에 영향을 주는 인프라의 과제

- 시장 기회

- 시장을 견인하는 기술의 진보

- 성장 촉진요인

- 밸류체인 및 공급망 분석

- 정부의 규제, 무역 협정, 이니셔티브

- 업계의 매력도-Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 플라스틱 폐기물 관리 시장에서의 기술 개척

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 폴리머별

- 폴리프로필렌(PP)

- 폴리에틸렌(PE)

- 폴리염화비닐(PVC)

- 폴리에틸렌테레프탈레이트(PET)

- 기타 폴리머

- 배출원별

- 주택용

- 상업용

- 공업용

- 기타(건설, 헬스케어)

- 처리별

- 재활용

- 화학처리

- 매립지

- 기타 처리

- 지역별

- 영국

- 독일

- 스페인

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Veolia Environment

- Suez Environment

- Biffa Group

- Waste Management Inc.

- REMONDIS

- Renewi

- FCC Environment

- Viridor

- DS Smith

- TOMRA

- 기타 기업

제7장 시장의 미래

제8장 부록

AJY 25.02.12The Europe Plastic Waste Management Market size is estimated at USD 36.69 billion in 2025, and is expected to reach USD 47.35 billion by 2030, at a CAGR of 5.23% during the forecast period (2025-2030).

Key Highlights

- The European plastic waste management market is mainly driven by government initiatives to curb rapid waste generation and a growing preference for sustainability.

- Plastic waste pollution is a pressing global concern. As a significant consumer of plastics, Europe plays a pivotal role in exacerbating this issue. The region's annual plastic waste production, notably from single-use items like packaging, is on the rise. However, recycling rates are lagging, underscoring the considerable distance Europe must traverse to achieve a circular economy for plastics.

- In 2023, the European Union produced an estimated 60 million metric tons of plastic waste. Projections suggest this trend will persist, potentially leading to a doubling of plastic waste generation by 2060, exceeding 100 million metric tons annually.

- Within Europe, packaging represents the primary source of plastic waste, with EU Member States collectively producing over 16 million metric tons in 2023. Over the last decade, plastic packaging waste in the European Union surged by approximately 30%.

- In Europe, landfilling and incineration for energy recovery continue to dominate plastic waste management, while recycling lags, making up less than 15% of the continent's waste disposal. Despite some progress, the plastic packaging recycling rate in the European Union has struggled to breach the 50% mark, falling short of the bloc's 2025 recycling goal.

- The plastic waste exported from the European Union to countries outside the bloc intended for treatment is factored into recycling rates. However, these shipments often face mismanagement due to inadequate waste infrastructure in the receiving nations. Despite this, plastic waste exports in the region have been on a downward trend, attributed to an increasing number of countries enforcing bans and restrictions on such imports.

- Plastic pollution is a pressing issue in Europe, prompting the region to enact new policies. For instance, the Single-use Plastics Directive of the European Union includes bans on various disposable plastic items commonly found on European beaches. The momentum for a broader single-use plastics ban in Europe is gaining traction. Notably, in November 2023, the European Union committed to halting plastic waste exports to non-OECD nations by 2026, although calls for a total export ban persist.

Europe Plastic Waste Management Market Trends

The European Union's New Policies Set to Transform the Packaging Industry and Drive Climate Neutrality by 2050

The European Union revised its legislation on packaging and packaging waste, effective 2023. This revision is part of a broader goal to steer the packaging industry toward climate neutrality by 2050.

From 2023, eateries, delivery services, and restaurants were mandated to provide reusable containers as an option for takeout food, moving away from single-use plastics. By 2025, the United Kingdom is projected to require disposable beverage bottles to contain a minimum of 25% recycled plastic content.

These new policies are poised to usher in a wave of business opportunities, particularly benefiting smaller enterprises. They will also reduce the reliance on virgin materials, bolster Europe's recycling capabilities, and lessen the continent's dependence on primary resources and external suppliers. Crucially, these initiatives are set to align the packaging industry with climate neutrality targets by 2050.

While striving for ambitious net-zero and net-positive goals, the plastics industry hinges on three pillars, i.e., speed, workforce, and policy. Achieving these milestones positions Europe competitively and marks a significant stride in combating climate change. The upcoming three to five years will be pivotal in gauging the industry's ability to decarbonize by mid-century.

The United Kingdom Ramps up Efforts to Tackle Plastic Waste Amid Global Shifts

Plastics, lauded for their affordability, durability, and versatility, have entrenched themselves in the global society. However, the limitations in their disposal pose a significant environmental threat. The United Kingdom stands out in its plastic waste production, with its households discarding a monumental 100 billion plastic packaging pieces annually, averaging 66 per week. In 2021, the country generated 2.5 million metric tons of plastic packaging waste.

Despite heightened environmental awareness, the country's recycling rate for plastic packaging waste lingered at 44% in 2021, which remained relatively static for half a decade. This rate encompasses both direct recycling and energy recovery from incineration. Alarmingly, nearly half of the United Kingdom's plastic waste is incinerated for energy, while a mere 12% is recycled domestically, with 25% ending up in landfills and the rest shipped overseas.

With insufficient domestic processing capabilities, the United Kingdom has increasingly turned to exports, notably channeling a significant portion to the Netherlands, which accounted for a quarter of UK plastic waste imports in 2022. However, the global scenario is shifting. Countries like China, a traditional waste importer, have clamped down on such practices, intensifying the pressure on the United Kingdom to revamp its waste management strategies. Calls for bolstered recycling infrastructure and the adoption of advanced recycling technologies have grown louder.

Given the slow decomposition rate of plastic, concerns over pollution are mounting in the United Kingdom. In response, the UK government has initiated various policies, including the single-use carrier bag charge, which has notably curbed supermarket plastic bag issuance. Calls for further bans have emerged, with Scotland leading the way by prohibiting problematic single-use plastics like cutlery, plates, and coffee cups. Following suit, England was set to implement a similar ban starting October 1, 2023. Additionally, a nationwide deposit return scheme (DRS) for beverage containers, initially slated for 2023, has been delayed to 2025, citing economic challenges.

Europe Plastic Waste Management Industry Overview

The European plastic waste management market is fragmented in nature. It boasts a competitive landscape shaped by key players such as Veolia Environnement SA, Suez, Remondis, Biffa, Waste Management Inc., and Renewi. These industry leaders vie for market share through pioneering recycling technologies, streamlined collection and sorting, and eco-conscious waste disposal methods. Their strategies pivot on adhering to regulations, championing circular economy tenets, and curbing the environmental toll of plastic waste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Demand for Sustainability Driving the Market

- 4.2.1.2 Environmental Concerns Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Factors Affecting the Market

- 4.2.2.2 Infrastructure Challenges Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Developments in the Plastic Waste Management Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Polymer

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene (PE)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Polyethylene Terephthalate (PET)

- 5.1.5 Other Polymers

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Other Sources (Construction and Healthcare)

- 5.3 By Treatment

- 5.3.1 Recycling

- 5.3.2 Chemical Treatment

- 5.3.3 Landfill

- 5.3.4 Other Treatments

- 5.4 By Region

- 5.4.1 The United Kingdom

- 5.4.2 Germany

- 5.4.3 Spain

- 5.4.4 France

- 5.4.5 Italy

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Veolia Environment

- 6.2.2 Suez Environment

- 6.2.3 Biffa Group

- 6.2.4 Waste Management Inc.

- 6.2.5 REMONDIS

- 6.2.6 Renewi

- 6.2.7 FCC Environment

- 6.2.8 Viridor

- 6.2.9 DS Smith

- 6.2.10 TOMRA*

- 6.3 Other Companies